Global Soil Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Application (Agricultural, Non-agricultural), By Offering (Hardware, Software, and Services), By System Type (Ground-based Sensing, Sensing & Imagery, and Robotic & Telematics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Industry: AgricultureGlobal Soil Monitoring Market Insights Forecasts to 2030

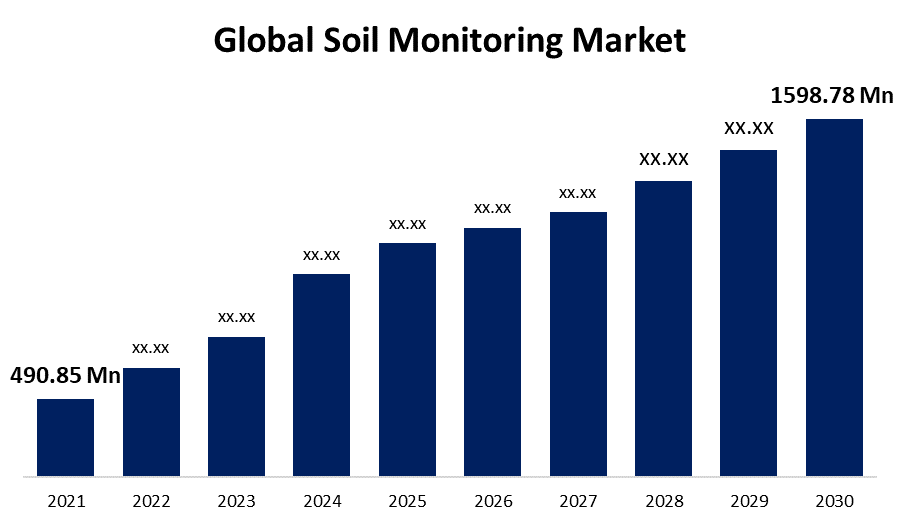

- The Global Soil Monitoring Market Size was valued at USD 490.85 Million in 2021

- The Market is growing at a CAGR of 13.9% from 2021 to 2030

- The Worldwide Soil Monitoring Market size is expected to reach USD 1598.78 Million by 2030

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Soil Monitoring Market is anticipated to reach USD 1598.78 Million by 2030, at a CAGR of 13.9% during the forecast period from 2022 to 2030. Government and corporate continous efforts to promote sustainable agriculture practices, stringent government regulations pertaining to ecological stability, the pressing need to preserve soil quality, and the growing need to improve farm productivity to feed the world's growing population are some of the driving factors for the soil monitoring market.

Market Overview

Soil monitoring is the analysis of soil and its stability, constituents, and physical condition in order to evaluate or ensure its suitability for use. Soil monitoring aids in the discovery of soil threats related to animal health, human health, and climate. Soil monitoring systems are made up of devices that perform various functions such as reading/storing data, soil sensing, and transmitting data to computers via a transmitter. Soil monitoring data is useful for analyzing soil conditions and making decisions. These systems have a wide range of applications in agriculture, golf courses, research laboratories, and urban farming communities. Growing demand for improved farm productivity to feed a rapidly growing population, as well as the growing popularity of precision agriculture and fertility management services, are the primary factors driving the growth of the soil monitoring system market. Furthermore, rapid technological advancements in the agriculture sector, as well as an increase in agricultural activities, are expected to positively impact future growth. Furthermore, the availability of technologically advanced soil monitoring systems at reasonable prices drives the market growth. In addition, an increase in government investments in agricultural R&D fuels the market. However, a lack of technical skills and awareness about soil monitoring may limit the market growth. On the contrary, the rise in soil monitoring adoption in emerging countries is expected to provide lucrative opportunities for the soil monitoring system market.

Report Coverage

This research report categorizes the market for the global soil monitoring market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the soil monitoring market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the soil monitoring market.

Global Soil Monitoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 490.85 million |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 13.9% |

| 2030 Value Projection: | USD 1598.78 million |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Application, By Offering, By System Type and By Region. |

| Companies covered:: | Sentek Technologies, Spectrum Technologies, Irrometer , CropX Technologies, AquaSpy, Element Materials Technology, Stevens Water Monitoring Systems, Manx Technology Group, AquaCheck, Caipos GmbH, Acclima, Inc., Vegetronix, SGS Group, METER Group, The Toro Company, Campbell Scientific. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Soil monitoring has become increasingly important as the world population continues to rise, potentially leading to food shortages. To address the threat of food insecurity for future generations, the farming community is under intense pressure to increase agricultural output. Because inputs must be precisely monitored to ensure proper crop development, the technology aids in increasing crop output per hectare. Good irrigation or water management techniques, combined with the use of soil moisture sensors, contribute to increased yields and crop quality. Sensors make farming more profitable by conserving water and energy and reducing costs significantly.

Precision agriculture, also referred to as smart farming, is a popular method that allows farmers to reduce input costs while increasing yields with limited resources such as seeds, fertilizer, and water. Soil monitoring technologies aid in field mapping and the deployment of soil monitoring sensors allows farmers to understand their crops at the micro-scale while reducing environmental impacts. Furthermore, various governments are taking steps to meet the surge in food demand. Precision Farming Development Centers in India receive a 100% cost subsidy from the government (PDFCs). These measures increase the popularity of precision farming, which drives the soil monitoring system market even further.

Restraining Factors

The affordability issues associated with soil monitoring components such as sensors and systems, as well as low levels of adoption of advanced farming technologies in some global geographies, are severely impeding the market growth. Furthermore, the difficulties associated with soil monitoring due to soil spatial variability are a significant factor impeding the market growth. Furthermore, soil monitoring necessitates technical knowledge in order to process the data and comprehend the findings. The lack of this expertise among farmers in many areas limits the adoption of soil monitoring and dampens market growth.

Market Segmentation

The Global Soil Monitoring Market share is categorized into application, offering, and system type.

- The agricultural segment is expected to hold the largest market over the predicted period.

Based on the application, the global soil monitoring market is differentiated into agricultural, non-agricultural. Among these, the agricultural segment is the largest contributor to the market. The reason behind the growth is, owing to the significant adoption of soil monitoring in the agricultural segment to accelerate crop production and limit water usage. Furthermore, the growing adoption of soil monitoring devices is attributed to increased government initiatives and growing farmer awareness of sustainable agriculture practices.

- The hardware segment is estimated to hold the largest share of the global soil monitoring market during the study period.

Based on the offering, the global soil monitoring market is classified into hardware, software, and services. Among these, the hardware segment is anticipated to hold the largest share of the global soil monitoring market during the forecast period. Farmers' increasing use of soil sensors, soil scanners, weather stations, and other soil monitoring devices is propelling growth. Soil monitoring has benefited progressive farmers worldwide, increasing the adoption of soil monitoring devices and sensors. During the projected timeframe, the services segment is expected to exhibit the highest CAGR based on offering in the global soil monitoring market. The growing use of IoT in agriculture, as well as the growing adoption of connected farming, has accelerated the growth of services in the global soil monitoring market. Furthermore, the growing adoption of technological developments to improve both soil and crop quality is increasing demand for the farming industry's services segment

.

- The ground-based monitoring sensing system witnessed the highest share in the soil monitoring market.

Based on the system type, the global soil monitoring market is categorized into ground-based sensing, sensing & imagery, and robotic & telematics. Among these, the ground-based monitoring sensing system witnessed the highest share in the soil monitoring market. Sensors and other soil monitoring devices are becoming more popular among agricultural producers all over the world. This is due to the numerous advantages provided by these sensors, which allow growers to provide crop-specific inputs. During the forthcoming years, ground-based monitoring systems are expected to boost the market.

Regional Segment Analysis of the Soil Monitoring Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

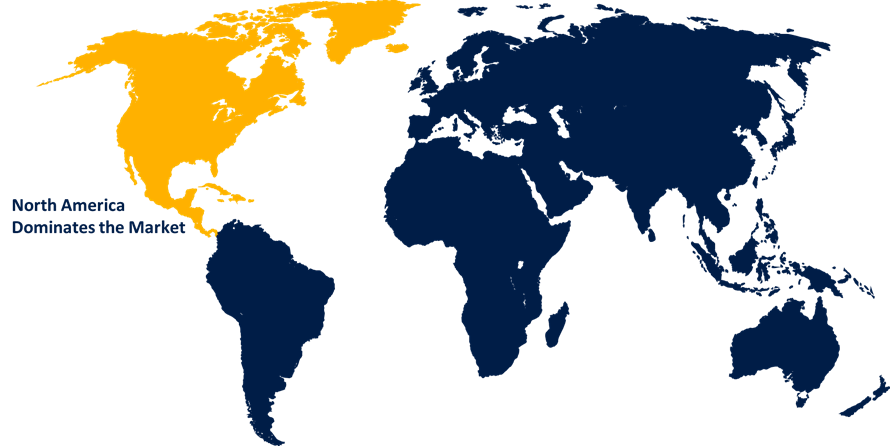

North America is expected to hold the largest share of the market during the predicted timeframe.

Get more details on this report -

North America is estimated to hold the largest share of the market during the predicted timeframe, because of the large pandemic scenario in the region, North America is the most profitable region in the worldwide market. The market has expanded as a result of increased sensor usage in the region's agriculture and sports industries. Campbell Scientific, Inc. and The Toro Company are both based in the United States. Strict environmental regulations, as well as the increased use of precision farming and yield monitoring technology by major and small farming communities, are projected to boost the market.

The Asia Pacific region is expected to grow the fastest in the soil monitoring market during the predicted timeframe. Digital agricultural technologies are being rapidly used in Asia-Pacific. Developing countries such as India and China are boosting their investments in next-generation farming techniques. Furthermore, governments are investing heavily in educating farmers about water conservation and encouraging farming methods. Because of developments in sensors, robots and automation, and remote sensing technology, the usage of digital farming techniques has grown in popularity in APAC. Soil monitoring enables farmers to better utilize technology to increase agricultural production. Furthermore, sensors can help save water in various applications such as sports turf, residential irrigation, landscaping, and ground care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global soil monitoring market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sentek Technologies

- Spectrum Technologies

- Irrometer

- CropX Technologies

- AquaSpy

- Element Materials Technology

- Stevens Water Monitoring Systems

- Manx Technology Group

- AquaCheck, Caipos GmbH

- Acclima, Inc.

- Vegetronix

- SGS Group

- METER Group

- The Toro Company

- Campbell Scientific

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2022, Aliaxis, a global leader in providing access to water and energy through innovative fluid management systems, has signed an investment contract and will collaborate with CropX, a global pioneer in ag-tech solutions for comprehensive farm management.

- In October 2021, SGS introduced the GLP soil characterization service to assist in determining the chemical, physical, and biological parameters that influence soil fertility.

- In August 2022, CropX Technologies, Ltd. has revealed the commercial release of a new farm management system capabilities. The new capability can monitor the transport of nitrogen and salts in the soil in real time. Traditional lab testing methods are more difficult and time-consuming than the CropX solution, which can provide continuous monitoring of nitrogen leaching occurrences.

- In March 2020, The Toro Corporation has completed the acquisition of Venture Products, Inc. With this acquisition, Toro expects to boost its market position and expand its portfolio.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global Soil Monitoring Market based on the below-mentioned segments:

Global Soil Monitoring Market, By Application

- Agricultural

- Non-agricultural

Global Soil Monitoring Market, By Offering

- Hardware

- Software

- Services

Global Soil Monitoring Market, By System Type

- Ground-based Sensing

- Sensing & Imagery

- Robotic & Telematics

Global Soil Monitoring Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?