Global Sodium Thiocyanate Market Size, Share, and COVID-19 Impact Analysis, By Type (Industrial Grade, Technical Grade, and Pharmaceutical Grade), By Application (Chemical Analysis Reagent, Polyacrylonitrile Fiber Spinning Solvent, Color Film Rinses, Defoliants and Propylene Fiber, and Others), By End Use (Pharmaceutical, Building and Construction, Agriculture, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Sodium Thiocyanate Market Insights Forecasts to 2035

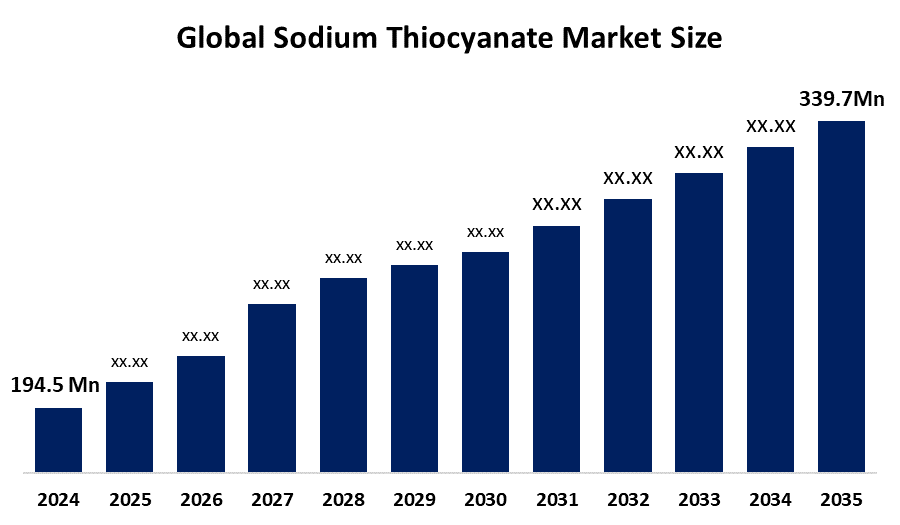

- The Global Sodium Thiocyanate Market Size Was Estimated at USD 194.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.2% from 2025 to 2035

- The Worldwide Sodium Thiocyanate Market Size is Expected to Reach USD 339.7 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global sodium thiocyanate market size was worth around USD 194.5 million in 2024 and is predicted to grow to around USD 339.7 million by 2035 with a compound annual growth rate (CAGR) of 5.2% from 2025 to 2035. The sodium thiocyanate market is expanding due to increasing demand in the textile and pharmaceutical sectors, where it serves as an essential solvent and chemical intermediate. Growth in construction uses is also boosting demand, especially in the Asia-Pacific area.

Market Overview

The worldwide sodium thiocyanate market refers to the sector focused on the manufacture and utilization of sodium thiocyanate, a chemical extensively utilized as a chemical intermediate. It is crucial in the pharmaceutical industry, acrylic fiber production, textile dyeing, agriculture, metal processing and laboratory reagents. Market expansion is fueled by growing manufacturing, escalating demand for acrylic fibers and the heightened use of agrochemicals to improve crop yields. Technological progress, exploration of industrial utilizations and rising demand in developing areas with growing manufacturing sectors continue to create new opportunities. The drive for high-performance fibers and sophisticated chemical blends further aids the growth of the market. Nevertheless, regulatory attention on chemical safety motivates firms to develop more effective manufacturing techniques. Major players in the market, such as Akzo Nobel, Henan Yindu Chemical, Taishan Zhicheng, Tianshui Chemical and Nippon Soda, concentrate on increasing capacity, enhancing product quality and forging alliances to boost their international footprint. In September 2025, the U.S. EPA proposed TSCA amendments to streamline risk evaluations for thiocyanates, reducing manufacturer obligations. TRI updates heightened reporting on occupational thiocyanate exposure. The FDA’s extended Phase II sodium-reduction guidance reaffirmed sodium thiocyanate's GRAS status, supporting its continued use in low-sodium food processing formulations.

Report Coverage

This research report categorizes the sodium thiocyanate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sodium thiocyanate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the sodium thiocyanate market.

Global Sodium Thiocyanate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 194.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.2% |

| 2035 Value Projection: | USD 339.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Type , By Application |

| Companies covered:: | Akzo Nobel, Evonik Industries, Nouryon, Mitsubishi Chemical Group, Henan Yindu Chemical, Taishan Zhicheng, Arkema, ZAMA CHEMICAL, Dongsheng Chemical, Hebei Chengxin Co. Ltd, Ronas Chemical, Asahi Kasei, Honeywell, Tianshui Chemical and Nippon Soda, and Other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The worldwide sodium thiocyanate market is propelled by its growing application in pharmaceuticals, textiles, agriculture and chemical manufacturing. Within the field, it is extensively utilized as a precursor in medication manufacturing, whereas in the textile industry, it aids in fibre creation and dyeing procedures. Rising demand for fibres in developing regions also fuels market growth. In agriculture, sodium thiocyanate is applied in herbicides and plant growth regulators to improve crop yields. Additionally, its applications, in photography, metal treatment and laboratory chemicals, further enhance the market opportunities. Expansion, in markets, is fueled by innovations, technological advances and improved research initiatives.

Restraining Factors

The sodium thiocyanate market faces restraints due to health and environmental risks linked to improper handling and exposure, prompting strict regulatory controls. Volatile raw material prices and the availability of safer chemical substitutes also hinder market expansion. Additionally, limited awareness in developing regions restricts broader adoption across end-use industries.

Market Segmentation

The sodium thiocyanate market share is classified into type, application, and end use.

- The industrial grade segment dominated the market in 2024, approximately 47% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the sodium thiocyanate market is divided into industrial grade, technical grade, and pharmaceutical grade. Among these, the industrial grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Industrial quality sodium thiocyanate leads the market owing to its application in producing textile fibers, chemical synthesis and dye manufacture. Appreciated for its solubility and durability, it plays a role in acrylic fiber creation, electroplating and photographic chemical formulations. Increased industrial production and progress in chemical manufacturing continue to strengthen its market standing, boosting revenue and fostering growth in various fields.

- polyacrylonitrile fiber spinning solvent segment accounted for the largest share in 2024, approximately 34% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the sodium thiocyanate market is divided into chemical analysis reagent, polyacrylonitrile fiber spinning solvent, color film rinses, defoliants and propylene fiber, and others. Among these, the polyacrylonitrile fiber spinning solvent segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The expansion of sodium thiocyanate is fueled by its function as a solvent in the manufacture of polyacrylonitrile fibers used in textiles and industrial fabrics. Its dissolution properties and stability allow for fiber creation and superior quality results. Increasing demand for fibres, in apparel, carpets and industrial goods, strengthens its market leadership, guaranteeing continuous segment expansion and reliable production performance.

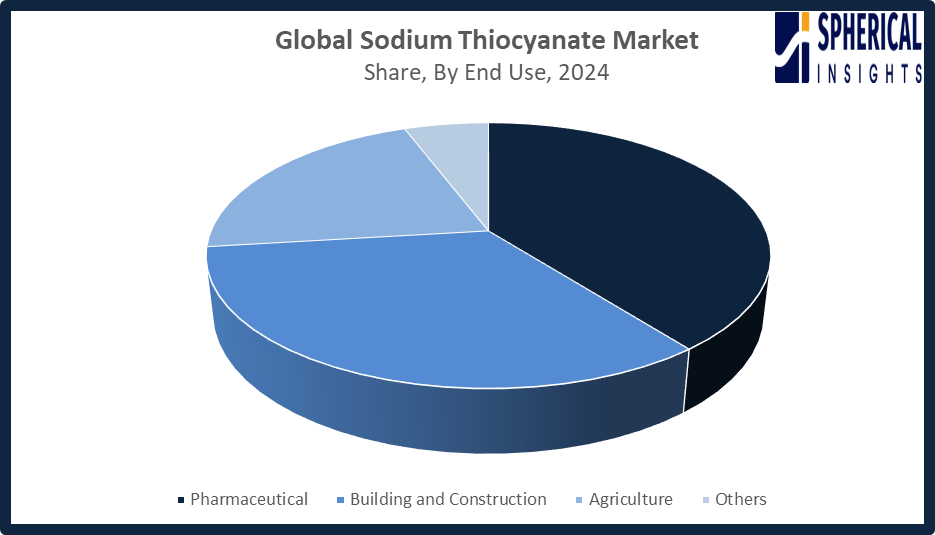

- The pharmaceutical segment accounted for the highest market revenue in 2024, approximately 39% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the sodium thiocyanate market is divided into pharmaceutical, building and construction, agriculture, and others. Among these, the pharmaceutical segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance of pharmaceutical-grade sodium thiocyanate stems from its extensive use in synthesizing pharmaceutical intermediates, diagnostic reagents, and therapeutic formulations. Valued for its reactivity and purity, it supports medical diagnostics and drug development. Growing healthcare focus, expanding pharmaceutical facilities, and consistent demand in laboratory reagents and clinical testing reinforce its critical role in biomedical applications.

Get more details on this report -

Regional Segment Analysis of the Sodium Thiocyanate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

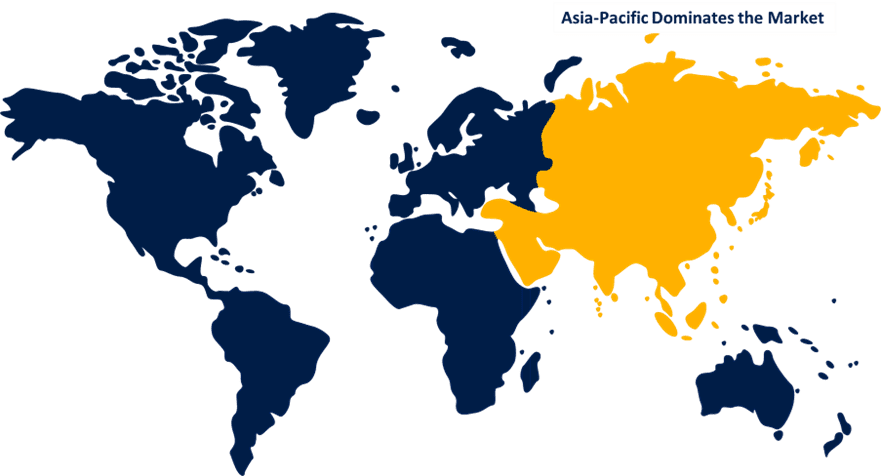

Asia Pacific is anticipated to hold the largest share of the sodium thiocyanate market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the sodium thiocyanate market over the predicted timeframe. The Asia Pacific area is expected to have 47% market share of the sodium thiocyanate market due to expansion, boosting pharmaceutical production, and the development of the textile and acrylic fiber sectors. China and India are contributors driven by the rising demand for synthetic fibers, chemical intermediates and laboratory reagents. Government initiatives, including incentives, for synthesis and stricter policies, promote environmentally friendly manufacturing practices. Within the scope of the Five-Year Plan, China’s Ministry of Ecology required a 15% cut in emissions while subsidies in Jiangsu and Hebei increased capacity by 12% aiding zero-emission goals by 2035 and encouraging expansion in markets.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the sodium thiocyanate market during the forecast period. North America is projected to have 30% market share in the sodium thiocyanate market, fueled by rising needs in pharmaceuticals, chemical synthesis and lab-related uses. The United States, being the market in this area, propels growth through innovative R&D, increasing pharmaceutical production and strict quality regulations. Enhanced use of fibers alongside an intensified emphasis on healthcare innovations also amplifies demand. Favorable regulatory policies and progress in chemical processing technology improve manufacturing efficiency, positioning the region as a player in market growth.

The European sodium thiocyanate market is growing due to rising demand in pharmaceuticals, chemical synthesis and fiber manufacturing. Germany leads the market with its infrastructure, strict quality standards and strong pharmaceutical sector. Focus on compliance in production and advancements, in polymer technology and laboratory applications further support this expansion. In 2025, Vietnam enacted Chemical Law No. 69/2025/QH15, expanding oversight of hazardous chemicals, enforcing lifecycle management, import declarations, and a national chemical database, reinforcing regulatory control and influencing regional market practices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the sodium thiocyanate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Akzo Nobel

- Evonik Industries

- Nouryon

- Mitsubishi Chemical Group

- Henan Yindu Chemical

- Taishan Zhicheng

- Arkema

- ZAMA CHEMICAL

- Dongsheng Chemical

- Hebei Chengxin Co. Ltd

- Ronas Chemical

- Asahi Kasei

- Honeywell

- Tianshui Chemical and Nippon Soda

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Emsa Tecnologia Química launched its Recovered sodium thiocyanate line in Europe, produced from wastewater via a Jiangsu Liaoyuan partnership. Designed for textile dyeing and agrochemicals, it reduces virgin cyanide use by 25%, enhances polymer yield, and captures a 7% share of the green segment.

- In October 2024, Honeywell announced plans to spin off its Advanced Materials business, including sodium thiocyanate in its research chemicals catalog, into a separate U.S.-listed company by late 2025/early 2026, aiming to streamline focus and enhance investment and supply for laboratory reagents.

- In September 2023, Shijiazhuang Synthesis Chemical Co., Ltd. expanded its facility to increase sodium thiocyanate production by approximately 40%, meeting rising global demand across pharmaceuticals, construction, and agriculture, and strengthening its position as a key supplier.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the sodium thiocyanate market based on the below-mentioned segments:

Global Sodium Thiocyanate Market, By Type

- Industrial Grade

- Technical Grade

- Pharmaceutical Grade

Global Sodium Thiocyanate Market, By Application

- Chemical Analysis Reagent

- Polyacrylonitrile Fiber Spinning Solvent

- Color Film Rinses,

- Defoliants and Propylene Fiber

- Others

Global Sodium Thiocyanate Market, By End Use

- Pharmaceutical

- Building and Construction

- Agriculture

- Others

Global Sodium Thiocyanate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?