Global Smart Therapeutic Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Portable Oxygen Concentrators & Ventilators, Insulin Pumps, Hearing Aids, Neurostimulation Devices, Smart Inhalers, and Smart Drug Delivery Systems), By End-Use (Hospitals, Clinics, Home Care, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Smart Therapeutic Devices Market Insights Forecasts to 2035

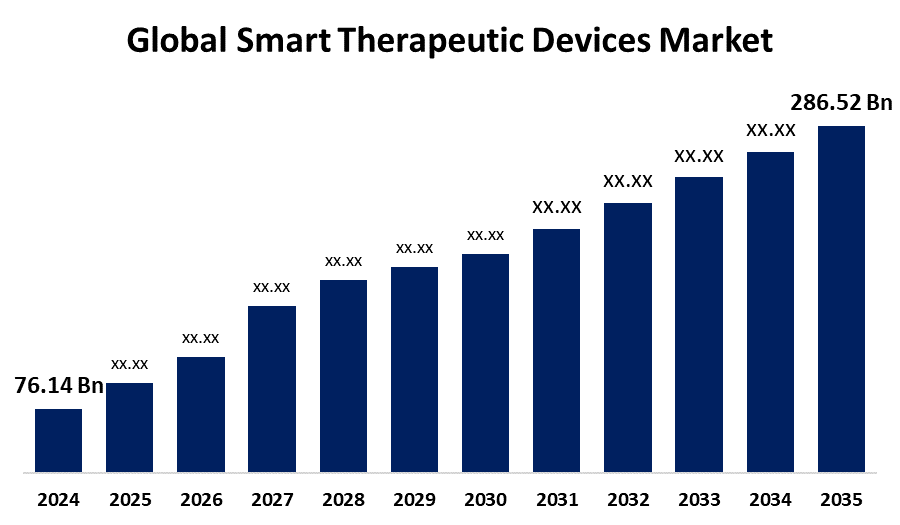

- The Global Smart Therapeutic Devices Market Size Was Estimated at USD 76.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.8% from 2025 to 2035

- The Worldwide Smart Therapeutic Devices Market Size is Expected to Reach USD 286.52 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Smart Therapeutic Devices Market Size was worth around USD 76.14 Billion in 2024 and is predicted to grow to around USD 286.52 Billion by 2035 with a compound annual growth rate (CAGR) of 12.8% from 2025 and 2035. The smart therapeutic devices market is expanding due to rising prevalence of chronic diseases, technological advancements in AI and IoT, increasing demand for remote and personalized healthcare, the increasing adoption of telemedicine, and encouraging government policies that facilitate digital health solutions.

Market Overview

The smart therapeutic devices market globally refers to sophisticated medical devices with smart technology to provide targeted therapy, track patient health, and improve the outcome of treatment. These devices are used in the treatment of chronic diseases, rehabilitation, pain management, and drug administration. Their major strengths are concurrent monitoring of data, individualized therapy, wireless transmission, and integration with healthcare IT infrastructures, allowing improved patient compliance and remote care. Opportunities arise from the increasing prevalence of chronic diseases, aging populations, and increasing telemedicine adoption.

Governments promote smart therapeutic devices through funding digital health programs, supporting telemedicine adoption, implementing regulations for device safety and data privacy, and encouraging innovation to improve healthcare access and chronic disease management globally. Key drivers are technological developments such as IoT and AI, increased expenditure in healthcare, and government policies supporting digital health solutions. As healthcare shifts towards patient-centric care, smart therapeutic devices are crucial for improving treatment outcomes and minimizing hospital visits, making the market dynamic and fast-growing.

Report Coverage

This research report categorizes the smart therapeutic devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the smart therapeutic devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the smart therapeutic devices market.

Global Smart Therapeutic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.8% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Device Type, By End-Use, By Regional Analysis |

| Companies covered:: | Abbott Laboratories, Omron Healthcare Co., Ltd., DexCom Inc., Medtronic, Garmin Ltd., Boston Scientific, ResMed Inc., Fitbit Inc, Koninklijke Philips N.V., Vital Connect, Inc., Nevro Corp., Sotera Wireless, Inc., F. Hoffmann-La Roche Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The smart therapeutic devices market is fueled by the increasing incidence of chronic conditions and an aging world population demanding constant monitoring and customized treatment. Technological innovations such as AI, IoT, and wireless connectivity provide real-time data gathering and remote patient care, improving the effectiveness of therapy. Rising healthcare spending and accelerating use of telemedicine also boost demand. Government initiatives in the form of encouraging digital health and regulatory policies guarantee safety and innovation. Furthermore, the transition to home care and minimally invasive procedures promotes the utilization of smart therapeutic devices, making health care more convenient and effective worldwide.

Restraining Factors

High prices, data privacy issues, regulatory issues, and limited awareness in the developing world restrict the market adoption of smart therapeutic devices. Also, technical difficulties and compatibility problems with current health systems hamper market expansion.

Market Segmentation

The smart therapeutic devices market share is classified into device type and end-use.

- The smart drug delivery systems segment accounted for the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the device type, the smart therapeutic devices market is divided into portable oxygen concentrators & ventilators, insulin pumps, hearing aids, neurostimulation devices, smart inhalers, and smart drug delivery systems. Among these, the smart drug delivery systems segment accounted for the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is due to smart drug delivery systems improving medicine precision and patient adherence for the treatment of chronic diseases. Dosage and response tracking in real time enables clinical and remote care. Connected platforms and personalization fuel rising adoption and long-term use of the devices.

- The hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the smart therapeutic devices market is divided into hospitals, clinics, home care, and others. Among these, the hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Hospitals drive smart device adoption, attributed to sophisticated treatment, specialist availability, and integration of therapeutic technologies. Their financial resources, established procurement procedures, and deployment and monitoring infrastructure are leading drivers to adopt neurostimulation, drug delivery, and connected ventilator systems.

Regional Segment Analysis of the Smart Therapeutic Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the smart therapeutic devices market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the smart therapeutic devices market over the predicted timeframe. North America led the smart therapeutic devices market, fueled by sophisticated healthcare infrastructure and the concentration of top medical technology firms. High chronic disease management awareness through connected solutions, early digital health technology adoption, strong R&D spending, and supportive reimbursement policies drive market growth. Top devices are insulin pumps, neurostimulators, and wearables. Moreover, increasing cases of lifestyle-related conditions such as diabetes and cardiovascular diseases in the U.S. and Canada continue to drive the demand for intelligent therapeutic devices in the region.

Asia Pacific is expected to grow at a rapid CAGR in the smart therapeutic devices market during the forecast period. The growing healthcare spending, the rise in incidence of chronic diseases, and a growing population are driving the growth in the Asia Pacific market for smart therapeutic devices. China, India, and Japan have robust investments in digital health, telemedicine, and mobile health. Increasing internet and smartphone penetration and government initiatives for greater access to remote care also improve demand. Furthermore, expansion of the middle class and increased awareness of healthcare grow demand for affordable, networked health solutions in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the smart therapeutic devices market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Omron Healthcare Co., Ltd.

- DexCom Inc.

- Medtronic

- Garmin Ltd.

- Boston Scientific

- ResMed Inc.

- Fitbit Inc

- Koninklijke Philips N.V.

- Vital Connect, Inc.

- Nevro Corp.

- Sotera Wireless, Inc.

- F. Hoffmann-La Roche Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, Medtronic announced FDA approval for Simplera™, its first unified, disposable continuous glucose monitor (CGM). Simplera™ offers a discreet, tape-free design and integrates with the InPen™ smart insulin pen and MiniMed™ 780G system via Simplera Sync™.

- In September 2024, Nevro Corp. announced FDA approval and limited market release of HFX iQ™ with HFX AdaptivAI™, a personalized, responsive pain management platform that powers the HFX iQ spinal cord stimulation (SCS) system for chronic pain treatment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the smart therapeutic devices market based on the below-mentioned segments:

Global Smart Therapeutic Devices Market, By Device Type

- Portable Oxygen Concentrators & Ventilators

- Insulin Pumps

- Hearing Aids

- Neurostimulation Devices

- Smart Inhalers

- Smart Drug Delivery Systems

Global Smart Therapeutic Devices Market, By End-Use

- Hospitals

- Clinics

- Home Care

- Others

Global Smart Therapeutic Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?