Global Smart Insulin Pen Market Size, Share, and COVID-19 Impact Analysis, By Connectivity (Bluetooth, Near Field Communication, Others), By Indication (Type 1 Diabetes, Type 2 Diabetes), By Distribution Channel (Hospital Pharmacies, Retail & Online Pharmacies, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: HealthcareGlobal Smart Insulin Pen Market Size Insights Forecasts to 2032

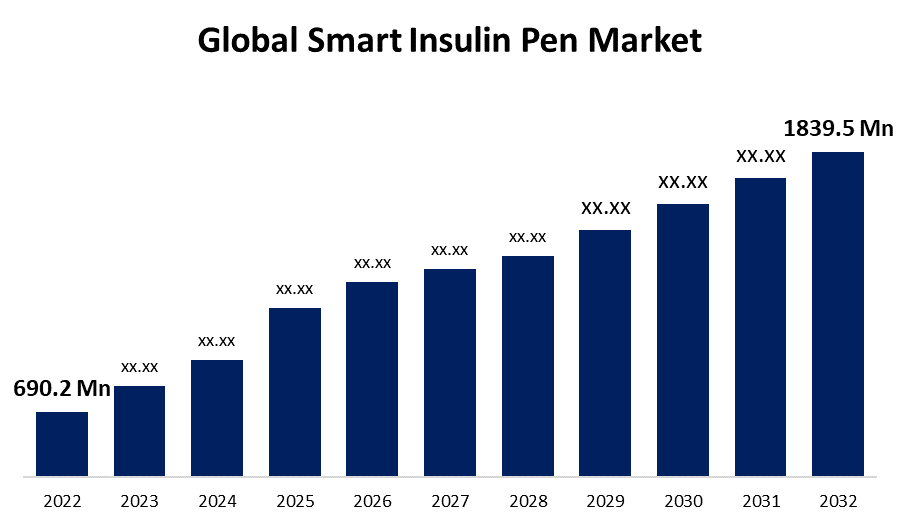

- The Global Smart Insulin Pen Market Size was valued at USD 690.2 Million in 2022.

- The Market Size is Growing at a CAGR of 10.3% from 2022 to 2032.

- The Worldwide Smart Insulin Pen Market Size is expected to reach USD 1839.5 Million by 2032.

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Smart Insulin Pen Market Size is expected to reach USD 1839.5 Million by 2032, at a CAGR of 10.3% during the forecast period 2022 to 2032.

Smart insulin pens are reusable wireless insulin injectors with an easy-to-use app that tracks dosing data and recommends insulin doses for diabetic patients. There are two types of smart insulin pens: disposable and reusable. These pens can be linked to a smartphone app via NFC or Bluetooth technology, allowing diabetics to keep track of insulin administration schedules. The majority of diabetic patients have difficulty correctly calculating insulin dosage. The smart insulin pen can calculate each dose based on carbohydrate amount, current blood sugar level, active insulin, meal size, and doctor-prescribed settings. The result could be insulin stacking. It aids in the management of diabetes by improving insulin administration. The disposable capability of intelligent insulin pens contributes to the product's sterility. As a result, the patient is safe from STDs, which have become the most worried threat in the hospital and clinic sectors. The use of this smart insulin pen has greatly simplified the management of diabetes types 1 and 2.

Global Smart Insulin Pen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 690.2 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 10.3% |

| 2032 Value Projection: | USD 1839.5 Million |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Connectivity, By Indication, By Region, |

| Companies covered:: | Novo Nordisk A/S, Medtronic, Ypsomed AG, Diabnext, Jiangsu Deflu Medical Device Co., Emperra GmbH, Pendiq, Cambridge Consultants Ltd., Sanofi, Berlin-Chemie AG, Bigfoot Biomedical Inc., Digital Medics Pty Ltd., Eli Lilly and Company, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

A sedentary lifestyle, which includes lack of exercise, poor diet, stress, and other factors, is one of the major causes of the rising prevalence of diabetes. Diabetes is also caused by genetic mutations, hormonal diseases, chronic pancreatitis, cystic fibrosis, and medications, which are driving up demand for smart insulin pens. The main driving factor of smart insulin pens is their high accuracy in dose calculation, which leads to improved clinical outcomes in diabetic patients with reminders and regular glucose monitoring, these pens assist patients in adhering to the prescribed insulin dose, resulting in an improvement in self-management of diabetes. Furthermore, the availability of multiple diabetes therapies encourages patients to self-manage with auto-injectors, including connected insulin pens. Thus, all of the above, as well as the rapidly growing patient pool, are expected to drive demand for these pens during the forecast period.

Restraining Factors

Smart insulin pens are technologically advanced and innovative, so they are relatively expensive. The high cost discourages product adoption, particularly among the uninsured. Additionally, coverage for connected insulin pens may be limited or non-existent for the insured population, further limiting product adoption and hindering market growth during the forecast period.

Market Segmentation

By Product Type Insights

The Bluetooth segment is expected to hold the largest share of the global smart insulin pen market during the forecast period.

Based on the product type, the global smart insulin pen market is classified into Bluetooth, near-field communication, and others. Among these, Bluetooth is expected to hold the largest share of the smart insulin pen market during the forecast period, due to Bluetooth connectivity with many products and its high availability. Furthermore, Bluetooth technology is becoming more widely adopted and supported across a wide range of devices and platforms. Furthermore, the technology provides a greater range of connectivity, up to around 100 meters, allowing for greater flexibility in usage. Many market players have developed connected insulin pens with Bluetooth connectivity due to multiple advantages.

By Indication Insights

The type 2 segment is witnessing significant CAGR growth over the forecast period.

Based on the Indication, the smart insulin pen market is segmented into type 1 diabetes and type 2 diabetes. Among these, the type 2 segment grow at a significant CAGR growth over the forecast period. Type 2 diabetes affects approximately 90% of diabetic patients, which is a significant proportion. The growing patient preference for innovative technologies attracts more users to these pens, propelling segment growth during the forecast period.

By End User Insights

The hospital pharmacies segment is witnessing substantial CAGR growth over the forecast period.

Based on the end user, the smart insulin pen market is segmented into hospital pharmacies, retail & online pharmacies, and others. Among these, the hospital pharmacies segment is dominating the market with substantial CAGR growth over the forecast period, due to the advanced procurement facilities, easy access, and availability of these pens. According to multiple studies, hospitals and pharmacies have more streamlined supply chain channels, which encourages physicians to pursue evidence-based prescribing.

Regional Insights

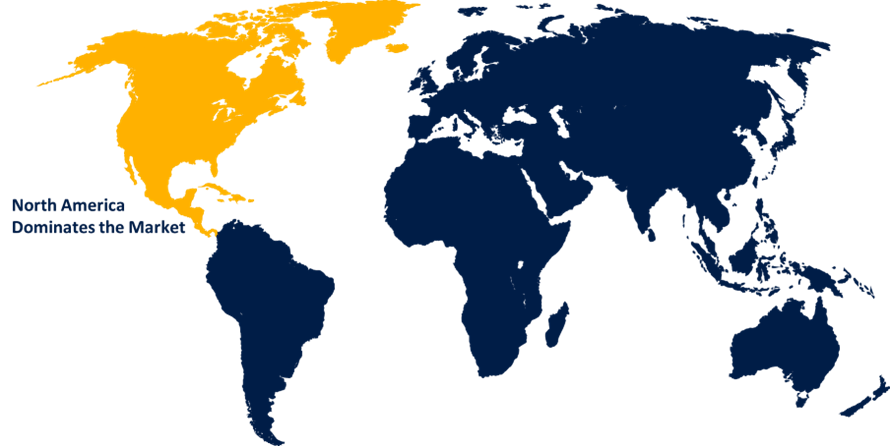

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market share over the forecast period. The growing use of connected insulin pens, as well as the significantly higher cost of the product in the United States compared to other countries, are the primary drivers of the region's comparatively large market size. Furthermore, a sizable insured population, offers and initiatives from key market players, and easy access to healthcare are propelling regional growth during the forecast period.

The European market is expected to grow at the fastest rate during the forecast period owing to the rising prevalence of diabetes, the presence of key players, technological collaborations, and R&D activities in the region's healthcare sector. Germany is expected to emerge as a highly profitable market for smart insulin pens, owing to large investment volumes to address the growing diabetes burden in the German population. With the growing preference for non-invasive surgeries, healthcare providers in the United Kingdom are emphasizing the importance of needle-free insulin injections.

List of Key Market Players

- Novo Nordisk A/S

- Medtronic

- Ypsomed AG

- Diabnext

- Jiangsu Deflu Medical Device Co.

- Emperra GmbH

- Pendiq

- Cambridge Consultants Ltd.

- Sanofi

- Berlin-Chemie AG

- Bigfoot Biomedical Inc.

- Digital Medics Pty Ltd.

- Eli Lilly and Company

Key Market Developments

- In March 2022, Novo Nordisk A/S announced that NovoPen 6 and NovoPen Echo Plus are now available to NHS patients in the United Kingdom. The availability of smart insulin pens increased access to devices and aided diabetic patients in efficiently monitoring and recording dosing information.

- In September 2022, Novo Nordisk A/S received National Medical Products Administration (NMPA) marketing approval in China for Novopen 6, a smart insulin pen that automatically stores the time of injections and the number of insulin units taken by users.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global smart insulin pen market based on the below-mentioned segments:

Smart Insulin Pen Market, Connectivity Analysis

- Bluetooth

- Near Field Communication

- Others

Smart Insulin Pen Market, Indication Analysis

- Type 1 Diabetes

- Type 2 Diabetes

Smart Insulin Pen Market, Distribution Channel Analysis

- Hospital Pharmacies

- Retail & Online Pharmacies

- Others

Smart Insulin Pen Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?