Global Smart Agriculture Market Size, Share, and COVID-19 Impact Analysis, By Agriculture Type (Precision Farming, Livestock Monitoring, Smart Greenhouse, and Others), By Offering (Hardware, Software, and Services), By Application (Precision Farming Application, Livestock Monitoring Application, Smart Greenhouse Application, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: AgricultureGlobal Smart Agriculture Market Insights Forecasts to 2032

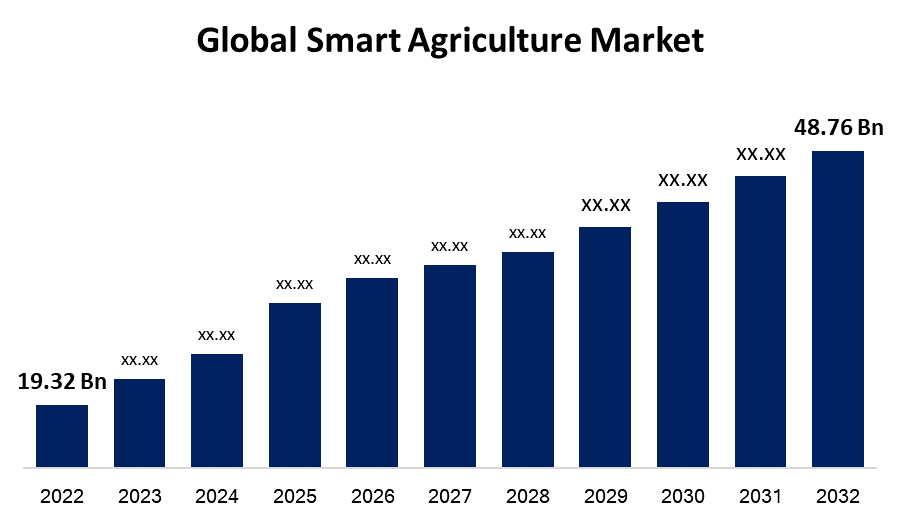

- The smart agriculture Market Size was valued at USD 19.32 Billion in 2022.

- The Market is Growing at a CAGR of 9.7% from 2022 to 2032

- The Worldwide smart agriculture Market Size is expected to reach USD 48.76 Billion by 2032

- Asia-Pacific is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global smart agriculture Market Size is expected to reach USD 48.76 Billion by 2032, at a CAGR of 9.7% during the forecast period 2022 to 2032.

Market Overview

Smart agriculture, also known as precision agriculture, refers to the integration of modern technologies into traditional farming practices to enhance productivity, efficiency, and sustainability. It involves the use of advanced sensors, data analytics, and automation to monitor and optimize various aspects of agricultural processes. Smart agriculture enables farmers to make data-driven decisions regarding irrigation, fertilization, pest control, and crop management. By leveraging Internet of Things (IoT) devices and remote sensing technologies, farmers can gather real-time information on soil moisture, weather conditions, crop health, and livestock monitoring. This information empowers them to optimize resource allocation, reduce waste, minimize environmental impact, and increase yields. Smart agriculture has the potential to revolutionize the farming industry, making it more efficient, resilient, and capable of feeding a growing global population while mitigating challenges such as climate change and resource scarcity.

Report Coverage

This research report categorizes the market for smart agriculture market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the smart agriculture market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the smart agriculture market.

Global Smart Agriculture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 19.32 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.7% |

| 2032 Value Projection: | USD 48.76 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Agriculture Type, By Offering, By Application, By Region |

| Companies covered:: | Ag Leader Technology, AGCO Corporation, AgJunction, Inc, AgEagle Aerial Systems Inc, Autonomous Solutions, Inc, Argus Control Systems Ltd, BouMatic Robotic B.V, CropMetrics LLC, CLAAS KGaA GmbH, CropZilla, Deere & Company, DICKEY-john, DroneDeploy, DeLaval Inc, Farmers Edge Inc, Grownetics, Inc, Granular, Inc, Gamaya, GEA Group Aktiengesellschaft, Raven Industries, Trimble Inc, Topcon Positioning Systems |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The smart agriculture market is driven by several key factors. The increasing global population and rising food demand necessitate higher agricultural productivity, prompting farmers to adopt advanced technologies to maximize yields. The need for resource optimization drives the adoption of smart solutions that enable precise water and fertilizer management, reducing waste and environmental impact. The growing trend of IoT and connected devices facilitates the collection of real-time data on weather conditions, soil moisture, and crop health, enabling farmers to make data-driven decisions and improve overall farm management. Additionally, government initiatives and policies promoting sustainable agriculture practices and the integration of technology in farming further propel the market growth. Furthermore, the declining cost of sensors, drones, and other smart agriculture technologies makes them more accessible to farmers, encouraging their adoption.

Restraining Factors

The smart agriculture market faces certain restraints that hinder its growth. The initial high cost of implementing smart agriculture technologies can be a barrier, especially for small-scale farmers with limited financial resources. There may be a lack of awareness and technical expertise among farmers regarding the benefits and effective utilization of these technologies. The limited internet connectivity and infrastructure in rural areas can pose challenges in accessing real-time data and implementing IoT-based solutions. Additionally, concerns regarding data security and privacy may hinder the adoption of smart agriculture solutions. Overall, regulatory complexities and slow policy implementation in some regions can impede the widespread adoption of these technologies in the agricultural sector.

Market Segmentation

- In 2022, the livestock monitoring segment accounted for around 21.3% market share

On the basis of the agriculture type, the global smart agriculture market is segmented into precision farming, livestock monitoring, smart greenhouse, and others. The livestock monitoring segment has emerged as the largest market share holder in the smart agriculture industry. This can be attributed to several factors. Efficient livestock management is crucial for farmers to ensure animal health, productivity, and overall farm profitability. Livestock monitoring solutions, integrated with IoT devices and sensors, enable real-time tracking and analysis of crucial parameters such as animal behavior, health, and feeding patterns. This helps farmers identify and address issues promptly, reducing the risk of disease outbreaks, optimizing feed utilization, and improving breeding and reproduction practices. Additionally, livestock monitoring solutions enhance operational efficiency by automating tasks like estrus detection and health monitoring, minimizing labor costs. Moreover, increasing consumer demand for quality animal products and the need to comply with stringent regulations regarding animal welfare and traceability further drive the adoption of livestock monitoring solutions, solidifying its dominant market position.

- In 2022, the yield monitoring segment dominated with more than 41.8% market share

Based on the type of material, the global smart agriculture market is segmented into precision farming application, livestock monitoring application, smart greenhouse application, and others. The yield monitoring, sub-segment of precision farming has captured the largest market share in the smart agriculture industry, and this can be attributed to several factors. The accurate yield monitoring is crucial for farmers to optimize crop production, resource allocation, and overall farm profitability. Yield monitoring solutions, integrated with advanced sensors and data analytics, provide real-time information on crop yield variability across fields. This enables farmers to identify areas of high or low productivity, assess the impact of different farming practices, and make data-driven decisions to enhance yield and efficiency. Additionally, yield monitoring solutions facilitate precision farming by enabling farmers to precisely apply inputs such as fertilizers and irrigation based on yield variability within their fields. Furthermore, increasing pressure to improve food production to meet the rising global demand, optimize resource utilization, and minimize environmental impact drives the adoption of yield monitoring technologies, consolidating its position as the largest market share holder in the smart agriculture industry.

Regional Segment Analysis of the Smart Agriculture Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

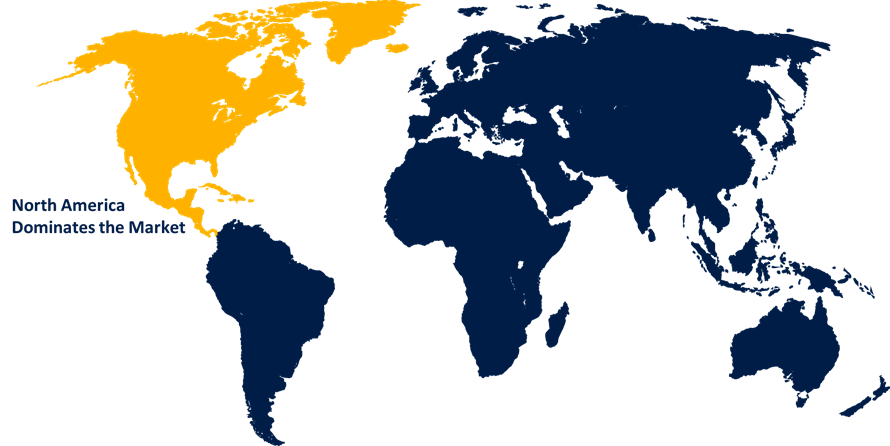

North America dominated the market with more than 40.5% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as the dominant region in the smart agriculture market, primarily due to several key factors. The region has a strong technological infrastructure and advanced farming practices, making it conducive to the adoption of smart agriculture solutions. North America has a large number of tech-savvy farmers who are open to embracing new technologies and innovations to improve their agricultural operations. Additionally, favorable government initiatives and policies promoting sustainable agriculture and the use of advanced technologies further drive the market in the region. Moreover, the presence of major players in the smart agriculture industry, coupled with significant investments in research and development, contributes to the market dominance of North America. Furthermore, the region's emphasis on precision farming, data-driven decision-making, and the need for efficient resource management propel the growth of the smart agriculture market in North America.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global smart agriculture market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Ag Leader Technology

- AGCO Corporation

- AgJunction, Inc.

- AgEagle Aerial Systems Inc.

- Autonomous Solutions, Inc.

- Argus Control Systems Ltd

- BouMatic Robotic B.V.

- CropMetrics LLC

- CLAAS KGaA GmbH

- CropZilla

- Deere & Company

- DICKEY-john

- DroneDeploy

- DeLaval Inc.

- Farmers Edge Inc.

- Grownetics, Inc.

- Granular, Inc.

- Gamaya

- GEA Group Aktiengesellschaft

- Raven Industries

- Trimble Inc.

- Topcon Positioning Systems

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, Trimble Inc. has introduced the GFX-1060 and GFX-1260 displays, designed specifically for precision agriculture applications. These advanced displays empower farmers to efficiently and effectively carry out various in-field tasks. With real-time mapping and monitoring capabilities, farmers can precisely gather and analyze field data on the go. The next-generation displays enable swift decision-making by providing accurate and up-to-date information, enhancing overall productivity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global smart agriculture market based on the below-mentioned segments:

Smart Agriculture Market, By Agriculture Type

- Precision Farming

- Livestock Monitoring

- Smart Greenhouse

- Others

Smart Agriculture Market, By Offering

- Hardware

- Software

- Services

Smart Agriculture Market, By Application

- Precision Farming Application

- Livestock Monitoring Application

- Smart Greenhouse Application

- Others

Smart Agriculture Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?