Global Small Hydropower Market Size, Share, and COVID-19 Impact Analysis, By Type (Micro Hydropower, Mini Hydropower), By Component (Civil Construction, Power Infrastructure, Electromechanical Equipment, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Energy & PowerSmall Hydropower Market Summary

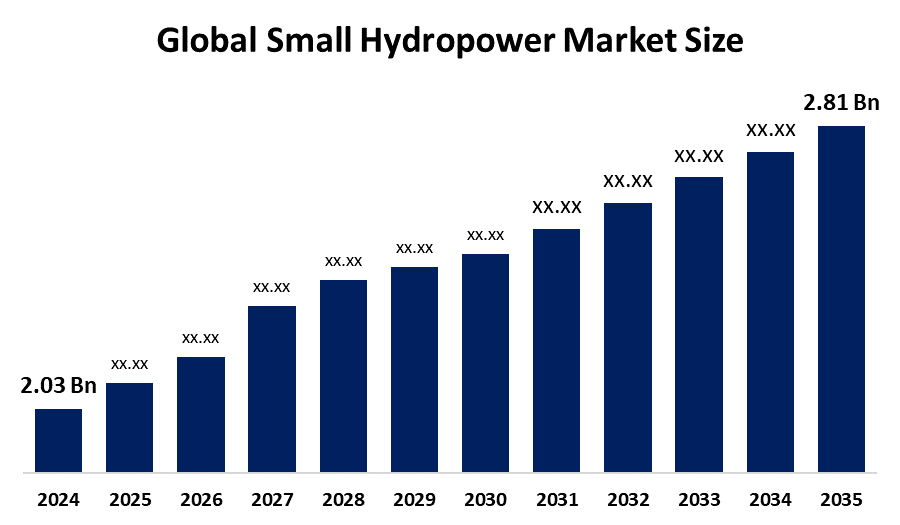

The Global Small Hydropower Market Size Was Valued at USD 2.03 Billion in 2024 and is Projected to Reach USD 2.81 Billion by 2035, Growing at a CAGR of 3% from 2025 to 2035. The market for small hydropower is expanding due to a number of factors, including the growing need for clean and dependable energy, rural electrification, favourable government regulations, minimal environmental impact, and technological developments that increase the efficiency, affordability, and adaptability of small-scale hydro projects in remote areas.

Get more details on this report -

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific small hydropower market led globally and had the highest revenue share of 36.57%.

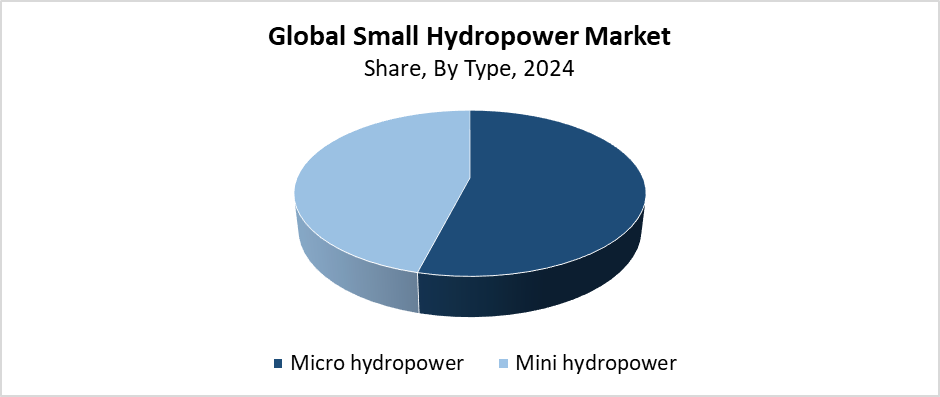

- In 2024, the micro hydropower segment had the highest revenue share of 54.36% and led the market by type.

- In 2024, the civil construction segment had the largest revenue share of 32.68% and led the market based on components.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.03 Billion

- 2035 Projected Market Size: USD 2.81 Billion

- CAGR (2025-2035): 3%

- Asia Pacific: Largest Market in 2024

The Small Hydropower (SHP) Market Size operates within the renewable energy sector through installations that produce up to 10 MW by converting water flow into electrical power. Small hydropower systems create fewer environmental impacts because they need less space and can operate in remote areas, which causes minimal harm to the environment compared to large-scale hydroelectric facilities. The market growth receives support from three main elements, which include rural electrification requirements, worldwide clean energy needs, and climate change concerns about greenhouse gas emissions. Small hydropower systems deliver dependable, affordable power solutions to off-grid areas. These develop in places where centralised power grids fail to reach.

The small hydropower market is experiencing its current growth because of technological progress. The development of turbine efficiency, automation systems, and low-head hydropower technology has enabled SHP systems to operate in new ways, which makes them more economical for locations with restricted water flow. The construction industry benefits from modular and prefabricated designs because they reduce both building costs and the time needed for installation. The development of SHP receives worldwide governmental backing through different policy measures which include feed-in tariffs and financial support through subsidies and grant programs. The national energy plans of Asia-Pacific, Africa, and Latin America now focus on small hydropower as their primary rural development and renewable energy solution.

Type Insights

Get more details on this report -

What Contributed to the Micro Hydropower Segment Holding the Largest Revenue Share of 54.36% in the Small Hydropower Market in 2024?

The micro hydropower segment led the small hydropower market in 2024 by holding the largest revenue share of 54.36%. The technology maintains its dominance because it serves as the primary energy source for local power needs in off-grid areas throughout developing countries. Micro hydropower systems generate up to 100 kW on average, which makes them ideal for community energy projects and rural power distribution, because they deliver affordable and sustainable solutions. Their popularity results from their easy installation process, together with their low maintenance requirements. The worldwide growth of micro hydropower technology receives backing from governments because they want to create renewable energy for off-grid communities and maintain stable power access in rural locations.

The mini hydropower segment is expected to grow at a significant rate throughout the forecast period because grid-connected renewable energy systems and decentralised power generation systems continue to grow in demand. Mini hydropower plants with capacities between 100 kW and 10 MW generate electricity that serves small towns and rural communities, as well as businesses. These systems attract funding from both public and private sectors because they offer high scalability while being cost-efficient and environmentally friendly. The deployment of these systems advances because clean energy targets have grown stronger. Governments support their adoption through feed-in tariffs, subsidies, and rural electrification programs. Micro hydropower projects worldwide have become more feasible because of technological improvements which enhance turbine performance and site selection processes.

Component Insights

What Factors Enabled the Civil Construction Segment to Lead the Small Hydropower Market with a 32.68% Revenue Share in 2024?

The civil construction segment led the small hydropower market with the largest revenue share of 32.68% in 2024. The section contains essential infrastructure components which serve to manage water flow and generate power through spillways, canals, tunnels, and dams. Small hydropower plants require major financial resources to build their sites and construct the facilities. This leads to their high percentage. The construction of SHP systems depends on civil construction, which provides both structural stability and water management capabilities. The total market leadership of this segment continues to grow because new small hydropower plants require customised civil engineering solutions that must be durable and adaptable for their development in mountainous and isolated areas.

The small hydropower market's electromechanical equipment segment is expected to grow significantly through the forecasted period because of advancements in turbine, generator, and control system technologies. The following section describes essential components which determine the performance and operational success of SHP plants through their impact on turbines, generators, speed regulators, and control panels. The market drives modern electromechanical system development because of the need for compact and low-maintenance equipment that delivers high performance. The organisation benefits from improved operational performance and reduced downtime through its implementation of automated systems. This includes remote monitoring capabilities. The market segment will experience growth because small hydropower projects need reliable and advanced electromechanical systems for their off-grid and rural installations.

Global Small Hydropower Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.03 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3% |

| 2035 Value Projection: | USD 2.81 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Region |

| Companies covered:: | ANDRITZ, TOSHIBA CORPORATION, Gilkes, Bharat Heavy Electricals Limited, Siemens Energy, SNC Lavalin Group, General Electric, Natel Energy, FLOVEL Energy Private Limited, Voith GmbH & Co., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Regional Insights

The North American small hydropower market experiences significant growth because renewable energy funding increases while old hydro infrastructure gets updated, and local power production becomes more vital. Small hydropower systems in the US and Canada operate off their water resources to provide power for remote areas and rural communities. The federal government, together with state authorities, backs environmentally friendly hydropower development through financial help, tax incentives, and legal frameworks. The technology advancements in automation, grid integration, and turbine efficiency improvements help make small hydropower systems more accessible and affordable. The regional power system depends on small hydropower as its core clean energy source because it delivers secure power and reduces carbon emissions.

Asia Pacific Small Hydropower Market Trends

The Asia Pacific small hydropower market led globally by holding the largest revenue share of 36.57% in 2024. Rural electrification in China, India, Vietnam, and Indonesia, together with government backing and extensive water resources, created the market for these countries. The countries dedicate major funds to small-scale renewable energy systems, which aim to meet the expanding power needs of remote areas without grid access. The deployment of minor hydropower projects moves forward because of government funding schemes. These include feed-in tariffs and other financial incentives. The area receives benefits from affordable labour costs and advancing technological capabilities, which help reduce project expenses while enhancing operational efficiency. The Asia Pacific region leads the global small hydropower market because it strongly supports climate goals and sustainable power development.

Get more details on this report -

Europe Small Hydropower Market Trends

Europe's small hydropower market experiences significant growth because the region maintains a strong dedication to energy security, renewable energy standards, and decarbonization efforts. Germany, France, Italy, and Austria promote small hydropower as a reliable, sustainable energy solution for rural and mountainous regions. The European Green Deal promotes small hydro project investments through its supportive policies, which include feed-in tariffs, grants and incentives. Smart technology integration and modernisation of hydro infrastructure have led to improved efficiency and better grid compatibility. Europe continues to develop small hydropower facilities to reach its sustainable energy targets. These address climate change and energy independence needs.

Key Small Hydropower Companies:

The following are the leading companies in the small hydropower market. These companies collectively hold the largest market share and dictate industry trends.

- ANDRITZ

- TOSHIBA CORPORATION

- Gilkes

- Bharat Heavy Electricals Limited

- Siemens Energy

- SNC Lavalin Group

- General Electric

- Natel Energy

- FLOVEL Energy Private Limited

- Voith GmbH & Co.

- Others

Recent Developments

- In May 2025, the Ministry of New and Renewable Energy (MNRE) released updated guidelines that apply to projects approved under the 2009 and 2014 frameworks. The guidelines were created to streamline processes and resolve long-standing issues in Small Hydro Power (SHP) schemes. Of particular note is that developers can now obtain the entire second instalment of Central Financial Assistance (CFA) by reaching 80% of expected electricity generation in a single month instead of three consecutive months; if they don't, that instalment will be reduced proportionately.

- In February 2025, the Deputy Chief Minister of Arunachal Pradesh examined the state's minor hydroelectric projects, highlighting their compatibility with Atmanirbhar Arunachal and India's net-zero objectives. In anticipation of an investment of INR 7,000 crore and the creation of 7,500 jobs, the state has allotted 570.75 MW to 35 minor hydropower projects. It is anticipated that these projects will produce INR 58.25 crore in free power revenue yearly once they are finished.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the small hydropower market based on the below-mentioned segments:

Global Small Hydropower Market, By Type

- Micro hydropower

- Mini hydropower

Global Small Hydropower Market, By Component

- Civil Construction

- Power Infrastructure

- Electromechanical Equipment

- Others

Global Small Hydropower Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?