Singapore Water Enhancer Market Size, Share, and COVID-19 Impact Analysis, By Product (Non-Nutritional and Nutritional), By Form (Liquid and Powder), Distribution Channel (Offline and Online), and Singapore Water Enhancer Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSingapore Water Enhancer Market Insights Forecasts to 2035

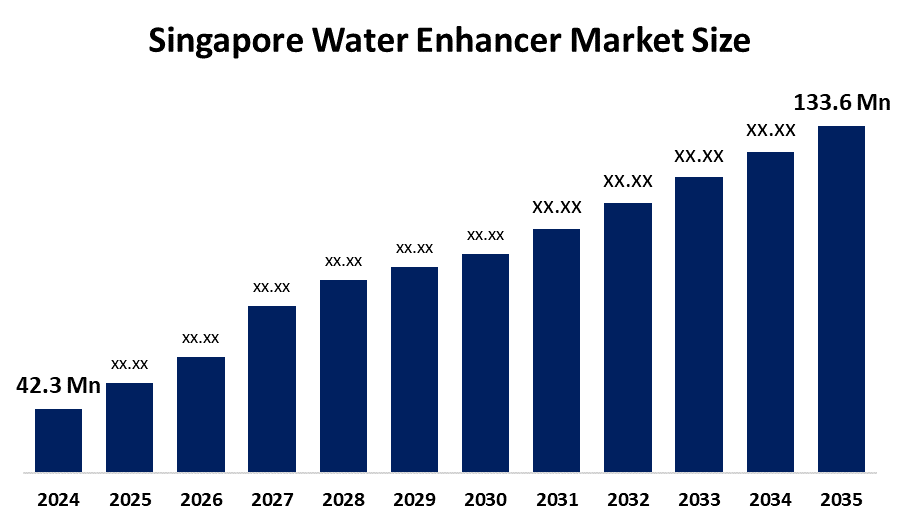

- The Singapore Water Enhancer Market Size Was Estimated at USD 42.3 Million in 2024

- The Singapore Water Enhancer Market Size is Expected to Grow at a CAGR of Around 11.02% from 2025 to 2035

- The Singapore Water Enhancer Market Size is Expected to Reach USD 133.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Singapore water enhancer market size is anticipated to reach USD 133.6 million by 2035, growing at a CAGR of 11.02% from 2025 to 2035. The Singapore water enhancer market is driven by growing health and wellness trends, increasing consumer preference for flavored and functional beverages, rising awareness of hydration benefits, and demand for low-sugar, convenient drink options. Greater availability of a wide variety of flavors and the influence of fitness and lifestyle culture also support market growth.

Market Overview

The Singapore water enhancer market covers the sales and distribution of additives in liquid, powder, or tablet form that are combined with plain water to enhance its taste, sweetness, or other functional benefits, e.g., added vitamins, minerals, electrolytes, or energy. These products provide easy, customizable hydration options that fit well with hectic lifestyles, with low sugar and customizable hydration options available both in physical stores and online in Singapore. The market is driven by an increasing health and wellness consciousness, a rising demand for low-sugar and functional beverages, growing fitness and active lifestyle trends, and a preference for convenient on-the-go beverage solutions, as well as enhanced distribution through retail stores and e-commerce platforms in Singapore.

Singapore's high-level market for water enhancers is mainly driven by people's health needs and lifestyle habits. The prevalence of overweight and obesity in adults in Singapore is more than 60%, and roughly 1 out of 3 adults drinks sugary beverages daily, thus increasing the risk of diabetes and metabolic disorders. Along with over 500,000 diabetic patients and the risk of dehydration due to Singapore's hot and humid climate, consumers are turning to low-sugar and convenient hydration solutions, which is what water enhancers offer by giving the flavor a boost while discouraging excessive sugar consumption. Hence, health-conscious individuals, office workers, and gym enthusiasts find them quite appealing.

Besides, the government-led initiatives act as a catalyst for market penetration. During the implementation of the 'War on Diabetes' and the programs of the Health Promotion Board (HPB), the authorities actively encourage the reduction of sugar intake, opting for healthier beverage types, and keeping oneself hydrated daily through publicity campaigns and food labeling regulations such as Nutri-Grade. These directives severely limit the use of sugar and strongly support the development of low-calorie, functional drinks. From a marketing standpoint, the water enhancer market in Singapore is a perfect example of a health-conscious population, government-initiated sugar reduction measures, and the general consumer trend towards hydration customization, making the market highly relevant, essential, and ready for growth.

Report Coverage

This research report categorizes the market for the Singapore water enhancer market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore water enhancer market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore water enhancer market.

Singapore Water Enhancer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 42.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 11.02% |

| 2035 Value Projection: | USD 133.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 221 |

| Tables, Charts & Figures: | 132 |

| Segments covered: | By Form,By Product |

| Companies covered:: | PepsiCo, Inc. Nestlé S.A. Kraft Heinz Company Abbott Nutrition Danone S.A. Dr Pepper Snapple Group Suntory Beverage & Food Ltd. Nature’s Flavors (Kerry Group) Monin (Nordic Group) True Citrus (True Natural Products) Crystal Light Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore water enhancers market is driven by several factors, including growing health and wellness consciousness and increasing demand for low-sugar and sugar-free drinks, as well as rising concerns about obesity and diabetes. Furthermore, the market growth is being supported by the city dwellers' hectic lifestyle, hot and humid weather that raises the need for hydration, the fitness craze and active living, and the great availability of the products via retail and e-commerce outlets.

Restraining Factors

The Singapore water enhancer market is restrained by consumer concerns over artificial sweeteners and additives, along with limited awareness about the benefits of these products among older people and regulatory scrutiny of food ingredients and labeling. Moreover, the market growth may be limited due to competition from natural beverages, infused water, and ready-to-drink functional drinks.

Market Segmentation

The Singapore water enhancer market share is classified into product, form, and distribution channel.

- The nutritional segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore water enhancer market is segmented by product into non-nutritional and nutritional. Among these, the nutritional segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The nutritional segment is growing because consumers in Singapore increasingly prefer functional hydration products that offer added benefits such as vitamins, minerals, electrolytes, and energy support. Rising health awareness, fitness trends, and demand for low-sugar, wellness-focused beverages are driving strong adoption of nutritional water enhancers.

- The liquid segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore water enhancer market is segmented by form into liquid and powder. Among these, the liquid segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The liquid segment is growing because it is easy to use, quickly dissolves in water, and allows precise flavor control, making it convenient for on-the-go consumption. Its portability, wide flavor variety, and strong retail availability drive higher consumer preference in Singapore.

- The offline segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore water enhancer market is segmented by distribution channel into offline and online. Among these, the offline segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The offline segment is growing because consumers prefer immediate product availability, in-store promotions, and the ability to compare flavors and brands in supermarkets, convenience stores, and pharmacies. Strong retail networks and impulse purchases further support offline sales growth in Singapore.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore water enhancer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PepsiCo, Inc.

- Nestlé S.A.

- Kraft Heinz Company

- Abbott Nutrition

- Danone S.A.

- Dr Pepper Snapple Group

- Suntory Beverage & Food Ltd.

- Nature’s Flavors (Kerry Group)

- Monin (Nordic Group)

- True Citrus (True Natural Products)

- Crystal Light

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2025, DKSH Consumer Goods Singapore announced a strategic partnership with Vida World to bring premium hydration solutions, including functional and enhanced beverages, to the Singapore market, expanding product availability and meeting rising consumer demand for healthier drink options.

- In November 2024: Premium water brand BE WTR launched its flavor-enhancing “activated water” technology and opened a bottling facility in Singapore, its first in Southeast Asia, to provide locally produced, sustainable, flavor-enhanced hydration and support growing consumer interest in enhanced water products.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore water enhancer market based on the below-mentioned segments:

Singapore Water Enhancer Market, By product

- Non-Nutritional

- Nutritional

Singapore Water Enhancer Market, By Form

- Liquid

- Powder

Singapore Water Enhancer Market, By Distribution Channel

- Offline

- Online

Need help to buy this report?