Singapore Rubber Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural and Synthetic), By End Use (Automotive, Construction, Industrial, Healthcare, Consumer goods, Packaging, and Others), and Singapore Rubber Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSingapore Rubber Market Insights Forecasts to 2035

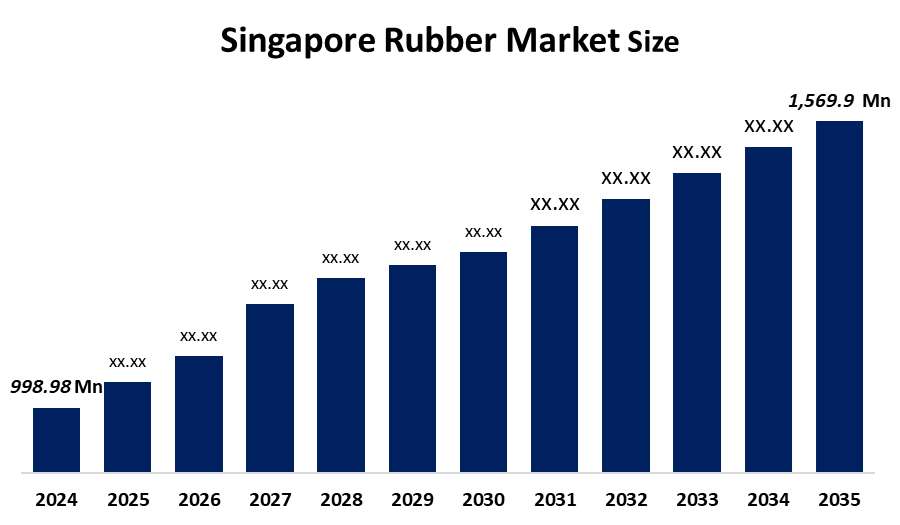

- The Singapore Rubber Market Size Was Estimated at USD 998.98 Million in 2024

- The Singapore Rubber Market Size is Expected to Grow at a CAGR of Around 4.2% from 2025 to 2035

- The Singapore Rubber Market Size is Expected to Reach USD 1,569.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Singapore Rubber Market size is anticipated to reach USD 1,569.9 Million by 2035, Growing at a CAGR of 4.2% from 2025 to 2035. The Singapore rubber market is driven by demand from automotive, electronics, construction, and healthcare industries, along with strong trade activity, easy exports, and Singapore’s role as a major regional business and logistics hub.

Market Overview

The Singapore rubber market encompasses the entire environment involved in the import, processing, distribution, trading, and use of natural and synthetic rubber, as well as rubber-based products, in Singapore. Singapore indeed has very little local rubber production; however, it is a significant player as a regional hub for rubber processing, compounding, and high-value manufacturing. This market caters to the needs of various end-use sectors such as automotive components, electronics, construction materials, industrial goods, medical and healthcare products like gloves and tubing, and consumer products. With the support of state-of-the-art infrastructure, efficient logistics networks, a talented workforce, and rigorous quality standards, the Singapore rubber market is concentrating on value-added rubber products, specialty compounds, sustainable rubber solutions, and innovation-driven manufacturing rather than large-scale raw rubber production.

The rubber market in Singapore is mainly influenced by the needs of the population and strong demand from industries. The healthcare sector needs are growing because of the aging population of about 5.9 million people, and that is raising the demand for medical gloves, tubing, seals, and assistive devices. Besides that, more than 80% of the people live in HDB flats, which are publicly owned housing. Continuous infrastructure development and the rise of automotive servicing, electronics, and industrial machinery sectors contribute to the steady demand for rubber in the areas of construction, insulation, safety systems, tires, hoses, gaskets, cables, and precision components, thus maintaining Singapore's position as a regional manufacturing and trade hub.

The Singapore rubber marketplace is backed by a strong government and innovative policies. The government has allocated more than SGD 25 billion to research as part of the RIE 2025 plan, with advanced materials and manufacturing for rubber and polymers being identified as priority areas for innovation. Besides financial aid, support from A*STAR, Enterprise Singapore, and EDB is also provided to the development of new technologies, automation, and sustainable materials, which in turn helps the production of rubber at a high level of processing, the manufacture of specialty compounds, and the adoption of eco-friendly solutions, thus strengthening the market, healthcare, industrial growth, exports, and economic resilience in the long run.

Report Coverage

This research report categorizes the market for the Singapore rubber market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore rubber market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore rubber market.

Singapore Rubber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 998.98 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.2% |

| 2035 Value Projection: | USD 1,569.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type |

| Companies covered:: | Cariflex Pte. Ltd., • Asahi Kasei Synthetic Rubber Singapore Pte. Ltd. (AKSS), • Zeon Chemicals Singapore Pte. Ltd., • R and P Technologies Pte. Ltd., • Arlanxeo Singapore Pte. Ltd., • Well Fine Tech Pte. Ltd., • Sumitomo Rubber Asia (Tyre) Pte. Ltd., • Rubber Services Singapore, • Lee Rubber Company Ltd., • Bear Development Pte. Ltd., • Wosen Tyre Trading Pte. Ltd., • DG Honglian Pte. Ltd., and • Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Singapore's rubber market is driven by increased demand from various sectors such as healthcare, construction, automotive servicing, electronics, and industrial manufacturing. Besides these, strong trade activities, advanced manufacturing capabilities, and the government's continued focus on innovation and high-value rubber products have all contributed to the market's growth.

Restraining Factors

The Singapore rubber market is restrained by limited natural rubber production in the domestic area, a large dependence on imported raw materials, price volatility of natural and synthetic rubber, and high labor and operational costs. Besides these, the implementation of very strict environmental laws, the increase in expenses for sustainability compliance, and the regional competition from low-cost manufacturing countries may be a hindrance to market growth.

Market Segmentation

The Singapore rubber market share is classified into type and end use.

- The natural segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore rubber market is segmented by type into natural and synthetic. Among these, the natural segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The natural segment is growing because of rising demand from the healthcare, construction, and automotive servicing sectors, where natural rubber is preferred for its elasticity, durability, and biocompatibility. Increasing use of medical gloves and healthcare products, growing infrastructure activities, and a shift toward sustainable and eco-friendly materials further support the strong growth of natural rubber in Singapore.

- The automotive segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore rubber market is segmented by end use into automotive, construction, industrial, healthcare, consumer goods, packaging, and others. Among these, the automotive segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The automotive segment is growing because of rising vehicle ownership, strong demand for tires, hoses, seals, belts, and gaskets, and continuous maintenance and replacement needs. Growth in automotive servicing, logistics fleets, and electric vehicles, along with Singapore’s role as a regional automotive trade and distribution hub, further supports demand for high-quality rubber components.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore rubber market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

Cariflex Pte. Ltd.

• Asahi Kasei Synthetic Rubber Singapore Pte. Ltd. (AKSS)

• Zeon Chemicals Singapore Pte. Ltd.

• R and P Technologies Pte. Ltd.

• Arlanxeo Singapore Pte. Ltd.

• Well Fine Tech Pte. Ltd.

• Sumitomo Rubber Asia (Tyre) Pte. Ltd.

• Rubber Services Singapore

• Lee Rubber Company Ltd.

• Bear Development Pte. Ltd.

• Wosen Tyre Trading Pte. Ltd.

• DG Honglian Pte. Ltd.

• Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, Cariflex launched the world’s largest polyisoprene latex plant on Jurong Island, Singapore, with a US$355 million investment to expand synthetic rubber latex production for medical and protective uses, doubling capacity and reinforcing Singapore’s role in advanced rubber manufacturing.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore rubber market based on the below-mentioned segments:

Singapore Rubber Market, By Type

- Natural

- Synthetic

Singapore Rubber Market, By End Use

- Automotive

- Construction

- Industrial

- Healthcare

- Consumer goods

- Packaging

- Others

Need help to buy this report?