Singapore Buy Now Pay Later (BNPL) Market Size, Share, and COVID-19 Impact Analysis, By Channel (Online, Point of Sale), By Enterprise Type (Large Enterprises, Small & Medium Enterprises (SMEs)), By End User (Consumer Electronics, Fashion & Garment, Healthcare, Retail, Media & Entertainment), and Singapore Buy Now Pay Later (BNPL) Market Insights, Industry Trend, Forecasts to 2032

Industry: Banking & FinancialSingapore Buy Now Pay Later (BNPL) Market Insights Forecasts to 2032

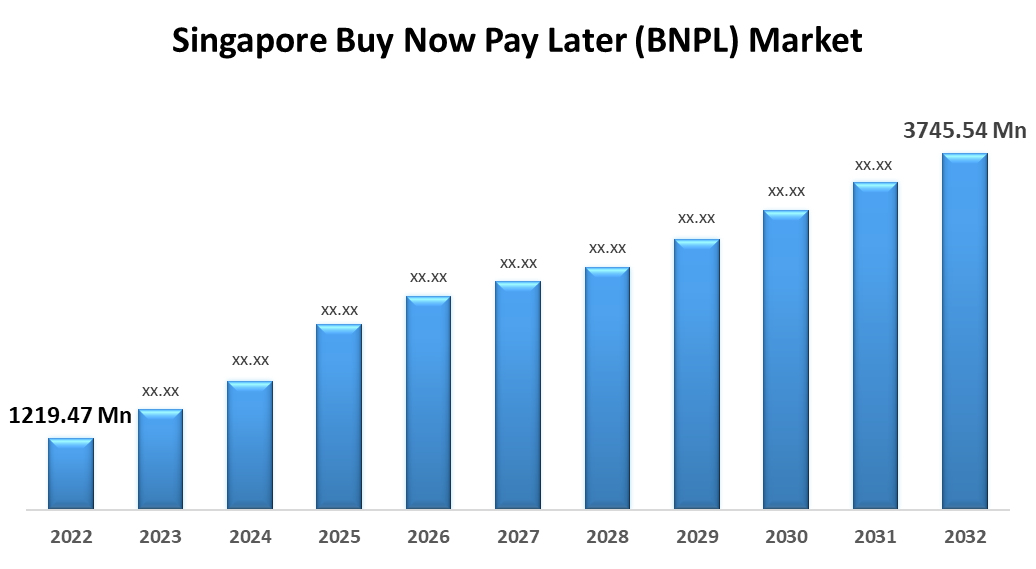

- The Singapore Buy Now Pay Later (BNPL) Market Size was valued at USD 1,219.47 Million in 2022.

- The Market Size is growing at a CAGR of 11.88% from 2022 to 2032

- The Singapore Buy Now Pay Later (BNPL) Market Size is expected to reach USD 3,745.54 Million by 2032

Get more details on this report -

The Singapore Buy Now Pay Later (BNPL) Market is anticipated to exceed USD 3,745.54 Million by 2032, growing at a CAGR of 11.88% from 2022 to 2032.

Market Overview

The Singapore buy now pay later (BNPL) system is a payment mechanism that allows customers to make purchases both online and in physical stores without having to pay the full amount up front. The ongoing digitization, wider merchant acceptance, increasing patronage among the younger demographic, and the emergence of new enterprises providing financing via BNPL services are driving the growth of this market in Singapore. BNPL services, which are particularly appealing to younger consumers, provide a variety of benefits, including the ability to acquire high-value items such as laptops and smartphones, as well as facilitate payments for everyday necessities such as stationery products. A growing use of e-commerce platforms, particularly during the pandemic, is a major growth driver for the Singapore buy now pay later (BNPL) market. This surge is being fueled further by the millennial generation, which is entering their prime spending years and tends to be cautious spenders due to previous experiences with market volatility during their formative years. BNPL, which provides a secure payment method with no hidden fees or interest charges, is a good fit for their needs.

Report Coverage

This research report categorizes the market for the Singapore Buy Now Pay Later (BNPL) Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Buy Now Pay Later (BNPL) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Buy Now Pay Later (BNPL) Market.

Singapore Buy Now Pay Later (BNPL) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1,219.47 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.88% |

| 2032 Value Projection: | USD 3,745.54 Million |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Channel, By Enterprise Type, By End User |

| Companies covered:: | GrabPay, Atome, Hoolah, Rely, Razer Fintech, Quadpay, Oxicash, Split, CashShield, Others and Other Top Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The use of online payment methods has increased significantly over the last decade. Convenience, evolving consumer behavior, financial flexibility, competitive interest rates, seamless integration with e-commerce platforms, enhanced security measures, effective marketing strategies, and the preferences of younger generations are driving this shift. This increased use of online payment methods, including BNPL services, is changing the way consumers pay and manage their finances. It is likely to continue to have an impact on the financial landscape in the future.

Restraining Factors

Regulatory concerns about BNPL services are stifling the Singapore buy now pay later (BNPL) market. While BNPL is gaining popularity, Singaporean authorities are concerned about potential risks, particularly overspending and debt accumulation. The Singapore Monetary Authority (MAS) intends to review regulatory approaches to ensure responsible lending practices. These concerns may result in regulatory changes that have an impact on the BNPL landscape. As Singapore moves closer to becoming a cashless society, addressing these regulatory challenges will be critical to maintaining the BNPL market's growth while also ensuring consumer protection and financial stability.

Market Segmentation

The Singapore Buy Now Pay Later (BNPL) Market share is classified into channel and end user.

- The online segment is expected to hold the largest share of the Singapore Buy Now Pay Later (BNPL) Market during the forecast period.

The Singapore Buy Now Pay Later (BNPL) Market is segmented by channel into online, point of sale. Among these, the online segment is expected to hold the largest share of the Singapore Buy Now Pay Later (BNPL) Market during the forecast period. The upsurge can be attributed to consumers' growing preference for online shopping. BNPL services' convenience and flexibility enhance the e-commerce experience, making them a popular choice for online shoppers. In addition, the ease with which BNPL options can be integrated into online checkout processes, as well as the availability of multiple BNPL providers, contribute to the segment's larger market share. As more consumers adopt digital shopping platforms, the online channel remains a major driver of BNPL adoption and growth in Singapore.

- The healthcare segment is expected to hold the largest share of the Singapore Buy Now Pay Later (BNPL) Market during the forecast period.

Based on the end user, the Singapore Buy Now Pay Later (BNPL) Market is divided into consumer electronics, fashion & garment, healthcare, retail, media & entertainment, and others. Among these, the healthcare segment is expected to hold the largest share of the Singapore Buy Now Pay Later (BNPL) Market during the forecast period. Healthcare costs are frequently significant and unexpected, making BNPL a valuable payment option for those seeking medical services, treatments, or healthcare products. BNPL enables patients to conveniently manage their medical bills by spreading payments over time, reducing the financial burden of immediate payment. Furthermore, in order to attract patients and improve the overall healthcare experience, healthcare providers and facilities are increasingly offering BNPL options. Because of this alignment of patient needs and healthcare industry offerings, the healthcare segment has dominated the BNPL market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore Buy Now Pay Later (BNPL) Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GrabPay

- Atome

- Hoolah

- Rely

- Razer Fintech

- Quadpay

- Oxicash

- Split

- CashShield

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Singapore Buy Now Pay Later (BNPL) Market based on the below-mentioned segments:

Singapore Buy Now Pay Later (BNPL) Market, By Channel

- Online

- Point of Sale (POS)

Singapore Buy Now Pay Later (BNPL) Market, By Enterprise Type

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

Singapore Buy Now Pay Later (BNPL) Market, By End User

- Consumer Electronics

- Fashion & Garment

- Healthcare

- Retail

- Media & Entertainment

- Others

Need help to buy this report?