Global Shoulder Replacement Implants Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Anatomical Prosthesis, Reverse Prosthesis, and Hybrid/Biological Prosthesis), By Material (Metallic, Ceramic, Polyethylene, and Others), By End Users (Hospitals, Orthopedic Centers, Ambulatory Surgical Centers, and Specialty Clinics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Shoulder Replacement Implants Market Insights Forecasts to 2035

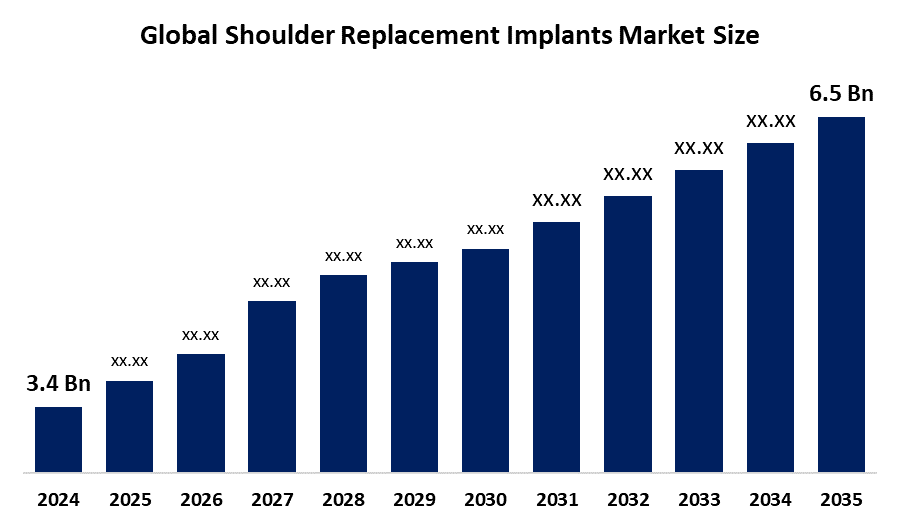

- The Global Shoulder Replacement Implants Market Size Was Estimated at USD 3.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.07% from 2025 to 2035

- The Worldwide Shoulder Replacement Implants Market Size is Expected to Reach USD 6.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Shoulder Replacement Implants Market Size was worth around USD 3.4 Billion in 2024 and is predicted to grow to around USD 6.5 Billion by 2035 with a compound annual growth rate (CAGR) of 6.07% from 2025 and 2035. The market for shoulder replacement implants has a number of opportunities to grow due to the growing awareness regarding the benefits of anaerobic adhesives in durable assemblies, as well as innovative breakthroughs, including advanced catalysts & nano-enhanced additives.

Market Overview

The Global Shoulder Replacement Implants Market Size industry focuses on the design, manufacturing, and sale of prosthetic devices used in shoulder replacement surgery to treat pain and dysfunction from conditions such as arthritis or rotator cuff tears. The surgery, also called shoulder arthroplasty (ARTH-row-plas-tee), involves the removal of damaged areas of bone and replacing them with parts made of metal and plastic (implants). An upsurging field of artificial intelligence (AI) and integration of robotics in shoulder arthroplasty is providing growth opportunities for personalized implant development and precision in surgical procedures.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and expanding partnerships. The quick development of robotic arms, as well as durability and wear-resistant properties of implant materials like ceramic coatings and strongly cross-linked polyethylene, are driving a huge surge in the global shoulder replacement implants market.

Report Coverage

This research report categorizes the shoulder replacement implants market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the shoulder replacement implants market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the shoulder replacement implants market.

Global Shoulder Replacement Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.07% |

| 2035 Value Projection: | USD 6.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Materials ,By End Users |

| Companies covered:: | Zimmer Biomet Stryker Corporation DePuy Synthes (Johnson & Johnson) Smith & Nephew plc Wright Medical Group N.V. DJO Global (Enovis) Exactech, Inc. Tornier N.V. Arthrex, Inc. Integra LifeSciences Holdings Corporation Conmed Corporation B. Braun Melsungen AG Medacta International LimaCorporate S.p.A. Corin Group and Other, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The frequent use of shoulder arthroplasty in an elderly population, especially those 80 years and older age is driving the shoulder replacement implants market. For instance, shoulder arthroplasty is increasingly used for treating various shoulder pathologies, particularly in older patients, while providing numerous advantages, including pain relief, preservation of bone stock, and natural joint mechanics, careful patient selection is required. As per a survey study, the prevalence of osteoarthritis was 17.4% in the respondents older than 40years. Rotator cuff tears are among the most frequent shoulder pathologies causing pain and functional impairment, responsible for 4.5 million annual patient visits in the U.S. and nearly 250,000 operative repairs. The increased prevalence of sport-related shoulder injuries among youth athletes is propelling the market. For instance, orthopedic implants by Zealmax Ortho are used in shoulder sports injuries and are designed to be biocompatible, aiding in promoting healing and restoring function to the shoulder joint.

Restraining Factors

The shoulder replacement implants market is restricted by the increased cost of the implants that limits its accessibility, especially in low and middle class income countries. Further, the lack of well-established healthcare infrastructure in low-income nations is hampering the market growth.

Market Segmentation

The Shoulder Replacement Implants Market share is classified into product type, material, and end users.

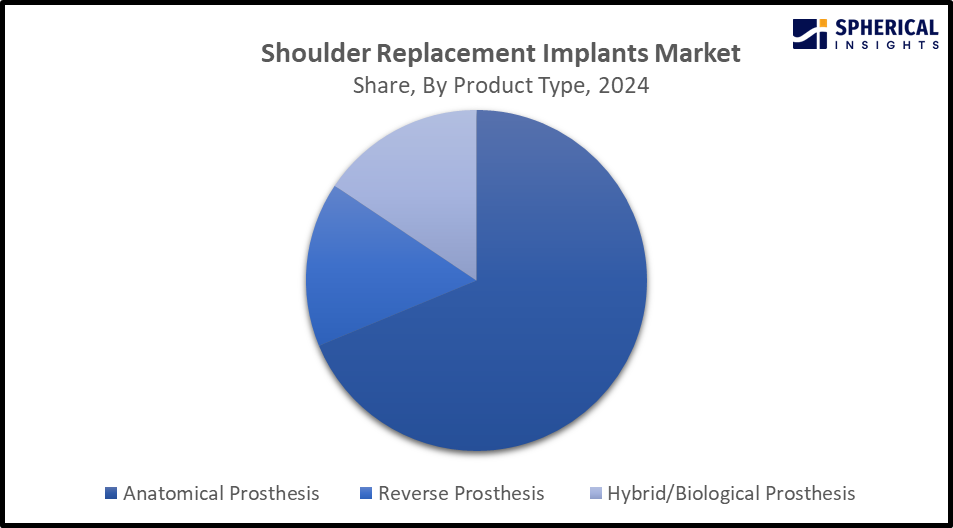

- The anatomic prostheses segment dominated the market with the largest share of nearly 66.2% in 2024 and is projected to grow at a substantial CAGR of 7.13% during the forecast period.

Based on the product type, the shoulder replacement implants market is divided into anatomical prosthesis, reverse prosthesis, and hybrid/biological prosthesis. Among these, the anatomic prostheses segment dominated the market with the largest share of nearly 66.2% in 2024 and is projected to grow at a substantial CAGR of 7.13% during the forecast period. Anatomic total shoulder arthroplasty is indicated when both sides of the scapula-humeral joint are worn out and when the rotator cuff remains intact with no sign of motricity deficiency. An increasing need for personalized and anatomically accurate implants enables manufacturers to invest in advanced imaging and 3D modeling technologies, contributing to driving the segmental market.

Get more details on this report -

- The metallic segment accounted for the dominant market share of about 40.5% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material, the shoulder replacement implants market size is divided into metallic, ceramic, polyethylene, and others. Among these, the metallic segment accounted for the dominant market share of about 40.5% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment includes titanium or cobalt-chromium alloys and metal implants that are lauded for their durability and strength. Further, they offer robust structural support and are biocompatible, with minimal adverse reactions. The superior mechanical strength, corrosion resistance, and biocompatibility of the metallic shoulder replacement implants are driving the market.

- The hospitals segment accounted for the dominant market revenue share of about 62% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the shoulder replacement implants market size is divided into hospitals, orthopedic centers, ambulatory surgical centers, and specialty clinics. Among these, the hospitals segment accounted for the dominant market revenue share of about 62% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Shoulder replacement implants are performed in hospitals using minimally invasive procedures. The presence of medical staff and the best medical facilities present in hospitals aid in improving health. The availability of skilled orthopaedic surgeons and accessibility to advanced surgical equipment in the hospitals are driving the market in the hospitals segment.

Regional Segment Analysis of the Shoulder Replacement Implants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the shoulder replacement implants market over the predicted timeframe.

North America is anticipated to hold the largest share of about 41% in the shoulder replacement implants market over the predicted timeframe. The market ecosystem in North America is strong, with both cutting-edge startups and major industrial heavyweights well-represented. For instance, in March 2025, Smith+Nephew, the global medical technology company, announced it would feature the latest advancements in Orthopaedic Reconstruction at the American Academy of Orthopaedic Surgeons Annual Meeting in San Diego. The market for shoulder replacement implants has been driven by the region's increasing prevalence of shoulder-related ailments and advancements in implant design. Innovative shoulder replacement implant products and partnerships with other industry players are supporting the market. For instance, shoulder innovations has secured $40m in a Series E equity financing round, mainly to progress the commercialisation of its InSet Total Shoulder and Reverse Shoulder Arthroplasty Systems. The U.S. is dominating the North America shoulder replacement implants market with around 90% share, owing to the growing ageing population and R&D investments for developing industry-specific innovation like smart shoulder implants.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR of nearly 8.2% in the shoulder replacement implants market during the forecast period. The Asia Pacific area has a thriving market for shoulder replacement implants due to its increasing healthcare needs and surge in the ageing population. Further, the strategic partnership and agreement with a medical device company are promoting the market. For instance, in March 2023, Zimmer Biomet entered a definitive agreement for the acquisition of privately held medical device company OSSIS for an undisclosed sum. Additionally, increasing healthcare needs and an increasing trend towards minimally invasive procedures are promoting the shoulder replacement implants market. Japan is leading the Asia Pacific shoulder replacement implants market, with over 20-40% share, driven by improved healthcare infrastructure and substantial progress in orthopaedic implant materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations companies involved within the shoulder replacement implants market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zimmer Biomet

- Stryker Corporation

- DePuy Synthes (Johnson & Johnson)

- Smith & Nephew plc

- Wright Medical Group N.V.

- DJO Global (Enovis)

- Exactech, Inc.

- Tornier N.V.

- Arthrex, Inc.

- Integra LifeSciences Holdings Corporation

- Conmed Corporation

- B. Braun Melsungen AG

- Medacta International

- LimaCorporate S.p.A.

- Corin Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Smith+Nephew, the global medical technology company, announced the launch of its CORIOGRAPH Pre-Op Planning and Modeling Services for total shoulder arthroplasty, available in the United States.

- In October 2025, Johnson & Johnson MedTech announced the U.S. launch of INHANCE INTACT, a proprietary complete instrumentation system specifically developed for subscapularis-sparing total shoulder arthroplasty (TSA), empowering surgeons to replace a damaged shoulder joint while keeping the shoulder muscle intact.

- In March 2025, Johnson & Johnson MedTech, a global leader in orthopaedic technologies and solutions, is highlighting its latest advancements in digital orthopaedics at the American Academy of Orthopaedic Surgeons (AAOS) 2025 Annual Meeting in San Diego, California.

- In January 2024, Stryker, one of the world’s leading medical technology companies, introduced the Tornier shoulder arthroplasty portfolio in India and launched its first new Tornier product, the Perform Humeral Stem, at the Shoulder Conclave in Pune.

- In August 2021, the Johnson & Johnson Medical Devices Companies announced that DePuy Synthes, the Orthopaedics Company of Johnson & Johnson, introduced the INHANCE Shoulder System, a first-to-market, fully integrated shoulder arthroplasty system.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the shoulder replacement implants market based on the below-mentioned segments:

Global Shoulder Replacement Implants Market, By Product Type

- Anatomical Prosthesis

- Reverse Prosthesis

- Hybrid/Biological Prosthesis

Global Shoulder Replacement Implants Market, By Material

- Metallic

- Ceramic

- Polyethylene

- Others

Global Shoulder Replacement Implants Market, By End Users

- Hospitals

- Orthopedic Centers

- Ambulatory Surgical Centers

- Specialty Clinics

Global Shoulder Replacement Implants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?