Global Rolling Stock Market, and COVID-19 Impact Analysis By Product (Locomotive, Rapid Transit Vehicle, Wagon), By Type, By Train Type, By Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America) – Market Size & Forecasting 2022 - 2030

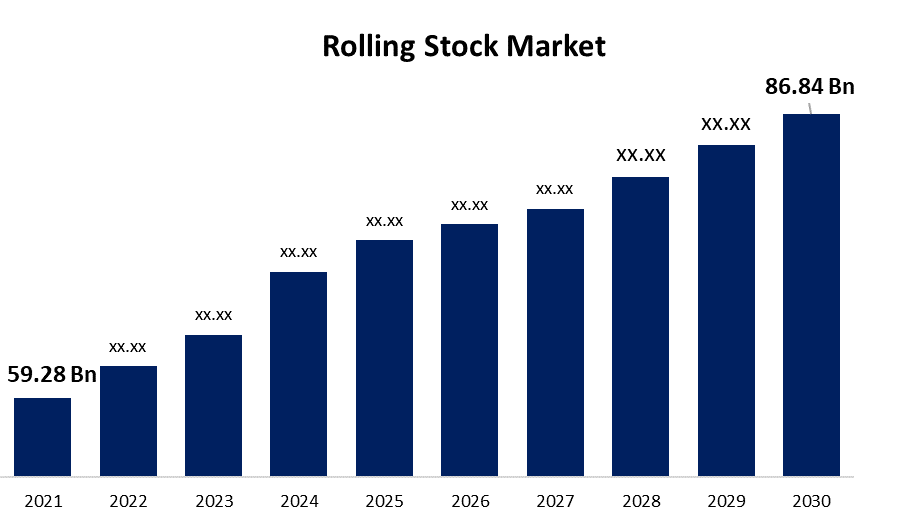

Industry: Automotive & TransportationThe global rolling stock market size was valued at $59,280 million in 2021 and is expected to reach a CAGR of 5.8% from 2022 to 2030. Long-distance passenger and freight transportation can be made more convenient, dependable, and affordable with the use of rolling stock like wagons, locomotives, freight cars, and rapid transit vehicles.

Get more details on this report -

An efficient indicator of the market's general expansion is the government's increased budget allocation and the implementation of numerous programs for the construction of railway infrastructure. Environmental issues including rising carbon emissions and high oil prices have sparked a need for environmentally friendly railroads, which has prompted the government and key firms like Alstom and CRRC Corporation Limited to shift their focus toward rolling stock powered by electricity.

Since the creation of the railway transportation system, significant technological improvement has occurred in rolling stock. The development of technology has improved rail travel in terms of speed, comfort, convenience, amenities, and environmental friendliness. Major players are developing novel solutions based on the technical advantages currently present in rolling stock. To improve the fuel efficiency and dependability of the trains, many businesses are creating lightweight components.

With the advancement of regenerative braking technology, rolling stock becomes more efficient as energy is conserved and the demand for mechanical brakes is reduced. These changes are anticipated to have a favourable effect on market expansion. Original Equipment Manufacturers (OEMs) like Alstom are advancing the development of hydrogen fuel and battery-operated rolling stock in an effort to produce greener transportation.

Global Rolling Stock Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 59,280 million |

| Forecast Period: | 2022-2030 |

| Forecast Period CAGR 2022-2030 : | 5.8 % |

| 2030 Value Projection: | USD 86,849.92 Million |

| Historical Data for: | 2019-2020 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Type, Train Type, and By Region |

| Companies covered:: | Bombardier Inc. General Electric ABB Ltd CRRC Alstom Siemens Kawasaki Heavy Industries Chittaranjan Locomotive Works Stadler Rail Hyundai Rotem |

| Growth Drivers: | The demand for rolling stocks is anticipated to increase over the forecast period as a result of rapid urbanization, traffic congestion, rising environmental concerns, and technological advancements. |

| Pitfalls & Challenges: | The high price of new rail vehicles may discourage investment and serve as a constraint. |

Get more details on this report -

Driving Factors

The demand for rolling stocks is anticipated to increase over the forecast period as a result of rapid urbanisation, traffic congestion, rising environmental concerns, and technological advancements. Robust rolling stock requires intense research and innovation because orders for it have significant lead times and must last for a very long time. Governments are actively involved in this industry to improve the comfort of the most affordable and secure mode of transportation. The median household income in the United States increased by 6.8% from 2018 to 2019, according to the census report 2020. As economic levels have climbed, so has the need for personal mobility, which has boosted road traffic in major cities all over the world.

To solve this problem, urban planners and municipal governments are integrating existing city infrastructure with rapid transit systems and tramways. Additionally, commuters are searching for dependable, affordable, and ecologically friendly ways of transportation. Fast transit systems are being promoted by developed nations like Germany, France, and the United Kingdom as a means of reducing traffic congestion. Due to the high cost of rolling stock and associated infrastructure, local governments must provide considerable financial support.

Restraining Factors

On the other side, the high price of new rail vehicles may discourage investment and serve as a constraint. City congestion is escalating due to increased environmental problems associated with air and vehicle travel; train travel presents a practical and environmentally friendly alternative. The option of refurbishing the current fleet of rolling stock is also taken by the railway organizations as the demand for rail travel rises. Refurbishing rolling stock updates it to meet the needs of the moment while also increasing reliability and speed. thus impeding the market for rolling stock's expansion.

COVID 19 Impact

The effects of COVID-19 were felt all around the world. Following the World Health Organization's (WHO) recommendations, many nations imposed a lockdown, which halted international economic activity. Countries like China significantly hampered exports and imports, which led to a worldwide stoppage of manufacturing and the closing of facilities.

These events had a negative effect on the rolling stock market. Due to the disruptions in the supply chain and the manufacturing process, the market was anticipating an uncertain recovery period because of the declining demand for the locomotive fleet. In the nations affected by COVID-19, the partial or complete implementation of lockdowns and travel restrictions had an influence on the demand for rolling stock. But once the worldwide lockdown was removed, there were less limitations on trade and movement. As industrial firms and factories began to operate again, the need for rolling stock witnessed a revival, sparking the resumption of railway projects all over the world.

Segmentation

The global rolling stock market is segmented into Product, Type, Train Type, and Region.

Global Rolling Stock Market, By Product

The market has been segmented into locomotives, rapid transit, and wagons based on the type of goods. The fastest CAGR of 6.7% is predicted for the rapid transit vehicle during the expected period. The growing urban population favours it as their preferred mode of public transportation due to factors including fast speed, affordability, and comfortable travel. Additionally, because they are powered by electricity, rapid transit vehicles are seen as environmentally good due to their Train Type source. As a result, the aforementioned information supports the development of rapid transit vehicles.

Global Rolling Stock Market, By Type

The two main categories of rolling stock are electric and diesel-based. During the projection period, the electric-based rolling stock market is anticipated to grow at a CAGR of 7.5%. Calls for decarbonization have been sparked by the rapidly increasing global warming. Compared to the diesel train, the electric railway segment emits less carbon monoxide and is more environmentally friendly. As a result, market expansion is being aided by investments in the creation of technology and infrastructure for electric trains.

Global Rolling Stock Market, By Train Type

The market is segmented into passenger rails and freight trains based on the type of train. With a CAGR of 8.0%, the passenger rails market is anticipated to expand. becoming the worldwide standard for daily commuting. The need for passenger trains increased along with the population's steady growth. Its advantages, including dependability, affordability, and nice accommodations for both long and short-distance travel, have helped to increase demand. Due to their quicker service, passenger railways including metros, high-speed trains, and trams are popular modes of transportation.

Global Rolling Stock Market, By Region

With a 42.8% market share in 2021, the Asia Pacific region dominated the market for rolling stock. The use of passenger trains for commuting is growing as a result of the region's expanding population. Additionally, increased government investment in the rail infrastructure needed to carry goods is credited with the region's growing trade. For instance, the Jaynagar-Kurtha Railway link was recently opened by the governments of India and Nepal. This cross-border railway aims to increase trade, commerce, and investment between the two nations.

Get more details on this report -

Recent Developments in Global Rolling Stock Market

- December 2021: A joint venture made up of Hitachi Rail and Alstom (HAH-S) has been given contracts by HS2 to develop, construct, and maintain high-speed rolling stock for the first phase of the line.

- November 2021: A deal for 55 Metropolis trains (each with nine carriages) and an eight-year maintenance agreement has been reached between Alstom and the National Authority for Tunnels (NAT).

- March 2021: Siemens Mobility has unveiled MoComp, a centralised computerised rolling stock spare parts catalogue.

List of Key Market Players

- Bombardier Inc.

- General Electric

- ABB Ltd

- CRRC

- Alstom

- Siemens

- Kawasaki Heavy Industries

- Chittaranjan Locomotive Works

- Stadler Rail

- Hyundai Rotem

Segmentation

By Product

- Locomotive

- Rapid Transport

- Wagon

By Type

- Diesel

- Train

By Train Type

- Rail Freight

- Rail Passenger

By Region

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Product

- North America, by Type

- North America, by Train Type

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Product

- Europe, by Type

- Europe, by Train Type

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Product

- Asia Pacific, by Type

- Asia Pacific, by Train Type

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Product

- Middle East & Africa, by Type

- Middle East & Africa, by Train Type

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Product

- South America, by Type

- South America, by Train Type

Need help to buy this report?