Global Rodenticides Market Size, Share, and COVID-19 Impact Analysis, By Type (Anticoagulants, Non-Coagulants), By Mode of Application (Pellets, Spray, and Powder), By End Use (Agriculture, Warehouses, and Urban Centers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: AgricultureGlobal Rodenticides Market Insights Forecasts to 2032

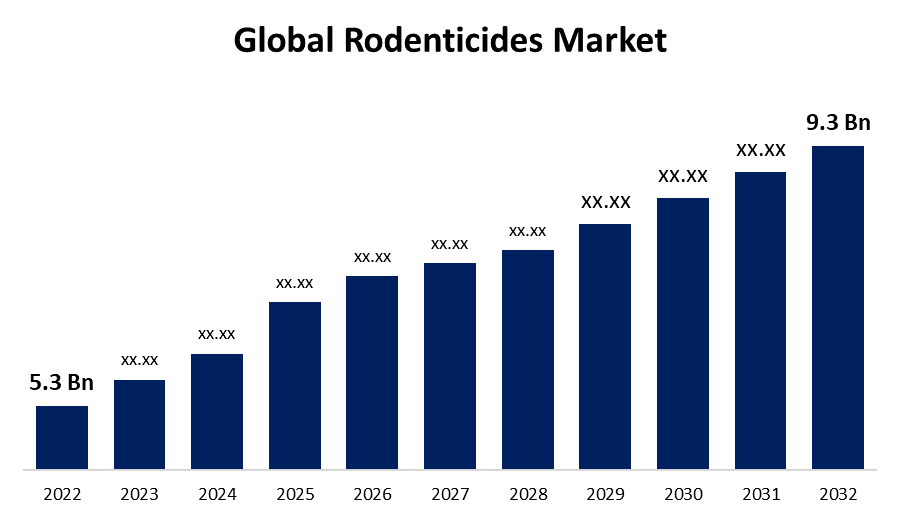

- The Global Rodenticides Market Size was valued at USD 5.3 Billion in 2022.

- The Market is Growing at a CAGR of 5.7% from 2022 to 2032

- The Worldwide Rodenticides Market Size is expected to reach USD 9.3 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Rodenticides Market Size is projected to exceed USD 9.3 Billion by 2032, growing at a CAGR of 5.7% from 2022 to 2032. The global rodenticides market has been experiencing steady growth over the years, driven by increasing urbanization, growing concerns over rodent-borne diseases, and the need to protect food storage facilities and agricultural crops. The market size is influenced by factors such as population growth, rising food demand, and expanding urban landscapes.

Market Overview

The global rodenticides market refers to the market for products used to control rodent populations, typically in agricultural, industrial, and residential settings. Rodenticides are poisons designed to kill rodents and are available in various formulations such as baits, pellets, and powders.

The growing concern about environmental pollution and the public health risks posed by vector-borne diseases is driving up demand for rodent control services around the world. The growing population, combined with overexploitation as well as the degradation of limited resources, is contributing to ecosystem degradation, leading to global warming and temperature rise. These factors, consequently, are subsequently strengthening pests' capacity to survive across multiple seasons, as evidenced by tropical pests' migration away from the equatorial region as a result of global warming.

Some of the key players operating in the global rodenticides market include BASF SE, Bayer AG, Syngenta AG, Rentokil Initial plc, Neogen Corporation, PelGar International, JT Eaton, Liphatech, Inc., Bell Laboratories, Inc., and Senestech, Inc.

For instance, in July 2021, Bayer launched an innovative pest control product, Harmonix Rodent Paste, an outstanding performance cholecalciferol rodenticide that is claimed to have a long shelf life. Furthermore, this new solution enables pest controllers to prevent rodents in both outdoor and indoor settings.

Report Coverage

This research report categorizes the market for the global rodenticides market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the rodenticides market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the rodenticides market.

Global Rodenticides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.7% |

| 2032 Value Projection: | USD 9.3 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Mode of Application, By End Use, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Bayer AG, UPL Limited, Anticimex, Rentokil Initial PLC, Liphatech, Inc., Bell Laboratories Inc., Abell Pest Control, BASF SE, Syngenta AG, Neogen Corporation, Ecolab Inc., Senestech, Inc., Rollins, Inc., JT Eaton & Co., Inc., Pelgar, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global rodenticides market is driven by the increasing population of rodents worldwide. Rodents, such as rats and mice, have a high reproductive rate and adaptability, enabling them to thrive in various environments. This poses significant challenges in terms of crop damage, contamination of food supplies, and disease transmission. The need for effective rodent control measures fuels the demand for rodenticides.

Rapid urbanization and infrastructure development lead to the expansion of cities and human settlements, creating favorable environments for rodents. Urban areas provide abundant food sources, shelter, and hiding places for rodents, leading to increased infestation risks. As urbanization continues, the demand for rodenticides to control and prevent rodent-related issues in residential, commercial, and industrial spaces rises.

Agriculture plays a vital role in the global economy, and rodents pose a significant threat to agricultural productivity. Rodents damage crops, consume stored grains, and contaminate food supplies, resulting in substantial economic losses. Farmers and agricultural organizations rely on rodenticides to protect crops and prevent rodent infestations, thereby driving the demand for rodenticides in the agricultural sector.

Restraining Factors

Rodents have the ability to develop resistance to rodenticides over time. Prolonged and extensive use of specific rodenticide active ingredients can lead to genetic resistance in rodent populations. This resistance reduces the efficacy of rodenticides, requiring the development of new formulations or alternative control methods. Resistance development poses a challenge for the rodenticides market and drives the need for continuous research and innovation.

The availability of alternative rodent control methods, such as electronic repellents, ultrasonic devices, and natural repellents, may reduce the demand for conventional rodenticides. These alternatives may be perceived as safer or more environmentally friendly options, limiting the market's growth potential.

Market Segmentation

The Global Rodenticides Market share is classified into type, mode of application, and end use.

- The anticoagulants segment is expected to hold the largest share of the global rodenticides market during the forecast period.

The global rodenticides market is segmented by type into anticoagulants and non-coagulants. Among these, the anticoagulants segment is expected to hold the largest share of the global rodenticides market during the forecast period. The growth can be attributed due to their long-term effectiveness and relatively low cost. First-generation anticoagulants are still used in some regions due to their affordability and lower risk of non-target animal exposure. However, there is a growing shift towards second-generation anticoagulants due to their higher potency and effectiveness against resistant rodent populations.

- The pellets segment is expected to hold the largest share of the global rodenticides market during the forecast period.

Based on the mode of application, the global rodenticides market is divided into pellets, spray, and powder. Among these, the pellets segment is expected to hold the largest share of the global rodenticides market during the forecast period. The growth can be attributed due the pellet formulations are widely preferred due to their ease of use, controlled release of the active ingredient, and versatility in application methods. Pellet formulations are solid granules or small cylindrical shapes designed for easy application and distribution. Pellets are typically impregnated with the active ingredient and attractants to lure rodents. They are commonly used in bait stations, bait boxes, and scattered in areas frequented by rodents. Pellets provide a controlled release of the active ingredient and are favored for their convenience and effectiveness.

- The agriculture segment is expected to hold the largest share of the global rodenticides market during the forecast period.

The global rodenticides market is divided into three segments based on end use: agriculture, warehouses, and urban centers. Among these, the agriculture segment is expected to hold the largest share of the global rodenticides market during the forecast period. The agricultural sector has a high demand for rodenticides due to the significant economic impact of rodent damage to crops and stored grains. Farmers worldwide rely on effective rodenticides to protect their agricultural investments and ensure food security. The agriculture sector is a significant consumer of rodenticides. Rodents pose a significant threat to agricultural productivity by damaging crops, consuming stored grains, and contaminating food supplies. Farmers rely on rodenticides to protect their crops and prevent infestations that can lead to significant economic losses. Rodenticides are used in agricultural fields, orchards, vineyards, and other crop-growing areas to control rodent populations and minimize crop damage.

Regional Segment Analysis of the Global Rodenticides Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is estimated to hold the largest share of the global rodenticides market over the predicted timeframe.

Get more details on this report -

North America is expected to hold the largest share of the global rodenticides market during the forecast period. The region has a well-established agricultural sector, including large-scale farming operations, where rodenticides are used to protect crops from rodent damage. The presence of extensive storage facilities, warehouses, and urban centers further drives the demand for rodenticides in this region. Stringent regulations regarding food safety and pest control also contribute to the market growth. In North America, the United States is the largest consumer of rodenticides, followed by Canada and Mexico.

Asia Pacific is expected to grow at the fastest pace in the global rodenticides market during the forecast period. The region is home to densely populated countries with significant agricultural activities, such as China and India. The large agricultural sector in these countries drives the demand for rodenticides to protect crops and ensure food supply. Rapid industrialization and urbanization also contribute to market growth, as warehouses, storage facilities, and urban centers require effective rodent control. Other countries in the Asia Pacific region, including Japan, South Korea, and Australia, also contribute to the market's growth.

Latin America is an emerging market for rodenticides. The region has a strong agricultural sector, with countries like Brazil, Argentina, and Mexico being major contributors. Agriculture plays a vital role in the economies of these countries, and rodenticides are used to protect crops from rodent damage. The market growth is also driven by the need for rodent control in warehouses and urban areas. Increasing awareness about the importance of food safety and quality drives the demand for rodenticides in Latin American countries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global rodenticides along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer AG

- UPL Limited

- Anticimex

- Rentokil Initial PLC

- Liphatech, Inc.

- Bell Laboratories Inc.

- Abell Pest Control

- BASF SE

- Syngenta AG

- Neogen Corporation

- Ecolab Inc.

- Senestech, Inc.

- Rollins, Inc.

- JT Eaton & Co., Inc.

- Pelgar

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2022, BASF launched its 2022 survey, designed specifically for farmers in the UK, to gather detailed information about rodent activity across the country. This survey will help farmers understand how to use rodenticides effectively and efficiently to control rodents such as rats and mice.

- In January 2022, Syngenta Crop Protection has completed the acquisition of two bioinsecticides, NemaTrident and UniSpore, from UK-based Biomema Limited, a key player in the development of bio-protection technology. This acquisition may assist the company in strategizing new developments within its pest management vertical.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Rodenticides Market based on the below-mentioned segments:

Global Rodenticides Market, By Type

- Anticoagulants

- Non-Coagulants

Global Rodenticides Market, By Mode of Application

- Pellets

- Spray

- Powder

Global Rodenticides Market, By End Use

- Agriculture

- Warehouses

- Urban Centers

Global Rodenticides Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?