Global Reprocessed Medical Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Cardiovascular, Laparoscopic, Gastroenterology, General Surgery Devices, and Orthopedic Devices), By Type (Third-party Reprocessing and In-house Reprocessing), By End-Use (Hospitals, Home Healthcare, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: HealthcareGlobal Reprocessed Medical Devices Market Insights Forecasts to 2032

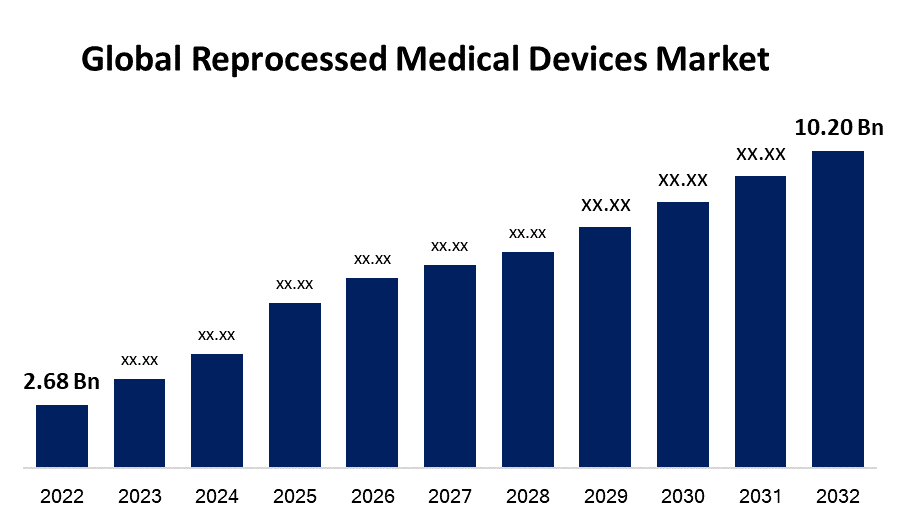

- The Reprocessed Medical Devices Market Size was valued at USD 2.68 Billion in 2022.

- The Market Size is Growing at a CAGR of 14.3% from 2022 to 2032

- The Worldwide Reprocessed Medical Devices Market Size is expected to reach USD 10.20 Billion by 2032

- Asia-Pacific is expected To Grow fastest during the forecast period

Get more details on this report -

The Global Reprocessed Medical Devices Market Size is expected to reach USD 10.20 Billion by 2032, at a CAGR of 14.3% during the forecast period 2022 to 2032.

Market Overview

Reprocessed medical devices refer to previously used medical devices that have undergone a thorough cleaning, testing, and sterilization process to be safely reused on patients. This practice has gained popularity in healthcare settings due to its potential cost savings and reduced environmental impact. However, the reprocessing of medical devices has sparked debates about safety and efficacy. Proponents argue that rigorous quality control measures ensure the safety of reprocessed devices, while opponents raise concerns about potential risks and variations in device performance. Regulatory agencies in various countries closely monitor the reprocessing industry to establish guidelines and standards, mitigating potential risks. Healthcare providers must carefully weigh the benefits and risks associated with using reprocessed medical devices to make informed decisions and maintain patient safety.

Report Coverage

This research report categorizes the market for reprocessed medical devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the reprocessed medical devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the reprocessed medical devices market.

Global Reprocessed Medical Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.68 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 14.3% |

| 2032 Value Projection: | USD 10.20 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Type, By End-Use, By Region. |

| Companies covered:: | Stryker, Innovative Health, NEScientific, Inc., Medline Industries, LP., Arjo, Vanguard AG, Cardinal Health, SureTek Medical, Soma Tech Intl, and Johnson & Johnson MedTech |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The reprocessed medical devices market is driven by several factors, the cost savings play a significant role as reprocessed devices offer a more economical alternative to purchasing new medical equipment. This is particularly attractive for healthcare facilities aiming to reduce expenses without compromising patient care. Additionally, growing environmental concerns drive the demand for reprocessed devices as they help minimize medical waste and reduce the carbon footprint associated with manufacturing new devices. Furthermore, stringent regulations and quality control measures imposed by regulatory authorities ensure the safety and efficacy of reprocessed devices, instilling confidence in healthcare providers to adopt this practice. Moreover, technological advancements in reprocessing methods and equipment contribute to market growth by improving the efficiency and effectiveness of the reprocessing process. Overall, the drivers of the reprocessed medical devices market encompass financial considerations, environmental consciousness, regulatory compliance, and technological advancements.

Restraining Factors

The reprocessed medical devices market also faces several restraints, concerns about the safety and efficacy of reprocessed devices may lead to hesitation among healthcare providers and potential resistance from patients. There is a need for clear evidence and studies to address these concerns and establish the reliability of reprocessed devices. The regulatory scrutiny and compliance requirements can create challenges for reprocessing companies, increasing their operational costs. Additionally, the limited availability of certain high-demand devices for reprocessing can limit market growth. Moreover, the preference for new devices by some healthcare providers and the potential risk of liability issues can further impede the widespread adoption of reprocessed medical devices in the market.

Market Segmentation

- In 2022, the cardiovascular segment accounted for around 52.7% market share

On the basis of the product, the global reprocessed medical devices market is segmented into cardiovascular, laparoscopic, gastroenterology, general surgery devices, and orthopedic devices. The cardiovascular segment has emerged as the leading contributor, holding the largest share in the reprocessed medical devices market. Several factors account for its significant market presence, cardiovascular diseases continue to be a major global health concern, with a high prevalence and a rising number of cases. As a result, there is a substantial demand for cardiovascular medical devices, including catheters, pacemakers, stents, and electrophysiology devices. The reprocessing of these devices provides a cost-effective solution for healthcare providers to address the growing demand without compromising patient care. The cardiovascular procedures often involve the use of expensive and complex medical devices. Reprocessing these devices presents a viable alternative to help reduce costs for hospitals and healthcare facilities, while still ensuring safety and efficacy. This cost-saving potential has been a significant driving factor in the adoption of reprocessed cardiovascular devices. Furthermore, regulatory agencies, such as the U.S. Food and Drug Administration (FDA), have established stringent guidelines and regulations for reprocessed medical devices, including those used in cardiovascular procedures. These regulatory measures ensure that reprocessed devices meet the necessary safety and quality standards, instilling confidence in healthcare providers to integrate reprocessed cardiovascular devices into their practice. Overall, the combination of a high prevalence of cardiovascular diseases, the cost-saving potential of reprocessed devices, and regulatory compliance has propelled the cardiovascular segment to hold the largest market share in the reprocessed medical devices market.

- In 2022, the hospitals segment dominated with more than 39.5% market share

Based on the end-use, the global reprocessed medical devices market is segmented into hospitals, home healthcare, and others. Hospitals have played a significant role in the reprocessed medical devices market, holding a substantial share. There are several reasons for their prominent presence in this market segment, the hospitals are major healthcare providers and often have high patient volumes, leading to a greater demand for medical devices. Reprocessed devices offer hospitals a cost-effective solution to meet their equipment needs without compromising patient care. The potential cost savings associated with reprocessed devices can help hospitals manage tight budgets and allocate resources more efficiently. The hospitals prioritize patient safety and adhere to rigorous quality control standards. Reprocessed medical devices undergo a thorough cleaning, testing, and sterilization processes, ensuring their safety and efficacy before being reintroduced for use. Hospitals value the assurance that reprocessed devices meet regulatory guidelines and maintain high-quality standards. Additionally, hospitals are increasingly focusing on sustainable healthcare practices and environmental stewardship. Reprocessing medical devices aligns with their goals of reducing waste and minimizing the environmental impact of healthcare operations. By incorporating reprocessed devices into their practices, hospitals demonstrate their commitment to sustainability while still delivering high-quality care. Furthermore, hospitals often have the necessary infrastructure and resources to implement reprocessing programs. They can collaborate with reputable reprocessing companies, establish protocols, and train staff to effectively integrate reprocessed devices into their supply chains. Overall, the substantial share held by hospitals in the reprocessed medical devices market is driven by their demand for cost-effective solutions, commitment to patient safety, environmental sustainability goals, and their capacity to implement reprocessing programs effectively.

Regional Segment Analysis of the Reprocessed Medical Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

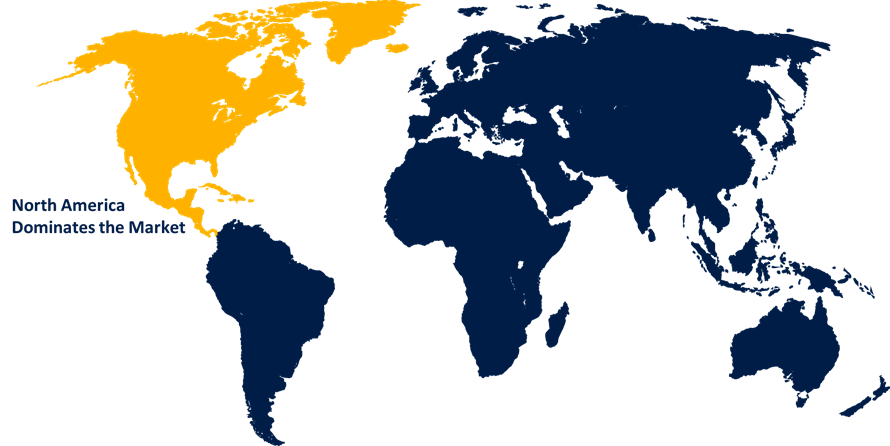

North America dominated the market with more than 43.5% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as a leading region in the reprocessed medical devices market, capturing the largest revenue share. North America possesses a well-established healthcare infrastructure and advanced medical facilities, leading to a higher volume of medical device usage. This increased usage provides a larger pool of devices suitable for reprocessing, driving market growth. Additionally, the region has stringent regulations and guidelines in place for reprocessed medical devices, ensuring quality and safety standards are met. Moreover, cost containment initiatives implemented by healthcare providers, such as hospitals and clinics, encourage the adoption of reprocessed devices to achieve cost savings without compromising patient care. Furthermore, increasing environmental consciousness and sustainability initiatives further support the demand for reprocessed medical devices in North America, contributing to its significant revenue share in the market.

Recent Developments

- In March 2023, Vanguard AG signed the Dutch Green Deal's third edition. This agreement is the result of a partnership between industrial groups, government ministries, and other organizations dedicated to improving sustainable development in the Netherlands. Vanguard is also collaborating with the scientific and professional network, Landelijk Netwerk de Groene OK, to help them accomplish their aim of CO2-neutral care.

- In May 2022, Innovative Health, LLC has been granted authorization to reprocess the Philips Eagle Eye Platinum digital IVUS (intravascular ultrasonography) catheter. This approval essentially marks the company's debut into the cath lab area, increasing the company's medical device reprocessing market reach in cardiac applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global reprocessed medical devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Stryker

- Innovative Health

- NEScientific, Inc.

- Medline Industries, LP.

- Arjo

- Vanguard AG

- Cardinal Health

- SureTek Medical

- Soma Tech Intl

- Johnson & Johnson MedTech

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global reprocessed medical devices market based on the below-mentioned segments:

Reprocessed Medical Devices Market, By Product

- Cardiovascular

- Laparoscopic

- Gastroenterology

- General Surgery Devices

- Orthopedic Devices

Reprocessed Medical Devices Market, By Type

- Third-party Reprocessing

- In-house Reprocessing

Reprocessed Medical Devices Market, By End-Use

- Hospitals

- Home Healthcare

- Others

Reprocessed Medical Devices Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?