Global QR Code Payment Market Size, Share, and COVID-19 Impact Analysis, By Solution (Static QR Code and Dynamic QR Code), By Payment Type (Push Payment and Pull Payment), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Information & TechnologyGlobal QR Code Payment Market Insights Forecasts To 2035

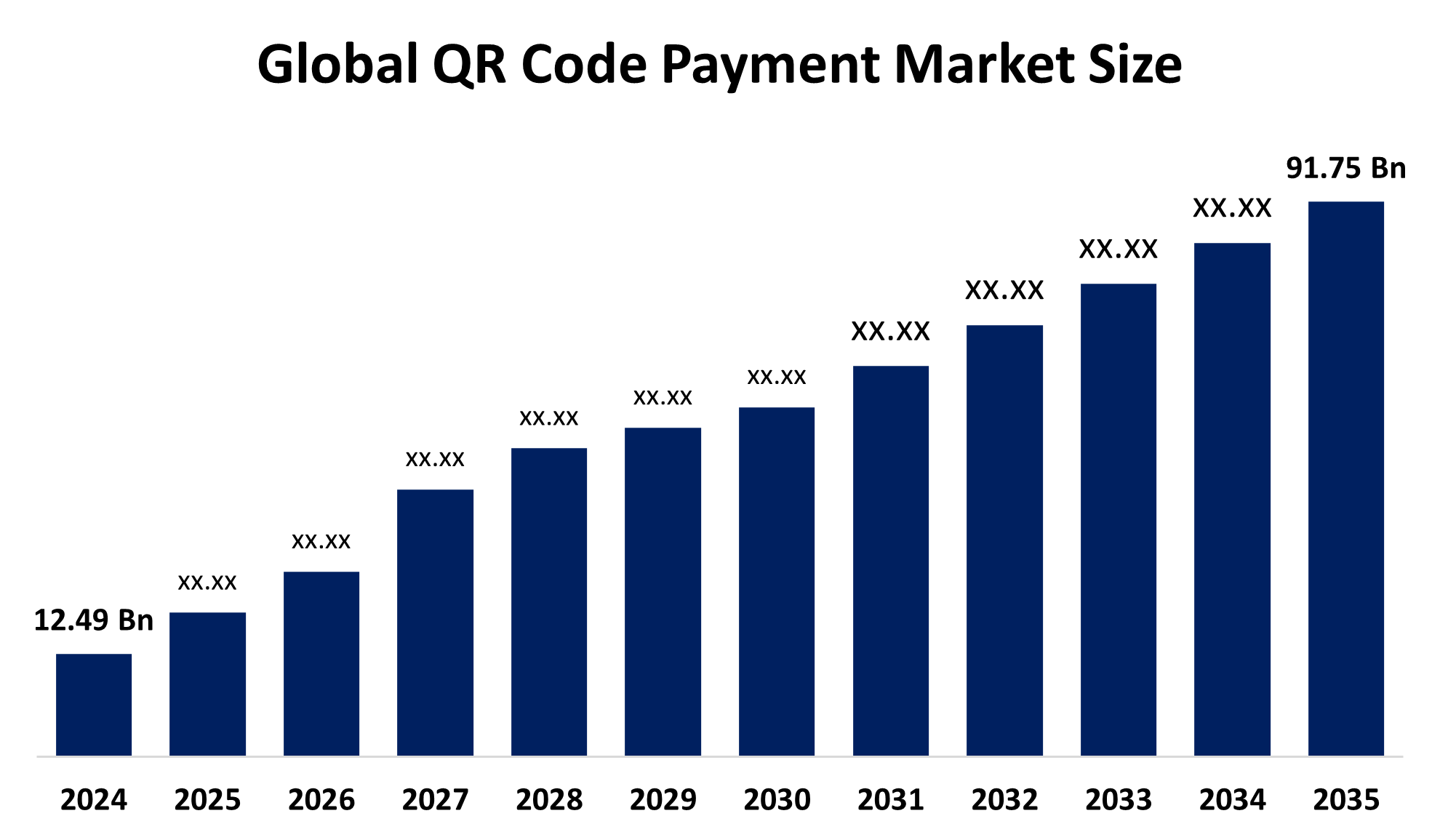

- The Global QR Code Payment Market Size Was Estimated at USD 12.49 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 19.88% from 2025 to 2035

- The Worldwide QR Code Payment Market Size is Expected to Reach USD 91.75 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

QR Code Payment Market

The global QR code payment market involves the use of Quick Response (QR) codes to facilitate digital payments through smartphones and other devices. This payment method enables users to complete transactions by scanning a QR code, offering a contactless and efficient alternative to traditional payment methods. QR code payments are widely used across various industries such as retail, hospitality, transportation, and e-commerce, providing a seamless and fast transaction experience. The technology supports multiple payment options, including bank transfers, digital wallets, and credit or debit cards, making it versatile for both consumers and merchants. With growing digitalization, QR code payments have become an essential part of the modern financial ecosystem. They simplify the checkout process, reduce the need for physical cash or cards, and integrate easily with mobile applications. As a result, the global QR code payment market continues to evolve, offering innovative solutions for secure and convenient digital transactions worldwide.

Attractive Opportunities in the QR Code Payment Market

- QR code payments provide an opportunity to integrate unbanked and underbanked populations into the digital economy, especially in remote areas with limited banking infrastructure. This opens up access to financial services for small businesses and individuals without the need for traditional banking setups.

- QR codes offer a seamless payment solution for international travelers, eliminating the need for currency exchange. This simplifies transactions for tourists and businesses in tourist destinations, creating a more convenient and secure payment experience.

Global QR Code Payment Market Dynamics

Global QR Code Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 12.49 Billion |

| Forecast Period: | 2025-2035 |

| 2035 Value Projection: | USD 91.75 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Solution, By Payment Type, By Regional Analysis |

| Companies covered:: | Alipay, WeChat Pay, Paytm, Google Pay, Apple Pay, Samsung Pay, Visa, Mastercard, Razorpay, Square, and Others |

| Growth Drivers: | 19.88% |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

DRIVER: Adoption of smartphones and increasing internet penetration

The widespread adoption of smartphones and increasing internet penetration have made QR code payments more accessible to a broad user base. The shift towards cashless and contactless transactions, accelerated by the COVID-19 pandemic, has further boosted demand for QR-based payment solutions. Ease of use, low implementation costs for merchants, and the ability to support various payment platforms make QR codes an attractive option for businesses of all sizes. Integration with digital wallets and mobile banking apps enhances user convenience and security, encouraging more consumers to adopt the technology. Additionally, the rise of e-commerce and in-store digital payments has created a strong demand for fast and reliable payment systems. Supportive policies from governments and financial institutions, along with increased awareness of digital finance, continue to fuel market expansion, making QR code payments a key component of the evolving digital economy.

RESTRAINT: Dependence on smartphones and stable internet connections further restricts usage in areas with poor digital infrastructure

Despite its rapid growth, the global QR code payment market faces several restraining factors. One major challenge is the risk of security breaches, such as phishing attacks and fraudulent QR codes, which can compromise user data and reduce trust in the system. Limited digital literacy, particularly in developing regions, can also hinder adoption, as some consumers may find QR code technology confusing or inaccessible. Additionally, the lack of standardization across QR code platforms can create compatibility issues, leading to inefficiencies and user frustration. Dependence on smartphones and stable internet connections further restricts usage in areas with poor digital infrastructure. Small businesses may also hesitate to adopt QR code payments due to concerns about transaction fees, technical support, or integration with existing systems. Furthermore, resistance to change and a strong preference for traditional payment methods in certain demographics can slow the transition to digital payments, limiting the market’s overall growth potential.

OPPORTUNITY: Expanding financial inclusion by bringing digital payment solutions to unbanked and underbanked populations

One key opportunity lies in expanding financial inclusion by bringing digital payment solutions to unbanked and underbanked populations, particularly in remote or rural areas. QR code payments, which require minimal infrastructure, can serve as an entry point to the digital economy for small vendors and informal businesses. Another opportunity exists in cross-border payments and tourism, where QR codes can simplify transactions for international travelers without the need for currency exchange. Businesses can also leverage QR codes for customer engagement by integrating them with loyalty programs, promotions, or personalized offers. In emerging technologies, the combination of QR codes with blockchain, biometric authentication, and IoT can enhance transaction security and transparency. Additionally, sectors like healthcare, education, and public transport can adopt QR payments for service efficiency, creating untapped potential for market expansion and innovation across various non-retail environments.

CHALLENGES: Managing data privacy and compliance with varying international regulations

Managing data privacy and compliance with varying international regulations, such as GDPR and other local data protection laws, adds complexity for global operators. Another challenge is maintaining system scalability and performance during peak transaction periods, especially in high-traffic areas or large-scale events. Additionally, educating both consumers and merchants about secure usage and the benefits of QR payments requires sustained awareness campaigns. In competitive markets, differentiation becomes difficult as many providers offer similar services, making customer retention and loyalty a challenge. Integration of QR payments into legacy point-of-sale systems can also be technically complex and costly. Addressing these challenges is essential to ensure smooth, secure, and scalable QR code payment experiences across diverse environments.

Global QR Code Payment Market Ecosystem Analysis

The global QR code payment market ecosystem includes national standards, fintech platforms, merchants, and technology providers. Central banks support interoperable systems like BharatQR and QRIS, enabling cross-platform compatibility. Fintech apps such as Alipay, Paytm, and WeChat Pay power consumer transactions, while retailers and service sectors integrate QR solutions into POS systems and mobile apps. Cross-border interoperability, especially in regions like ASEAN, enhances global usability. This ecosystem enables seamless, secure, and scalable digital transactions across various industries and geographies.

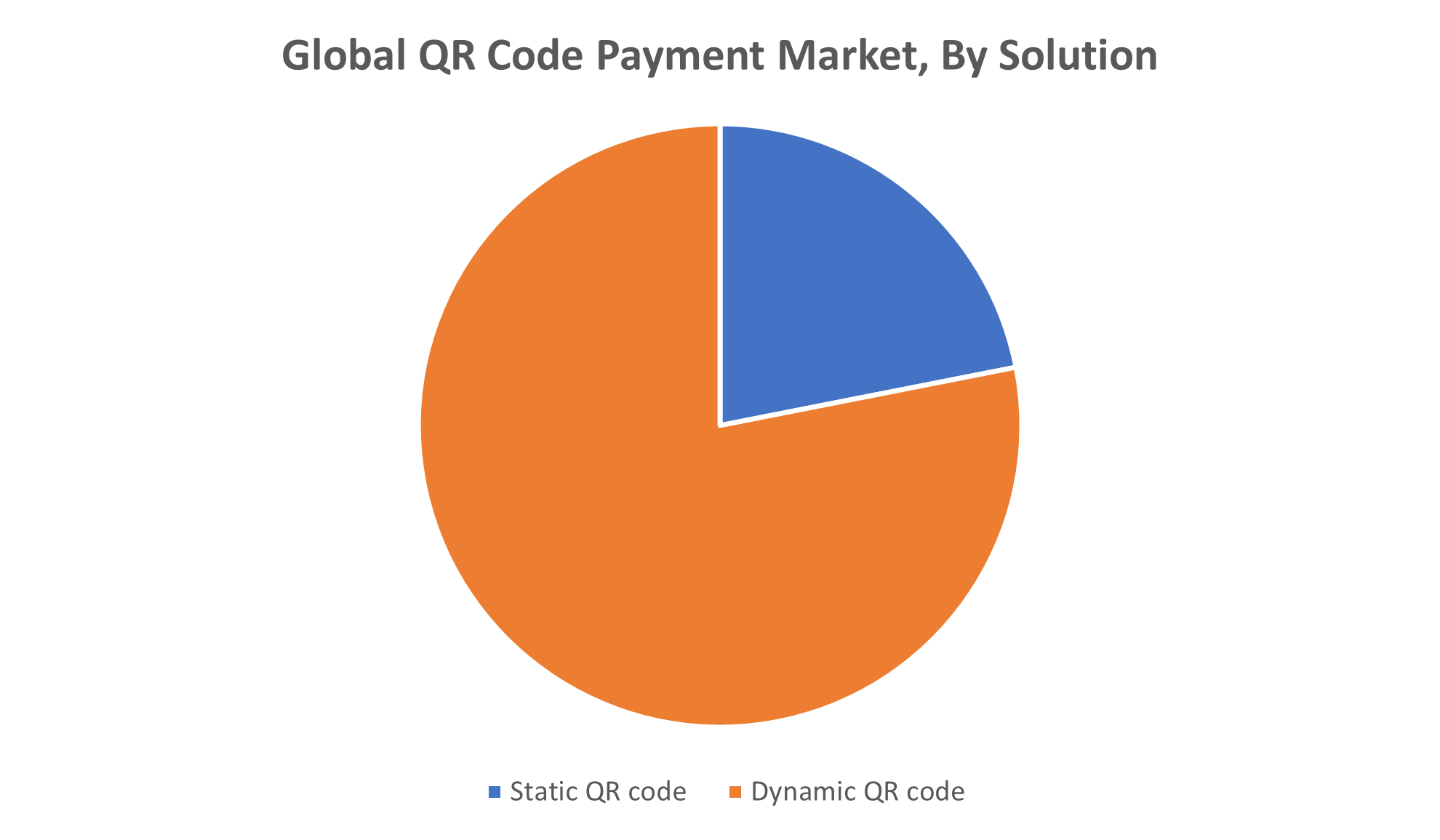

Based on the solution, the dynamic QR code segment dominated the global QR code payment market over the forecast period

Get more details on this report -

The dynamic QR code segment has dominated the global QR code payment market over the forecast period due to its advanced functionality and enhanced security features. Unlike static QR codes, which contain fixed information, dynamic QR codes are generated in real-time for each transaction, allowing customization, better tracking, and easier integration with point-of-sale (POS) systems. This makes them particularly suitable for high-volume sectors such as retail, hospitality, and e-commerce. Dynamic QR codes also offer advantages like editable content, detailed transaction records, and improved fraud prevention, making them more reliable for both consumers and merchants. Their ability to support personalized payments and promotional offers further increases their appeal in customer-focused environments.

Based on the payment type, the push payment segment held the largest share during the forecast period

The push payment segment held the largest share of the global QR code payment market during the forecast period. In a push payment, the payer initiates the transaction by scanning the QR code and authorizing the payment from their account, providing greater control and security over the transaction. This method is widely used in person-to-person (P2P) payments, retail purchases, and small business transactions due to its simplicity, transparency, and low risk of fraud. Push payments do not require merchants to access sensitive customer data, which enhances privacy and trust. The growing adoption of mobile wallets and banking apps that support QR-based push payments has further contributed to the segment's dominance.

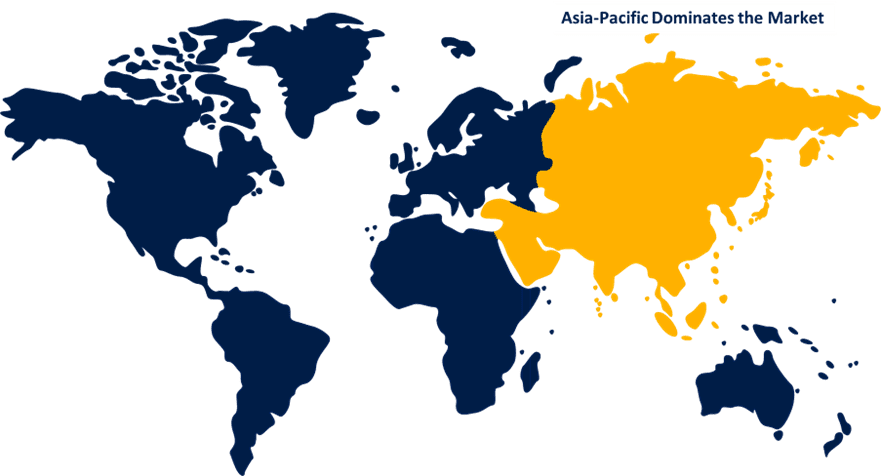

Asia Pacific is anticipated to hold the largest market share of the QR code payment market during the forecast period

Get more details on this report -

Asia Pacific is anticipated to hold the largest market share of the global QR code payment market during the forecast period. This region has been a pioneer in adopting QR code-based payment systems, driven by widespread smartphone usage, high internet penetration, and the rising popularity of digital wallets. Countries like China, India, and Southeast Asian nations have rapidly embraced QR code payments, with platforms such as Alipay, WeChat Pay, Paytm, and others leading the charge. The convenience, low-cost implementation for merchants, and ease of use for consumers have accelerated the adoption of QR payments across diverse sectors like retail, transportation, and hospitality. Additionally, supportive government initiatives and the push for cashless economies have further fueled market growth. As mobile payment technology continues to evolve and more businesses integrate QR code payment solutions, Asia Pacific remains at the forefront, setting the stage for continued dominance in the global market.

North America is expected to grow at the fastest CAGR in the QR code payment market during the forecast period

North America is expected to grow at the fastest CAGR in the QR code payment market during the forecast period. This growth can be attributed to the increasing adoption of mobile payment solutions, the rise of contactless payment preferences, and the growing digital transformation across businesses in the region. Major players in the fintech industry, such as Apple Pay, Google Pay, and various banking apps, have integrated QR code payment functionalities, making it easier for consumers and merchants to adopt this technology. Additionally, the increasing demand for seamless, secure, and efficient payment systems in sectors like retail, transportation, and entertainment is driving the market's expansion. As both consumers and businesses in North America continue to embrace cashless and digital payment methods, the QR code payment market is set for significant growth, with innovations in user experience and enhanced security features further accelerating adoption.

Recent Development

- In April 2022, Paytm introduced dynamic QR codes for enhanced transaction security and real-time updates. This solution caters to small businesses and consumers, providing more detailed transaction tracking and fraud prevention features.

Key Market Players

KEY PLAYERS IN THE QR CODE PAYMENT MARKET INCLUDE

- Alipay

- WeChat Pay

- Paytm

- Google Pay

- Apple Pay

- Samsung Pay

- Visa

- Mastercard

- Razorpay

- Square

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the QR code payment market based on the below-mentioned segments:

Global QR Code Payment Market, By Solution

- Static QR code

- Dynamic QR code

Global QR Code Payment Market, By Payment Type

- Push Payment

- Pull Payment

Global QR Code Payment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?