Global Produced Water Treatment Market Size, Share, and COVID-19 Impact Analysis, By Treatment (Physical Treatment, Chemical Treatment, and Biological Treatment), By Application (Onshore and Offshore), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Chemicals & MaterialsGlobal Produced Water Treatment Market Insights Forecasts to 2032

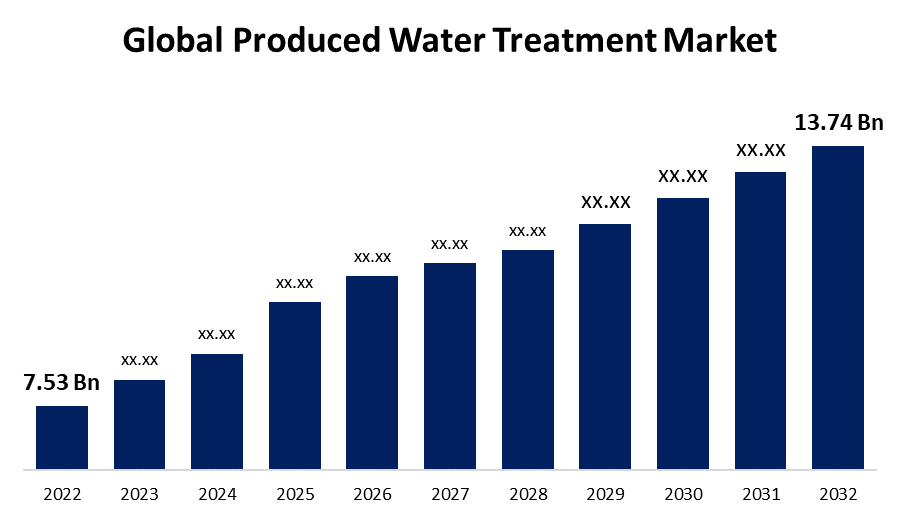

- The Global Produced Water Treatment Market Size was valued at USD 7.53 Billion in 2022.

- The Market is growing at a CAGR of 6.2% from 2022 to 2032.

- The Worldwide Produced Water Treatment Market Size is expected to reach USD 13.74 Billion by 2032.

- Asia-Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Produced Water Treatment Market Size is expected to reach USD 13.74 billion by 2032, at a CAGR of 6.2% during the forecast period 2023 to 2032.

Market Overview

Produced water treatment refers to the process of treating wastewater generated during oil and gas production. When oil and gas are extracted from reservoirs, water present in the formations, known as produced water, is brought to the surface as a byproduct. This water contains various impurities, including hydrocarbons, salts, heavy metals, and other contaminants, making it unsuitable for direct discharge or reuse. Produced water treatment involves several stages, including separation, where oil and gas are separated from the water, followed by physical, chemical, and biological treatment processes to remove impurities. The treated water can then be safely disposed of or reused for various purposes, such as irrigation, industrial processes, or even reinjection into oil and gas reservoirs. Effective produced water treatment is crucial for minimizing environmental impacts and ensuring sustainable oil and gas production practices.

Report Coverage

This research report categorizes the market for produced water treatment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the produced water treatment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the produced water treatment market.

Global Produced Water Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.53 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.2% |

| 2032 Value Projection: | USD 13.74 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Treatment, By Application, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Weatherford International, Halliburton Company, General Electric Company, Enviro-Tech Systems, Baker Hughes, Mineral Technologies, Inc., Siemens AG, Exterran Corporation, Ovivo, Veolia Environnement S.A., Schlumberger Limited. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The produced water treatment market is driven by several factors such as the growing demand for oil and gas, coupled with increasing exploration and production activities, leads to a significant rise in produced water volumes, necessitating efficient treatment solutions. The stringent environmental regulations and water quality standards imposed by governments worldwide compel oil and gas companies to implement effective produced water treatment systems to minimize environmental impacts. The increasing adoption of advanced technologies, such as membrane filtration, electrocoagulation, and chemical treatments, drives market growth as they offer higher treatment efficiency and reduced operational costs. Additionally, the need to maximize water reuse and minimize freshwater consumption in water-stressed regions stimulates the demand for produced water treatment solutions. Overall, the rising awareness and corporate responsibility towards sustainable practices further fuel the market growth as companies strive to adopt eco-friendly treatment technologies and reduce their ecological footprint.

Restraining Factors

The produced water treatment market faces certain restraints due to the high capital investment required for setting up advanced treatment infrastructure poses a challenge for small and medium-sized oil and gas companies. The complexity of produced water composition, which can vary significantly depending on the reservoir and production processes, makes it difficult to develop standardized treatment solutions. The disposal of treated water can be limited by the availability of suitable injection wells or environmental constraints, leading to logistical challenges. Additionally, the fluctuating oil and gas prices and economic uncertainties can impact the investment decisions and budgets for produced water treatment projects. Overall, the lack of awareness and understanding of the benefits of produced water treatment in certain regions can hinder market growth.

Market Segmentation

- In 2022, the chemical treatment segment accounted for around 28.4% market share

On the basis of the treatment type, the global produced water treatment market is segmented into physical treatment, chemical treatment, and biological treatment. The chemical treatment segment has emerged as the dominant force in the produced water treatment market. Several factors contribute to its market dominance such as chemical treatments offer a versatile and effective approach to address various contaminants present in produced water, such as hydrocarbons, heavy metals, and scaling agents. Chemical additives, such as coagulants, flocculants, demulsifiers, and corrosion inhibitors, are widely employed to enhance the separation and removal of impurities. The chemical treatments provide flexibility in adjusting treatment parameters and optimizing performance based on the specific characteristics of produced water. Moreover, advancements in chemical formulations and dosage control systems have improved treatment efficiency and reduced operational costs. Additionally, chemical treatment technologies have demonstrated high reliability and scalability, making them suitable for large-scale oil and gas production operations. The dominance of the chemical treatment segment is further bolstered by the extensive research and development activities focused on developing new chemical formulations and innovative treatment approaches.

- In 2022, the on-shore segment dominated with more than 65.8% market share

Based on the type of application, the global produced water treatment market is segmented into onshore and offshore. The on-shore segment has established its dominance in the Produced Water Treatment market. Several factors contribute to its market leadership such as on-shore oil and gas production accounts for a significant portion of global production, with numerous extraction activities taking place on land. Consequently, the volume of produced water generated from on-shore operations is considerably higher than that from off-shore activities. The on-shore production sites generally have more accessible and cost-effective infrastructure for installing and operating water treatment systems. This accessibility facilitates efficient and timely implementation of treatment solutions. Additionally, regulatory compliance and environmental concerns surrounding on-shore operations are often more stringent, necessitating effective produced water treatment to minimize environmental impact. Furthermore, the cost advantages associated with on-shore operations, such as lower transportation costs and simplified logistics, contribute to the dominance of the on-shore segment. Overall, the combination of higher production volumes, regulatory requirements, and operational efficiencies positions the on-shore segment as the market leader in produced water treatment.

Regional Segment Analysis of the Produced Water Treatment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 40.2% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as a dominant player in the produced water treatment market. Several factors contribute to its market dominance because North America is a major hub for oil and gas production, with significant shale gas and tight oil reserves. The region experiences high volumes of produced water, necessitating robust treatment infrastructure. Stringent environmental regulations in countries like the United States and Canada drive the demand for effective produced water treatment systems to ensure compliance and minimize ecological impact. The presence of advanced technology providers and research institutions fosters innovation and the development of efficient treatment solutions. Additionally, the focus on sustainable practices and the availability of investment opportunities in the region further propel the market growth. The combination of favorable regulatory frameworks, technological advancements, and a booming oil and gas industry contributes to North America's dominance in the produced water treatment market.

Recent Development

- In March 2022, Cavitation Technologies and SD Partners have established a collaboration to expand the use of sustainably produced water treatment into new sectors. CTi will get assistance from Sustainable Development Partners in commercialising novel uses of its unique technology in produced water treatment utilising low-pressure nanoreactors (LPN).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global produced water treatment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Weatherford International

- Halliburton Company

- General Electric Company

- Enviro-Tech Systems

- Baker Hughes

- Mineral Technologies, Inc.

- Siemens AG

- Exterran Corporation

- Ovivo

- Veolia Environnement S.A.

- Schlumberger Limited

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global produced water treatment market based on the below-mentioned segments:

Produced Water Treatment Market, By Treatment

- Physical Treatment

- Chemical Treatment

- Biological Treatment

Produced Water Treatment Market, By Application

- Onshore

- Offshore

Produced Water Treatment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?