Global Polymeric Adsorbents Market Size By Product (Aromatic (Cross-linked Polystyrenic Matrix), Modified Aromatic (Brominated Aromatic Matrix), Methacrylic (Methacrylic Ester Copolymer), Others (Phenol formaldehyde-based resins), By End-Use Industry (Pharmaceutical, Food & Beverages, and Industrial), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Chemicals & MaterialsGlobal Polymeric Adsorbents Market Insights Forecasts to 2033

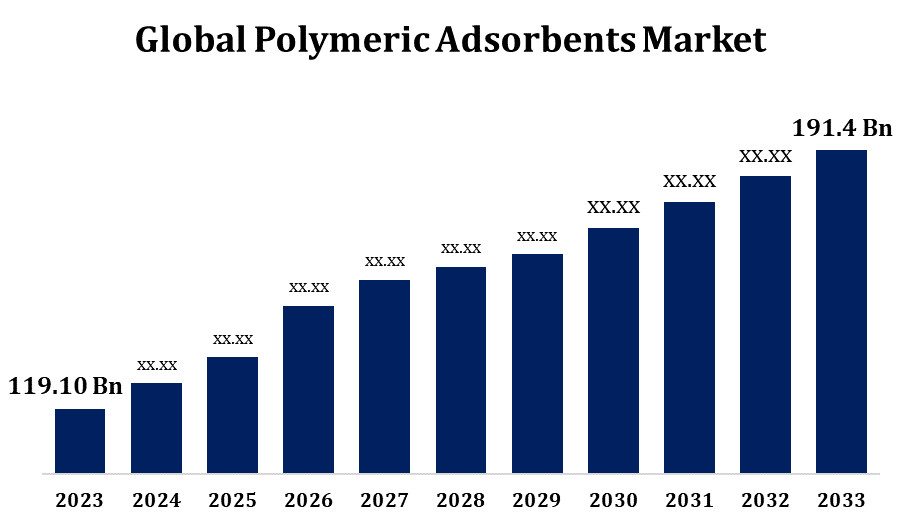

- The Global Polymeric Adsorbents Market Size was valued at USD 119.10 Billion in 2023

- The Market Size is growing at a CAGR of 8.1% from 2023 to 2033

- The Worldwide Polymeric Adsorbents Market Size is expected to reach USD 191.4 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Polymeric Adsorbents Market Size is expected to reach USD 191.4 Billion by 2033, at a CAGR of 8.1% during the forecast period 2023 to 2033.

Water and wastewater treatment, pharmaceutical manufacture, biotechnology, food and beverages, and mining are just a few of the industries that use polymeric adsorbents. Polymeric adsorbents are used in water treatment to remove impurities such as heavy metals, organic pollutants, and colourants. They have benefits like high adsorption capacity, selectivity, and simplicity of regeneration. Polymeric adsorbents are used in the pharmaceutical sector to purify and separate biomolecules such as proteins and enzymes. These materials are used in pharmaceutical manufacturing chromatographic procedures. Polymeric adsorbents are used in the food and beverage industries to remove colourants, flavour chemicals, and pollutants. They contribute to the improvement of food quality and safety.

Polymeric Adsorbents Market Value Chain Analysis

The value chain begins with the acquisition of raw materials required for the production of polymeric adsorbents. Polymers, resins, and other chemical components are important raw materials. Polymeric adsorbents are synthesised and processed throughout the manufacturing step. Polymeric materials with specialised adsorption properties are created using polymerization procedures, chemical changes, and formulation processes. Quality control measures are critical to ensuring that the polymeric adsorbents manufactured meet the specifications and performance standards. Adsorption capacity, selectivity, stability, and other essential qualities are rigorously tested. Polymeric adsorbents are provided to clients and end-users after they have been made and tested. Polymeric adsorbents are used in a variety of industries, including water treatment, pharmaceuticals, biotechnology, food and drinks, and mining.

Polymeric Adsorbents Market Opportunity Analysis

The ongoing expansion of the pharmaceutical industry, notably in biopharmaceuticals, presents an opportunity for polymeric adsorbents. These materials are essential in the purification of proteins, monoclonal antibodies, and other medicinal compounds via chromatography techniques. With the rising biotechnology sector, polymeric adsorbents have a potential in bioprocessing and biomanufacturing applications. The purification of biomolecules by chromatography methods is critical in the manufacture of biopharmaceuticals. The rise of the food and beverage industry, combined with rising quality standards, generates potential for polymeric adsorbents. These materials can be used to remove colourants, flavour compounds, and pollutants, resulting in higher-quality food items. The mining industry's growing emphasis on environmentally friendly procedures and efficient metal extraction processes presents prospects for polymeric adsorbents.

Global Polymeric Adsorbents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 119.10 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.1% |

| 2033 Value Projection: | USD 191.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-Use Industry, By Region, By Geographic Scope |

| Companies covered:: | The DOW Chemical Company, Mitsubishi Chemical Holdings Corporation, Purolite Corporation, Thermax Limite, Chemra GmbH, Sunresin New Materials Co. Ltd., Amicogen Biopharm Co. Ltd., Ajinomoto Fine-Techno Co. Ltd., Shanghai Bairy Technology Co. Ltd., and Other Key Vendors. |

| Growth Drivers: | Rising importance in purifications in the pharmaceutical and food & beverage industries |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Polymeric Adsorbents Market Dynamics

Rising importance in purifications in the pharmaceutical and food & beverage industries

The purification of biopharmaceuticals, such as monoclonal antibodies, vaccines, and therapeutic proteins, is critical. To selectively collect and purify these biomolecules, polymeric adsorbents are utilised in chromatography processes. Polymeric adsorbents are used in a variety of chromatography techniques, including ion exchange, affinity, and hydrophobic interaction chromatography. To remove colourants, flavour compounds, and off-flavors, polymeric adsorbents are used in the food and beverage sector. This is especially significant in the manufacture of beverages, juices, and food products, where keeping a consistent colour and flavour profile is critical. The increasing need for biopharmaceuticals, which are frequently complicated and require sophisticated purification techniques, is a major driver of polymeric adsorbent usage in the pharmaceutical industry.

Restraints & Challenges

Polymeric adsorbents may have weak selectivity for particular chemicals, which can be problematic in applications requiring high specificity. Improving polymeric adsorbent selectivity for a broader range of compounds is an ongoing subject of research and development. Polymeric adsorbents' adsorption capacity may hit saturation limits, reducing their efficiency over time. Manufacturers and end-users must carefully evaluate adsorption kinetics and capacity in order to maximise the adsorbent's lifespan and performance. The expense of producing polymeric adsorbents, especially those developed for specialised purposes, can be a barrier to wider adoption. Balancing performance and cost-effectiveness is critical for market competitiveness. Other types of adsorbents, membranes, and separation processes compete with polymeric adsorbents.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Polymeric Adsorbents Market from 2023 to 2033. Polymeric adsorbents are widely used in the pharmaceutical and biotechnology industries in North America. Polymeric adsorbents are used in chromatography operations to purify biopharmaceuticals, monoclonal antibodies, and other therapeutic proteins. Polymeric adsorbents are used in the water treatment sector in North America to remove impurities from water sources. Adsorbents like these are utilised in municipal water treatment, industrial wastewater treatment, and point-of-use water purification systems.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Pharmaceuticals, water treatment, food and beverage, and environmental applications are among the industries driving the market. Polymeric adsorbents are widely used in the pharmaceutical and biotechnology industries in Asia-Pacific. These adsorbents are employed in the purification of biopharmaceuticals, monoclonal antibodies, and other therapeutic proteins via chromatography techniques. Polymeric adsorbents are used in the food and beverage sector in Asia-Pacific to remove colourants, flavour compounds, and pollutants. These adsorbents help to improve the quality and safety of food and beverages.

Segmentation Analysis

Insights by Product

The Modified Aromatic (Brominated Aromatic Matrix) segment accounted for the largest market share over the forecast period 2023 to 2033. Modified aromatic matrices, such as brominated aromatic matrices, are frequently used because of their high adsorption capabilities and selectivity for specific target compounds. These changes can be customised to improve adsorption performance in particular applications. Chemical functionalization of aromatic matrices is frequently used to introduce particular groups that improve adsorption capabilities. Bromination is one such functionalization that can alter the polarity and reactivity of the matrix, hence influencing its adsorption properties. Aromatic matrices can be created to be selective towards specific pollutants or compounds. This selectivity is critical in applications where the removal of specific compounds is critical, such as water treatment or purification procedures in a variety of industries.

Insights by End Use

The pharmaceutical segment accounted for the largest market share over the forecast period 2023 to 2033. Purification methods are used in the production of biopharmaceuticals such as monoclonal antibodies, vaccines, and therapeutic proteins. Polymeric adsorbents, particularly those used in chromatography processes, play an important role in the selective capture and purification of these complex biomolecules. Polymeric adsorbents are widely used in various chromatography techniques used in biopharmaceutical downstream processing. For purification, ion exchange chromatography, affinity chromatography, and other chromatographic procedures take advantage of the excellent selectivity and efficiency of polymeric adsorbents. In pharmaceutical manufacturing, downstream processing efficiency is critical. Polymeric adsorbents help to remove impurities, aggregates, and contaminants efficiently, resulting in high-purity biopharmaceutical products.

Recent Market Developments

- In January 2020, DuPont acquired Memcor, Desalitech, inge GmbH, and OxyMem Limited, expanding its leading range of separation technologies, which includes reverse osmosis, ultrafiltration, ion exchange resins, and water purification.

Competitive Landscape

Major players in the market

- The DOW Chemical Company

- Mitsubishi Chemical Holdings Corporation

- Purolite Corporation

- Thermax Limite

- Chemra GmbH

- Sunresin New Materials Co. Ltd.

- Amicogen Biopharm Co. Ltd.

- Ajinomoto Fine-Techno Co. Ltd.

- Shanghai Bairy Technology Co. Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Polymeric Adsorbents Market, Product Analysis

- Aromatic (Cross-linked Polystyrenic Matrix)

- Modified Aromatic (Brominated Aromatic Matrix)

- Methacrylic (Methacrylic Ester Copolymer)

- Others (Phenol formaldehyde-based resins)

Polymeric Adsorbents Market, End-Use Analysis

- Pharmaceutical

- Food & Beverages

- Industrial

Polymeric Adsorbents Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?