Global Polyethylene Furanoate (PEF) Market Size, Share, and COVID-19 Impact Analysis, By Type (Bio-Based and Plant-Based), By Application (Packaging, Films, Fibers, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Polyethylene Furanoate (PEF) Market Insights Forecasts to 2035

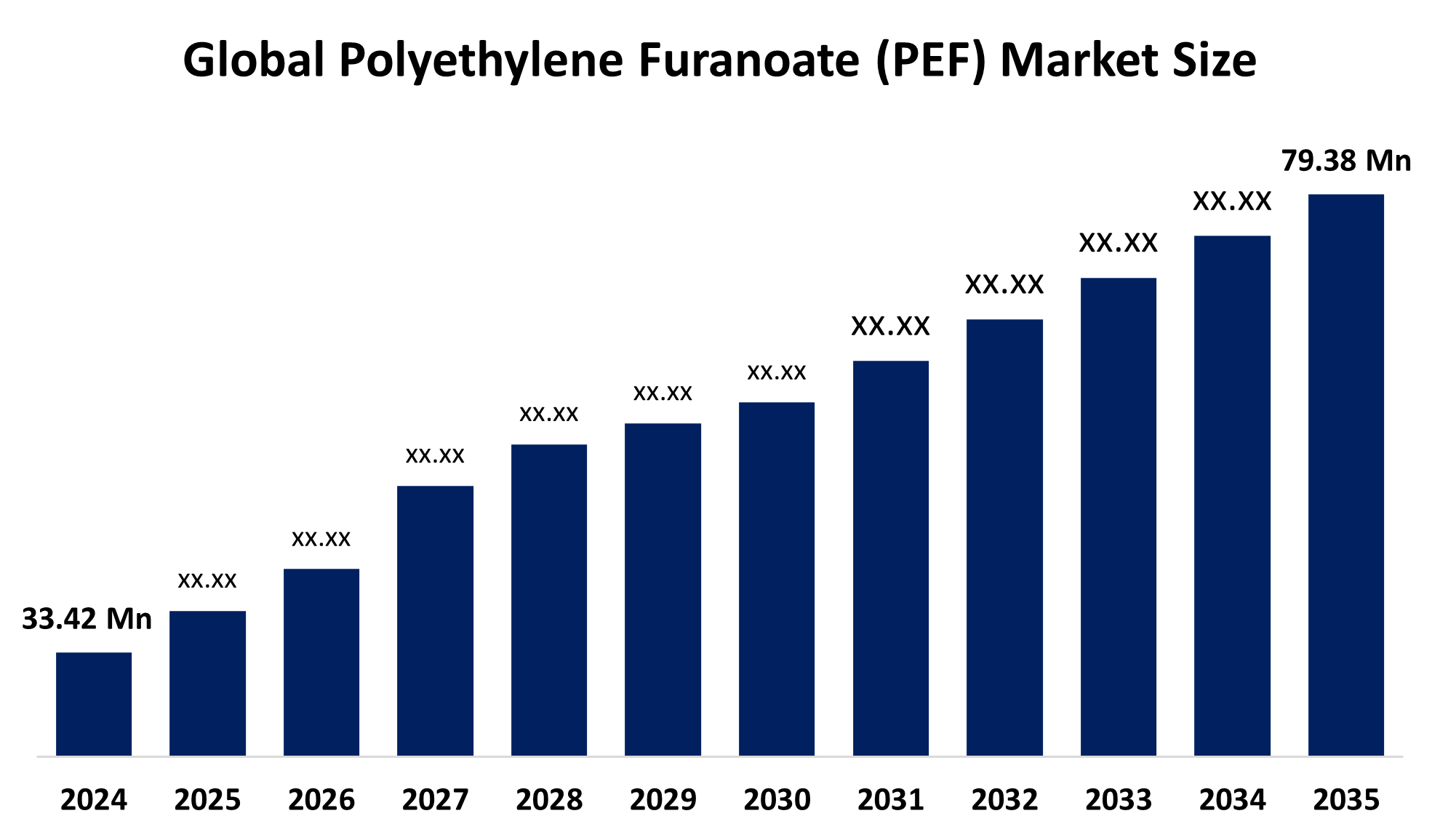

- The Global Polyethylene Furanoate (PEF) Market Size Was Estimated at USD 33.42 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.18% from 2025 to 2035

- The Worldwide Polyethylene Furanoate (PEF) Market Size is Expected to Reach USD 79.38 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Polyethylene Furanoate (PEF) Market size was worth around USD 33.42 Million in 2024, Growing to USD 36.21 Million in 2025, and is predicted to grow to around USD 79.38 Million by 2035 with a compound annual growth rate (CAGR) of 8.18% from 2025 to 2035. The polyethylene furanoate (PEF) market grows due to the increasing global demand for sustainable, bio-based alternatives to traditional plastics. Supportive government regulations promoting eco-friendly materials and the superior performance of PEF, such as high barrier properties and renewability, further drive its adoption in packaging and other industries as a promising alternative to PET.

Global Polyethylene Furanoate (PEF) Market Forecast and Revenue Outlook

- 2024 Market Size: USD 33.42 Million

- 2025 Market Size: USD 36.21 Million

- 2035 Projected Market Size: USD 79.38 Million

- CAGR (2025-2035): 8.18%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The polyethylene furanoate (PEF) market refers to a bio-polyester of renewable origins, including plant sugars, and is a green alternative to conventional plastics such as PET. PEF is a good gas barrier, thermally stable, and of excellent mechanical strength, and is primarily used in the packaging industry, for example, in bottles, food packages, films, textiles, and automotive materials. The world PEF market is picking up speed with mounting environmental issues, the growth in demand for sustainable packaging, and strict legislation on fossil-based plastics. Major drivers are the expansion of the food and beverage segment, the move towards recyclable and biodegradable materials, and technology advancements in bio-refining.

The scope lies in replacing PET in advanced packaging, expanding into fibers and films, and utilizing circular economy strategies. Market leaders Avantium N.V., TOYOBO Co., Ltd., Sulzer Ltd, and AVA Biochem AG are putting money into R&D and strategic alliances to expand production and penetrate new applications. Government initiatives such as the EU Green Deal, EPR schemes, and bioplastic research funding promote market expansion. Supportive policies, increasing awareness, and technological trends make the PEF market a niche value in the global move towards sustainable materials.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the polyethylene furanoate (PEF) market during the forecast period.

- In terms of type, the bio-based segment is projected to lead the polyethylene furanoate (PEF) market throughout the forecast period.

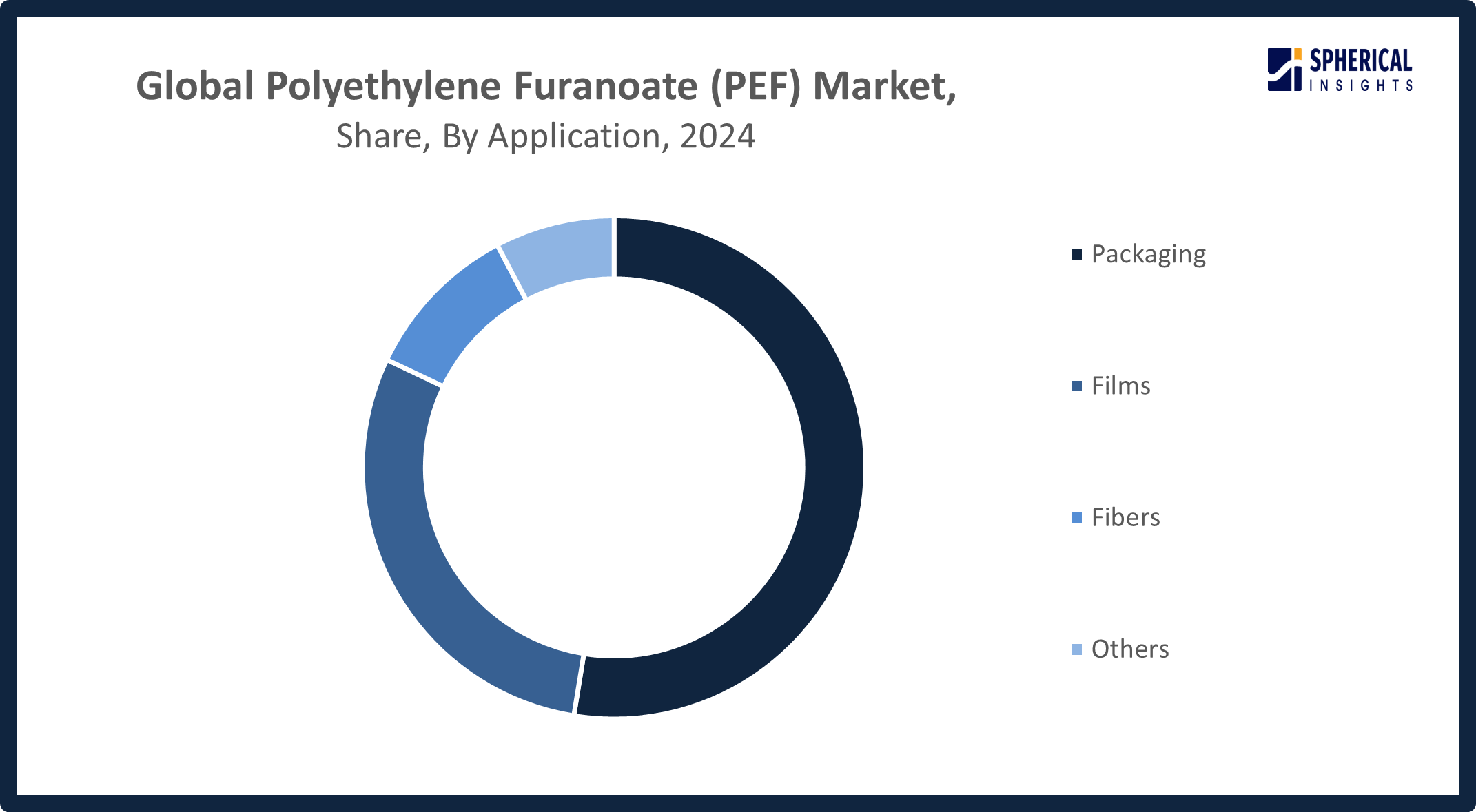

- In terms of application, the packaging segment captured the largest portion of the market.

Polyethylene Furanoate (PEF) Market Trends

- PEF’s superior gas barrier properties make it ideal for food and beverage packaging.

- The shift toward sustainable and bio-based materials is driving demand for polyethylene furanoate (PEF).

- Rising environmental regulations are pushing industries to adopt biodegradable alternatives like PEF.

- Increasing investments in bio-refineries and pilot plants are accelerating the commercialization of PEF.

- Technological advancements are improving PEF production efficiency and cost competitiveness.

Report Coverage

This research report categorizes the polyethylene furanoate (PEF) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the polyethylene furanoate (PEF) market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the polyethylene furanoate (PEF) market.

Global Polyethylene Furanoate (PEF) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 33.42 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.18% |

| 2035 Value Projection: | USD 79.38 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Avantium, Danone, Toyobo, Alpla Group, Sulzer, Corbion, Origin Materials, BASF, ADM, AVA Biochem, Mitsui & Co, Sukano, Others, and |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving factors

Principal drivers of the PEF market are increasing demand for sustainable packaging, environmental legislation, adoption of bio-based material, technological development, and growing investment in renewable plastics. Increasing demand for sustainable packaging compels industries to adopt more environmentally friendly alternatives such as PEF. Environmental legislation compels businesses to lower their dependence on fossil-based plastics. Technological development improves PEF's production efficiency and performance. Growing investments in renewable plastics enable research, upscaling, and commercialization of PEF. These combine to drive the transition toward more sustainable, high-performance materials across different packaging and industrial uses.

Restraining Factor

High costs of production, restricted commercial availability, scalability issues, consumer unawareness, and competition from existing plastics hold back PEF market growth. The high cost of production makes PEF uncompetitive. Restricted commercial availability limits supply. Scalability issues hamper mass adoption. Consumer unawareness delays demand. Intense competition from existing plastics, such as PET, restricts PEF's market penetration.

Market Segmentation

The global polyethylene furanoate (PEF) market is divided into type and application.

Global Polyethylene Furanoate (PEF) Market, By Type:

What factors contributed to the bio-based segment's dominance in 2024?

The bio-based segment led due to growing environmental consciousness, government policies supporting eco-friendly materials, and the rising popularity of green products. Technological improvements lowered the costs of production, while consumers wanted biodegradable products, propelling growth in the market and cementing the segment's top position in that year.

The plant-based segment in the polyethylene furanoate (PEF) market is expected to grow at the fastest CAGR over the forecast period. The most rapidly growing segment in the polyethylene furanoate (PEF) market will be plant-based, owing to the increasing demand for sustainable alternatives, concerns related to the environment, and improvements in bio-based material technologies.

Global Polyethylene Furanoate (PEF) Market, By Application:

Why did the packaging segment account for the largest share in 2024?

Packaging is the dominating segment, attributed to the increasing demand for sustainable and innovative solutions in the form of packaging from various industries. Rising consumer demand for green packaging, high regulation on plastic usage, and surging e-commerce activity increased market growth. Further, improvements in biodegradable and recyclable materials tightened the grip of the packaging segment during this period.

Get more details on this report -

The films segment in the polyethylene furanoate (PEF) market is expected to grow at the fastest CAGR over the forecast period. The films segment of the polyethylene furanoate (PEF) industry is rapidly growing based on growing demand for flexible, lightweight packaging, rising consumer consciousness of sustainability, and improving technologies in the manufacturing of PEF films.

Regional Segment Analysis of the Global Polyethylene Furanoate (PEF) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Polyethylene Furanoate (PEF) Market Trends

Why is Asia Pacific expected to hold the largest share of the global polyethylene furanoate (PEF) market over the forecast period?

Asia Pacific is dominating the global polyethylene furanoate (PEF) market during the forecast period, due to rapid industrialization, expanding environmental concerns, and a greater need for sustainable packaging systems. China, India, and Japan are investing in bio-based materials to decrease plastic pollution. Encouraging government policies, growing consumer demand for green products, and the development of manufacturing facilities also fuel the growth of the market, establishing the region as a major hub for PEF manufacturing and utilization.

Why is the Indian polyethylene furanoate (PEF) market experiencing notable growth trends?

The Indian polyethylene furanoate (PEF) market is witnessing significant growth owing to growing environmental awareness, favorable policies by the government towards sustainable materials, increasing demand for green packaging, and higher investment in bio-based plastics by domestic players and international giants.

What are the major trends shaping the polyethylene furanoate (PEF) market in China?

Key trends defining the polyethylene furanoate (PEF) market in China are robust government initiatives toward green materials, fast industrialization, mounting demand for bio-based packaging, advancements in technology, and rising customer awareness of environmentally caused traditional plastics.

Why is Japan witnessing growth in the polyethylene furanoate (PEF) market?

Japan is observing growth within the polyethylene furanoate (PEF) market due to a focus on sustainability, bio-based material innovation, and robust demand for green packaging within the food and beverage sectors.

North America Polyethylene Furanoate (PEF) Market Trends

What factors are driving North America's rapid growth in the polyethylene furanoate (PEF) market?

North America is experiencing a surge in the polyethylene furanoate (PEF) market due to rising demand for eco-friendly and bio-based packaging materials, especially in food and beverages. The environmental policies and government support for green alternatives have increased the adoption of PEF. Strong R&D capabilities and technological advancements in the U.S. and Canada enable effective production of PEF. Furthermore, increased consumer consciousness about plastic pollution and corporate sustainability commitments also drive market growth. The industrial infrastructure of the region is also well-developed to support quicker commercialization and scalability of new materials such as PEF.

Why is the U.S. witnessing significant trends in the polyethylene furanoate (PEF) market?

The United States is seeing notable trends in the polyethylene furanoate (PEF) market due to heightened environmental consciousness, governmental support for green materials, heightened investment in bioplastics, and rising demand for green packaging among different industries.

Europe Polyethylene Furanoate (PEF) Market Trends

What are the major trends driving the polyethylene furanoate (PEF) market in Europe?

Major trends driving the polyethylene furanoate (PEF) market in Europe include strong environmental regulations, increasing adoption of sustainable packaging, and government incentives for bio-based materials. The region's focus on circular economy practices, rising consumer demand for eco-friendly products, and ongoing R&D in advanced bioplastics technologies are also contributing significantly to the market's growth.

Why is the polyethylene furanoate (PEF) market gaining momentum in the U.K.?

The market for polyethylene furanoate (PEF) is picking up steam in the U.K. due to increasing environmental awareness, supporting government policies, and increasing demand for eco-friendly packaging materials in the food, beverage, and consumer goods industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global polyethylene furanoate (PEF) market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Polyethylene Furanoate (PEF) Market Include

- Avantium

- Danone

- Toyobo

- Alpla Group

- Sulzer

- Corbion

- Origin Materials

- BASF

- ADM

- AVA Biochem

- Mitsui & Co

- Sukano

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In August 2025, Avantium announced the successful start-up of the sugar dehydration unit and auxiliary systems at its FDCA Flagship Plant in Delfzijl, marking a major milestone in producing FDCA, the key building block for its plant-based, recyclable PEF polymer, Releaf.

- In May 2025, Avantium announced a partnership with the Bottle Collective to showcase fiber bottles using Dry Molded Fiber technology, integrating Avantium’s plant-based PEF polymer to improve the bottles' barrier performance and sustainability.

- In October 2024, Avantium launched its plant-based, recyclable polyethylene furanoate (PEF) polymer under the brand name Releaf, promoting sustainable packaging and textiles, along with the debut of its official website and eco-conscious branding.

- In July 2024, BASF introduced Haptex 4.0, a recyclable polyurethane for synthetic leather, enabling combined recycling with PET fabric. It supports sustainable production, meets VOC regulations, and is ideal for footwear, fashion, automotive, and furniture applications.

- In August 2023, Origin Materials and Husky Technologies announced a milestone in commercializing PET incorporating sustainable FDCA, advancing eco-friendly packaging solutions and supporting the global transition to sustainable materials through innovative technology and collaboration.

- In April 2021, Packaging Matters partnered with Origin Materials to develop advanced packaging materials, including PEF. Packaging Matters will shift from petroleum-based PET to Origin’s sustainable, carbon-negative PET, which is chemically identical, recyclable, and made using FDCA-based technology.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the polyethylene furanoate (PEF) market based on the following segments:

Global Polyethylene Furanoate (PEF) Market, By Product Type

- Bio-Based

- Plant-Based

Global Polyethylene Furanoate (PEF) Market, By Application

- Packaging

- Films

- Fibers

- Others

Global Polyethylene Furanoate (PEF) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?