Global Plastic Contract Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Product (Polypropylene, ABS, Polyethylene, Polystyrene, and Others), By Application (Medical, Aerospace & Defense, Automotive, Consumer Goods & Appliances, and Others), By Region (Asia Pacific, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Plastic Contract Manufacturing Market Insights Forecasts to 2035

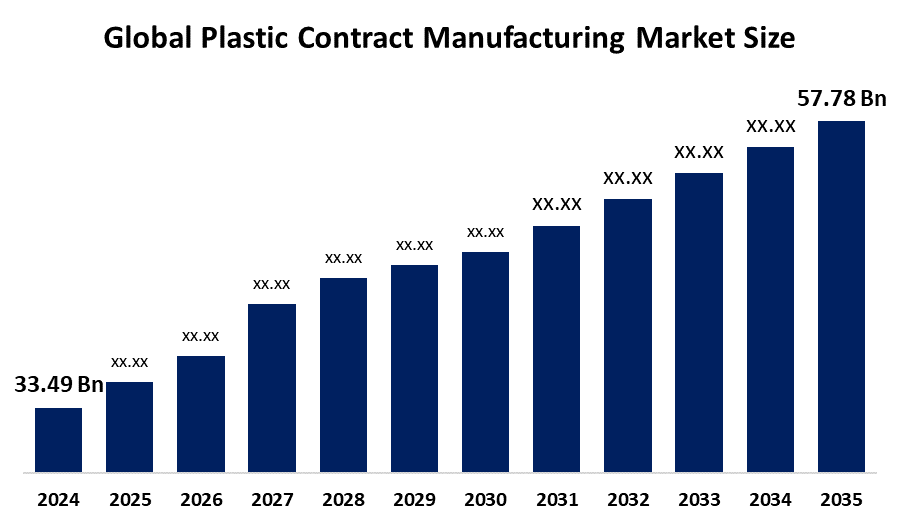

- The Global Plastic Contract Manufacturing Market Size Was Estimated at USD 33.49 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.08% from 2025 to 2035

- The Worldwide Plastic Contract Manufacturing Market Size is Expected to Reach USD 57.78 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Plastic Contract Manufacturing market size was worth around USD 33.49 Billion in 2024, growing to 35.18 billion in 2025, and is predicted to grow to around USD 57.78 Billion by 2035 with a compound annual growth rate (CAGR) of 5.08% from 2025 to 2035. The expansion of the global plastic contract manufacturing market is propelled by an increase in the outsourcing of plastic components, particularly in the automotive, electronics, medical, and packaging industries, as businesses seek to reduce costs and shorten time-to-market. More specialised, complicated, and efficient production is made possible by technological advancements, including automation, high-precision manufacturing, sustainable plastics, and moulding.

Global Plastic Contract Manufacturing Market Forecast and Revenue Size

- 2024 Market Size: USD 33.49 Billion

- 2025 Market Size: USD 35.18 Billion

- 2035 Projected Market Size: USD 57.78 Billion

- CAGR (2025-2035): 5.08%

- Asia Pacific: Dominated market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The plastic contract manufacturing industry refers to the outsourcing of plastic manufacturing activities to specialized organizations. The market has grown significantly due to the increasing desire for production methods that are inexpensive and of high quality. The United States Bureau of Economic Analysis suggests that the plastic manufacturing sector in the United States produced nearly $380 billion in the past year, indicating a stable growth trend as a sector even before the pandemic. The growth is largely due to the increased need for lightweight, strong materials for a variety of applications, including consumer goods, healthcare, and transportation. Plastic contract manufacturing is a real solution for manufacturers looking to cut costs without sacrificing product quality. The plastic contract manufacturing sector is evolving rapidly through technological innovations. Industry stakeholders are acquiring advanced equipment and developing innovative processes to meet the higher quality expectations of various industry sectors. This advancement depicts the overarching trend of companies focusing on developing scalability and operational efficiencies.

Governments are increasingly implementing laws and incentives to promote infrastructure, sustainability, and downstream processing in order to increase plastic contract manufacturing. In India, the New Scheme of Petrochemicals' plan to build plastic parks encourages shared facilities for waste collection and processing. In order to promote contract manufacturers who use bioplastics, a proposed national bioplastics policy seeks to offer financial incentives, subsidies, and regulatory clarification. In order to encourage more recyclable and compostable plastics, design-for-recycle guidelines, and increased reuse, the European Union's European Strategy for Plastics in a Circular Economy puts pressure on contract manufacturers to improve their operations.

Key Market Insights

- Asia Pacific is expected to account for the dominant share in the Plastic Contract Manufacturing market during the forecast period.

- In terms of product, the polypropylene segment is projected to lead the Plastic Contract Manufacturing market throughout the forecast period

- In terms of application, the consumer goods & appliances segment captured the dominant portion of the market during the forecast period.

Plastic Contract Manufacturing Market Trends

- Sustainability & Eco friendly Materials

- Customization & Specialization

- Adoption of Advanced Manufacturing Technologies

- Outsourcing & Demand from End Use Industries

- Circular Economy & Regulatory Pressure

Report Coverage

This research report categorizes the plastic contract manufacturing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the plastic contract manufacturing market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the plastic contract manufacturing market.

Global Plastic Contract Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 33.49 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.08% |

| 2035 Value Projection: | USD 57.78 Billion |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 119 |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors: Aerospace, healthcare drives a surge in the contract manufacturing market.

One major contributing factor to the bioactive bone graft market because plastic components are in demand among various industries, including packaging, automotive, and healthcare. The plastic contract manufacturing services market is strong. In addition, the movement toward lightweight materials in aircraft and automotive applications is another factor. The American Chemistry Council estimates that plastic parts can reduce vehicle weight by as much as 40%, resulting in improved fuel efficiency and reduced emissions. An increasing demand for lightweight materials will likely stimulate the plastic contract manufacturing market.

Restraining Factor: Raw material price volatility restricts the market.

The market for plastic contract manufacturing is restricted by manufacturers, and raw material price volatility, particularly for petrochemical-derived materials, is a significant challenge. Crude oil price fluctuations have a direct effect on plastic resin prices, which directly impact total production costs for contract manufacturers.

Market Segmentation

The global bioactive bone graft market is divided into product and application.

Global Plastic Contract Manufacturing Market, By Product:

Why does the polypropylene segment hold the dominant revenue share in the global plastic contract manufacturing market, accounting for approximately 35% of the total market during the forecast period?

The polypropylene segment led the plastic contract manufacturing market, generating the dominant revenue share. The putty-based material is praised for automotive and medical components. Polypropylene's resistance to impact and sterilization capabilities are expected to expand its application in the medical industry. In automotive applications, polypropylene's lightweight properties, coupled with high levels of electrical and chemical resistance, are what make it particularly useful.

The ABS segment in the plastic contract manufacturing market is expected to grow at the fastest CAGR over the forecast period. The ABS segment is a robust expansion, estimated at approximately 6.1% or greater. ABS is an engineering polymer that provides strength, chemical inertness, and resistance to impact and chemicals.

Global Plastic Contract Manufacturing Market, By Application:

Why do consumer goods and appliances represent the dominant application segment, capturing approximately 28.3% market share during the forecast period in the global plastic contract manufacturing market?

The consumer goods and appliances segment held the dominant market share in the plastic contract manufacturing market. The main factor propelling the consumer goods and appliances segment is rising discretionary income levels and rising consumer reliance on home appliances as a result of an expanding working population. Plastics are used in power trains, electrical parts, chassis, and interior and exterior components in the automotive sector. Some plastics that are commonly used in automotive components include PP, PU, ABS, PE, PVC, PA, and PMMA. Contract manufacturers provide injection molding manufacturing services for a variety of automotive components, such as under-the-hood plastic components, interior molded systems, vehicle exterior plastic automotive components, and interior trim.

The medical segment in the plastic contract manufacturing market is expected to grow at the fastest CAGR over the forecast period. It is expected that product demand will be fueled by the increased application of catheters in the medical sector for procedures such as angiography, cardiac electrophysiological testing, angioplasty, and intravenous fluid administration. The aerospace industry relies on plastics for various applications, including aerostructure, components, equipment, systems & support, cabin interiors, propulsion systems, satellites, and insulation components. The use of advanced engineering plastics in aerospace & defense components such as POM, PA, PTFE, PPS, PEEK, PAI, and PI will also require unique methods of manufacture.

Regional Segment Analysis of the Global Plastic Contract Manufacturing Market

- Asia Pacific (U.S., North America, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Plastic Contract Manufacturing Market Trends

What factors contribute to the Asia Pacific region holding the dominant share, approximately 42%, of the global plastic contract manufacturing market during the forecast period?

Asia Pacific is dominant in the global plastic contract manufacturing market, with an estimated 42% share during the forecast period. The plastic contract manufacturing market in the Asia Pacific has expanded greatly in recent years, mainly because the region is by far the largest manufacturer and consumer of plastics. It is also the largest maker of appliances in the world. The growing population of the region and the rising disposable incomes are expected to create expansion in the appliances sector, benefiting the market. The expansion of the Indian market is expected to be predominantly driven by the growing economy and government initiatives to foster manufacturing across many sectors. India is also one of the fast-growing markets for consumer goods, automotive, medical technologies, and aerospace, which is expected to draw many economic players.

North America Plastic Contract Manufacturing Market Trends

What factors are contributing to the growth of the plastic contract manufacturing market in North America?

The market for plastic contract manufacturing in North America, which is essential for orthopedic and dental applications, is anticipated to grow significantly. North America is one of the leading global markets for contract production of plastics. The region's substantial market is currently controlled by the United States due to its early industrialization and use and acceptance of new technologies and innovation trends. The vast number of consumer electronics and appliance manufacturers in the U.S. is projected to greatly affect the growth of the plastic contract manufacturing market over the course of the assessment period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global plastic contract manufacturing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Plastic Contract Manufacturing Market Include

- McClarin Plastics, LLC

- EVCO Plastics

- C&J Industries

- Plastikon Industries, Inc.

- RSP, Inc.

- Mack Molding

- Tessy Plastics

- Inzign Pte Ltd.

- Genesis Plastics Welding

- Baytech Plastics

- Gregstrom Corp.

- Nolato AB

- Natech Plastics, Inc.

- PTI Engineered Plastics, Inc.

- Rosti Group AB, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In February 2025, Arterex, a leading global medical device developer and contract manufacturer, took hold of Adroit USA Inc. The company has expanded its medical manufacturing and metal fabrication.

- In January 2025, Zeus, a global leader in advanced polymer solutions and catheter manufacturing, announced and introduced StreamLiner NG, an addition to the company’s ultra-thin-walled catheter liners.

- In July 2024, Hansgrohe Group, known for its premium bathroom and kitchen products, launched a recycling initiative for plastic at its Offenburg/Elgersweier production site. The company collaborated with ImplusTec to contribute to sustainable manufacturing practices.

- In March 2023, OsteoCove Vonco Products, a prominent manufacturer specializing in plastic products and packaging, disclosed its acquisition of Genesis Plastics Welding, a well-established contract manufacturer of thermoplastics. This strategic move by Vonco aims to enhance its portfolio diversification and expand its range of offerings. With expertise in the production of custom flexible components and packaging solutions, Vonco is recognized for its ability to manufacture liquid-tight bags of various shapes and accommodate desired fitments using both supported and unsupported films.

- In October 2022, Eakin Surgical, a UK-based manufacturer of single-use surgical instruments located in Cardiff, South Wales, unveiled plans to expand its contract manufacturing services. The company aims to assist medical device original equipment manufacturers (OEMs) in cost reduction, meeting the increasing demand for sterile packaging, and mitigating supply shortages. Eakin Surgical's comprehensive service encompasses various aspects of medical device manufacturing, including plastics injection molding, assembly, packaging within an ISO Class 8 cleanroom, and ethylene oxide (EtO) sterilization.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the plastic contract manufacturing market based on the following segments:

Global Plastic Contract Manufacturing Market, By Product

- Polypropylene

- ABS

- Polyethylene

- Polystyrene

- Others

Global Plastic Contract Manufacturing Market, By Application

- Medical

- Aerospace & Defense

- Automotive

- Consumer Goods & Appliances

- Others

Global Plastic Contract Manufacturing Market, By Regional Analysis

- Asia Pacific

- US

- North America

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?