Global Performance Fabric Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Polyester, Nylon, Spandex, Aramid, Others), By End Use (Textile & Apparel, Sports & Outdoor, Defense & Public Safety, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Advanced MaterialsPerformance Fabric Market Summary

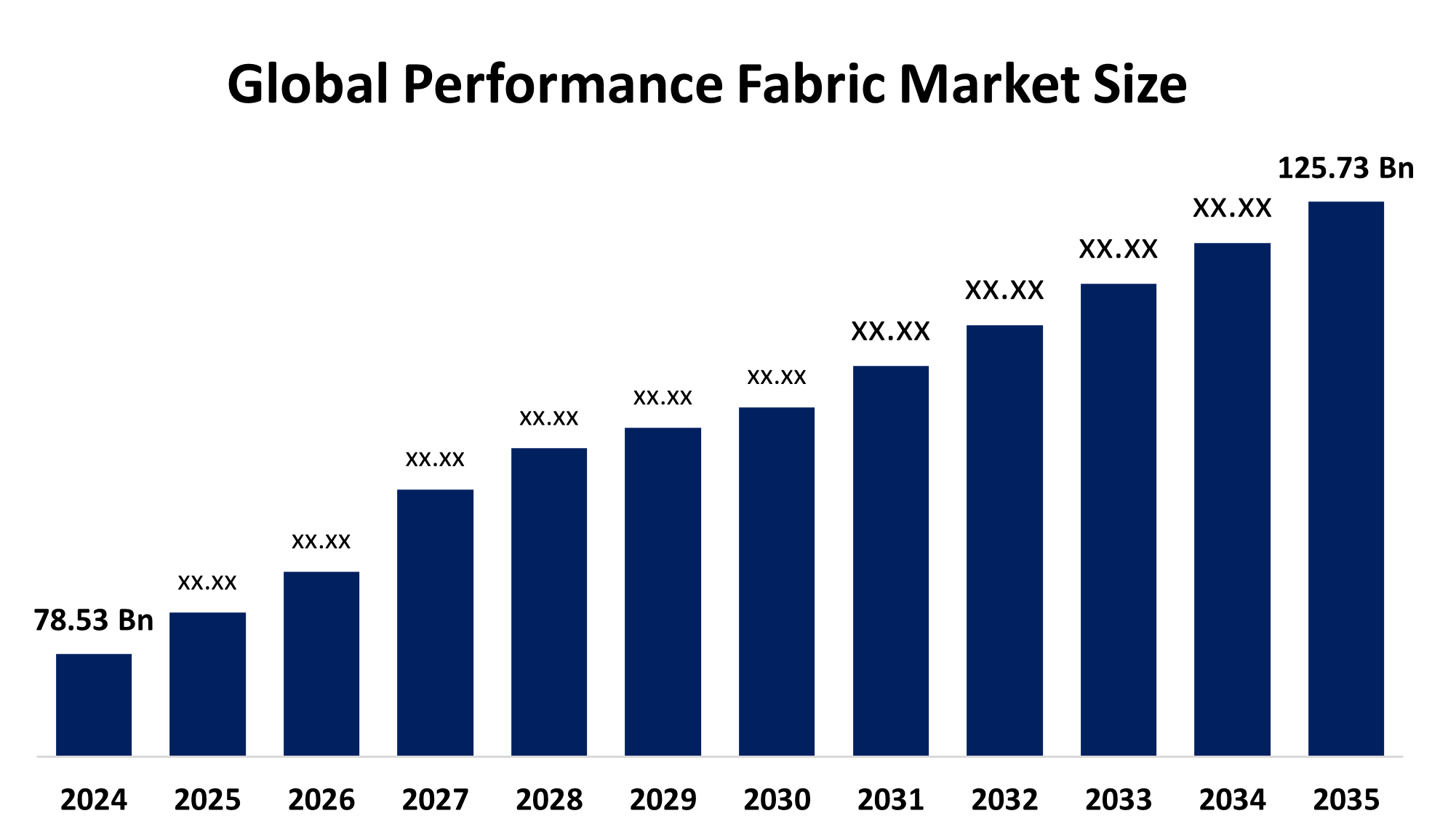

The Global Performance Fabric Market Size Was Estimated at USD 78.53 Billion in 2024 and is Projected to Reach USD 125.73 Billion by 2035, Growing at a CAGR of 4.37% from 2025 to 2035. The market for performance fabrics is expanding as a result of a number of factors, such as increased demand from different industries, developing technology, and a greater focus on sustainability.

Get more details on this report -

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of over 38.6% and dominated the Performance textiles market globally.

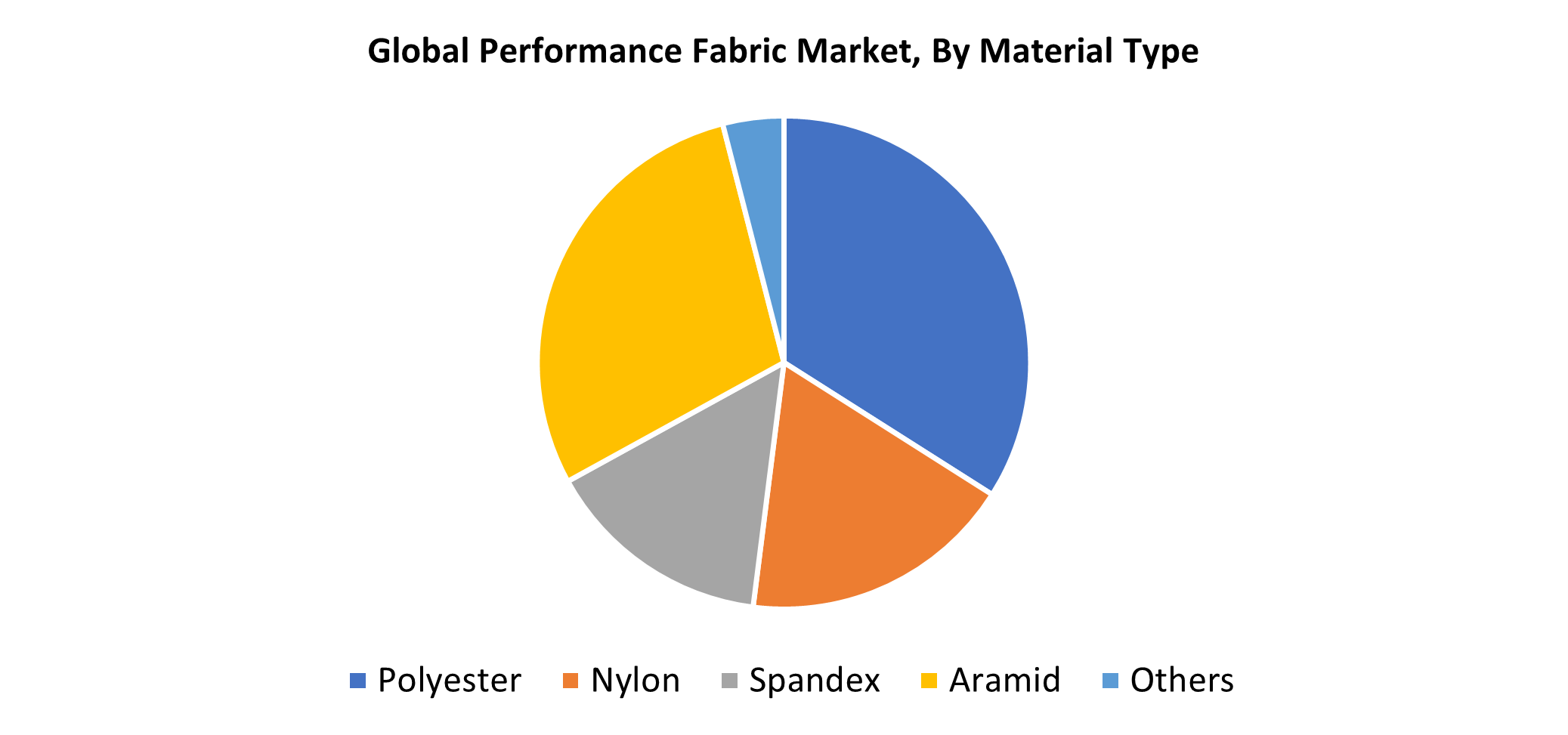

- In 2024, the polyester segment had the highest market share by material type, accounting for 34.3%.

- In 2024, the textile & apparel segment had the biggest market share by end use, accounting for 38.4%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 78.53 Billion

- 2035 Projected Market Size: USD 125.73 Billion

- CAGR (2025-2035): 4.37%

- Asia Pacific: Largest market in 2024

Performance textiles represent specialized fabrics that deliver enhanced operational features, including antimicrobial properties, together with temperature regulation, moisture management, UV defense, and the capability to withstand extreme conditions. These materials find widespread applications in sportswear, activewear, military uniforms, medical textiles, and industrial settings. The market expansion stems from rising consumer interest in comfortable, high-performance clothing primarily intended for outdoor and fitness activities. The market sees growth because organizations need durable multi-functional textiles for challenging work environments, climate management, and individual health consciousness. The importance of performance fabrics in consumer and technical textile markets continues to grow because of increasing urban populations and changing lifestyles, along with the rising popularity of athleisure clothing.

Technological advances in fabric engineering, together with nanotechnology and smart textile integration, drive the market expansion of performance fabrics. Product appeal receives enhancement through innovations, which include odor-resistant treatments, biodegradable high-performance fibers, and phase-change materials for temperature control. The creation of recyclable and sustainable textiles addresses the rising environmental worries of our time. Governments across North America, Europe, and Asia-Pacific are fostering advanced textile research through financial support, alongside tax incentives and public-private collaborations. Growth receives a boost from programs that fund local manufacturing as well as eco-friendly material development and industry-academia partnerships. These initiatives work together to drive performance textile innovation while enhancing supply chain stability and global market expansion.

Global Performance Fabric Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 78.53 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.37% |

| 2035 Value Projection: | USD 125.73 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material Type, By End Use, By Regional Analysis |

| Companies covered:: | Spradling International, Inc., DuPont, Owens Corning, Novustex, Omnova Solutions, Inc., Royal TenCate N.V., Hexcel Corporation, Royal DSM, Toray Industries, Inc., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Material Type Insights

Get more details on this report -

The polyester category dominated the performance fabric market by generating 34.3% revenue share during 2024. The wide-ranging appeal of polyester stems from its combination of strength, along with low weight, fast drying capabilities, and stretching and shrinking resistance, which make it ideal for performance-oriented applications. Performance fabrics use polyester extensively because it offers both breathability and moisture-wicking features, which suit sportswear as well as activewear, outdoor gear, and industrial uniforms. The affordable price of polyester combines with its adaptability to modern treatment processes, including water-repellent coatings, UV-protective coatings, and antimicrobial treatments. The growing popularity of sustainable developments like recycled polyester (rPET) drives up the demand because consumers, along with companies, show increased interest in performance fabrics that deliver ecological benefits along with functional properties.

The aramid segment of the performance fabric market is expected to experience the fastest CAGR during the forecast period. Aramid fibers are essential for safety and durability applications due to their proven high strength, thermal stability, and resistance to abrasion and flame. The automotive, aerospace, defense, and industrial manufacturing sectors use Aramid-based textiles increasingly for body armor and protective gear as well as heat-resistant clothing. The primary drivers behind this growth consist of enhanced safety requirements, rising defense investments, and strengthened workplace protection initiatives. The ongoing development of fiber technology enhances Aramid textile performance which expands its use in dangerous environments.

End Use Insights

The textile & apparel segment led the performance fabric market with 38.4% revenue share during 2024. The Performance Fabric Market dominates because of the increasing requirement for durable and high-quality textiles in athletic, casual, and activewear. The market expands because customers now value clothing features, including comfort, breathability, and moisture-wicking properties. The market adoption rates have increased because of fabric technology developments that include sustainable and stretchable fabrics. The market expansion received support from the rising popularity of athleisure clothing alongside increased public interest in outdoor fitness activities. The performance fabric market growth is driven by the Textile & Apparel segment, which producers achieve by developing functional and sustainable fabrics to meet customer expectations and government regulations.

The defense & public safety segment of the performance fabric market is anticipated to grow at the fastest CAGR during the forecast period. The rapid growth stems from rising demand for performance fabrics, which deliver enhanced protection, durability, and comfort to first responders, law enforcement, and military personnel. Advanced textiles possessing weather resistance and flame resistance, and ballistic protection capabilities have become crucial for multiple industries. The defense industry experiences growth because of escalating geopolitical tensions combined with rising government expenditures for defense infrastructure development. The Defense & Public Safety market segment will achieve major growth in the performance fabric market because lightweight materials and smart textile innovations enhance fabric performance.

Regional Insights

The Asia Pacific region dominated the performance fabric market with a 38.6% revenue share in 2024 because of its developing textile production centers, rapid industrial development, and increasing consumer interest in performance clothing. The region attracts major fabric manufacturers and brands through its affordable manufacturing methods, together with its large base of skilled workers. The rising fitness awareness and technical clothing demand, along with outdoor activity popularity, have caused increased market demand in China, India, Japan, and South Korea. Industry growth received additional support from government textile innovation programs and expanding defense and public safety sectors. Asia Pacific stands as the leading region that shapes future performance fabric market developments because of its active economic growth and shifting customer preferences.

North America Performance Fabric Market Trends

The performance fabric market in North America experiences steady growth because the textile and clothing industry, along with the defense and healthcare sectors, require these products. Market growth in this region stems from its dedication to advanced textile technology, sustainable practices, and innovative approaches. Performance textiles, which combine comfort with durability along with environmental friendliness, are rapidly gaining popularity among consumers who use them for athletic and outdoor apparel. North America's growing public safety and defense sectors are purchasing specialized protective textiles that feature enhanced moisture management capabilities along with flame-resistant properties. The presence of major market players, along with ongoing research and development initiatives, enables stronger expansion. The technical textiles and smart fabric applications market in North America remains substantial despite its growth potential.

Europe Performance Fabric Market Trends

The European performance fabric market maintains a significant market share because the automotive, defense, textile, and clothing industry sectors produce high demand. European consumers prioritize innovative, sustainable products, which drives manufacturers toward creating high-performance, environmentally friendly fabrics. Major industrial companies throughout the area are dedicating substantial funds to research and development for enhancing fabric characteristics such as durability, along with breathability and water resistance. The implementation of sustainable manufacturing processes and materials receives support from rigorous environmental regulations. The growing awareness of fitness and outdoor sports activities drives market expansion. Europe's position as a leading market in the worldwide performance fabric industry stems from its dedication to quality, together with innovation and sustainability.

Key Performance Fabric Companies:

The following are the leading companies in the performance fabric market. These companies collectively hold the largest market share and dictate industry trends.

- Spradling International, Inc.

- DuPont

- Owens Corning

- Novustex

- Omnova Solutions, Inc.

- Royal TenCate N.V.

- Hexcel Corporation

- Royal DSM

- Toray Industries, Inc.

- Others

Recent Developments

- In May 2025, Teijin Frontier Co., Ltd. announced the release of a cutting-edge polyester fabric that offers improved comfort and performance while simulating the elegant look and tactile feel of natural fibers. This innovation successfully blends the superior durability, breathability, and moisture-wicking properties of contemporary synthetic fabrics with the aesthetic appeal and soft texture usually associated with materials like cotton or wool, marking a significant advancement in textile engineering.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the performance fabric market based on the below-mentioned segments:

Global Performance Fabric Market, By Material Type

- Polyester

- Nylon

- Spandex

- Aramid

- Others

Global Performance Fabric Market, By End Use

- Textile & Apparel

- Sports & Outdoor

- Defense & Public Safety

- Others

Global Performance Fabric Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?