Global Peptide Synthesis Reagents Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Coupling Reagents, Protecting Group Reagents, Solid Support Materials, Deprotection & Cleavage, Solvent & Reaction Media, And Analytical & QC Reagents), By Synthesis Method (SPPS Reagents, LPPS Reagents, and Hybrid & Advanced), By Application (Therapeutic Synthesis, R&D Applications, Diagnostic & Analytical, and Specialty Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Peptide Synthesis Reagents Market Insights Forecasts to 2035

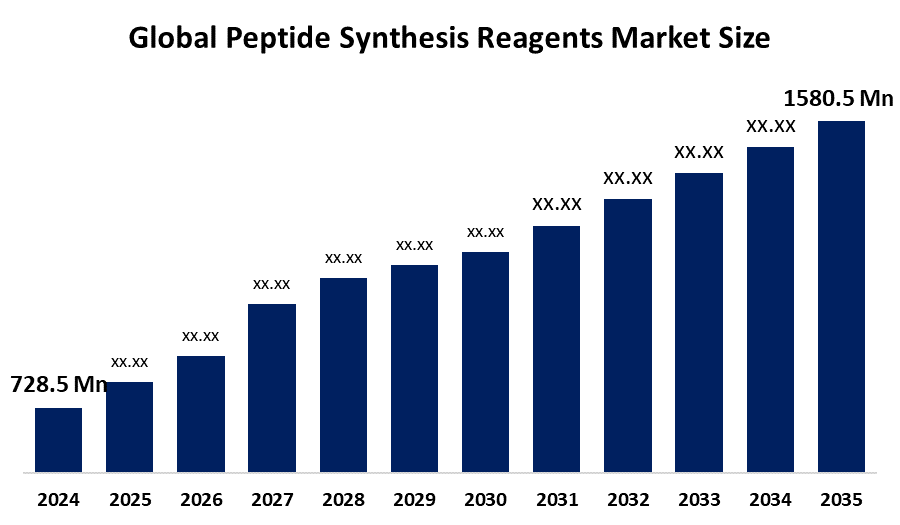

- The Global Peptide Synthesis Reagents Market Size Was Estimated at USD 728.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.29% from 2025 to 2035

- The Worldwide Peptide Synthesis Reagents Market Size is Expected to Reach USD 1580.5 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Peptide Synthesis Reagents market size was worth around USD 728.5 million in 2024 and is predicted to grow to around USD 1580.5 million by 2035 with a compound annual growth rate (CAGR) of 7.29% from 2025 and 2035. The market for peptide synthesis reagents has a number of opportunities to grow due to the development of peptide-specific formulations for targeted therapeutic outcomes, integration of automated synthesis & precision medicine technologies, and co-development of personalized synthesis solutions.

Market Overview

The global peptide synthesis reagents market size refers to a segment of the larger peptide synthesis market focused on the chemicals used to create peptides from amino acids. Peptide synthesis reagents, like coupling agents, protecting groups, and resin, are used in solid-phase peptide synthesis, enabling efficient peptide bond formation, deprotection, and purification. They are used to manufacture pharmaceutical anesthetics, pesticides, herbicides, and others. Further, they were used as catalysts in the hydrolysis or condensation of phenylchloroformic acid and for the arylation of dihydrofuran in the presence of trifluorobenzene. Partnerships between peptide synthesis companies and chemistry reagent manufacturers aid in boosting production at a larger scale. Innovation and market expansion are anticipated as a result of major players' growing emphasis on sustainable peptide synthesis and the expanding partnerships.

The increasing innovation in the design of reagent solutions is driving a significant surge in the global peptide synthesis reagents market. For instance, in June 2024, Aurorium, a specialty ingredients manufacturer and materials innovation partner, announced the launch of Haelium Pharmaceutical Solutions.

Report Coverage

This research report categorizes the peptide synthesis reagents market size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the peptide synthesis reagents market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the peptide synthesis reagents market.

Global Peptide Synthesis Reagents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 728.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.29% |

| 2035 Value Projection: | USD 1580.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Merck KGaA Bachem AG Thermo Fisher Scientific GenScript Biotech ChemPep Inc. AAPPTec / Advanced ChemTech CSBio Company Iris Biotech GmbH GL Biochem (Shanghai) Ltd Peptides International (Biosynth/vivitide) Biosynth (vivitide, Pepscan, CRB, Pepceuticals) AmbioPharm Inc. Creative Peptides Peptide Institute, Inc. CEM Corporation and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market size demand for peptide synthesis reagents is driven by an increasing need for peptide-based therapeutics due to their high specificity, biocompatibility, and lower risk of off-target effects. Surging advancements in discovery technologies enabling the development of peptides capable of modulating targets for clinical applications, including metabolic disorders, oncology, infectious diseases, and cardiometabolic syndromes contributing to propel the market of peptide synthesis reagents. Investment in pharmaceutical research is contributing to supporting the market. For instance, in January 2025, BioDuro, a research and CDMO group, opened a new peptide synthesis manufacturing facility at its campus in the Zhangjiang Tech Centre in Shanghai.

Restraining Factors

The peptide synthesis reagents market size is restricted by the increased development cost and complexity in formulation requirements. Further, the competition with recombinant production methods is challenging the peptide synthesis reagents market.

Market Segmentation

The peptide synthesis reagents market share is classified into product type, synthesis method, and application.

- The coupling reagents segment dominated the market with the largest share of 35% in 2024 and is projected to grow at a substantial CAGR of 7.6% during the forecast period.

Based on the product type, the peptide synthesis reagents market size is divided into coupling reagents, protecting group reagents, solid support materials, deprotection & cleavage, solvent & reaction media, and analytical & QC reagents. Among these, the coupling reagents segment dominated the market with the largest share of 35% in 2024 and is projected to grow at a substantial CAGR of 7.6% during the forecast period. DCC and DIC are commonly used coupling reagents under the category of carbodiimides. Further, phosphonium salts, uranium salts, and triazole-based reagents are several coupling reagents used for peptide synthesis. The widespread use of peptide coupling reagents in drug development, diagnostics, and other industrial applications, along with the advancement in pharmaceutical and biotechnology research, is driving the market expansion.

- The SPPS reagents segment accounted for the largest share of about 75% in 2024 and is anticipated to grow at a significant CAGR of 7.5% during the forecast period.

Based on the synthesis method, the peptide synthesis reagents market size is divided into SPPS reagents, LPPS reagents, and hybrid & advanced. Among these, the SPPS reagents segment accounted for the largest share of about 75% in 2024 and is anticipated to grow at a significant CAGR of 7.5% during the forecast period. It refers to the method which is used to create peptides by assembling amino acids in a stepwise fashion on a solid support like resin, enabling peptides to be synthesized in a controlled, efficient, and scalable manner. The expanding biotech and pharma industry that drives the advancement in the drug development lifecycle is contributing to propel the market. For instance, in September 2023, CordenPharma announced the inauguration of increased commercial peptide production capacity with newly-upgraded facilities at CordenPharma Colorado, which is the largest SPPS manufacturing facility globally.

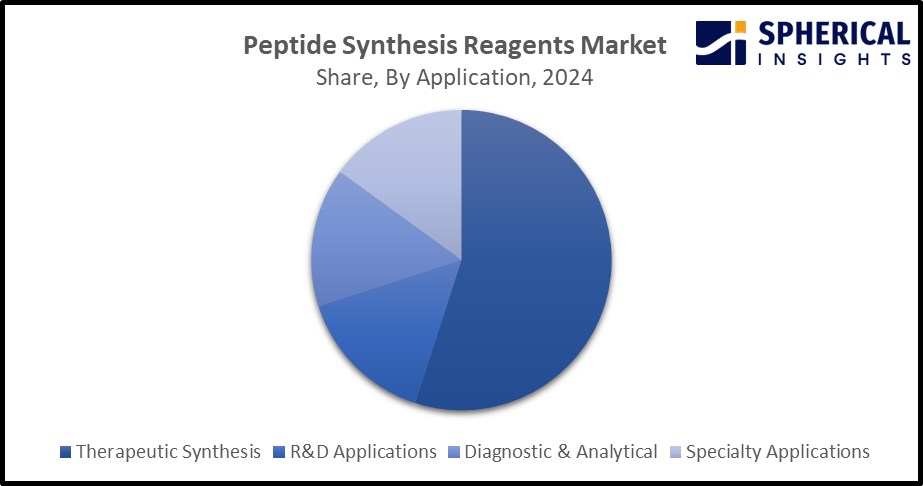

- The therapeutic synthesis segment held a major market share of 60% in 2024 and is anticipated to grow at a significant CAGR of 7.2% during the projected period.

Based on the application, the peptide synthesis reagents market size is divided into therapeutic synthesis, R&D applications, diagnostic & analytical, and specialty applications. Among these, the therapeutic synthesis segment held a major market share of 60% in 2024 and is anticipated to grow at a significant CAGR of 7.2% during the projected period. Peptide synthesis is a backbone in the development of novel therapeutic agents and designing molecules targeting specific biological pathways and disease mechanisms. Further, the integration of advanced peptide chemistry, computational modelling, and HTP screening techniques for personalized medicine and precision therapeutics is bolstering the market growth in the therapeutic synthesis segment.

Get more details on this report -

Regional Segment Analysis of the Peptide Synthesis Reagents Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the peptide synthesis reagents market over the predicted timeframe.

North America is anticipated to hold the largest share of over 39% in the peptide synthesis reagents market over the predicted timeframe. The market ecosystem in North America is strong, with both cutting-edge startups and major industrial heavyweights well-represented. For instance, LifeTein LLC is a contract research organization regarded as the fastest peptide synthesis service, providing custom protein, antibody, and chemical services for biotech, pharma, academia, government agencies, and diagnostics. The demand for peptide synthesis reagents has been driven by the region's increasing need for peptide based therapeutics and advancements in proteomics. The U.S. is the dominant country in the North America peptide synthesis reagents market in 2024, driven by the integration of peptide synthesis innovations in pharmaceutical industry.

Asia Pacific is expected to grow at a rapid CAGR of 7.5% in the peptide synthesis reagents market during the forecast period. The Asia Pacific area has a thriving market for peptide synthesis reagents due to its increased investments in the pharmaceutical and biotechnology industry, along with the growing need for peptide-based therapeutics. Further, the strategic alliance with the biotech industry is contributing to propelling the peptide synthesis reagents market. For instance, in May 2025, Asahi Kasei Bioprocess America (AKBA) and PeptiSystems announced an exclusive partnership aimed at delivering a streamlined process to the peptide manufacturing industry. China is dominating the Asia Pacific peptide synthesis reagents market during the forecast period, owing to the expanding application of peptide synthesis reagents across various industries, along with an increasing technological innovation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the peptide synthesis reagents market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Merck KGaA

- Bachem AG

- Thermo Fisher Scientific

- GenScript Biotech

- ChemPep Inc.

- AAPPTec / Advanced ChemTech

- CSBio Company

- Iris Biotech GmbH

- GL Biochem (Shanghai) Ltd

- Peptides International (Biosynth/vivitide)

- Biosynth (vivitide, Pepscan, CRB, Pepceuticals)

- AmbioPharm Inc.

- Creative Peptides

- Peptide Institute, Inc.

- CEM Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Cambrex, a global contract development and manufacturing organization (CDMO), announced that Snapdragon Chemistry, a Cambrex company, had expanded its active pharmaceutical ingredient (API) facility in Waltham, Massachusetts, to further support the development and manufacturing of peptide therapies.

- In April 2025, Sai Life Sciences, a Contract Research, Development, and Manufacturing Organisation (CRDMO), inaugurated a Peptide Research Center at its integrated R&D campus in Hyderabad. The Peptide Research Centre is designed to support pharmaceutical and biotech companies with services across peptide synthesis, discovery, and advanced modalities, including complex conjugates.

- In February 2025, Granules India announced the successful closing of the acquisition of Senn Chemicals AG, a Swiss-based Contract Development and Manufacturing Organization (CDMO) specializing in peptide development and manufacturing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the peptide synthesis reagents market based on the below-mentioned segments:

Global Peptide Synthesis Reagents Market, By Product Type

- Coupling Reagents

- Protecting Group Reagents

- Solid Support Materials

- Deprotection & Cleavage

- Solvent & Reaction Media

- Analytical & QC Reagents

Global Peptide Synthesis Reagents Market, By Synthesis Method

- SPPS Reagents

- LPPS Reagents

- Hybrid & Advanced

Global Peptide Synthesis Reagents Market, By Application

- Therapeutic Synthesis

- R&D Applications

- Diagnostic & Analytical

- Specialty Applications

Global Peptide Synthesis Reagents Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?