Global Pancreatic Cancer Diagnostic Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments, Consumables, and Services), By Test Type (Imaging Test, Biopsy, Blood Test, and Others), By Cancer Type (Exocrine and Endocrine), By End-Use (Hospitals, Clinics, Laboratories, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: HealthcareGlobal Pancreatic Cancer Diagnostic Market Insights Forecasts to 2032

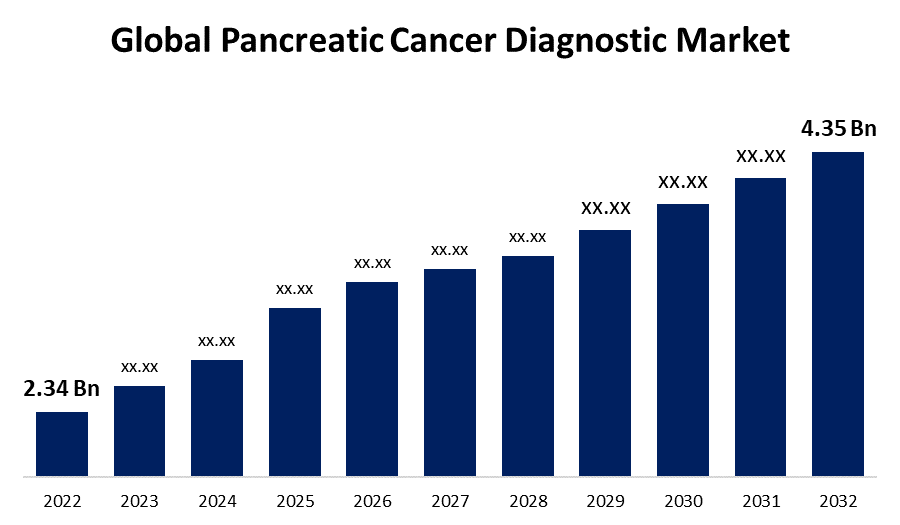

- The Global Pancreatic Cancer Diagnostic Market Size was valued at USD 2.34 Billion in 2022.

- The Market is Growing at a CAGR of 6.4% from 2022 to 2032

- The Worldwide Pancreatic Cancer Diagnostic Market Size is expected to reach USD 4.35 Billion by 2032

- Asia-Pacific is expected to grow higher during the forecast period

Get more details on this report -

The Global Pancreatic Cancer Diagnostic Market Size is expected to reach USD 4.35 Billion by 2032, at a CAGR of 6.4% during the forecast period 2022 to 2032.

Market Overview

Pancreatic cancer diagnostic methods play a crucial role in the early detection and effective management of this aggressive malignancy. Various techniques are employed to diagnose pancreatic cancer, including imaging tests such as computed tomography (CT) scans, magnetic resonance imaging (MRI), and endoscopic ultrasound (EUS). These imaging modalities allow physicians to visualize the pancreas and surrounding structures, aiding in the identification of tumors and assessing their size and spread. Additionally, blood tests are utilized to measure specific biomarkers associated with pancreatic cancer, such as CA19-9. These biomarkers can provide valuable information about the presence and progression of the disease. Biopsy procedures, such as endoscopic retrograde cholangiopancreatography (ERCP) and fine-needle aspiration (FNA), may also be performed to obtain tissue samples for definitive diagnosis. A comprehensive approach combining these diagnostic tools facilitates early detection and improves treatment outcomes for individuals with pancreatic cancer.

Report Coverage

This research report categorizes the market for pancreatic cancer diagnostic market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the pancreatic cancer diagnostic market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the pancreatic cancer diagnostic market.

Global Pancreatic Cancer Diagnostic Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.34 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.4% |

| 2032 Value Projection: | USD 4.35 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Test Type, By Cancer Type, By End-Use, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Thermo Fisher Scientific, Inc., QIAGEN, Illumina, Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc., Myriad Genetics, Inc., Koninklijke Philips N.V., Abbott, Hitachi, Ltd., Danaher, Prestige Biopharma Ltd., BioMarker Strategies, Asuragen, Inc., and other venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The pancreatic cancer diagnostic market is driven by several factors that contribute to its growth and development because the rising incidence of pancreatic cancer worldwide is a major driver. The increasing prevalence of risk factors such as smoking, obesity, diabetes, and family history of pancreatic cancer fuels the demand for diagnostic tools. The advancements in medical imaging technologies have significantly enhanced the accuracy and efficiency of pancreatic cancer diagnosis. The development of techniques like CT scans, MRI, and EUS has improved the early detection and staging of tumors, leading to better treatment outcomes. Thirdly, the growing awareness among healthcare professionals and patients about the importance of early detection and timely intervention drives the demand for diagnostic tests. Moreover, research and development efforts focused on the discovery of novel biomarkers and diagnostic techniques further contribute to the expansion of the pancreatic cancer diagnostic market.

Restraining Factors

The pancreatic cancer diagnostic market faces several restraints that hinder its growth and progression, such as the lack of specific symptoms in the early stages of pancreatic cancer often leads to delayed diagnosis and challenges in early detection. This delay affects treatment outcomes and overall survival rates. The high cost associated with advanced diagnostic techniques and procedures limits their accessibility, particularly in developing regions with limited healthcare resources. Additionally, the invasive nature of certain diagnostic procedures, such as biopsies, may pose risks and complications for patients. Furthermore, the complexity and heterogeneity of pancreatic cancer itself pose challenges in developing accurate and reliable diagnostic tests. These restraints collectively impact the adoption and utilization of pancreatic cancer diagnostic tools in clinical practice.

Market Segmentation

- In 2022, the consumables segment accounted for around 46.5% market share

On the basis of the product, the global pancreatic cancer diagnostic market is segmented into instruments, consumables, and services. The consumables segment has emerged as a significant revenue contributor in the pancreatic cancer diagnostic market. This segment encompasses various consumable products utilized in diagnostic procedures, including reagents, test kits, and other disposable items. There are several factors that have contributed to the segment's substantial revenue share. The consumables are essential components in the diagnostic process, and their usage is integral to performing accurate and reliable tests. As pancreatic cancer diagnosis often involves multiple tests and imaging procedures, the demand for consumables remains high. The increasing prevalence of pancreatic cancer has led to a rise in diagnostic procedures, driving the demand for consumables. With a growing global incidence of the disease, healthcare providers and laboratories require a steady supply of consumables to meet diagnostic needs. Moreover, advancements in diagnostic technologies and the development of new biomarkers and test methodologies have further boosted the demand for consumables. These innovations often require specialized reagents and test kits tailored for specific diagnostic techniques. Furthermore, the consumables segment benefits from ongoing research and development activities focused on improving diagnostic accuracy and efficiency. Manufacturers are investing in the development of advanced consumables that offer enhanced sensitivity, specificity, and ease of use, catering to the evolving needs of healthcare providers. Overall, the consumables segment's largest revenue share is a result of its critical role in pancreatic cancer diagnostics, coupled with the increasing demand driven by the rising incidence of the disease and advancements in diagnostic technologies.

- In 2022, the exocrine segment dominated with more than 83.2% market share

Based on the cancer type, the global pancreatic cancer diagnostic market is segmented into exocrine and endocrine. The exocrine cancer segment has emerged as the dominant force in the pancreatic cancer diagnostic market, holding a significant revenue share. This segment primarily focuses on the diagnosis of pancreatic adenocarcinoma, the most common type of pancreatic cancer that originates from the exocrine cells of the pancreas. Several factors contribute to the segment's market dominance because pancreatic adenocarcinoma represents the majority of pancreatic cancer cases, accounting for approximately 90% of diagnoses. The high prevalence of exocrine pancreatic cancer translates into a substantial demand for diagnostic tests specifically tailored for this subtype. Consequently, the exocrine cancer segment benefits from the larger patient pool and increased diagnostic requirements associated with pancreatic adenocarcinoma. The advancements in diagnostic technologies and imaging modalities have greatly improved the detection and characterization of exocrine pancreatic cancer. Techniques like CT scans, MRI, and endoscopic ultrasound have enhanced the ability to visualize tumors and assess their size, location, and stage. These advancements have contributed to the growth of the exocrine cancer segment by providing accurate and precise diagnostic information for pancreatic adenocarcinoma. Moreover, research and development efforts have primarily focused on improving diagnostic tools and techniques for exocrine pancreatic cancer. Biomarker discovery, molecular profiling, and genetic testing have all been geared towards enhancing the early detection and personalized treatment of this subtype. These developments have further bolstered the market dominance of the exocrine cancer segment. Overall, the dominance of the exocrine cancer segment in the pancreatic cancer diagnostic market can be attributed to the high prevalence of pancreatic adenocarcinoma, advancements in diagnostic technologies, and research focus on improving diagnostic capabilities specifically for exocrine pancreatic cancer.

Regional Segment Analysis of the Pancreatic Cancer Diagnostic Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 40.3% revenue share in 2022.

Get more details on this report -

Based on region, North America has consistently held a significant market share in the pancreatic cancer diagnostic market. The region benefits from a well-established healthcare infrastructure and advanced medical technologies, facilitating early detection and accurate diagnosis of pancreatic cancer. Additionally, North America exhibits a higher prevalence of risk factors associated with pancreatic cancer, such as smoking and obesity, leading to a higher incidence of the disease. Moreover, extensive research and development activities in the region drive the innovation and adoption of novel diagnostic tools. Furthermore, strong government initiatives and support for cancer awareness and screening programs contribute to the market's growth. Overall, the presence of major market players and collaborations with academic institutions further strengthen North America's market share in the pancreatic cancer diagnostic sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global pancreatic cancer diagnostic market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies, Inc.

- Myriad Genetics, Inc.

- Koninklijke Philips N.V.

- Abbott

- Hitachi, Ltd.

- Danaher

- Prestige Biopharma Ltd.

- BioMarker Strategies

- Asuragen, Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Mayo Clinic recently revealed their clinical trial evaluating the use of the radiotracer 68Ga-Fibroblast-Activation-Protein-Inhibitors (FAPI)-46 for pancreatic cancer imaging. This trial aims to assess the efficacy of the radiotracer in providing detailed imaging of pancreatic cancer. The utilization of 68Ga-FAPI-46 could potentially improve diagnostic accuracy and aid in the effective management of pancreatic cancer.

- In December 2022, The first early detection tests for pancreatic cancer were created by the Japanese biotechnology company Hirotsu Bio Science. The demand for less invasive diagnostics is also rising, and government policies that promote this trend are accelerating regional market growth.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global pancreatic cancer diagnostic market based on the below-mentioned segments:

Pancreatic Cancer Diagnostic Market, By Product

- Instruments

- Consumables

- Services

Pancreatic Cancer Diagnostic Market, By Test Type

- Imaging Test

- Biopsy

- Blood Test

- Others

Pancreatic Cancer Diagnostic Market, By Cancer Type

- Exocrine

- Endocrine

Pancreatic Cancer Diagnostic Market, By End-Use

- Hospitals

- Clinics

- Laboratories

- Others

Pancreatic Cancer Diagnostic Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?