Pakistan Defense Market Size, Share, and COVID-19 Impact Analysis, By Type (Missiles & Missile Defense Systems, Military Fixed Wing Aircraft, Military Land Vehicles, Naval Vessels & Surface Combatants, Ammunition, and Others) and Pakistan Defense Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefensePakistan Defense Market Insights Forecasts to 2035

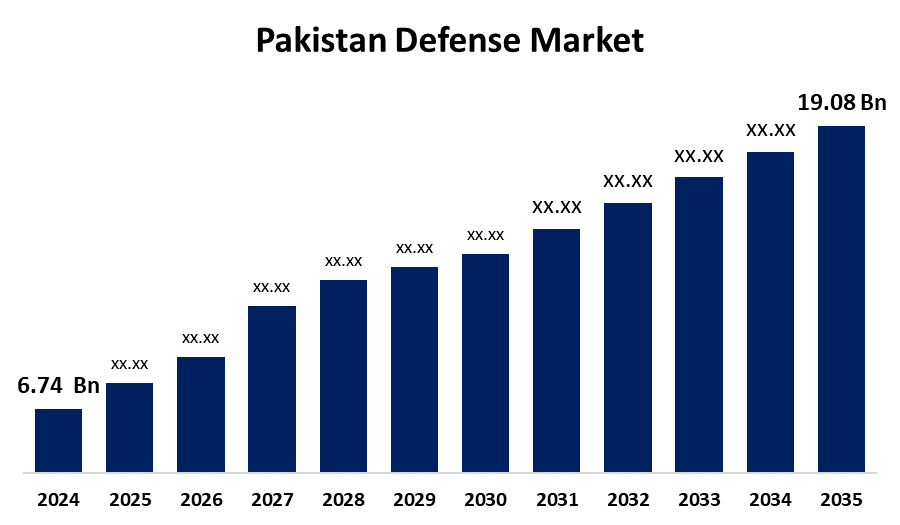

- The Pakistan Defense Market Size was estimated at USD 6.74 billion in 2024

- The Market Size is expected to grow at a CAGR of around 9.92% from 2025 to 2035

- The Pakistan Defense Market Size is expected to reach USD 19.08 billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Pakistan Defense Market Size is anticipated to reach USD 19.08 Billion by 2035, Growing at a CAGR of 9.92% from 2025 to 2035.

Market Overview

The Pakistan defense market involves military expenditures, procurement, and indigenous manufacturing in air, land, and naval forces, covering military aircraft, armored vehicles, missile systems, submarines, and artillery. Pakistan, a South Asian country with a predominantly Indo-Iranian population, is closely linked to its neighbours Iran, Afghanistan, and India. Defense industry companies offer military capabilities in naval, land, aerospace, and electronic systems to governments, supporting current and future military requirements. They also collaborate with governments as strategic partners for major operations. The complex and challenging defense sector is influenced by high technology development and large contracts.

The increasing investment by the government of Pakistan escalates the demand for the defense system and leads to the growth of the market. For instance, according to secondary research studies and a brief review of the official government websites and articles, it was found that citing tensions with India, the Pakistan coalition government approved an 18% increase in defense spending to over Rs 2.5 trillion in the upcoming budget. The government led by the Pakistan Muslim League-Nawaz shared a new budget framework worth Rs 17.5 trillion with its influential ally, the PPP, which agreed to an 18% increase in defense spending.

Report Coverage

This research report categorizes the market for the Pakistan defense market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Pakistan defense market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Pakistan defense market.

Pakistan Defense Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.74 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.92% |

| 2035 Value Projection: | USD 19.08 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Type and COVID-19 Impact Analysis |

| Companies covered:: | Boeing, Pakistan Space and Upper Atmosphere Research Commission, Pakistan Aeronautical Complex, Aselsan, Turkish Aerospace Industries, Raytheon, The Heavy Mechanical Complex, Heavy Industries Taxila, Karachi Shipyard and Engineering Works, Pakistan Ordnance Factories, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The armed forces' procurement and modernization efforts to combat new threats are anticipated to propel the Pakistani defense market's expansion. There is currently a demand for defense equipment due to ongoing contracts from the military, air force, and naval forces, as well as the anticipated distribution of new contracts. Countries have increased their defense budgets in response to growing geopolitical tensions and conflicts, highlighting the necessity of sophisticated military systems. Modern warfare heavily relies on technological innovations like artificial intelligence, unmanned systems, and cybersecurity. Countries are investing in next-generation technologies and upgrading their current equipment in response to the growing demand for defense modernization. Collaborations between nations and defense contractors are improving capabilities and stimulating innovation.

Restraining Factors

The lack of investment, high level of management corruption, limited development of advanced military technology, and political problems may limit the growth of the market.

Market Segmentation

The Pakistan defense market share is classified by type.

- The military fixed wing aircraft segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Pakistan defense market is segmented by type into missiles & missile defense systems, military fixed wing aircraft, military land vehicles, naval vessels & surface combatants, ammunition, and others. Among these, the military fixed wing aircraft segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the stability, high speed over long distances, heavy payloads, capability of carrying different weapons, and aerodynamic efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Pakistan defense market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boeing

- Pakistan Space and Upper Atmosphere Research Commission

- Pakistan Aeronautical Complex

- Aselsan

- Turkish Aerospace Industries

- Raytheon

- The Heavy Mechanical Complex

- Heavy Industries Taxila

- Karachi Shipyard and Engineering Works

- Pakistan Ordnance Factories

- Others

Recent Developments:

- In May 2025, Pakistan's recent acquisition of Chinese-made weapons, such as the HQ-9 air defense system and PL-15 missiles, indicates a significant shift in the country's defense procurement strategy, despite concerns about Chinese equipment quality and defective frigates.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Pakistan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Pakistan defense market based on the below-mentioned segments:

Pakistan Defense Market, By Type

- Missiles & Missile Defense System

- Military Fixed Wing Aircraft

- Military Land Vehicles

- Naval Vessels & Surface Combatants

- Ammunition

- Others

Need help to buy this report?