Global OTR Tires Market Size, Share, and COVID-19 Impact Analysis, By Product (Solid, Radial, Bias Tire, Non-Pneumatic Tire), By Process (Pre-Cure, Mold Cure), By Rim Size (25”- 30”, 29"-41", 51"-63"), By End-Use (Agriculture, Construction, Material Handling, Mining, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal OTR Tires Market Insights Forecasts to 2033

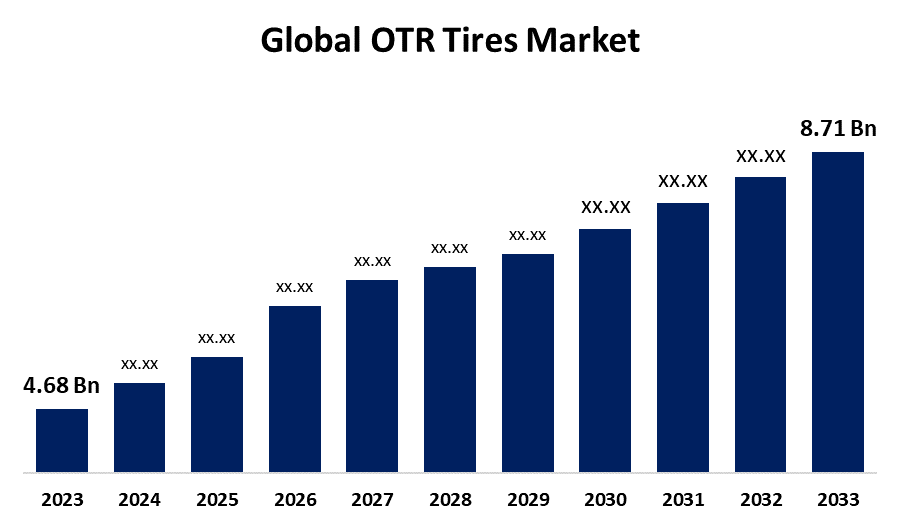

- The Global OTR Tires Market Size was Valued at USD 4.68 Billion in 2023

- The Market Size is Growing at a CAGR of 6.41% from 2023 to 2033

- The Worldwide OTR Tires Market Size is Expected to Reach USD 8.71 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global OTR Tires Market Size is Anticipated to Exceed USD 8.71 Billion by 2033, Growing at a CAGR of 6.41% from 2023 to 2033.

Market Overview

Off-road (OTR) tires, often known as earthmover or heavy equipment tires, are designed specifically for vehicles and equipment used in a variety of off-road applications. These tires are intended to withstand the harsh conditions and tough terrains commonly seen in construction, mining, agriculture, and industrial applications. The material used in OTR tires is intended to lower operating temperatures and increase tire life for more efficient operation. Many industry participants provide OTR tires that are more durable, energy-efficient, use fewer raw materials, generate less CO2, and create fewer tires that are nearing the end of their useful life. Depending on the material's unique application, different compounds are required in various areas of the tire. Several retread tire manufacturers have contacted us to improve awareness of the retreading process and to facilitate tire remolding when fleet owners' tires wear out. Reuse of tires, such programmers reduce the amount of old, worn-out tires disposed of, minimizing environmental risks. The United States presents a promising market for retreading tires due to the government's ad hoc legislation governing worn-out tires.

Report Coverage

This research report categorizes the market for the global OTR tires market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global OTR tires market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global OTR tires market.

Global OTR Tires Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.68 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.41% |

| 2033 Value Projection: | USD 8.71 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Process, By Rim Size, By End-Use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Techking Tires, JK Tire & Industries Ltd, Linglong Tire, Belshina, MRF Tires, Balkrishna Industries Limited, The Goodyear Tire & Rubber Company, Pirelli & C. S.p.A., The Firestone Tire & Rubber Company, Continental AG, Bridgestone Corporation, Michelin, Apollo Tires Ltd., Double Coin Tire Group Ltd, and Others Key Vendors |

| Growth Drivers: | Regional Segment Analysis of the Global OTR tires Market |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing need for construction equipment, agricultural tractors, mining equipment, and rapid infrastructure development in established and emerging economies are likely to drive up demand for off-the-road (OTR) tires over the forecast period. Furthermore, rising demand for 4WD and AWD cars for a variety of recreational activities is likely to drive market expansion in the coming years. Furthermore, these tires give better traction and rolling friction, which improves safety and the driving experience. Hence, increased demand for driving safety on uneven roads is expected to enhance market growth in the years to come.

Restraining Factors

Due to the high cost of OTR tires, businesses have the option to extend the service life of existing tires, posing potential safety risks and diminishing operating efficiency. Tires replacement cycles may be delayed or staggered in industries with limited finances or facing economic instability, affecting overall demand for new OTR tires.

Market Segmentation

The global OTR tires market share is classified into product, process, rim size, and end user.

- The radial segment is expected to hold the largest share of the global OTR tires market during the forecast period.

Based on the product, the global OTR tires market is categorized into solid, radial, bias tire, and non-pneumatic tire. Among these, the radial segment is expected to hold the largest share of the global OTR tires market during the forecast period. Radial tires provide higher performance and longevity, bias-ply tires' lower initial cost makes them more appealing in areas where economic considerations greatly affect purchasing decisions. This trend is especially prominent in emerging economies, where infrastructure expansion increases demand for heavy machinery while financial limits limit tyre options. However, they are currently switching to radial tires due to the availability of low-cost radial tires on the market.

- The pre-cure segment is expected to grow at the fastest CAGR during the forecast period.

Based on the process, the global OTR tires market is categorized into pre-cure and mold cure. Among these, the pre-cure segment is expected to grow at the fastest CAGR during the forecast period. In the pre-cure construction step, the inspected/buffed casing will apply a thin layer of cushion gum to serve as an adhesive between the vulcanized pre-cured tread and the tire. Pre-cure retreading demands high-quality carcasses. Precure retreading involves wrapping a new tread that has already been vulcanized (Sulphur and heat treated) with the new tread pattern around the old tire casing and splicing it with a bonding agent called cushion gum. The tire is then placed in a chamber to be cured.

- The 25”- 30” segment is expected to hold a significant share of the global OTR tires market during the forecast period.

Based on the rim size, the global OTR tires market is categorized into 25”- 30”, 29"-41", and 51"-63". Among these, the 25”- 30” segment is expected to hold a significant share of the global OTR tires market during the forecast period. The 25”–30” rim size is widely used in a variety of applications, including construction, mining, and agriculture, as it provides a balance of stability, load-bearing capacity, and compatibility with a wide range of gear. The 25”-30” inch rim size also delivers excellent grip, longevity, and performance in tough terrains, making it a popular choice among OTR tyre users. Additionally, these rim-size OTR tires provide a mix between maneuverability construction sites are packed with tight corners and obstacles, so larger rim sizes provide improved weight while making equipment awkward. The 25”- 30” size preserves an ideal position while providing adequate power to carry large loads and agility to negotiate complicated areas.

- The agriculture segment is predicted to dominate the global OTR Tires market during the forecast period.

Based on the end user, the global OTR tires market is categorized into agriculture, construction, material handling, mining, and others. Among these, the agriculture segment is predicted to dominate the global OTR tires market during the forecast period. The agriculture r category is rapidly expanding in the OTR (Off-The-Road) tires market as a result of the growing global population and rising demand for food production, which drive agricultural activities and contribute to increased adoption of heavy machinery like tractors. As farmers strive to improve productivity and efficiency, there is an increasing demand for long-lasting tires that can resist the rigours of farming operations. In addition, technological improvements in agriculture, such as precision farming and autonomous machinery, are driving up demand for OTR tires in the industry.

Regional Segment Analysis of the Global OTR tires Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global OTR tires market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global OTR tires market over the forecast period. Emerging economies including China, India, Japan, and South Korea are major contributors. With 173 discovered minerals and 163 proven resources, China ranks third after the United States and Russia in terms of the demand for OTR tires for construction and mining equipment. As China pursues the Made in China 2025 objective and the economy grows, demand for minerals will rise even further. These regions also dominate in terms of road development, urban expansion, and the establishment of industrial zones, all of which rely significantly on heavy machinery with OTR tires.

Europe is expected to grow at the fastest CAGR growth of the global OTR tires market during the forecast period. European tyre manufacturers have focused on R&D to develop OTR tires that are more durable, effective, and environmentally friendly. Manufacturers developed environmentally friendly OTR tires that consume less fuel and produce less emissions in response to Europe's stringent environmental rules. The increased emphasis on environmental programmers and tire recycling has resulted in the development of recycled and renewable materials for tire production.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global OTR tires market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Techking Tires

- JK Tire & Industries Ltd

- Linglong Tire

- Belshina

- MRF Tires

- Balkrishna Industries Limited

- The Goodyear Tire & Rubber Company

- Pirelli & C. S.p.A.

- The Firestone Tire & Rubber Company

- Continental AG

- Bridgestone Corporation

- Michelin

- Apollo Tires Ltd.

- Double Coin Tire Group Ltd

- Others

Key Market Developments

- In February 2024, The Goodyear Tire & Rubber Company has introduced the RL-5K off-road (OTR) tire, which has a three-star load capacity rating for heavy-duty loaders and wheel dozers. This new tire is designed to boost the load carrying capability of larger wheel loaders, with a deep tread for cut resistance and traction in tough terrain. The RL-5K is Goodyear's latest radial OTR tire in the 45/65R45 size, designed to resist the required air pressure for a 16% improvement in load-carrying capability over its predecessor.

- In February 2023, The Continental VF Tractor Master Hybrid is a tire developed for agricultural contracts that provides road comfort as well as grip on both hard and soft soil. The tire includes an inbuilt sensor that measures pressure and temperature to assist extend its life and ensure proper pressure. It also boasts a hybrid tread design, which provides grip in the field while remaining comfortable on the road.

- In April 2023, The MICHELIN x mine l4 tire is a revolutionary radial tire built for earthmover operations, specifically the KOMATSU WE2350/P&H L2350 large wheel loader used in surface mining. This tire improves mobility and productivity by providing superior traction, decreased tread wear, an optimized footprint, and a life expectancy improvement of 50% or greater. It is designed to run cooler than competitors, maintaining an ideal temperature even at faster speeds, which adds to its endurance and performance in harsh mining situations. This device has a tire pressure monitoring system (TPMS), which improves uptime and communication during mining operations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global OTR tires market based on the below-mentioned segments:

Global OTR Tires Market, By Product

- Solid

- Radial

- Bias Tire

- Non-Pneumatic Tire

Global OTR Tires Market, By Process

- Pre-Cure

- Mold Cure

Global OTR Tires Market, By Riz Size

- 25”–30"

- 29"-41"

- 51"-63"

Global OTR Tires Market, By End User

- Agriculture

- Construction

- Material Handling

- Mining

- Others

Global OTR Tires Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?