Global Oral Health Ingredient Market Size, Share, and COVID-19 Impact Analysis, By Ingredient (Glycerin/Glycerol, Sorbitol, Calcium Carbonate, Sodium Lauryl Sulfate, Fluoride, Cetylpredinium Chloride, Chlorhexidine, and Ethanol), By Source (Bio-Based and Synthetic), By Application (Toothpaste and Mouthwash), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Oral Health Ingredient Market Insights Forecasts to 2035

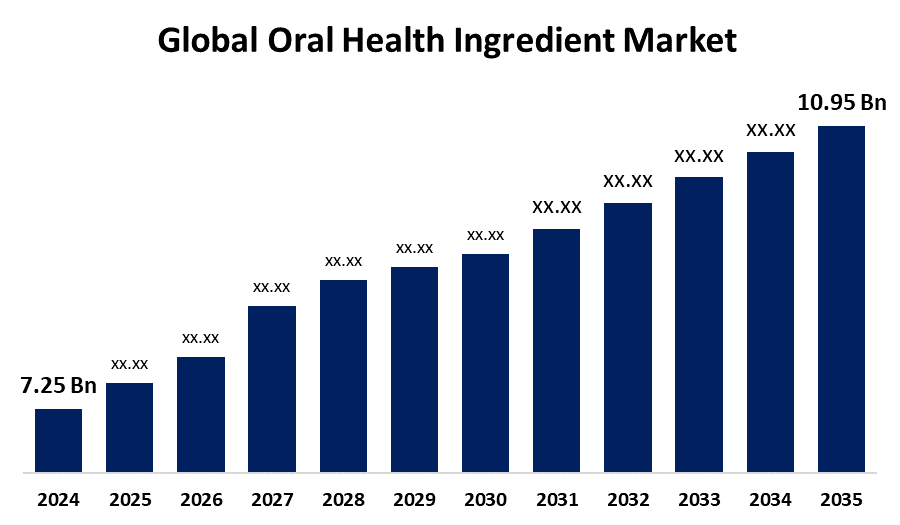

- The Global Oral Health Ingredient Market Size Was Estimated at USD 7.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.82% from 2025 to 2035

- The Worldwide Oral Health Ingredient Market Size is Expected to Reach USD 10.95 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global oral health ingredient market size was worth around USD 7.25 billion in 2024 and is predicted to grow to around USD 10.95 billion by 2035 with a compound annual growth rate (CAGR) of 3.82% from 2025 to 2035. The increasing prevalence of dental caries and growing awareness of dental hygiene are driving the worldwide oral health ingredient market.

Market Overview

The oral health ingredient market is an industry that emphasizes the substances and compounds used in the formulation of oral care products such as toothpaste, mouthwash, and dental gels. Different kinds of ingredients are present in the toothpaste, mouthwashes, and other types of oral health products, catering to the various oral conditions. Premium oral care product formulations, including products having high-end whitening solutions combined with probiotic toothpaste and sophisticated mouthwash systems. Companies are developing herbal product solutions by incorporating sustainable, clean ingredients in their formulations due to increasing preference towards the use of plant-based products with the growing environmental consciousness among people. E-commerce expansion and increasing oral hygiene awareness are driving the need for specialized oral care products, which are contributing to the market growth for oral health ingredient.

Report Coverage

This research report categorizes the oral health ingredient market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the oral health ingredient market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the oral health ingredient market.

Global Oral Health Ingredient Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.25 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.82% |

| 2035 Value Projection: | USD 10.95 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Ingredient, By Application, By Region |

| Companies covered:: | BASF SE, Cargill, Ashland, DSM Nutritional Products, Henkel, Spectrum Chemicals, MANE, DuPont, Biosecure Lab, Orkila, Johnson & Johnson, Church & Dwight Co. Inc., GlaxoSmithKline Plc, Unilever SE, Procter & Gamble, Colgate-Palmolive Company, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing prevalence of dental caries in the growing urban region, owing to lifestyle factors including inadequate exposure to fluoride (in the water supply) and consumption of high sugar content food, is expected to drive the market for oral health ingredient. It was found that untreated dental caries to be the most common health condition, as per the Global Burden Disease 2021. Oral disease is estimated to affect about 3.7 billion people according to WHO. The increasing awareness of dental hygiene is driving the use of oral hygiene products, thereby escalating the market growth for oral health ingredient.

Restraining Factors

The strict regulations associated with oral health product development and sales are challenging the market. Further, the growing number of product recalls impacting consumer trust and purchasing power is hindering the market growth.

Market Segmentation

The oral health ingredient market share is classified into ingredient, source, and application.

- The calcium carbonate segment dominated the oral health ingredient market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the ingredient, the oral health ingredient market is divided into glycerin/glycerol, sorbitol, calcium carbonate, sodium lauryl sulfate, fluoride, cetylpredinium chloride, chlorhexidine, and ethanol. Among these, the calcium carbonate segment dominated the oral health ingredient market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Calcium carbonate is an essential ingredient in toothpaste, possessing abrasive properties, the capability to control acidity, and mineral benefits for dental health. An increasing application of sensitive oral drug formulations is contributing to propel the market growth.

- The synthetic segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the source, the oral health ingredient market is divided into bio-based and synthetic. Among these, the synthetic segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. With the growing technological advancement, synthetic compounds are increasingly being used for oral health in modern dentistry, meeting standardized regulatory requirements. The extensive use of synthetic oral care products, along with increasing R&D activities, is contributing to driving the market growth.

- The toothpaste segment accounted for the dominant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the oral health ingredient market is divided into toothpaste and mouthwash. Among these, the toothpaste segment accounted for the dominant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Propylene glycol, sodium bicarbonate, sodium pyrophosphate, anhydrous dicalcium phosphate, and dioctyl sodium sulfosuccinate are some of the ingredients of toothpaste. The growing consumer need for specialized toothpaste products with an increasing oral hygiene awareness is driving the market.

Regional Segment Analysis of the Oral Health Ingredient Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the oral health ingredient market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the oral health ingredient market over the predicted timeframe. The growth in oral hygiene routines and a significant increase in oral care product sales are driving the market. Further, the inclination towards the use of natural products, which leads to product innovation using organic ingredients, contributes to propelling the market growth. An increasing awareness and establishment of oral hygiene practices are promoting the oral health ingredient market.

Asia Pacific is expected to grow at a rapid CAGR in the oral health ingredient market during the forecast period. An increasing accessibility to oral care products among the growing middle-class population, along with the region’s increasing disposable income, is driving the market of oral health ingredient. In addition, the high consumer awareness about oral hygiene, as well as the increasing geriatric population contributing to bolster the market for oral health ingredient.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the oral health ingredient market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Cargill

- Ashland

- DSM Nutritional Products

- Henkel

- Spectrum Chemicals

- MANE

- DuPont

- Biosecure Lab

- Orkila

- Johnson & Johnson

- Church & Dwight Co. Inc.

- GlaxoSmithKline Plc

- Unilever SE

- Procter & Gamble

- Colgate-Palmolive Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the oral health ingredient market based on the below-mentioned segments:

Global Oral Health Ingredient Market, By Ingredient

- Glycerin/Glycerol

- Sorbitol

- Calcium Carbonate

- Sodium Lauryl Sulfate

- Fluoride

- Cetylpredinium Chloride

- Chlorhexidine

- Ethanol

Global Oral Health Ingredient Market, By Source

- Bio-Based

- Synthetic

Global Oral Health Ingredient Market, By Application

- Toothpaste

- Mouthwash

Global Oral Health Ingredient Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?