Global Oral Bone Implant Material Market Size, Share, and COVID-19 Impact Analysis, By Classification (Autologous Bone, Natural Bone, and Artificial Bone), By Application (Hospital and Dental Clinic), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Oral Bone Implant Material Market Insights Forecasts to 2035

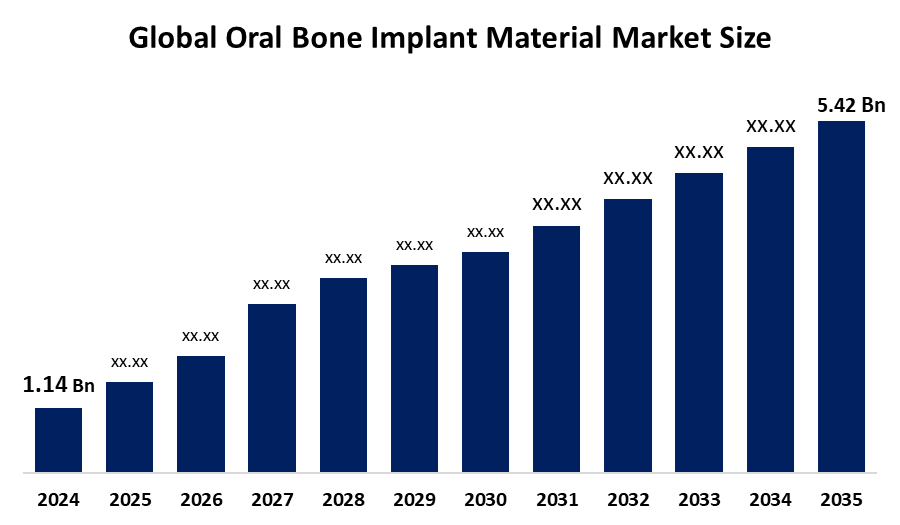

- The Global Oral Bone Implant Material Market Size Was Estimated at USD 1.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.23% from 2025 to 2035

- The Worldwide Oral Bone Implant Material Market Size is Expected to Reach USD 5.42 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research report Published by Spherical Insights and Consulting, The Global Oral Bone Implant Material Market Size was worth around USD 1.14 Billion in 2024 and is predicted to Grow to around USD 5.42 Billion by 2035 with a compound annual Growth rate (CAGR) of 15.23% from 2025 to 2035. The oral bone implant material market has opportunities due to the increased usage of dental implants, the development of new biomaterials, the increase in elderly people, the rise in demand for cosmetic dentistry, and the healthcare investments that facilitate the creation of implants that are innovative, durable, and bio-compatible.

Market Overview

The oral bone implant material market covers the network of biomaterials designed for alveolar ridge augmentation, periodontal defect restoration, and osseointegration assistance within dental implantology. These materials, categorized by the U.S. Food and Drug Administration (FDA) under 21 CFR 872.3930 as Class II devices, comprise autografts, allografts, xenografts, and synthetic options like hydroxyapatite, tricalcium phosphate, and bioactive ceramics promoting bone regeneration, via osteoinductive or osteogenic pathways. The government launched innovation efforts as the National Institute of Dental and Craniofacial Research awarded a 2024 grant to N2 Biomedical, supporting the development of antimicrobial biodegradable grafts to advance oral implant technology. The continuous expansion of the dental implant market is being fueled by more and more dental implant procedures, better oral rehabilitation knowledge, and the development of biomaterials for bone grafting and tissue integration. The above factors, combined with the increasing accessibility of dental care in developing countries and the growing preference for dental implants in cosmetic dentistry, are all supporting the oral bone implant material market.

Report Coverage

This research report categorizes the oral bone implant material market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the oral bone implant material market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the oral bone implant material market.

Global Oral Bone Implant Material Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.14 billion |

| Forecast Period: | 2025 – 2035 |

| Forecast Period CAGR 2025 – 2035 : | CAGR of 15.23% |

| 025 – 2035 Value Projection: | USD 5.42 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 264 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Classification By Application By Region |

| Companies covered:: | ACE Surgical, ALLGENS MEDICAL, Bejing Datsing Bio-Tech, Bioteck, Botiss Biomaterials, Cook Medical, Dentsply Sirona, Keystone Dental, Neoss Limited, OraPharma, Pashionbio, RESHINE-BIO, Zhenghai Bio-Tech, Zimmer Biomet and Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The oral bone implant material market is rising as dental implant surgeries and bone regeneration treatments develop globally. Adoption of implant materials is driven by an increase in dental problems, tooth loss, and the need for aesthetic dental care. The oral bone implant material market is developing due to increasing tooth loss and periodontal problems in ageing and middle-aged populations. Growing patient acceptance of implantology and cosmetic dental treatments improves demand for jaw-bone augmentation alternatives. Increased demand for dental implants, developments in regenerative dentistry, an increase in the number of elderly people, and innovations in the infrastructure supporting dental care are all factors driving the oral bone implant material market's growth.

Restraining Factors

The oral bone implant material market confronts restrictions due to high procedure costs, limited reimbursement coverage, concerns over graft compatibility, regulatory difficulties, and shortages of experienced dental professionals, which collectively hinder broad adoption and slow market expansion.

Market Segmentation

The oral bone implant material market share is classified into classification and application.

- The autologous bone segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the classification, the oral bone implant material market is divided into autologous bone, natural bone, and artificial bone. Among these, the autologous bone segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The autologous bone segment has superior osteogenic, osteoinductive, and osteoconductive qualities; it continues to be the clinical standard. The Autologous bone section is backed by strong clinical outcomes in difficult dental reconstructive surgeries, including sinus lifts, ridge augmentation, and socket preservation following tooth extraction.

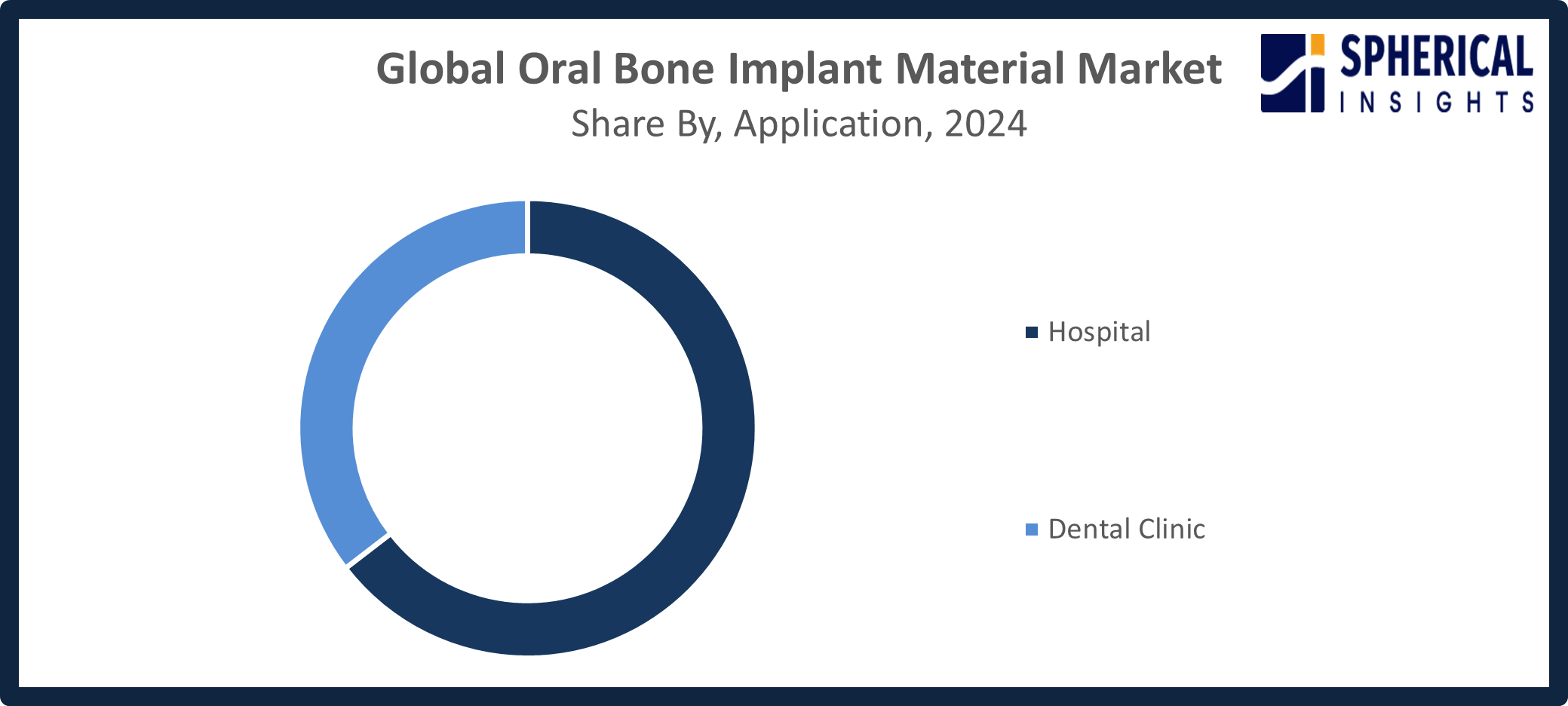

- The hospital segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the oral bone implant material market is divided into hospital and dental clinic. Among these, the hospital segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hospital segment is due to its capacity to execute advanced maxillofacial and reconstructive dental treatments involving bone grafting and implant insertion under controlled clinical circumstances. These hospitals have access to advanced surgical tools, imaging technology, and multidisciplinary skills required for managing difficult bone regeneration patients.

Get more details on this report -

Regional Segment Analysis of the Oral Bone Implant Material Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the oral bone implant material market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the oral bone implant material market over the predicted timeframe. North America is attributed to its excellent healthcare infrastructure, strong presence of top dental implant manufacturers, and high acceptance rates of technologically sophisticated biomaterials. The region gains from significant investments in dental research, a strong regulatory framework, and a high level of consumer awareness of oral health. Increasing demand for minimally invasive bone augmentation techniques and improved surgical outcomes promotes continuing investment in R&D. The CDC launched new data that highlights growing oral health concerns: 178 million Americans are missing at least one tooth, and 15% of individuals over 65 more than 40 million people, face total tooth loss. The North American government announced 37 state-level dental insurance reforms in 2025, backed by American Dental Association grants, aiming to reduce reimbursement barriers and improve access to essential dental care nationwide.

Asia Pacific is expected to grow at a rapid CAGR in the oral bone implant material market during the forecast period. The manufacture and distribution of bone graft replacements are being improved by the Make in India and National Oral Health Programme programs. The market is expanding as a result of significant investments made in contemporary dental technologies by nations including China, India, South Korea, and Japan. To enhance osseointegration, universities and biotechnology companies are working together on nanostructured and bioresorbable scaffolds. The WHO issued a new analysis projecting 92 million edentulism cases in the Western Pacific, warning that growing urbanization and a doubling elderly population by 2050 will increase regional oral health concerns. In order to lower costs by up to 80% and increase public access through competitive tendering, the Chinese government introduced the Volume-Based Procurement (VBP) program for dental implants in 2024.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the oral bone implant material market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ACE Surgical

- ALLGENS MEDICAL

- Bejing Datsing Bio-Tech

- Bioteck

- Botiss Biomaterials

- Cook Medical

- Dentsply Sirona

- Keystone Dental

- Neoss Limited

- OraPharma

- Pashionbio

- RESHINE-BIO

- Zhenghai Bio-Tech

- Zimmer Biomet

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Shanghai Jiao Tong University launched a novel PEEK-based Oral Bone Implant Material with antibacterial properties, promoting bone growth and potentially revolutionizing implant design and patient outcomes.

- In March 2025, the International Dental Show (IDS) 2025 launched a global platform for Oral Bone Implant Material innovation, featuring over 2,500 exhibitors from 64 countries and attracting 160,000 visitors in five days.

- In February 2025, LifeNet Health announced the launch of OraGen, the first dental bone allograft combining cryopreserved corticocancellous bone and demineralized matrix, advancing Oral Bone Implant Material innovation and enhancing clinical outcomes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the oral bone implant material market based on the below-mentioned segments:

Global Oral Bone Implant Material Market, By Classification

- Autologous Bone

- Natural Bone

- Artificial Bone

Global Oral Bone Implant Material Market, By Application

- Hospital

- Dental Clinic

Global Oral Bone Implant Material Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?