Global Open Banking Market Size, Share, and COVID-19 Impact Analysis, By Financial Services (Banking & Capital Markets, Payments, Digital Currencies, Value Added Services, Others), By Distribution Channel (Bank Channel, App market, Distributors, Aggregators, Others), By Deployment (Cloud, On-premise), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Banking & FinancialGlobal Open Banking Market Insights Forecasts to 2032

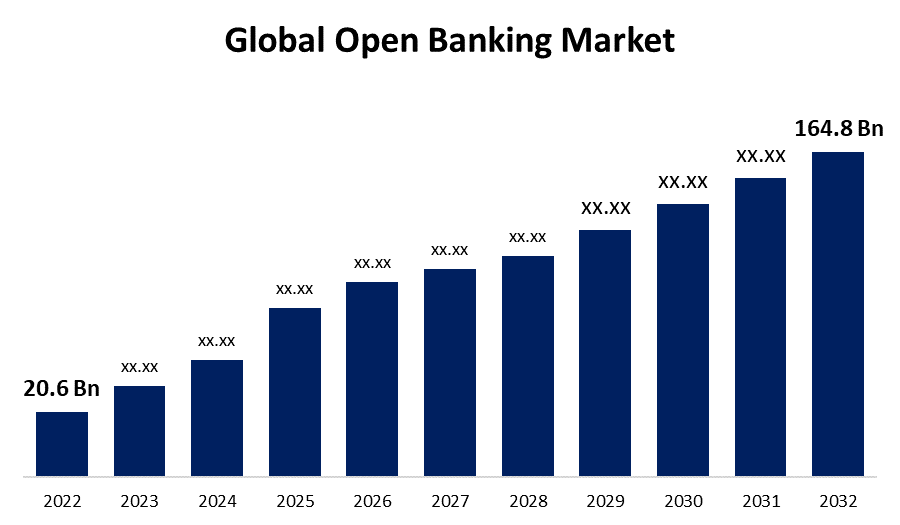

- The Global Open Banking Market Size was valued at USD 20.6 Billion in 2022

- The Market Size is Growing at a CAGR of 23.11% from 2022 to 2032

- The Worldwide Open Banking Market Size is expected to reach USD 164.8 Billion by 2032

- Asia-Pacific Market is expected to Grow the fastest during the Forecast period

Get more details on this report -

The Global Open Banking Market Size is expected to reach USD 164.8 Billion by 2032, at a CAGR of 23.11% during the forecast period of 2022–2032.

Open banking is a financial service that involves the electronic sharing of financial information. In addition, open banking services use application programming interfaces (APIs) to protect the exchange of financial data. Open Banking allows you to access and act on your banking data, such as creating a unified view of your accounts and making direct payments from them. You can link bank accounts to loyalty programs, share data with accountants and consultants, and do a variety of other things. Open Banking also expands your options for banking products and services. Data accessibility and portability make it easier to shop around, compare products, and choose the best banking solution for your needs. Financial information gathered for a client is used in the development of advanced apps targeted at improving the consumer experience associated with the usage of financial services.

Global Open Banking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 20.6 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 23.11% |

| 2032 Value Projection: | USD 164.8 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Financial Services, By Distribution Channel, By Deployment, By Region |

| Companies covered:: | Bannco Bilbao Vizcaya Argentaria, S.A., DemystData, Ltd., Finleap connect, Crédit Agricole, FormFree Holdings Corporation, MineralTree, Inc., NCR Corporation, Finastra, Jack Henry & Associates, Inc., Mambu and Other Key Player. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Open banking benefits everyone in the financial services industry, including consumers, businesses, Fintech firms, banks, and financial institutions. Through the deployment of open banking across the industry, a consumer in financial services gains access to superior banking services as well as innovative customized financial solutions. The growing adoption of open banking has attracted the interest of venture capital firms, which are driving investments in the open banking market. Growing strategic efforts and new product launches by market participants are also projected to fuel the expansion of the open banking market during the forecast period. Open banking-related third-party providers and banks created applications that allow clients to obtain consolidated account information from multiple financial service providers. Furthermore, the utilization of these applications and services helps in the management of client data and funds. Furthermore, these programs provide customers with advice on how to better manage their wealth. Customers benefit from digital services provided by open banking and other banking industries.

Restraining Factors

Concerns about increasing cyber-attacks and online fraud are among the market's problems. Furthermore, because open banking encourages the sharing of sensitive customer details, it raises issues about data security and privacy protection. diverse open banking organizations, on the other hand, implement unique plans to ensure that crucial data is shared securely and consensually.

Market Segmentation

By Financial Services Insights

The payments segment dominates the market with the largest revenue share over the forecast period.

Based on technology, the global open banking market is segmented into banking & capital markets, payments, digital currencies, value-added services, and others. Among these, the payments segment is dominating the market with the largest revenue share over the forecast period. The characteristics of the expansion are growing internet usage around the world and an increase in the use of various platforms for online payments. Such advancements presented banks with an opportunity to acquire a competitive advantage and boost their market position by collaborating or partnering with such platform providers. Furthermore, the increased implementation of payment services by open banking organizations bodes well for the segment's growth.

By Distribution Channel Insights

The distributors segment is witnessing significant CAGR growth over the forecast period.

Based on distribution channels, the global open banking market is segmented into bank channels, app markets, distributors, aggregators, and others. Among these, the distributors segment is witnessing significant CAGR growth over the forecast period. The growth is attributed to the fact that in a distributor model, banks primarily serve as service providers or product providers by processing what is ultimately sold by a third-party source. In this case, the third-party supplier owns the customer's interface, which is likely to give unique chances for the segment's growth. Banks can profit from this by making cash available to third parties through a commission-based business model, allowing clients to obtain services from third parties that a bank would then resell.

By Deployment Insights

The cloud segment is expected to hold the rapid revenue growth of the global Open Banking market during the forecast period.

Based on the deployment, the global Open Banking market is classified into cloud and on-premise. Among these, the cloud segment is expected to grow at a rapid pace during the forecast period. Cloud deployment services enable the bank to acquire an unprecedented amount of consumer data, analyze it, and provide personalized services where they are needed. Furthermore, cloud technology ensures the highest levels of security. Furthermore, the cloud allows for scalability, flexibility, and real-time processing, which is projected to open up new avenues for category growth.

Regional Insights

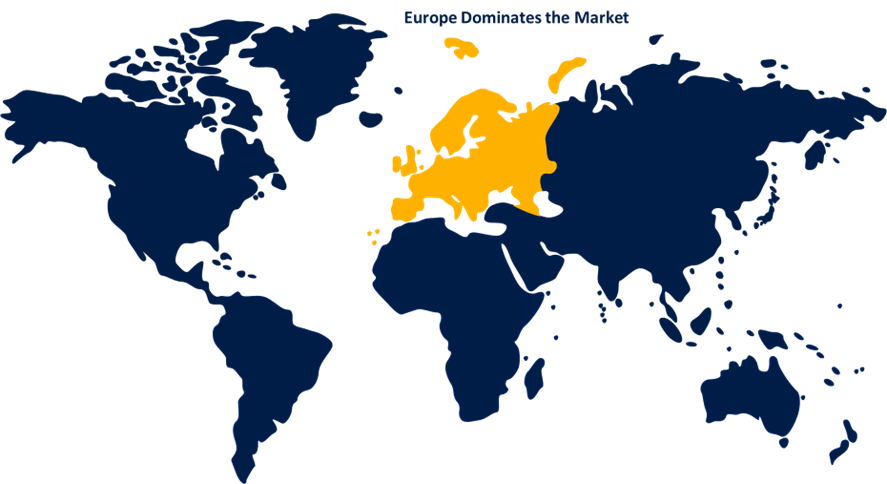

Europe dominates the market with the largest market share of more than 38.8% over the forecast period.

Get more details on this report -

Europe is dominating the largest market share of more than 38.8% over the forecast period. The growing need for improved online payment security in the region might be attributed to the regional market expansion. Another factor encouraging industry expansion in this region is the government's orders for financial businesses to open APIs. The presence of multiple major companies in the region is projected to propel regional market growth even further. Strong customer authentication (SCA), which adds an additional layer to all electronic payments and reduces the risk of payment fraud, has been deployed across the Europe region through open banking and PSD2 services. As a result, open banking solutions are expected to dominate the sector.

North America holds a substantial growth during forecast period. North America has a strong fintech sector, with various startups and technology firms specializing in financial innovation. Open banking is used by these fintech as a service provider to produce new goods and services such as digital wallets, personal financial apps, and investing platforms. The presence of a durable fintech sector contributes to the expansion of open banking in the region. North American regulatory measures, such as the Consumer Data Right (CDR) in Canada and the anticipated introduction of open banking regulations in the United States, are increasing market size. These regulatory efforts aim to encourage competition, innovation, and consumer data rights, creating conditions suitable to open banking adoption.

Asia-Pacific market is expected to grow the fastest during the forecast period. The expansion of the regional market can be due to increased knowledge of the benefits of open financial systems in countries such as China, India, and Japan. The rapid development of digital payment services in the Asia Pacific is also likely to contribute to regional market growth.

List of Key Market Players

- Bannco Bilbao Vizcaya Argentaria, S.A.

- DemystData, Ltd.

- Finleap connect

- Crédit Agricole

- FormFree Holdings Corporation

- MineralTree, Inc.

- NCR Corporation

- Finastra

- Jack Henry & Associates, Inc.

- Mambu

- Others

Key Market Developments

- In July 2023, Fintonic launched OpenInsights to promote the use of open banking data analytics. It focuses on the development of innovative open banking services and data analytics for businesses and financial institutions.

- In October 2022, Crowdz, an SME credit platform, became GoCardless' latest customer for US$ 10 million. The open banking solutions will feature instant bank payments to the United Kingdom, the United States, and Europe confirmed mandates to prevent fraud, as well as PayTo for instant payment and account verification.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global open banking market based on the below-mentioned segments:

Open Banking Market, Financial Services Analysis

- Banking & Capital Markets

- Payments

- Digital Currencies

- Value Added Services

- Others

Open Banking Market, Distribution Channel Analysis

- Bank Channel

- App market

- Distributors

- Aggregators

- Others

Open Banking Market, Deployment Analysis

- On-premise

- Cloud

Open Banking Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?