North America Well Intervention Market Size, Share, and COVID-19 Impact Analysis, By Type (Light, Medium, Heavy), By Service (Logging & Bottom Hole Survey, Tubing/Packer Failure & Repair, Stimulation, Remedial Cementing, Zonal Isolation, Sand Control, Artificial Lift, Fishing, Reperforation, Others), By Application (Onshore, Offshore), By Country (United States, Canada, Mexico, Rest of North America), and North America Well Intervention Market Insights Forecasts to 2033

Industry: Energy & PowerNorth America Well Intervention Market Insights Forecasts to 2033

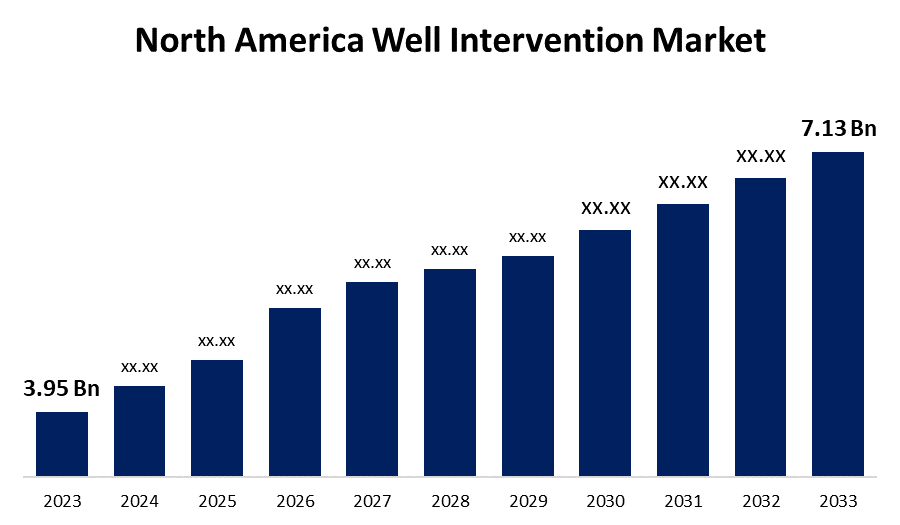

- The North America Well Intervention Market Size was valued at USD 3.95 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.08% from 2023 to 2033.

- The North America Well Intervention Market Size is Expected to Reach USD 7.13 Billion by 2033.

Get more details on this report -

The North America Well Intervention Market Size is expected to reach USD 7.13 billion by 2033, at a CAGR of 6.08% during the forecast period 2023 to 2033.

Market Overview

Well intervention is an operation performed on an oil or gas well during or near the end of its production life to improve the efficiency of the well geometry through equipment maintenance, repair, and replacement. Workover, slickline, wireline, or coiled tubing are examples of well intervention, which enables the operator to reduce the likelihood of well blockages. Crude oil demand has increased even more due to rising energy consumption and the number of discoveries. The primary driver of the well intervention market's expansion in North America is increased emphasis on increasing production output combined with cost-optimization efforts. To guarantee improved productivity and cost-effectiveness, upstream companies are offering well operators tailored well intervention cover packages. Furthermore, growing initiatives to incorporate efficient production techniques and flexibility to advanced equipment to supplement the output produced from existing old and mature wells are expected to propel market growth in the forecast period. Planning, exploring, and producing oil and gas wells effectively all depend on well intervention techniques. As a result, it would lengthen the life of production tubing, lower risks, enhance output, and run more smoothly.

Report Coverage

This research report categorizes the market for North America well intervention market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America well intervention market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America well intervention market.

North America Well Intervention Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.95 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.08% |

| 2033 Value Projection: | USD 7.13 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Service, By Application, By Country and COVID-19 Impact Analysis. |

| Companies covered:: | Oceaneering, Nine Energy Services, Step Energy Services, Schlumberger, BHGE, Weatherford, NOV, Basic Energy Services, RPC, Legend Energy Services, Superior Energy Services, Inc., Trican, Welltec, Altus Intervention and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increase in demand for conventional fuels such as gasoline, diesel, kerosene, and others from the transportation and power generation industries is the primary driver of the North America well intervention market's growth during the forecast period. Conversely, it is expected that the key players in the well intervention market will have lucrative opportunities to keep up the pace in the forecast period due to the use of smart control systems in well intervention equipment and R&D toward efficient well intervention services.

Restraining Factors

The use of petroleum products and the implementation of strict government regulations regarding environmental pollution are expected to hamper the market growth during the forecast period.

Market Segment

- In 2023, the light segment accounted for the largest revenue share over the predicted period.

Based on the type, the North America well intervention market is segmented into light, medium, and heavy. Among these, the light segment has the largest revenue share over the predicted period. It is thought to be a more cost-effective solution than the other segments. With its growing use in improving the quality of subsea wells, the medium intervention segment is in high demand. Since this technique is used to complete wells and replace parts like tubing strings and pumps, the heavy intervention segment is expected to grow moderately.

- In 2023, the sand control segment accounted for the largest revenue share through the anticipation period.

On the basis of service, the North America well intervention market is segmented into logging & bottom hole survey, tubing/packer failure & repair, stimulation, remedial cementing, zonal isolation, sand control, artificial lift, fishing, reperforation, and others. Among these, the sand control segment has the largest revenue share though the anticipation period. Sand control intervention services are provided in areas with high sand infiltration when the formation is loosely packed, increasing the likelihood of sand intrusion in the well from the producing zone and causing production issues. The development of unconventional and subsea oil and gas fields has resulted in a significant increase in the demand for sand control services.

- In 2023, the onshore segment is expected to hold the largest share of the North America well intervention market during the forecast period.

Based on the application, the North America well intervention market is classified into onshore, and offshore. Among these, the onshore segment is expected to hold the largest share of the North America well intervention market during the forecast period. Interventions in onshore wells are usually less expensive than those in offshore ones. Since onshore wells are typically easier to access, intervention services can be provided for a lower cost. The increasing demand for onshore well operations may have resulted in increased income output due to this cost advantage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America well intervention market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer

- Expro Group

- Halliburton

- Pioneer Energy Services

- Calfrac Well Services

- Oceaneering

- Nine Energy Services

- Step Energy Services

- Schlumberger

- BHGE

- Weatherford

- NOV

- Basic Energy Services

- RPC

- Legend Energy Services

- Superior Energy Services, Inc.

- Trican

- Welltec

- Altus Intervention

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the North America Well Intervention Market based on the below-mentioned segments:

North America Well Intervention Market, By Type

- Light

- Medium

- Heavy

North America Well Intervention Market, By Service

- Logging & Bottom Hole Survey

- Tubing/Packer Failure & Repair

- Stimulation

- Remedial Cementing

- Zonal Isolation

- Sand Control

- Artificial Lift

- Fishing

- Reperforation

- Others

North America Well Intervention Market, By Application

- Onshore

- Offshore

North America Well Intervention Market, By Country

- United States

- Canada

- Mexico

- Rest of North America

Need help to buy this report?