North America Veterinary Services Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Companion Animals and Production Animals), By Service Type (Medical Services and Non-Medical Services), and North America, Veterinary Services Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareNorth America Veterinary Services Market Insights Forecasts to 2035

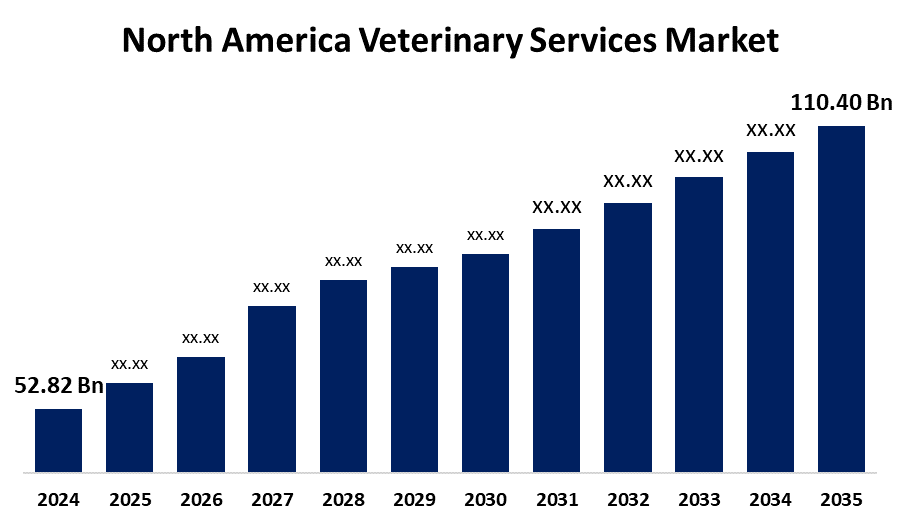

- The North America Veterinary Services Market Size Was Estimated at USD 52.82 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.93% from 2025 to 2035

- The North America Veterinary Services Market Size is Expected to Reach USD 110.40 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Veterinary Services Market Size is anticipated to reach USD 110.40 Billion by 2035, growing at a CAGR of 6.93% from 2025 to 2035. The market for veterinary services in North America has opportunities in the areas of sophisticated pet healthcare, telemedicine expansion, pet ownership growth, companion animal spending, and the expansion of specialized and preventative veterinarian care.

Market Overview

The entire sector that includes the diagnosis, treatment, and prevention of diseases in animals, both companion and livestock species, across nations, including the US, Canada, and Mexico, is referred to as the North America veterinary services market. Licensed veterinary experts offer a wide range of services in this sector, including surgery, regular checkups, vaccinations, emergency care, diagnostic imaging, laboratory tests, and specialty therapies. According to the North America Pet Health Insurance Association (NAPHIA), the growing demand for comprehensive coverage was reflected in the fact that pet insurance premiums in 2023 exceeded USD 4.27 billion. Growing pet ownership, improvements in veterinary technology, increased demand for products derived from animals, and growing awareness of animal health are some of the factors driving the North America veterinary services market. The growing prevalence of infectious and chronic diseases in pets and animals, increased pet ownership and healthcare spending, and improvements in diagnostic and treatment technology are all driving growth in the North America veterinary services market.

Report Coverage

This research report categorizes the market for North America veterinary services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America veterinary services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America veterinary services market.

North America Veterinary Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 52.82 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.93% |

| 2035 Value Projection: | USD 110.40 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Animal Type, By Service Type |

| Companies covered:: | IVC Evidensia, CVS Group PLC, Airpets International, Greencross Vets, Pets at Home Group PLC, Fetch Pet Care, PetSmart, National Veterinary Associates, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding at a faster rate due to rising demand for wellness services, preventive care, and specialist veterinary knowledge. Food safety, zoonotic disease prevention, and animal health are receiving more attention worldwide, which is driving the veterinary services market's strong growth. The North America veterinary services market is driven by factors such as growing awareness of pet health, increasing prevalence of various diseases in animals or zoonotic diseases, and rising demand for effective medical care. The sharp increase in pet ownership and the growing focus on preventative healthcare are one of the primary factors in the veterinary services sector's robust expansion.

Restraining Factors

High service costs, a lack of qualified veterinarians, complicated regulations, a lack of pet insurance, and financial limitations that affect pet owners' capacity to pay for cutting-edge veterinary care are some of the reasons restricting the growth of the North America veterinary services market.

Market Segmentation

The North America veterinary services market share is classified into animal type and service type.

- The production animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America veterinary services market is segmented by animal type into companion animals and production animals. Among these, the production animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The production animals segment, due to veterinary services, is crucial to maintaining the productivity, health, and biosecurity of livestock, including pigs, poultry, sheep, goats, cattle, and aquaculture. Production animal services continue to be the foundation of the veterinary services sector, maintaining their largest revenue share despite the global push for biosecurity and sustainable agriculture.

- The medical services segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America veterinary services market is segmented by service type into medical services and non-medical services. Among these, the medical services segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The medical services market has been affected as a result of the widespread efforts to manage and control outbreaks and the increasing incidence of zoonotic illnesses. The need for diagnostic procedures, surgeries, and preventative care has surged due to rising pet ownership and increased knowledge of animal health.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America veterinary services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IVC Evidensia

- CVS Group PLC

- Airpets International

- Greencross Vets

- Pets at Home Group PLC

- Fetch Pet Care

- PetSmart

- National Veterinary Associates

- Others

Recent Developments

- In September 2025, to simplify veterinary services, SignalPET launched SignalPET 360°, a complete radiology solution. The platform combines instant triage powered by AI, a Complete AI Report that is based on radiologist reports, and round-the-clock access to board-certified radiologists into a single solution.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America veterinary services market based on the below-mentioned segments:

North America Veterinary Services Market, By Animal Type

- Companion Animals

- Production Animals

North America Veterinary Services Market, By Service Type

- Medical Services

- Non-Medical Services

Need help to buy this report?