North America Travel Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Type (Annual Multi-Trip Travel Insurance and Single-Trip Travel Insurance), By Distribution Channel (Insurance Brokers, Insurance Companies, Banks, Insurance Aggregators, Insurance Intermediaries, Others), By End-Users (Senior Citizens, Educational Travelers, Backpackers, Business Travelers, Family Travelers, Fully Independent Travelers, Others), and North America Travel Insurance Market Insights Forecasts to 2032

Industry: Banking & FinancialNorth America Travel Insurance Market Insights Forecasts to 2032

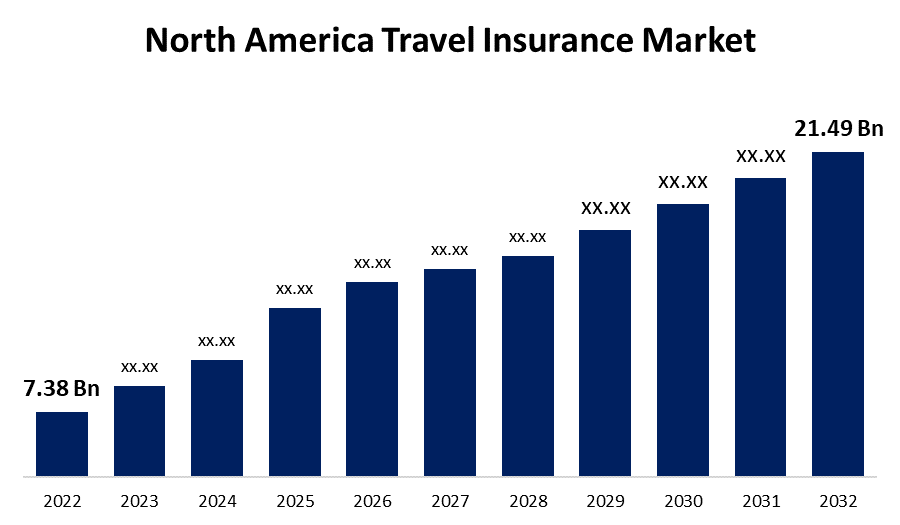

- The North America Travel Insurance Market Size was valued at USD 7.38 Bllion in 2022.

- The Market is Growing at a CAGR of 11.28% from 2022 to 2032.

- The North America Travel Insurance Market Size is expected to reach USD 21.49 Billion by 2032.

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The North America Travel Insurance Market Size is expected to reach USD 21.49 Billion by 2032, at a CAGR of 11.28% during the forecast period 2022 to 2032. This expansion is mostly driven by an increase in multiple family travel, along with the expansion of the North American travel insurance market. Furthermore, many tourists prefer to travel for lengthy weekend excursions in order to avoid numerous worries such as robbery and health problems.

Market Overview

North America's three major nations — Canada, the United States, and Mexico – are worldwide financial, political, and societal strongholds. The region has excellent public transportation connections, stunning heritage sites, vibrant towns, and a fascinating combination of Indigenous, French, British, and Spanish cultures. Tourists and overseas residents are also comforted that medical assistance in North America meets many of the finest standards in the entire globe. In addition, the variety of health insurance plans available in North America mirrors that of the population.

In Canada, the majority of the healthcare is provided privately and is publicly supported. It is frequently referred to as "socialized" or "universal" care. In the United States, public healthcare is not socialized. Because of this, healthcare in the US is exceedingly expensive. Employers frequently offer health insurance as a perk of employment. Employees are, however, frequently expected to contribute to the expenditures of health insurance due to increasing expenses. Furthermore, the Mexican health insurance system has a total of three elements: public, private, and employer-funded, and it provides a combination of comprehensive public healthcare and private care services. The unemployed receive the least basic level of service. The publicly funded sector national healthcare program, Instituto Mexicano de Seguro Social, or IMSS, is at the medium level. This is the method by which more than 80 percent of Mexicans obtain healthcare facilities. The highest level of healthcare in Mexico is provided through commercial healthcare facilities and hospitals, which citizens have to cover with their own funds.

Report Coverage

This research report categorizes the market for North America Travel Insurance Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Travel Insurance Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America Travel Insurance Market.

North America Travel Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.38 Bllion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.28% |

| 2032 Value Projection: | USD 21.49 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Insurance Type, By Distribution Channel, By End-Users, and COVID-19 Impact Analysis |

| Companies covered:: | AIG Travel Guard, Future Generali Travel Insurance, Allianz Travel, HTH Worldwide, Generali Global Assistance, Chola MS Travel Insurance, USI Insurance Services, LLC, Travel Insurance Company, American Express Company, Highway to Health, Inc., VisitorsCoverage, John Hancock, Genki, WorldNomads.com Pty Limited, Tata AIG General Insurance Company Limited |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased financial flexibility, inexpensive vacations, broad public awareness of holiday types, and simplicity of online travel reservations have all contributed to the tourism industry's expansion. More instances of lost luggage, misplaced crucial documents, medical issues, and natural disasters are being reported as visitor traffic grows. In order to minimize the risk connected with such incidents, an increasing number of people are opting for travel insurance policies. As a result, the rise of the tourist industry is a major driver of the North American travel insurance market.

The United States contributes to the majority of the market percentage of the North American travel insurance market, with travel companies and travel providers such as travel agents and cruise companies accounting for a large number of travel insurance policy sales. Based on market projections, over 44 percent of the American populace is now more anxious about traveling than they were previously, owing to the emergence of pandemic disease, an increase in terrorist assaults, and extreme weather events. Furthermore, in comparison to domestic travelers, the total number of overseas travelers who purchase travel insurance is significantly higher.

Market Segment

- In 2022, the single-trip travel insurance segment is witnessing a higher growth rate over the forecast period.

On the basis of insurance type, the North America Travel Insurance Market is segmented into annual multi-trip travel insurance and single-trip travel insurance. Among these, the single-trip travel insurance segment is witnessing a higher growth rate over the forecast period. This growth is attributed to the growth in business travel and rise in disposable income, which creates the need for safe traveling. However, more affordable and cheaper travel has made it easy for a number of family travelers, and fully independent travelers to take up several trips in a year, thus creating a substantial growing path for annual multi-trip travel insurance.

- In 2022, the insurance intermediaries segment is expected to hold the largest share of North America travel insurance market during the forecast period.

On the basis of distribution channel, the North America Travel Insurance Market is classified into insurance brokers, insurance companies, banks, insurance aggregators, and insurance intermediaries. Among these, insurance intermediaries are likely to hold the highest share of the North American travel insurance market throughout the forecast period since they provide a variety of services and insurance policies for travelers. Several travel middlemen are also improving the amenities they offer by devising it easier for customers to choose from their e-commerce platforms. The usage of programs such as the global distribution system (GDS) allows consumers to facilitate transactions amongst travel sector service providers such as automobile rental businesses, lodging establishments, airline companies, and travel intermediaries.

- In 2022, the family travelers segment accounted for the largest revenue share of more than 41.3% over the forecast period.

On the basis of end-users, the North America Travel Insurance Market is segmented into senior citizens, educational travelers, backpackers, business travelers, family travelers, fully independent travelers, and others. Due to the increased emphasis on minimizing an outbreak from one patient to another, the family traveler’s category is dominating the market with the biggest revenue share of 41.3% over the projection period. Furthermore, there is an increasing need for travel insurance services when customers travel with their family members. The family is made up of multiple members of varied ages and with diverse health conditions. This enhances the demand for family travel insurance because it involves better preparation and risk reduction, which results in greater travel experiences for family members.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Travel Insurance Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AIG Travel Guard

- Future Generali Travel Insurance

- Allianz Travel

- HTH Worldwide

- Generali Global Assistance

- Chola MS Travel Insurance

- USI Insurance Services, LLC

- Travel Insurance Company

- American Express Company

- Highway to Health, Inc.

- VisitorsCoverage

- John Hancock

- Genki

- WorldNomads.com Pty Limited

- Tata AIG General Insurance Company Limited

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, Trek Travel, a major luxury bicycle vacations tour operator in North America, has chosen Arch RoamRight as its primary travel insurance provider, according to Arch RoamRight Travel Insurance. Arch RoamRight's policies include cash protection against trip cancellations and disruptions, baggage and personal items coverage, and 24-hour global travel and medical emergency help.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America Travel Insurance Market based on the below-mentioned segments:

North America Travel Insurance Market, By Insurance Type

- Annual Multi-Trip Travel Insurance

- Single-Trip Travel Insurance

North America Travel Insurance Market, By Distribution Channel

- Insurance Brokers

- Insurance Companies

- Banks

- Insurance Aggregators

- Insurance Intermediaries

- Others

North America Travel Insurance Market, By End-Users

- Senior Citizens

- Educational Travelers

- Backpackers

- Business Travelers

- Family Travelers

- Fully Independent Travelers

- Others

North America Travel Insurance Market, By Country

- United States

- Canada

- Mexico

Need help to buy this report?