North America Thermal Barrier Coatings Market Size, Share, and COVID-19 Impact Analysis, By Product (Metal, Ceramic, Intermetallic, Others), By End User Industry (Automotive, Aerospace, Power Plants, Oil & Gas, Others), By Region (US, Canada, Mexico, Rest of North America), and North America Thermal Barrier Coatings Market Insights Forecasts 2023 – 2033

Industry: Chemicals & MaterialsNorth America Thermal Barrier Coatings Market Insights Forecasts to 2033

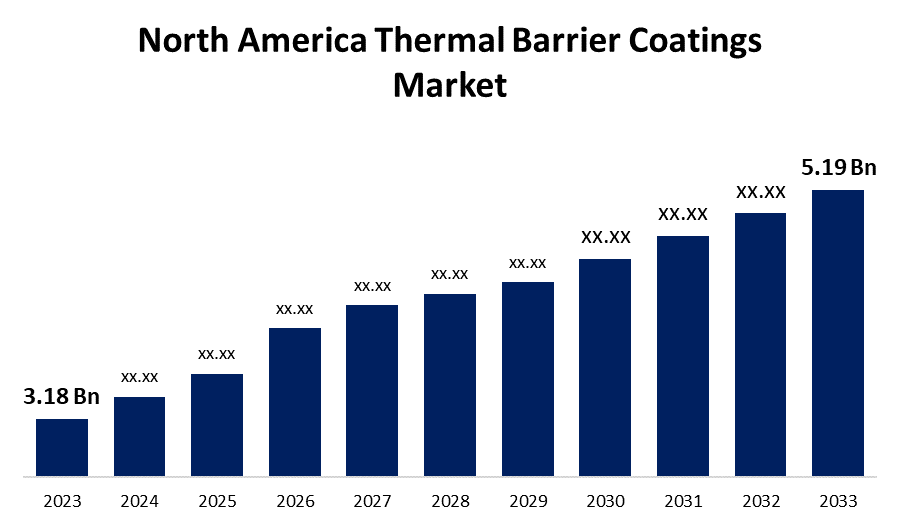

- The North America Thermal Barrier Coatings Market Size was valued at USD 3.18 Billion in 2023

- The Market Size is Growing at a CAGR of 5.02% from 2023 to 2033.

- The North America Thermal Barrier Coatings Market Size Expected to Reach USD 5.19 Billion by 2033.

Get more details on this report -

The North America Thermal Barrier Coatings Market Size is expected to reach USD 5.19 Billion by 2033, at a CAGR of 5.02% during the forecast period 2023 to 2033.

Market Overview

Thermal Barrier Coating (TBC) is a highly advanced or cutting-edge protective layer that allows insulating devices to function at extremely high temperatures. It is a material that operates at higher temperatures on metal surfaces (such as gas turbines or aero-engine components), primarily as an exhaust heat control. Thermal barrier coatings are made from epoxy resins, polymers, zirconia, aluminates, polymers, and other materials. Thermal barrier coatings typically consist of four layers: the metal base, the metallic bond coat, the thermally generated oxide (TGO), and the ceramic topcoat. The North American thermal barrier coatings market has grown considerably in recent years, owing to rising demand for efficient and high-performance materials across a wide range of industries. These coatings play an important role in improving the heat resistance and durability of components, making them widely used in industries such as aerospace, automotive, energy, and manufacturing. The energy sector, which includes power generation and renewable energy, is another significant market for thermal barrier coatings. These coatings are used in gas turbines, boilers, and other power plant components to increase efficiency and reduce heat-related wear and tear. The growing emphasis on clean and sustainable energy sources increases the demand for thermal barrier coatings.

Report Coverage

This research report categorizes the market for the North America thermal barrier coatings market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America thermal barrier coatings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America thermal barrier coatings market.

North America Thermal Barrier Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.18 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.02% |

| 2033 Value Projection: | USD 5.19 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End User Industry, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | A&A Thermal Spray Coatings, Chromalloy Gas Turbine LLC, CTS, Inc., Hayden Corp., Honeywell International Inc., KECO Coatings, Metallic Bonds, Ltd., Northwest Mettech Corp., OC Oerlikon Management AG, Praxair S.T. Technology, Inc. and Other key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased installation of power plants in North America is expected to boost the market. TBCs are used as fire-resistant materials, saving energy by reducing heat transfer. Thus, it is used for wire insulation. In recent years, the North American thermal barrier coatings market has experienced a remarkable growth, owing largely to the aerospace industrial rising demands. Furthermore, in the dynamic landscape of industrial advancements, the North American market for thermal barrier coatings is experiencing an enormous surge, with the energy sector emerging as a key driver of this growth. Nanotechnology, in particular, has emerged as a leader in the field of thermal barrier coatings. The creation of nanocomposite coatings represents a paradigm shift, providing unrivaled thermal resistance and mechanical strength. The incorporation of nanomaterials not only improves the protective capabilities of these coatings but also opens the door to applications in diverse and demanding environments. Collaborations among research institutions, manufacturers, and industry players have become critical to driving technological advancements. These collaborations enable the seamless translation of cutting-edge research into practical and scalable solutions, keeping the market dynamic and responsive to changing industrial needs.

Restraining Factors

Fluctuations in raw material prices are expected to hamper market growth. The constant rise and fall of raw materials may push production costs to a certain point. The lack of regulations governing the application of thermal barrier coatings is likely to limit the market. Furthermore, TBCs contain hazardous substances, raising environmental concerns and reducing North American thermal barrier coatings market growth during forecast period.

Market Segment

- In 2023, the ceramic segment accounted for the largest revenue share over the forecast period.

Based on product, the North America thermal barrier coatings market is segmented into metal, ceramic, intermetallic, and others. Among these, the ceramic segment has the largest revenue share over the forecast period. Ceramic thermal barrier coatings are synonymous with high-temperature protection and are widely used in the aerospace, automotive, and energy industries. These coatings, made of oxide ceramics such as yttria-stabilized zirconia (YSZ), form a protective barrier that insulates components from heat. Ceramic coatings, with their low thermal conductivity and ability to withstand extreme temperatures, are indispensable in applications such as turbine blades and exhaust systems.

- In 2023, the automotive segment is witnessing significant growth over the forecast period.

Based on the end-user industry, the North American thermal barrier coatings market is segmented into automotive, aerospace, power plants, oil and gas, and Others. Among these, the automotive segment is witnessing significant growth over the forecast period. The automotive sector is a major consumer of thermal barrier coatings, especially as the industry evolves toward cleaner and more efficient technologies. To effectively manage heat in internal combustion engines, these coatings are applied to components such as exhaust systems and cylinders. Furthermore, as the electric vehicle (EV) revolution gains traction, thermal barrier coatings play an important role in maintaining optimal temperatures within lithium-ion batteries, thereby enhancing their safety and longevity.

- The United States is projected to have the largest share of the North America thermal barrier coatings market over the forecast period.

Based on region, the United States is projected to have the largest share of the North America thermal barrier coatings market over the forecast period. The United States leads in aerospace innovation and research. The country's aerospace industry heavily relies on thermal barrier coatings to improve the durability and performance of turbine components. The United States excels in research and development, continuously pushing the boundaries of coating technologies to meet the rigorous demands of high-temperature environments, thus driving the regional market forward. Thermal barrier coatings have been adopted by the automotive and energy industries in the United States, particularly to improve engine efficiency and reduce emissions. As the United States continues to attract investments and foster industrial growth, demand for advanced coatings is increasing, cementing its position as a key player in the North American market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America thermal barrier coatings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- A&A Thermal Spray Coatings

- Chromalloy Gas Turbine LLC

- CTS, Inc.

- Hayden Corp.

- Honeywell International Inc.

- KECO Coatings

- Metallic Bonds, Ltd.

- Northwest Mettech Corp.

- OC Oerlikon Management AG

- Praxair S.T. Technology, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, Cabot Corporation introduced the ENTERA aerogel particle range, a ground-breaking thermal insulation additive designed to make it easier to create extremely thin thermal barriers for lithium-ion batteries used in electric vehicles. This innovative portfolio includes three ENTERA aerogel solutions that formulators can combine to create a wide variety of thermal barrier formats, such as pads, sheets, films, blankets, foams, and coatings.

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the North America thermal barrier coatings market based on the below-mentioned segments:

North America Thermal Barrier Coatings Market, By Product

- Metal

- Ceramic

- Intermetallic

- Others

North America Thermal Barrier Coatings Market, By End User Industry

- Automotive

- Aerospace

- Power Plants

- Oil and Gas

- Others

North America Thermal Barrier Coatings Market, By Region

- US

- Canada

- Mexico

- Rest of North America

Need help to buy this report?