North America Tequila Market Size, Share, and COVID-19 Impact Analysis, By Product (Blanco, Reposado, Anejo, and Super Premium), By Distribution Channel (On-Premise, and Off-Premise), and North America, Tequila Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsNorth America Tequila Market Insights Forecasts to 2035

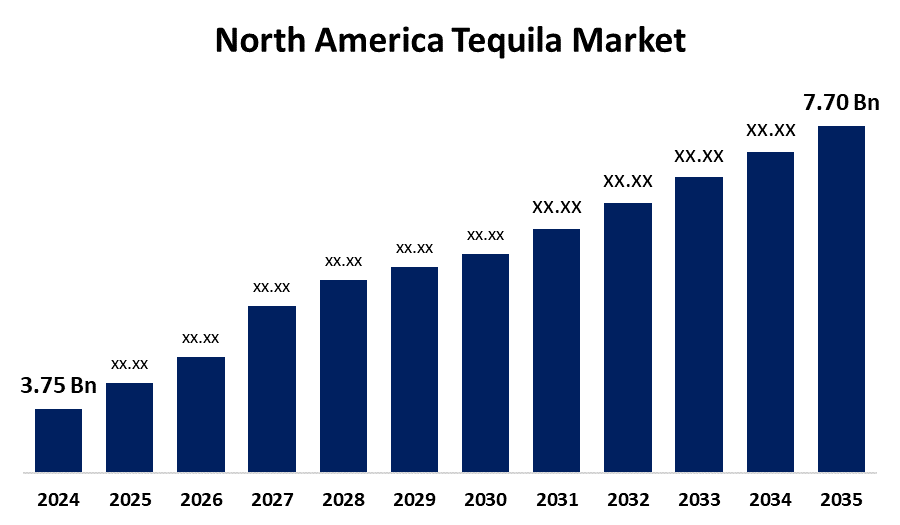

- The North America Tequila Market Size Was Estimated at USD 3.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.76% from 2025 to 2035

- The North America Tequila Market Size is Expected to Reach USD 7.70 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Tequila Market Size is anticipated to reach USD 7.70 Billion by 2035, growing at a CAGR of 6.76% from 2025 to 2035. Rising demand for artisanal and premium spirits, growing cocktail culture, creative flavor development, the expansion of e-commerce, and consumer preference for sustainable and health-conscious alcoholic beverages are all opportunities in the North America tequila market.

Market Overview

The manufacture, distribution, and consumption of tequila, a distilled spirit mostly derived from the blue agave plant, are the main focus of the North America tequila market, which is a regional section of the alcoholic beverage business. The market offers a variety of product kinds, including Blanco, Reposado, Añejo, and Extra Añejo, and is subject to stringent Mexican laws to guarantee authenticity. The North America tequila market is being significantly supported by the growing trend of combining various spirits to create a cocktail that gives the customer an amazing alcoholic beverage experience. The rising demand for artisanal and premium tequila is a major factor. The increasing demand for spirits across the globe has pushed multinational liquor corporations to capitalize on the beverage's barrel-aged varieties. The spirit's demand in the market is also expected to be boosted by new celebrity sponsorships. The need for delectable, exotic drinks that are fresh and have a distinct flavor is driving the expansion of the tequila market.

Report Coverage

This research report categorizes the market for North America tequila market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America tequila market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America tequila market.

North America Tequila Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.75 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.76% |

| 2035 Value Projection: | USD 7.70 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product and By Distribution Channel |

| Companies covered:: | Don Julio, Siete Leguas, Pernod Ricard, Jose Cuervo, Riazul Tequila, Tequila Cazadores, Exotico Tequila, Los Generales, Tanteo Tequila, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for distilled spirits made from blue agave plants is mostly due to the growing appeal of different artisanal spirits among customers worldwide. The market is anticipated to expand due to the growing trend of premiumization in spirits. The main North America tequila market trends propelling the industry's expansion are the introduction of new products and an increase in exports to other nations. Growing consumer appreciation for artisanal and premium spirits is a major factor behind the present notable upsurge in popularity of tequila in North America.

Restraining Factors

The North American tequila market is restricted by a number of problems, such as the limited availability of agave, complicated regulations, competition from other spirits, shifting economic conditions, and growing customer demand for low- or non-alcoholic beverage options.

Market Segmentation

The North America tequila market share is classified into product and distribution channel.

- The blanco segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America tequila market is segmented by product into blanco, reposado, anejo, and super premium. Among these, the blanco segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The Blanco tequila segment is expanding due to a number of important market factors that highlight its appeal and adaptability. It makes the perfect foundation for many different types of drinks, especially traditional ones like margaritas and palomas.

- The off-premise segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America tequila market is segmented by distribution channel into on-premise, and off-premise. Among these, the off-premise segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing customer appetite for high-end and artisanal spirits is a major factor driving tequila sales off-premises. The rising demand for luxury tequila brands, which appeal to customers looking for unique flavor profiles and genuine experiences, is one example of this trend.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America tequila market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Don Julio

- Siete Leguas

- Pernod Ricard

- Jose Cuervo

- Riazul Tequila

- Tequila Cazadores

- Exotico Tequila

- Los Generales

- Tanteo Tequila

- Others

Recent Developments

- In February 2025, the ultra-premium spirits company FINO Tequila, which was co-founded by cricket legend Yuvraj Singh and a group of businesspeople, made a big splash in the luxury tequila market with its official U.S. launch.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America tequila market based on the below-mentioned segments:

North America Tequila Market, By Product

- Blanco

- Reposado

- Anejo

- Super Premium

North America Tequila Market, By Distribution Channel

- On-Premise

- Off-Premis

Need help to buy this report?