North America Temperature Sensor Market Size, Share, and COVID-19 Impact Analysis, By Product (Contact, and Contactless), By Application (Automotive, Consumer Electronics, Environmental, Healthcare/Medical, Process Industries, and Others), and North America Temperature Sensor Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsNorth America Temperature Sensor Market Insights Forecasts to 2035

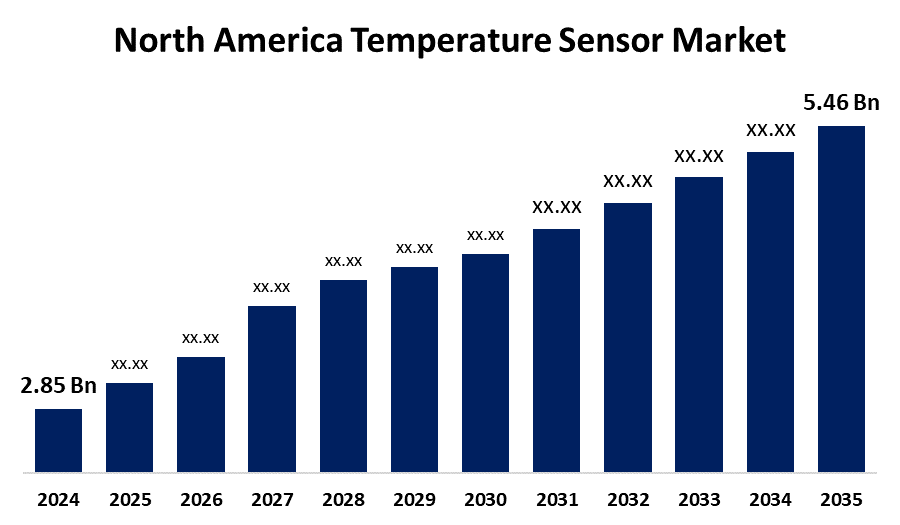

- The North America Temperature Sensor Market Size Was Estimated at USD 2.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.09% from 2025 to 2035

- The North America Temperature Sensor Market Size is Expected to Reach USD 5.46 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Temperature Sensor Market Size is anticipated to Reach USD 5.46 Billion by 2035, Growing at a CAGR of 6.09% from 2025 to 2035. Growing automation, the need for accurate temperature monitoring, the development of miniaturized sensor technologies, and the expansion of applications in the automotive, aerospace, healthcare, and smart manufacturing sectors offer opportunities in the North America temperature sensor market.

Market Overview

The manufacturing, distribution, and use of temperature sensing technologies in a variety of sectors, such as consumer electronics, business automation, healthcare, automotive, and aerospace, are all included in the North America temperature sensor market. Electronic devices called temperature sensors are made to measure and identify temperature changes. They then translate those changes into electrical signals that can be used for control and monitoring. The North America temperature sensors market, which includes thermistors, infrared sensors, resistance temperature detectors (RTDs), and thermocouples, is essential for maintaining product quality, energy efficiency, and operational safety.

The market for North America temperature sensors has expanded as a result of higher R&D expenditures made to create and introduce new sensors with improved precision and effectiveness. These sensors are used by medical devices to take a patients body temperature and track it throughout a variety of treatments. Consequently, the expansion of this market has been ascribed to these factors. The temperature sensors market in North America is expected to increase significantly, as evidenced by trends and predicted revenues that show rising demand across a number of industries.

Report Coverage

This research report categorizes the market for North America temperature sensor market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America temperature sensor market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the North America temperature sensor market.

North America Temperature Sensor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.09% |

| 2035 Value Projection: | USD 5.46 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 193 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application |

| Companies covered:: | ABB Limited, Robert Bosch GmbH, Analog Devices Inc, Emerson Electric Company, Honeywell International Inc, Fluke Process Instruments, Texas Instruments Incorporated, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing temperature sensor applications and the expansion of the electronics industry are the main drivers of the North America temperature sensor market. Temperature sensors are becoming more and more in demand in fields like microtechnology and nanotechnology, where they are utilized to measure precise data. Technological developments in wireless communication and sensor downsizing also contribute to the North America temperature sensor market. Technological developments, the growing need for smart manufacturing, and the spread of IoT-enabled systems are driving the North America temperature sensor market.

Restraining Factors

High sensor costs, a lack of standardization, integration difficulties, and performance issues in harsh environments particularly in the aerospace, oil, and gas industries that demand strong precision and dependability, are restricting North America temperature sensor market.

Market Segmentation

The North America temperature sensor market share is classified into product and application.

- The contact segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America temperature sensor market is segmented by product into contact and contactless. Among these, the contact segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growing need for contact temperature sensors in the manufacturing, food, chemical, and medical industries is driving the contact segment. Physical contact with the surfaces or items being monitored is necessary for contact temperature sensors to function. They are frequently used to keep an eye on the temperatures of different gases, liquids, and solids.

- The automotive segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America temperature sensor market is segmented by application into automotive, consumer electronics, environmental, healthcare/medical, process industries, and others. Among these, the automotive segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The expansion of the automotive industry and the rising need for temperature sensors as a result of their growing use in car manufacturing are the reasons behind the automotive segment. The temperatures of different liquids and gases within a car are measured and tracked using temperature sensors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America temperature sensor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Limited

- Robert Bosch GmbH

- Analog Devices Inc

- Emerson Electric Company

- Honeywell International Inc

- Fluke Process Instruments

- Texas Instruments Incorporated

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, A top US product engineering firm, Azilen Technologies, announced that it had integrated the Things Board platform with cutting-edge IoT-powered thermal monitoring sensors to provide improved thermal sensing. Specifically designed for temperature-sensitive industries like AgriTech, healthcare, and logistics, this cutting-edge system, which was created from the ground up for clients, sets a new standard for accuracy and real-time temperature monitoring.

- In November 2024, Asahi Kasei Microdevices Open new window (AKM), a division of Asahi Kasei Corporation, unveiled a range of sensor technologies, such as contactless monitoring and millimeter-wave (mmWave) radar. These innovations can reduce interference in users lives while increasing AgeTechs dependability and accessibility.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America temperature sensor market based on the below-mentioned segments:

North America Temperature Sensor Market, By Product

- Contact

- Contactless

North America Temperature Sensor Market, By Application

- Automotive

- Consumer Electronic

- Environmental

- Healthcare/Medical

- Process Industries

- Others

Need help to buy this report?