North America Storage Water Heater Market Size, Share, and COVID-19 Impact Analysis, By Capacity (Below 30 Liter, 30 - 100 Liter, 100 - 250 Liter, 250 - 400 Liter, and Above 400 Liter), By Application (Residential, and Commercial), and North America, Storage Water Heater Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentNorth America Storage Water Heater Market Insights Forecasts to 2035

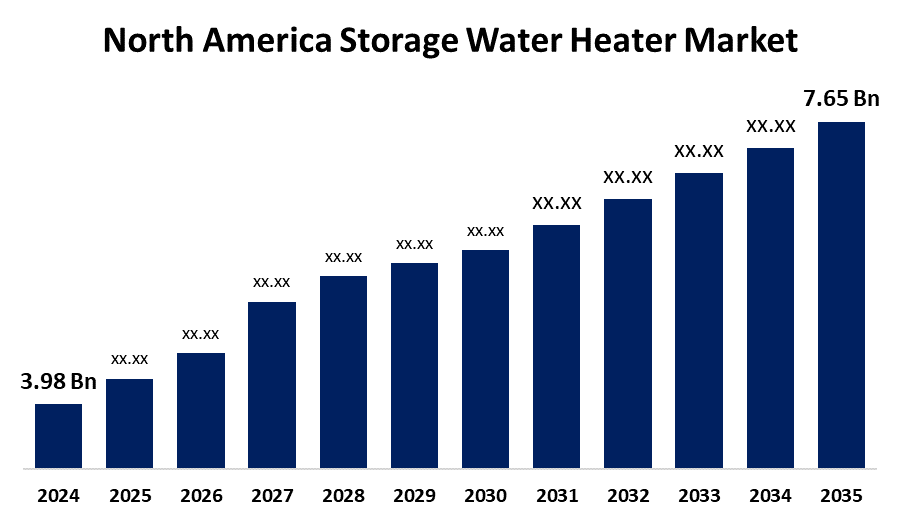

- The North America Storage Water Heater Market Size Was Estimated at USD 3.98 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.12 % from 2025 to 2035

- The North America Storage Water Heater Market Size is Expected to Reach USD 7.65 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the North America Storage Water Heater Market Size is Anticipated to Reach USD 7.65 Billion by 2035, Growing at a CAGR of 6.12 % from 2025 to 2035. The North America storage water heater market opportunities are expected to see the integration of cutting-edge technologies like the Internet of Things to increase the operating efficiency of storage water heaters and automatically adjust to weather changes and other real-time data.

Market Overview

The regional industry devoted to the production, marketing, and installation of water heating systems that store heated water for use in homes, businesses, and industries is known as the North America storage water heater market. These systems are intended to deliver a steady supply of hot water and usually run on electricity, gas, or solar power. Smart control features, low-emission designs, and advanced insulation technologies are making products more appealing. Manufacturers and providers of storage water heaters are anticipated to benefit greatly from the stringent regulations and guidelines governing the design of heating systems in commercial and industrial environments.

These units' clean combustion and low emissions, as compared to other fuels, have led to an increase in demand over time. Additionally, the government's propensity to embrace greener fuels can boost the expansion of the North America storage water heater market. The North America storage water heaters market is anticipated to be significantly driven by the growing trend of using solar energy-run storage water heaters in different parts of the world throughout the forecast period.

Report Coverage

This research report categorizes the market for North America storage water heater market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America storage water heater market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America storage water heater market.

North America Storage Water Heater Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.98 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.12 |

| 2035 Value Projection: | USD 7.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 130 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Capacity, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | A.O. Smith, Hubbell Heaters, State Industries, Ariston Thermo USA, American Water Heater, Bosch Thermotechnology, Rinnai America Corporation, Bradford White Corporation, Rheem Manufacturing Company and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The replacement of old appliances, growing urban infrastructure, and growing demand for energy-efficient appliances are the main factors propelling the North America storage water heater market expansion. The systems are more appealing to businesses, and customers care about the environment since they have energy-saving features and sophisticated insulation. Industry partnerships are also essential for promoting product penetration, advancing innovation, and broadening market reach and efficiency in the North America storage water heater market. The North America storage water heater market is expected to be significantly influenced by changing customer tastes and a growing focus on sustainability.

Restraining Factors

The North America storage water heaters market is being constrained by high upfront costs, low energy efficiency in older models, bulky designs, and growing consumer preference for small, on-demand systems.

Market Segmentation

The North America storage water heater market share is classified into capacity and application.

Get more details on this report -

- The 100 – 250 liter segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America storage water heater market is segmented by capacity into below 30 liter, 30 – 100 liter, 100 – 250 liter, 250 – 400 liter, and above 400 liter. Among these, the 100 – 250 liter segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The 100–250 liter market is fueled by its ideal ratio of efficiency, capacity, and fit for light commercial and household uses. Rising need for dependable hot water solutions, energy-efficient technologies, and the growing replacement of antiquated systems with contemporary, insulated units that offer improved performance and environmental compliance all increase this market.

- The residential segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America storage water heater market is segmented by application into residential and commercial. Among these, the residential segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The necessity for a steady and dependable supply of hot water, energy efficiency regulations, and technological developments are some of the main drivers of the commercial industry. The replacement of outdated systems, growing urbanization, and residential need for energy-efficient water heating solutions are all affecting the commercial segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America storage water heater market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- A.O. Smith

- Hubbell Heaters

- State Industries

- Ariston Thermo USA

- American Water Heater

- Bosch Thermotechnology

- Rinnai America Corporation

- Bradford White Corporation

- Rheem Manufacturing Company

- Others

Recent Developments

- In July 2025, A national marketing campaign has been launched by Rinnai America Corporation to inform homes about the benefits of moving away from conventional tank water heaters. Rinnai champions unlimited hot water and energy savings offered in tankless systems while highlighting the inadequacies of antiquated water heater technology in a novel and amusing way.

- In May 2025, Homeowners in the US and Canada are receiving access to a competitive product portfolio of residential water heaters due to a joint venture between Lennox, a leader in the HVACR industry for creative climate solutions, and Ariston Group, a global leader in water comfort and sustainable climate.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America storage water heater market based on the below-mentioned segments:

North America Storage Water Heater Market, By Capacity

- Below 30 Liter

- 30 – 100 Liter

- 100 – 250 Liter

- 250 – 400 Liter

- Above 400 Liter

North America Storage Water Heater Market, By Application

- Residential

- Commercial

Need help to buy this report?