North America Sporting Goods Market Size, Share, and COVID-19 Impact Analysis, By Type (Ball Sports and Racquet sports), By Distribution Channel (Offline and Online), By Country (United States, Canada, Mexico, and Rest of North America) and North America Sporting Goods Market Insights, Industry Trend, Forecasts to 2032.

Industry: Consumer GoodsNorth America Sporting Goods Market Insights Forecasts to 2032

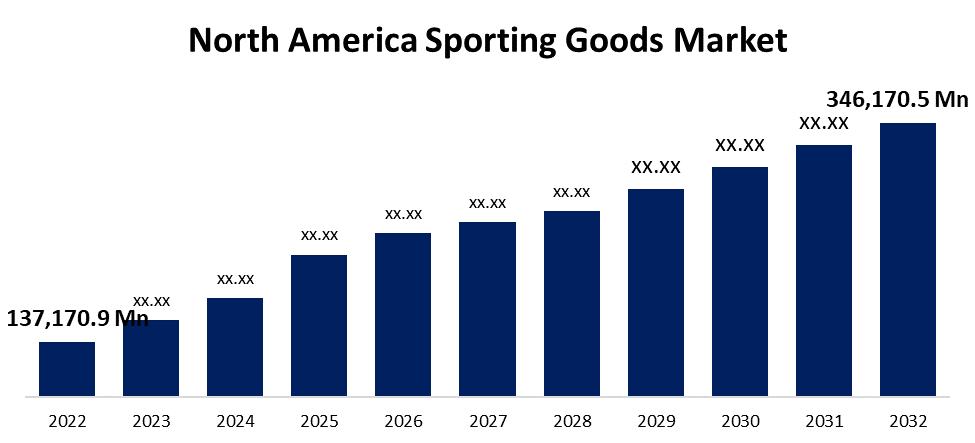

- The North America Sporting Goods Market Size was valued at USD 137,170.9 Million in 2022.

- The Sporting Goods Market is Growing at a CAGR of 9.7% from 2022 to 2032

- The North America Sporting Goods Market Size is expected to reach USD 346,170.5 Million by 2032

- The Canada is expected to grow fastest during the forecast period

Get more details on this report -

The North America Sporting Goods Market Size was valued at USD 137,170.9 million in 2022 to USD 346,170.5 million by 2032 at a CAGR OF 9.7% during the forecast period (2022-2032).

Market Overview

The U.S. Olympic team for the Beijing Games, which consisted of 222 athletes, that had 107 women participants, the most of any country in the history of the Winter Olympics, according to the information given by the Olympic Committee in 2022. Furthermore, according to statistics made public by the Canadian government, 60% of Canada's competitors competing in the 2020 Olympics were female, while 55% of the country's Paralympic squad was made up of female athletes. The regional sporting goods industry is anticipated to benefit from the rise in female sports participation. The rise of the sporting goods industry in North America is also being aided by the rising popularity of regional and worldwide sporting events like the Olympic Games, the Cricket World Cup, and the Soccer World Cup. Over the past several years, countries in North America have seen a dramatic rise in the participation of women in sports.

Report Coverage

This research report categorizes the market of the North America Sporting goods market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Sporting goods market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America Sporting goods market.

North America Sporting Goods Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 137,170.9 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.7% |

| 2032 Value Projection: | USD 346,170.5 Million |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Distribution Channel, By Country, and COVID-19 Impact Analysis |

| Companies covered:: | Nike, Inc., Adidas AG, PUMA SE, Columbia Sportswear Company, Under Armour, Inc., lululemon athletica Inc., Yonex Co., Ltd., New Balance Athletics, Inc, Callaway Golf Company, ANTA Sports Products Limited |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Participation in sports and fitness activities has risen as a result of the growing knowledge of a healthy lifestyle. As a result, athletic items are being adopted at a higher rate. Also, the development of high-performance athletic products that are long-lasting and perform better is the result of technological developments. Demand for novel and cutting-edge goods has surged as a result. Moreover, the Growing Popularity of Outdoor Recreation Activities also driving the market growth, as more individuals look for outdoor activities, there is a rise in demand for sports products. Bicycles, trekking gear, and camping gear are among these items. In addition, sporting products may now be easily purchased online thanks to the expansion of e-commerce. Sporting items are becoming more widely available, giving customers more options. The increase in online distribution channels is one of the main factors fueling expansion in the athletic goods sector in North America. Sporting products are now more accessible to customers because of the existence of internet buying platforms. Retailers now compete with one another more fiercely for customers by providing alluring discounts and offers.

Restraining Factors

Shifting consumer preferences and lifestyle changes can influence the demand for specific sporting goods products. For example, if there is a trend towards alternative fitness activities or a decline in interest in certain sports, it could impact sales in those categories. Also, certain sports and outdoor activities are seasonal, leading to fluctuating demand throughout the year.

Market Segment

- In 2022, the ball games segment is dominating the market with the largest share of 84.9% during the forecast period

Based on the type, the North America Sporting goods market is segmented into ball sports and racquet sports. Among these, the ball games segment is expected to have a higher market share value over the forecast period. The growth in global popularity of sporting events like the Olympics, NBA, Football World Cup, and others is one of the main factors promoting market expansion over the forecast period. Due to growing public interest in athletes and elite league competitions, the global sports event industry is growing. Ball sports' sporting goods industry is being supported by expanding consumer spending on fitness equipment and apparel as well as rising sports participation.

- In 2022, the offline segment is leading the largest market share of 58.8% over the forecast period.

Based on the distribution channel, the North America Sporting goods market is bifurcated into offline and online. Among these, the offline segment held the largest market share of 58.8% over the forecast period. During the epidemic, consumers have begun to spend more time outside. The sales of sporting goods clothes and equipment have increased as a result. Retailers of sporting goods in the US reported higher monthly sales in 2021 compared to 2020. The interactive shopping environments created by specialty retailers like DICK'S Sporting Goods, Golf Galaxy, Nike, Adidas, Puma, and Public Lands emphasize their wide range of products and value-added services for sports lovers.

- The United States segment is dominating the largest market growth share of 92.5% over the projection period

Based on the country, the North America sporting goods market is classified into the United States, Canada, Mexico, and the Rest of North America. Among these, the United States segment holds the largest market growth during the forecast period, Throughout the projection period, there will likely be a sizable increase in demand for sports and fitness items due to the growing engagement of women and children in these activities. To draw in more customers, major firms in the nation are introducing new items. In addition, as worries about health and fitness increased during the COVID-19 epidemic, Americans were urged to spend money on exercise and health accessories to preserve a healthy body and posture. This was a major factor in the nation's athletic goods market expansion via influencing sales.

Canada is expected to register a significant growth rate of 7.4% over the projected period because more money is being invested in promoting sports in the nation and because other sports are becoming more popular. The most well-liked sports in Canada include hockey, golf, baseball, softball, racquet sports, soccer, basketball, volleyball, skiing, and snowboarding.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Sporting goods market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nike, Inc.

- Adidas AG

- PUMA SE

- Columbia Sportswear Company

- Under Armour, Inc.

- lululemon athletica Inc.

- Yonex Co., Ltd.

- New Balance Athletics, Inc

- Callaway Golf Company

- ANTA Sports Products Limited

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In 2021, Nike revealed plans to spend $140 million building a factory in Arizona where the business makes its Flyknit shoes. Over 500 employments are anticipated to be created by the plant.

- In 2021, Adidas and Peloton, a well-known workout platform, launched a new relationship. Exclusive Adidas clothing for Peloton members, as well as coordinated marketing and social media efforts, are all part of the relationship.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the North America Sporting Goods Market based on the below-mentioned segments:

North America Sporting Goods Market, By Product Type

- Ball Sports

- Racquet sports

North America Sporting Goods Market, By Distribution Channel

- Offline

- Online

- Others

North America Sporting Goods Market, By Country

- United States

- Canada

- Mexico

- Rest of North America

Need help to buy this report?