North America Radiation Cured Coatings Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Oligomers, Monomers, Photoinitiators, Additives), By Application (Adhesives, Pulp and Paper, Printing Inks, Wood, Glass, Others), By Region (US, Canada, Mexico, Rest of North America), and North America Radiation Cured Coatings Market Insights Forecasts 2023 – 2033

Industry: Chemicals & MaterialsNorth America Radiation Cured Coatings Market Insights Forecasts to 2033

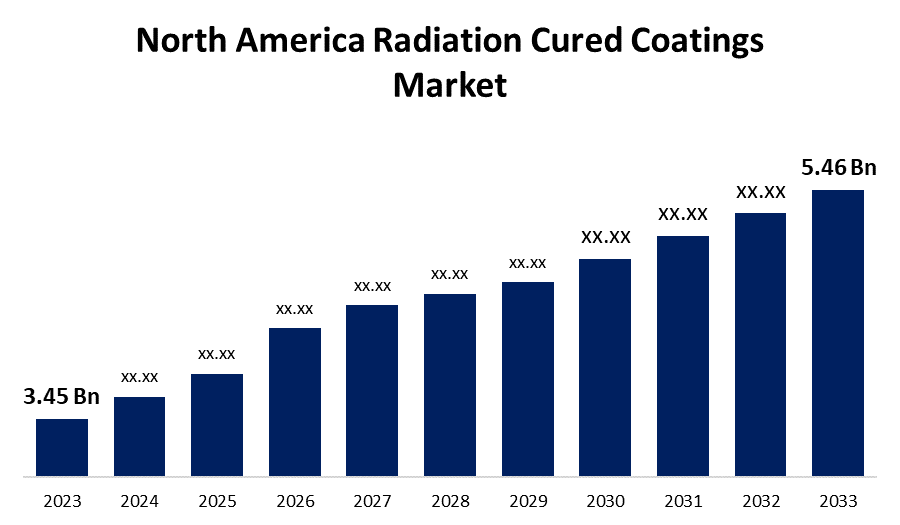

- The North America Radiation Cured Coatings Market Size was valued at USD 3.45 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.70% from 2023 to 2033.

- The North America Radiation Cured Coatings Market Size Expected to Reach USD 5.46 Billion by 2033.

Get more details on this report -

The North America Radiation Cured Coatings Market size is expected to reach USD 5.46 Billion by 2033, at a CAGR of 4.70% during the forecast period 2023 to 2033.

Market Overview

Radiation-curable coatings are polymer coatings that are cured with ultraviolet or electron beam radiation and can be used on a variety of materials such as wood, metal, glass, plastic, and paper. These formulations are commonly used to cross-link adhesives, inks, and electronics with high-intensity UV or electron beam energy sources. The market is being driven by the increased use of solvent-free technologies to meet environmental regulations. Radiation-curable coatings are composed of reactive liquid, pigments, and additives that are activated by high-intensity radiation energy, such as visible light, ultraviolet (UV), or low-energy electrons (EB). These coatings have a long service life and good performance, consume less energy, improve surface properties, and are corrosion-resistant. The radiation-cured coatings market is at the forefront of coating technologies, driven by a combination of factors including sustainability, performance excellence, and technological advancements. As industries prioritize efficiency, environmental responsibility, and high-quality finishes, radiation-cured coatings will become increasingly important in shaping the future of coatings. Radiation-cured coatings in chemical plants provide chemical resistance to heating tubes, tanks, vessels, and pipes while also preventing corrosion on protective covers. These are scratch-resistant and have a high surface strength without sacrificing the flexibility of metals commonly used in the automotive industry for steering wheels, roof racks, and truck axles. Radiation-curable coatings are widely used in the fabrication of semiconductors and optical devices due to their excellent abrasion resistance, quick healing capabilities, and increased optical cable endurance. As a consequence, its widespread use in various industries is driving market growth in the North America radiation-cured coatings market.

Report Coverage

This research report categorizes the market for North America radiation cured coatings market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America radiation-cured coatings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America radiation-cured coatings market.

North America Radiation Cured Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.45 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.70% |

| 2033 Value Projection: | USD 5.46 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Raw Material, By Application, By Region, and COVID-19 Impact Analysis. |

| Companies covered:: | Dow Chemical Company, PPG Industries, The Sherwin-Williams Company, Akzo Nobel N.V., ICA SpA, Axalta Coating Systems, Covestro AG, The Lubrizol Corporation, NEI Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary reasons for the widespread use of radiation-cured coatings is their inherent low volatile organic compound (VOC) content. Furthermore, the rapid curing nature of these coatings is perfectly compatible with just-in-time manufacturing principles. Industries can quickly respond to changing market demands by producing coatings on demand with short lead times. This adaptability makes radiation-cured coatings a strategic choice for industries that require flexible and adaptable manufacturing processes. The ability of manufacturers to customize formulations to meet regional and industry-specific requirements drives the North American expansion of the radiation-cured coatings market. This adaptability makes the coatings more suitable for various markets, contributing to their widespread acceptance. With a growing emphasis on sustainable building practices, radiation-cured coatings are increasingly popular in green construction projects. These coatings help to achieve green building certifications by meeting criteria such as low VOC emissions and sustainable material choices.

Restraining Factors

The prices and availability of raw materials are important factors in determining the price of finished goods. The primary issue for the radiation-cured coatings industry is changing raw material price trends caused by volatile energy costs. Radiation-cure products primarily consist of crude oil derivatives such as photoinitiators, oligomers, and monomers. As a consequence, fluctuations in energy prices have an impact on the pricing of radiation-cured coatings, which presents an obstacle.

Market Segment

- In 2023, the oligomers segment accounted for the largest revenue share over the forecast period.

Based on raw material, the North America radiation-cured coatings market is segmented into oligomers, monomers, photoinitiators, and additives. Among these, the oligomers segment has the largest revenue share over the forecast period. Oligomers form the backbone of radiation-cured coatings, defining their fundamental properties. These are polymeric compounds with a predetermined molecular weight, which influences key properties like flexibility, adhesion, and curing speed. Innovations in oligomer design enable formulators to tailor coatings to specific applications, ensuring a precise balance of properties.

- In 2023, the adhesives segment is witnessing significant growth over the forecast period.

Based on application, the North America radiation-cured coatings market is segmented into adhesives, pulp and paper, printing inks, wood, glass, and others. Among these, the adhesives segment is witnessing significant growth over the forecast period. The adhesive industry has seen a transformative embrace of radiation-cured coatings. Radiation-cured formulations have a competitive advantage in adhesive applications due to their rapid cure times, which allow for efficient bonding processes. This application is especially useful in industries that require speed and precision in bonding, such as electronic component assembly.

- Mexico is projected to have the largest share of the North America radiation-cured coatings market over the forecast period.

Based on region, the Mexico is projected to have the largest share of the North America radiation-cured coatings market over the forecast period. Mexico's strategic location and strong manufacturing capabilities have established it as a major player in the regional radiation-cured coatings industry. The country's automotive and aerospace industries, in particular, have embraced these coatings for their ability to deliver superior performance while adhering to strict quality specifications. As Mexico continues to attract foreign investment and create a favorable business environment, demand for radiation-cured coatings is increasing, greatly contributing to the regional market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America radiation cured coatings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dow Chemical Company

- PPG Industries

- The Sherwin-Williams Company

- Akzo Nobel N.V.

- ICA SpA

- Axalta Coating Systems

- Covestro AG

- The Lubrizol Corporation

- NEI Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the North America radiation-cured coatings market based on the below-mentioned segments:

North America Radiation Cured Coatings Market, By Raw Material

- Oligomers

- Monomers

- Photoinitiators

- Additives

North America Radiation Cured Coatings Market, By Application

- Adhesives

- Pulp and Paper

- Printing Inks

- Wood

- Glass

- Others

North America Radiation Cured Coatings Market, By Region

- US

- Canada

- Mexico

- Rest of North America

Need help to buy this report?