North America Polyurethane Market Size, Share, and COVID-19 Impact Analysis, By Product (Rigid Foam, Flexible Foam, Coatings, Adhesives & Sealants, Elastomers, and Others), By End Use (Furniture and Interiors, Construction, Electronics & Appliances, Automotive, Footwear, Packaging, and Others), and North America Polyurethane Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsNorth America Polyurethane Market Size Insights Forecasts to 2035

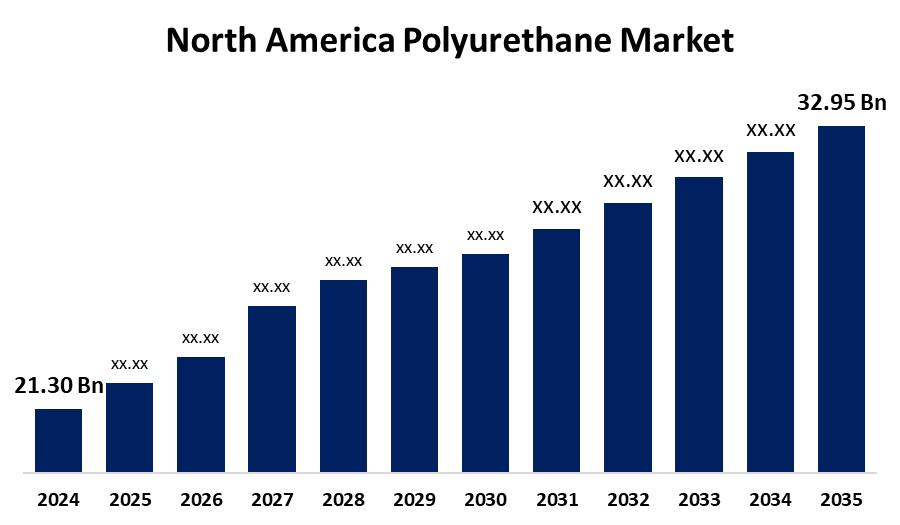

- The North America Polyurethane Market Size Was Estimated at USD 21.30 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.05% from 2025 to 2035

- The North America Polyurethane Market Size is Expected to Reach USD 32.95 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the North America Polyurethane Market Size is anticipated to reach USD 32.95 billion by 2035, growing at a CAGR of 4.05% from 2025 to 2035. The growing demand for polyurethane in the electronics, automotive, and construction industries due to technological improvements, environmental initiatives, and the growing use of lightweight and energy-efficient materials creates an opportunity for the North America polyurethane market.

Market Overview

The geographical sector that produces, distributes, and uses polyurethane-based materials in nations such as the US, Canada, and Mexico is known as the North America polyurethane market. Composed of organic units connected by carbamate bonds, polyurethane is a versatile polymer that finds extensive application in a variety of applications, such as elastomers, adhesives, sealants, varnishes, and stiff and flexible foams. The North America polyurethane market is essential to important industries like construction, automotive, electronics, furniture, footwear, and packaging due to polyurethane's advantageous qualities, which include its lightweight nature, flexibility, durability, and insulating effectiveness.

The North America polyurethane market is anticipated to be driven by the growing demand for the product from the U.S. construction, automotive, and packaging industries. The growing need for strong, lightweight products in the electronics, construction, and automotive sectors, as well as the use of PU for insulation in a variety of end-use industries, are major factors propelling the expansion of the North America polyurethane market. The market is anticipated to be driven by the growing demand for the product from the nation's construction, automotive, and packaging industries.

Report Coverage

This research report categorizes the market for North America polyurethane market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America polyurethane market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the North America polyurethane market.

North America Polyurethane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21.30 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.05% |

| 2035 Value Projection: | USD 32.95 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | BASF, Covestro AG, Recitel NV/SA, Woodbridge, RTP Company, DIC CORPORATION, Tosoh Bioscience LLC, The Lubrizol Corporation, Mitsui & Co. (U.S.A.), Inc., Huntsman International LLC, Eastman Chemical Company, The Dow Chemical Company, RAMPF Holding GmbH & Co. KG, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increase in demand in the construction industry brought on by foreign direct investment and an increase in construction activity is which propels the North America polyurethane market. The construction industry, which is experiencing a surge in demand due to increased foreign direct investment and rising construction activity, is a key factor driving the North America polyurethane market. The market is expanding as a result of the automotive and aviation sectors' adoption of environmentally friendly solutions, as well as the rising need for strong polymers. The automobile and aerospace sectors are another important driver, as polyurethane foam's lightweight and long-lasting properties make it the perfect material for cushioning and aircraft applications.

Restraining Factors

The commercial growth and sustainability of the North America polyurethane market are restricted by a number of restraining issues, including fluctuating raw material prices, environmental concerns about hazardous emissions, regulatory obstacles, and limited recycling capabilities.

Market Segmentation

The North America polyurethane market share is classified into product and end use.

Get more details on this report -

- The rigid foam segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America polyurethane market is segmented by product into rigid foam, flexible foam, coatings, adhesives & sealants, elastomers, and others. Among these, the rigid foam segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The need for rigid foam insulation, which provides excellent performance and sustainability, has increased due to an increasing focus on energy efficiency in building constructions. Market participants are taking advantage of the tight energy rules and building standards being enforced by governments by pushing rigid foam materials for both new construction and retrofit projects.

- The construction segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America polyurethane market is segmented by end use into furniture and interiors, construction, electronics & appliances, automotive, footwear, packaging, and others. Among these, the construction segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The need for green and insulating structures is fueling the construction industry's sustainable expansion. It is anticipated that as the business grows internationally, sustainable practices need to be incorporated into fundamental building procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America polyurethane market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF

- Covestro AG

- Recitel NV/SA

- Woodbridge

- RTP Company

- DIC CORPORATION

- Tosoh Bioscience LLC

- The Lubrizol Corporation

- Mitsui & Co. (U.S.A.), Inc.

- Huntsman International LLC

- Eastman Chemical Company

- The Dow Chemical Company

- RAMPF Holding GmbH & Co. KG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, BASF announced Haptex 4.0, a polyurethane solution that produces synthetic leather and introduces a completely recyclable material. By using PET fabric as a single unit, this formulation and recycling were made possible, obviating the requirement to remove layers.

- In May 2024, the Pearlbond ECO 590 HMS TPU was introduced by the Lubrizol Corporation to its line of bio-based thermoplastic polyurethane adhesives. TPU is a resin for hot melt adhesives that comes from a renewable source.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America polyurethane market based on the below-mentioned segments:

North America Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

North America Polyurethane Market, By End Use

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

Need help to buy this report?