North America Packaging Tapes Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Plastic and Paper), By End User (E-Commerce, Food and Beverage Industry, Retail Industry, and Others), and North America, Packaging Tapes Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsNorth America Packaging Tapes Market Insights Forecasts to 2035

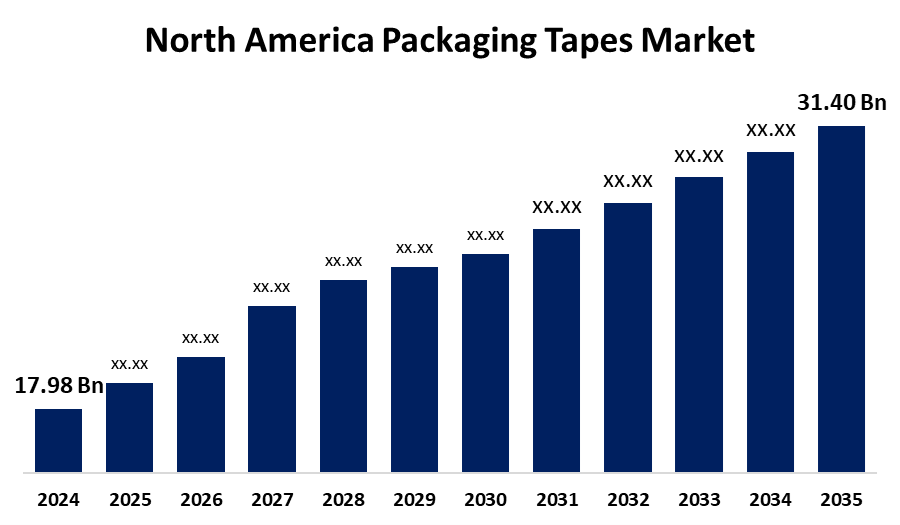

- The North America Packaging Tapes Market Size was Estimated at USD 17.98 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.20% from 2025 to 2035

- The North America Packaging Tapes Market Size is Expected to Reach USD 31.40 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Packaging Tapes Market Size is anticipated to reach USD 31.40 Billion by 2035, Growing at a CAGR of 5.20% from 2025 to 2035. Globalization and international trade, the rise of retail chains, the expansion of the e-commerce industry, strong growth in other industries, a growing focus on sustainable packaging solutions, fast urbanization, and strict adherence to regulations are all factors driving the North America packaging tapes market.

Market Overview

E-commerce, food and beverage, logistics, and manufacturing are just a few of the industries that utilize adhesive tapes for bagging, labeling, fastening, and sealing packages this market is known as the North America packaging tapes market. A variety of tape kinds, including filament, water-activated, and pressure-sensitive tapes, are available in the North America packaging tapes market. Technology developments, increased trade activity, especially in the US, Canada, and Mexico, and growing demand for effective packaging solutions are its main drivers. Technological developments and shifting consumer tastes are driving a major revolution in the North America packaging tapes market. The necessity for safe and durable packaging solutions is heightened by rising industrial production, which drives the North America packaging tapes market. The market for packaging tapes in North America is being driven by the growth of the food and beverage industry since more manufacturing calls for reliable and food-safe packaging options.

Report Coverage

This research report categorizes the market for North America packaging tapes market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America packaging tapes market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America packaging tapes market.

North America Packaging Tapes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 17.98 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.20% |

| 2035 Value Projection: | USD 31.40 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Material Type, By End User |

| Companies covered:: | 3M Company, Berry Global Inc., Scotch Tape, Sealed Air Corporation, Duck Brand, Shurtape Technologies, LLC, Intertape Polymer Group Inc., Avery Dennison Corporation, Nitto Denko Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing demand for packaging tapes that are recyclable, biodegradable, and ecologically friendly is a result of the rising focus on sustainability, which is driving the expansion of the North American packaging tapes market. The increased packaging requirements resulting from e-commerce sales are supporting the use of packing tapes. Online activity has caused sales of consumer products, packaged food and beverage items, and more to reach previously unheard-of levels. Market growth is being driven primarily by the developing global e-commerce market and the expanding online shopping market.

Restraining Factors

The expansion of the North America packaging tapes market is restricted by fluctuating raw material prices. Packaging tapes are very susceptible to changes in the price of crude oil since they depend on important raw materials including polyester, PVC, and petroleum-based adhesives.

Market Segmentation

The North America packaging tapes market share is classified into material type and end user.

- The plastic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America packaging tapes market is segmented by material type into plastic and paper. Among these, the plastic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The widespread usage of plastic packaging tapes to seal carton joints in a variety of industries, such as the food and beverage, personal care, pharmaceutical, chemical, sporting products, and domestic sectors, further strengthens the segment's strength.

- The retail industry segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America packaging tapes market is segmented by end user into E-commerce, food and beverage industry, retail industry, and others. Among these, the retail industry segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The widespread use of packaging tapes in a variety of retail processes, such as product bundling, store inventory control, and safe packaging for consumer goods, is responsible for the retail industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America packaging tapes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Company

- Berry Global, Inc.

- Scotch Tape

- Sealed Air Corporation

- Duck Brand

- Shurtape Technologies, LLC

- Intertape Polymer Group Inc.

- Avery Dennison Corporation

- Nitto Denko Corporation

- Others

Recent Developments

- In August 2024, the rPET Recycled Series, launched by Shurtape Technologies, consists of packaging tapes made from 90% recycled PET film. By utilizing less virgin plastic while preserving durability, this launch encourages sustainability.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America packaging tapes market based on the below-mentioned segments:

North America Packaging Tapes Market, By Material Type

- Plastic

- Paper

North America Packaging Tapes Market, By End User

- E-Commerce

- Food and Beverage Industry

- Retail Industry

- Others

Need help to buy this report?