North America Neo banking Market Size, Share, and COVID-19 Impact Analysis, By Type (Business, Savings), By Application (Enterprises, Personal), By Country (US, Canada, Mexico, Rest of North America), and North America Neo banking Market Insights Forecasts to 2033

Industry: Banking & FinancialNorth America Neo banking Market Insights Forecasts to 2033

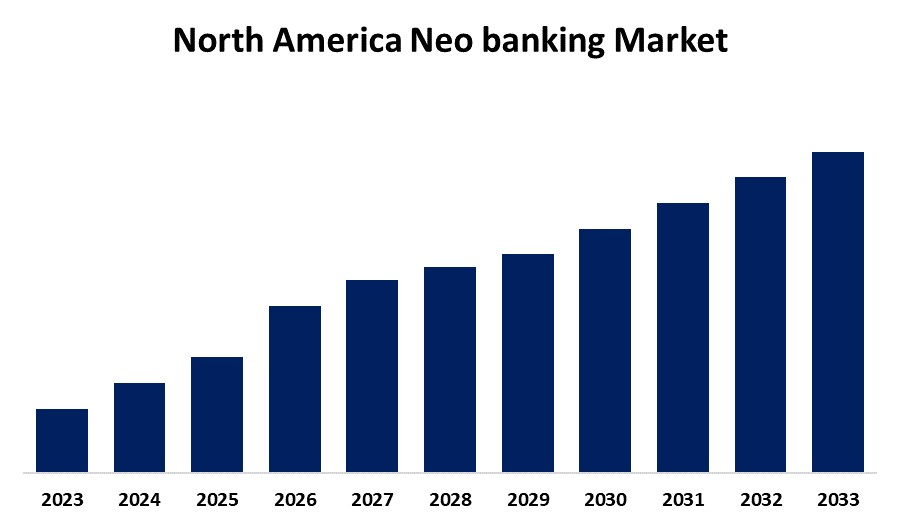

- The Market Size is Growing at a CAGR of XX% from 2023 to 2033

- The North America Neo banking Market Size is Expected to Reach USD XX Billion by 2033

Get more details on this report -

The North America Neo banking Market Size is expected to reach USD XX Billion by 2033, at a CAGR of XX% during the forecast period 2023 to 2033.

Market Overview

The neobank is a first digital financial company that offers online baking services such as debit cards and checking account details. The term neobank is often used interchangeably with digital bank, fintech bank. Neobanks are streamline the banking process by providing financial services in only in digital format. Neobanks help users to validate their offering services through the mobile. Furthermore, the global adoption of smartphones and the internet for online banking is expected to accelerate demand for neobank platforms. The market is growing more quickly as a result of the growing number of bank and organization partnerships to introduce neo banking platforms. Enhancing safety and stability as well as improving customer experience are the goals of these partnerships. For example, the co-creators of Google Pay announced in April 2021 the opening of Fi, a neobank, in collaboration with the Federal Bank to offer instant savings accounts and debit cards to young people in the workforce. Financial service providers are able to provide their clients with innovative digital services thanks to technological breakthroughs and a noticeable rise in internet usage worldwide. Additionally, the rise in popularity of digital wallets has increased demand for the neo banking market.

Report Coverage

This research report categorizes the market for North America Neo banking market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Neo banking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America Neo banking market.

North America Neo banking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | XX% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Country |

| Companies covered:: | Money Lion, Monzo Bank Ltd., Chime Financial Inc., Starling Banks, Tinkoff Bank, Nubank, Sofi, N26, Judo Bank, Revolut, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In order to provide inexpensive money transfer services, numerous financial service providers are teaming up with mobile money wallet providers. Small and medium-sized businesses (SMEs) and retail customers are becoming more and more interested in nonbanking. Free debit cards, digital account opening, instant payments, e-bill generation, account integration, invoice management, and GST-compliant invoicing are just a few of the benefits that neobanks offer to retail customers and small and medium-sized enterprises (SMEs) in comparison to traditional banks.

Restraining Factors

Authenticity and financial security are major barriers to the North America neo banking market's growth over time. Since neobanks mainly provide basic banking services, using one for any complicated financial transactions or help is not advised as the lack of in-person interaction or support can be aggravating.

Market Segment

- In 2023, the business segment accounted for the largest revenue share over the forecast period.

Based on the type, the North America Neo banking market is segmented into business, and savings. Among these, the business segment has the largest revenue share over the forecast period. The enterprise clientele towards the neo bank and for bulk payout systems. The neo baking services strategically aligned with their business account the features with the needs of small enterprise and large enterprise end users, they service such as instant credit limits, detailed account insights and international transfers.

- In 2023, the enterprise segment accounted for the largest revenue share over the forecast period.

On the basis of application, the North America Neo banking market is segmented into enterprises, and personal. Among these, the enterprise segment has the largest revenue share over the forecast period. The research & development investments, the enterprise companies together with the use of technologies like IOT (Internet of Things), AI, big data analytics, foster innovation and allow companies to provide technology in enterprise services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Neo banking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Money Lion

- Monzo Bank Ltd.

- Chime Financial Inc.

- Starling Banks

- Tinkoff Bank

- Nubank

- Sofi

- N26

- Judo Bank

- Revolut

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional and country levels from 2022 to 2033. Spherical Insights has segmented the North America Neo banking Market based on the below-mentioned segments:

North America Neo banking Market, By Type

- Business

- Savings

North America Neo banking Market, By Application

- Enterprises

- Personal

North America Neo banking Market, By Country

- US

- Canada

- Mexico

- Rest of North America

Need help to buy this report?