North America Medical Imaging Market Size, Share, and COVID-19 Impact Analysis, By Product (X-ray Devices, Ultrasound, Computed Tomography, Magnetic Resonance Imaging, and Nuclear Imaging), By End Use (Hospitals, Diagnostic Imaging Centres, and Others), and North America Medical Imaging Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareNorth America Medical Imaging Market Insights Forecasts to 2035

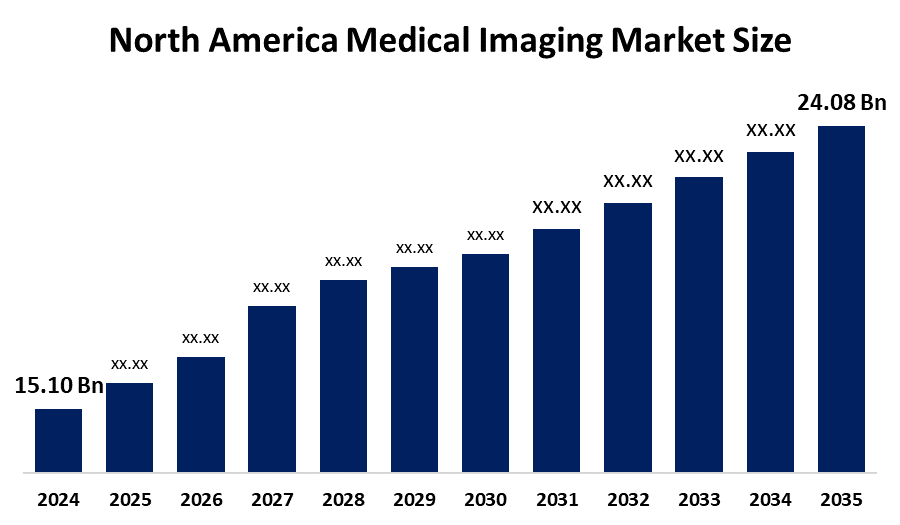

- The North America Medical Imaging Market Size Was Estimated at USD 15.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.33 % from 2025 to 2035

- The North America Medical Imaging Market Size is Expected to Reach USD 24.08 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America medical imaging market is anticipated to reach USD 24.08 billion by 2035, growing at a CAGR of 4.33 % from 2025 to 2035. The aging population, growing healthcare spending, telemedicine development, AI integration, enhanced diagnostic technologies, and innovative minimally invasive imaging solutions are all areas that offer opportunities North American medical imaging market.

Market Overview

The research, development, manufacturing, distribution, and use of cutting-edge imaging technologies for the diagnosis, tracking, and treatment of a range of medical conditions in the US, Canada, and Mexico contribute to the North America medical imaging market. The North America medical imaging market encompasses a broad range of imaging modalities, including nuclear imaging, computed tomography (CT), magnetic resonance imaging (MRI), ultrasound, positron emission tomography (PET), and X-rays. A wide variety of end customers are served by it, such as academic and research institutions, outpatient clinics, diagnostic imaging facilities, and hospitals. The growing need for early detection tools combined with the incidence of lifestyle-related disorders is driving the market's expansion. The presence of numerous industry players and the high frequency of new product launches in the region are two important factors propelling the market's expansion. In addition, the use of AI to automate the identification and quantification of images is anticipated to accelerate North America medical imaging market expansion.

Report Coverage

This research report categorizes the market for North America medical imaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America medical imaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the North America medical imaging market.

North America Medical Imaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15.10 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.33% |

| 2035 Value Projection: | USD 24.08 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product Type, By End Use |

| Companies covered:: | Hologic, Inc., Cubresa Inc., GE Healthcare, PerkinElmer Inc., Koning Corporation, Siemens Healthineers, Koninklijke Philips N.V., FUJIFILM VisualSonics Inc., Samsung Medison Co., Ltd., Mindray Medical International, Canon Medical Systems Corporation, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing prevalence of lifestyle-related disorders, the need for early detection tools, technology improvements that speed up turnaround times, and government investment and reimbursement programs are some of the primary factors propelling the expansion of the North America medical imaging market. One of the main factors driving the market's expansion is the development of technologically sophisticated items. Increased investment, government reimbursement programs, and technological developments to speed up turnaround times are all positive for the expansion of the North American medical imaging market. The North America medical imaging market is essential to improving patient outcomes through early and correct diagnosis, and it is driven by technological improvements, rising healthcare costs, and an aging population.

Restraining Factors

The high cost of technology, strict regulations, reimbursement issues, restricted accessibility in remote areas, and a lack of qualified imaging professionals are some of the factors that are restricting the North American medical imaging market.

Market Segmentation

The North America medical imaging market share is classified into product and end use.

Get more details on this report -

The magnetic resonance imaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America medical imaging market is segmented by product into X-ray devices, ultrasound, computed tomography, magnetic resonance imaging, and nuclear imaging. Among these, the magnetic resonance imaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Numerous organs, including the brain, spine, heart, breast, pelvis, abdomen, and musculoskeletal system, can be imaged using magnetic resonance imaging devices. The market is anticipated to be driven by MRI systems since their remarkable contrast resolution results in scans of superior quality.

The hospitals segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America medical imaging market is segmented by end use into hospitals, diagnostic imaging centers, and others. Among these, the hospitals segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Hospital segment growth is being driven by a number of factors, including the integration of surgical suites with imaging technology and the growing need for improved imaging modalities. Imaging modalities typically have their own room in new hospitals. Hospital expansion is anticipated to be fueled by rising competition and rising demand for top-notch healthcare services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America medical imaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hologic, Inc.

- Cubresa Inc.

- GE Healthcare

- PerkinElmer Inc.

- Koning Corporation

- Siemens Healthineers

- Koninklijke Philips N.V.

- FUJIFILM VisualSonics Inc.

- Samsung Medison Co., Ltd.

- Mindray Medical International

- Canon Medical Systems Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, GE HealthCare has announced the launch of its advanced floor-mounted digital X-ray system, Definium Pace Select ET1, aimed at delivering high-image quality, improved efficiency, and greater accessibility in demanding clinical environments while enhancing overall affordability in medical imaging.

- In January 2024, Canon launched Aplio me, a state-of-the-art shared-service ultrasound system designed to meet the diverse requirements of regular users in a wide range of medical settings. Ultrasound professionals value workflow efficiency and are looking for advanced standard solutions; whether they work in large hospitals or tiny clinics, they will find this incredibly lightweight and portable device ideal.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America medical imaging market based on the below-mentioned segments:

North America Medical Imaging Market, By Product

- X-ray Devices

- Ultrasound

- Computed Tomography

- Magnetic Resonance Imaging

- Nuclear Imaging

North America Medical Imaging Market, By End Use

- Hospitals

- Diagnostic Imaging Centres

- Others

Need help to buy this report?