North America Mayonnaise Market Size, Share, and COVID-19 Impact Analysis, By Type (Unflavored Mayonnaise, Flavored Mayonnaise), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Stores, Specialty Stores, Others), By End Use (Institutional, Retail), By Region (US, Canada, Mexico, Rest of North America), and North America Mayonnaise Market Insights Forecast to 2033

Industry: Food & BeveragesNorth America Mayonnaise Market Insights Forecasts to 2033

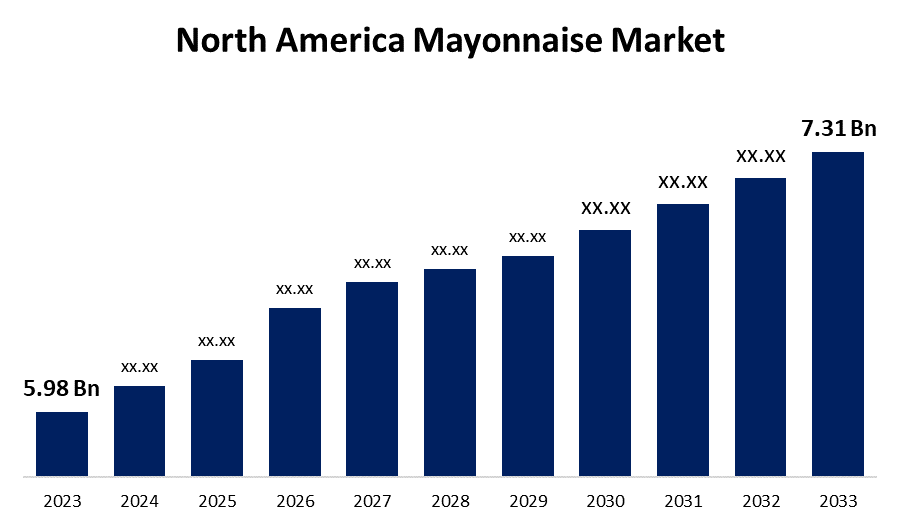

- The North America Mayonnaise Market Size was valued at USD 5.98 Billion in 2023

- The Market Size is Growing at a CAGR of 2.03% from 2023 to 2033.

- The North America Mayonnaise Market Size is Expected to Reach USD 7.31 Billion by 2033.

Get more details on this report -

The North America Mayonnaise Market size is expected to reach USD 7.31 Billion by 2033, at a CAGR of 2.03% during the forecast period 2023 to 2033.

Market Overview

Mayonnaise is a thick, creamy condiment or sauce that has a wide range of culinary applications. It is usually made by combining egg yolks, oil, vinegar or lemon juice, and seasonings. These ingredients are emulsified to form a smooth, creamy texture. It has a full flavor profile that is tangy, slightly acidic, and savory. Mayonnaise, with its creamy texture and distinct flavor, is a versatile ingredient in a variety of dishes. As such, it is frequently used as a sandwich and burger spread, a base for salad dressings and dips, and an ingredient in a variety of sauces and marinades. The market is primarily driven by changing consumer preferences. Mayonnaise is a versatile condiment that can be used on a variety of foods, including sandwiches, salads, burgers, and dips. As consumers seek convenience, flavor variety, and culinary experimentation, mayonnaise's popularity as a flavor-enhancing and customizable ingredient has grown. Furthermore, North America is a culturally diverse region with a growing population from various ethnic backgrounds. Many cuisines use mayonnaise-based sauces and dressings, which has boosted demand for mayonnaise in North America. Furthermore, the expansion of retail channels such as supermarkets, hypermarkets, convenience stores, and online platforms increases the availability and accessibility of mayonnaise products, thereby driving North America market growth.

Report Coverage

This research report categorizes the market for the North America mayonnaise market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America mayonnaise market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America mayonnaise market.

North America Mayonnaise Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.98 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.03% |

| 2033 Value Projection: | USD 7.31 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution Channel, By End Use, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Unilever, Hellmann’s, Inc, The Kraft Heinz Company, McCormick & Company and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers are constantly looking for new flavors and culinary experiences, which is driving demand for a wide range of mayonnaise products. Additionally, the growing fast-food industry and the increasing number of quick-service restaurants have contributed to the demand for mayonnaise as a condiment and ingredient in various dishes. Mayonnaise provides convenience and versatility in meal preparation, making it a popular choice among consumers looking for quick and easy options. The demand for healthier food options has prompted manufacturers to create low-fat, light, and organic mayonnaise to appeal to health-conscious consumers. Furthermore, by offering a diverse range of flavors, mayonnaise manufacturers spark the interest of a larger consumer base, stimulating market demand. Furthermore, packaging formats play a significant role in consumer purchasing decisions. The introduction of new packaging formats, such as squeeze bottles, portion-controlled sachets, and convenient resealable pouches, improves product presentation, ease of use, and storage convenience, thereby contributing to North America mayonnaise market growth.

Restraining Factors

Mayonnaise is frequently associated with high fat and calorie content, which may discourage health-conscious consumers from incorporating it into their diets. Furthermore, consumers have a variety of condiment options to choose from, such as ketchup, mustard, and salad dressings, which may influence demand for mayonnaise. The market is extremely competitive, with many players vying for market share in North America. This fierce competition can present obstacles for new entrants and smaller players.

Market Segment

- In 2023, the unflavored mayonnaise segment accounted for the largest revenue share over the forecast period.

Based on type, the North America mayonnaise market is segmented into unflavored mayonnaise, and flavored mayonnaise. Among these, the unflavored mayonnaise segment has the largest revenue share over the forecast period. Unflavored mayonnaise is a versatile base for a wide variety of dishes. Its neutral flavor complements and enhances the flavors of various ingredients without overpowering them. It can be used as a spread on sandwiches, a base for dressings and sauces, and a binding agent in salads, among other things. Its versatility makes it a popular choice among consumers looking to create their custom flavors or pairings. Consumers can easily create their own unique flavored mayonnaise by combining herbs, spices, and other ingredients. This customization feature appeals to those who enjoy experimenting with new flavors or who have specific dietary restrictions or flavor preferences. Furthermore, unflavored mayonnaise is frequently available in low-fat or light versions, catering to consumers who are mindful of their calorie or fat intake. These healthier options allow people to enjoy mayonnaise's creamy texture and versatility while sticking to their dietary goals.

- In 2023, the supermarkets & hypermarkets segment is witnessing significant growth over the forecast period.

Based on distribution channel, the North America mayonnaise market is segmented into supermarkets and hypermarkets, convenience stores, online stores, specialty stores, and others. Among these, the supermarkets and hypermarkets segment are witnessing significant growth over the forecast period. Mayonnaise is available in a variety of brands, flavors, and packaging sizes at supermarkets and hypermarkets. They provide shelves or dedicated sections for condiments, including mayonnaise. This diverse product offering allows customers to select from a variety of options that cater to their specific preferences, dietary needs, or financial constraints. Furthermore, these stores provide the benefit of bulk purchasing for both individual and institutional customers. Customers can buy mayonnaise in larger quantities, which is more cost-effective for regular use. Bulk purchasing options are especially appealing to households, foodservice establishments, and businesses that require large quantities of mayonnaise.

- In 2023, the institutional segment accounted for the largest revenue share over the forecast period.

Based on end use, the North America mayonnaise market is segmented into institutional, and retail. Among these, the institutional segment has the largest revenue share over the forecast period. Institutional establishments typically require large quantities of mayonnaise to meet their operational demands. These establishments serve a large number of customers each day, and mayonnaise is a common ingredient in many menu items and food preparations. Institutional purchasing and consumption account for a significant portion of the mayonnaise market. Furthermore, these businesses require larger containers or packaging formats, such as tubs, jars, or pouches, to ensure proper storage, use, and distribution. The availability of bulk packaging specifically designed for institutional use allows them to seamlessly integrate mayonnaise into their operations, contributing to their dominant market share.

- The United States is projected to have the largest share of the North America mayonnaise market over the forecast period.

Based on region, the United States is projected to have the largest share of the North America mayonnaise market over the forecast period. The United States has a large population and a high consumption rate for mayonnaise products. Mayonnaise is a popular condiment in American cuisine, being used in sandwiches, salads, dressings, and a variety of recipes. Furthermore, the country's food service industry is expanding, with restaurants, fast food chains, hotels, and catering services. Mayonnaise is widely used in the food service industry, which contributes to its high demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America mayonnaise market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unilever

- Hellmann’s, Inc

- The Kraft Heinz Company

- McCormick & Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the North America mayonnaise market based on the below-mentioned segments:

North America Mayonnaise Market, By Type

- Unflavored Mayonnaise

- Flavored Mayonnaise

North America Mayonnaise Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Stores

- Specialty Stores

- Others

North America Mayonnaise Market, By End Use

- Institutional

- Retail

North America Mayonnaise Market, By Region

- US

- Canada

- Mexico

- Rest of North America

Need help to buy this report?