North America Liquid Biopsy Market Size, Share, and COVID-19 Impact Analysis, By Biomarker (Circulating Tumor Cells (CTCs), Circulating Tumor DNA (ctDNA), Extracellular Vehicles (EVs), and Others), By Application (Cancer, and Reproductive Health), and North America Liquid Biopsy Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareNorth America Liquid Biopsy Market Insights Forecasts to 2035

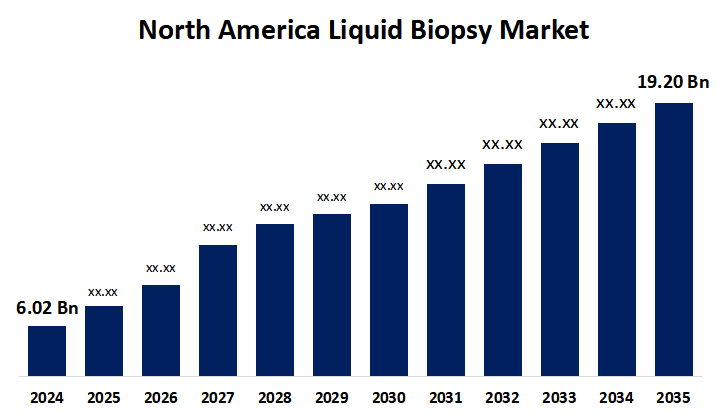

- The North America Liquid Biopsy Market Size Was Estimated at USD 6.02 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.12% from 2025 to 2035

- The North America Liquid Biopsy Market Size is Expected to Reach USD 19.20 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America liquid biopsy market is anticipated to reach USD 19.20 billion by 2035, growing at a CAGR of 11.12% from 2025 to 2035. The growing use and advancement of multi-cancer early detection tests, coupled with the continuous research into liquid biopsy assays and testing, are offering a significant opportunity for North America liquid biopsy market expansion.

Market Overview

The North America liquid biopsy market is the name given to the area of the healthcare diagnostics sector that focuses on non-invasive testing techniques that examine biomarkers from physiological fluids like blood and urine, including circulating tumor DNA (ctDNA), cell-free RNA, and exosomes. The main purposes of these tests are recurrence evaluation, therapy monitoring, and early cancer identification. The North America liquid biopsy market includes products, services, and technology like next-generation sequencing and PCR, and is driven by developments in precision medicine, the growing incidence of cancer, and the need for minimally invasive diagnostics. The market for liquid biopsy is expanding due in large part to the rising incidence of cancer. The growing incidence of cancer, the growing need for non-invasive diagnostics, and the quick development of testing technologies are the main factors driving the North America liquid biopsy market. The market is growing due in large part to the constraints of conventional tissue biopsies, the increased use of liquid biopsy in precision oncology, and favorable regulatory environments.

Report Coverage

This research report categorizes the market for North America liquid biopsy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America liquid biopsy market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America liquid biopsy market.

North America Liquid Biopsy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.02 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.12% |

| 2035 Value Projection: | USD 19.20 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Biomarker, By Application |

| Companies covered:: | Labcorp, F. Hoffmann-La Roche Ltd, Exact Sciences Corporation, Bio-Rad Laboratories, Inc., CARDIFF ONCOLOGY, INC., Sysmex Inostics Inc., Fluxion Biosciences Inc, Johnson & Johnson Services, Inc., Thermo Fisher Scientific Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing incidence of cancer, improvements in cancer diagnostic technology, and increased demand for minimally invasive cancer diagnostics are some of the main factors propelling the North America liquid biopsy market. The use of liquid biopsy products and services is growing as a result of healthcare systems giving priority to technologies that facilitate prompt and precise clinical decision-making as cancer becomes more common. The increasing incidence of cancer, improvements in cancer diagnostic technology, and increased demand for minimally invasive cancer diagnostics are all contributing reasons to the North America liquid biopsy market's expansion.

Restraining Factors

The high expense of liquid biopsy testing, the absence of standardized procedures, the lack of reimbursement coverage, and the scarcity of qualified personnel are major obstacles to North America liquid biopsy market.

Market Segmentation

The North America liquid biopsy market share is classified into biomarker and application.

- The circulating tumor cells (CTCs) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America liquid biopsy market is segmented by biomarker into circulating tumor cells (CTCs), circulating tumor DNA (ctDNA), extracellular vehicles (EVs), and others. Among these, the circulating tumor cells (CTCs) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The biomarker segment for circulating tumor cells (CTCs) is ascribed to the extensive use of circulating tumor DNA (ctDNA) in liquid biopsies for cancer. The market for circulating tumor cells has grown quickly since liquid biopsies are thought to be the best way to find circulating tumor cells.

- The cancer segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America liquid biopsy market is segmented by application into cancer and reproductive health. Among these, the cancer segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The cancer segment as a result of the growing use of liquid biopsies in cancer detection, which is facilitated by the increased incidence of cancer worldwide. One of the most rapidly developing diagnostic procedures, liquid biopsy, has advanced significantly in recent years and is now widely used in clinical settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America liquid biopsy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Labcorp

- F. Hoffmann-La Roche Ltd

- Exact Sciences Corporation

- Bio-Rad Laboratories, Inc.

- CARDIFF ONCOLOGY, INC.

- Sysmex Inostics Inc.

- Fluxion Biosciences Inc

- Johnson & Johnson Services, Inc.

- Thermo Fisher Scientific Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Labcorp announced that it has added two additional products to their precision oncology portfolio growth. The first is Labcorp Plasma Detect, a clinical test intended to assist in assessing patients with stage III colon cancer's likelihood of disease recurrence. The second is the first and only FDA-approved packed liquid biopsy test for pan-solid tumors, PGDx elio plasma focus Dx, which aids in identifying patients who might qualify for targeted treatments.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America liquid biopsy market based on the below-mentioned segments:

North America Liquid Biopsy Market, By Biomarker

Circulating Tumor Cells (CTCs)

- Circulating Tumor DNA (ctDNA)

- Extracellular Vehicles (EVs)

- Others

North America Liquid Biopsy Market, By Application

- Cancer

- Reproductive Health

Need help to buy this report?