North America Hospital Beds Market Size, Share, and COVID-19 Impact Analysis, By Type (Acute Care Beds, Rehabilitative Care Beds, Long-Term Care Beds, Other Hospital Beds), By Function (Manual, Electric), By Application (Intensive, Non-Intensive), By End-User (Hospitals, Long Term Care Centers, Acute Care Facilities, Others), and North America Hospital Beds Market Insights Forecasts to 2032

Industry: HealthcareNorth America Hospital Beds Market Size Insights Forecasts to 2032

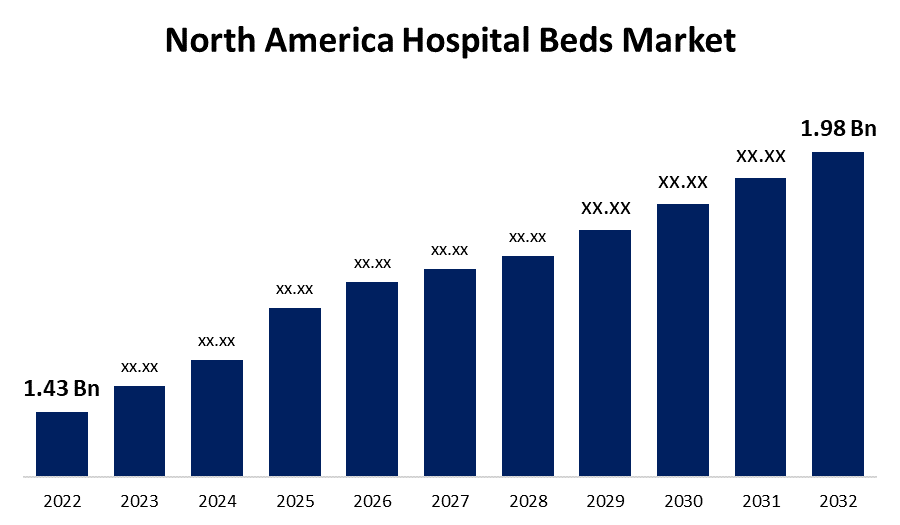

- The North America Hospital Beds Market Size was valued at USD 1.43 Billion in 2022.

- The Market Size is Growing at a CAGR of 3.3% from 2022 to 2032.

- The North America Hospital Beds Market Size is expected to reach USD 1.98 Billion by 2032.

Get more details on this report -

The North America Hospital Beds Market Size is expected to reach USD 1.98 Billion by 2032, at a CAGR of 3.3% during the forecast period 2022 to 2032.

Market Overview

The rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and others is increasing the number of hospital admissions in the region, putting strain on the healthcare infrastructure. Key players are increasing their manufacturing capacities to meet the rising number of hospital admissions and the growing demand for beds in various healthcare settings. Additionally, growing government investment in enhancing the regional healthcare infrastructure, as well as the establishment of new hospitals and expansion of existing healthcare facilities in the countries, is expected to drive the growth of the North America hospital beds market. The growth of the market in North America is attributed to the increasing adoption of healthcare smart beds in acute care or long-term care facilities. The global healthcare environment has changed significantly over the last few years. Many countries around the world have seen unprecedented economic growth. As a result, the economic, cultural, industrial, and healthcare environments in these economies have changed significantly. This rapid growth in the healthcare industry is mainly caused by widespread policy reforms, economic liberalization, rapidly growing middle-class populations with rising purchasing power, and increased investments in infrastructure development.

Report Coverage

This research report categorizes the market for North America hospital beds market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America hospital beds market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America hospital beds market.

North America Hospital Beds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.43 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.3% |

| 2032 Value Projection: | USD 1.98 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Function, By Application, By End- User |

| Companies covered:: | Hill-Rom Services Inc., Stryker, Arjo, Invacare Corporation, GF Health Products, Inc., Span America, LINET, PARAMOUNT BED CO., LTD, Joerns Healthcare LLC, and Others Companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Increased hospitalizations due to an increase in chronic disease cases will drive market growth during forecast period. Cancer, cardiovascular disease, diabetes, and other chronic diseases are among the leading causes of disability and mortality in the populations of the United States and Canada. The region is currently dealing with a significant burden of lifestyle-related disorders and noncommunicable diseases, necessitating proper management to avoid premature deaths. Moreover, the government in the region is launching a number of programs to raise patient awareness about the proper management of various chronic disorders. The increased awareness is causing a greater influx of patients to hospitals for early diagnosis and proper treatment, causing the healthcare infrastructure to become stressed. These factors are also increasing demand for beds in the region, which is propelling market growth during forecast period.

Restraining Factors

Despite various technological advancements in the product and the introduction of new and innovative beds, the rising number of voluntary recalls of a few beds is limiting market growth. Product recalls are caused by a variety of factors, including poor quality and malfunctioning hospital bed accessories, which impact manufacturers' brand presence and impede product adoption. This has shifted consumer preferences toward market-available refurbished and rental products.

Market Segment

- In 2022, the acute care beds segment accounted for the largest revenue share over the forecast period.

Based on the type, the North America hospital beds market is segmented into acute care beds, rehabilitative care beds, long-term care beds, other hospital beds. Among these, the acute care beds segment has the largest revenue share over the forecast period. This dominance can be attributed to the rising burden of chronic diseases, an increase in surgeries, and an increase in the number of serious injuries resulting in hospitalizations in the region. Other factors driving the segment's growth include favorable reimbursement scenarios and the government's emphasis on increasing hospital bed capacity.

- In 2022, the electric segment holds the fastest revenue growth over the forecast period.

Based on function, the North America hospital beds market is segmented into manual, and electric. Among these, the electric segment holds the fastest revenue growth over the forecast period. Electric beds are in high demand in a variety of healthcare settings due to benefits such as reduced pressure ulcer risk, easy patient transfer, enhanced safety features such as adjustable side rails to prevent falls, and others. Furthermore, key player’s launches of technologically advanced electric beds are promoting the segment's growth during forecast period.

- In 2022, the intensive segment accounted for the significant revenue growth over the forecast period.

Based on application, the North America hospital beds market is segmented into intensive, non-intensive. Among these, the intensive segment has the significant revenue growth over the forecast period. The rising incidence of life-threatening conditions, the increasing number of surgical procedures, growing government initiatives to increase intensive care capacity in the region, and other factors are all contributing to the increased demand for intensive care beds. In addition, the growing number of hospitals with dedicated ICU units is driving up demand for these beds. Furthermore, key players shifting their focus to R&D initiatives to launch new and advanced beds for use in Intensive Care Units (ICUs) in hospitals is fueling the segment's growth during the forecast period.

- In 2022, the hospitals segment accounted for the significant revenue growth over the forecast period.

Based on end user, the North America hospital beds market is segmented into hospitals, long term care centers, acute care facilities, others. Among these, the hospitals segment has the largest revenue share over the forecast period. This segment's dominance can be attributed to the region's growing number of hospitals as a result of the opening of new healthcare facilities. Furthermore, existing hospitals are shifting their focus to increase bed capacity in order to meet the rising patient burden, which is expected to grow demand for beds.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America hospital beds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hill-Rom Services Inc.

- Stryker

- Arjo

- Invacare Corporation

- GF Health Products, Inc.

- Span America

- LINET

- PARAMOUNT BED CO., LTD

- Joerns Healthcare LLC

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, GF Health Products Inc. expanded its offering of New Basic American 7200 beds for subacute care and extended care. in United States.

- In April 2023, Invacare Corporation collaborated with MedCare Group LLC to broaden the reach of its lifestyle product portfolio, which includes hospital beds, in North America

- In February 2023, Linet introduced Essenza, a new line of acuity medical beds with a wide range of configurations designed to reduce nurses' physical effort.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America hospital beds market based on the below-mentioned segments

North America Hospital Beds Market, By Type

- Acute Care Beds

- Rehabilitative Care Beds

- Long-Term Care Beds

- Other Hospital Beds

North America Hospital Beds Market, By Function

- Manual

- Electric

North America Hospital Beds Market, By Application

- Intensive

- Non-Intensive

North America Hospital Beds Market, By End-User

- Hospitals

- Long Term Care Centers

- Acute Care Facilities

- Others

Need help to buy this report?