North America Home Security Systems Market Size, Share, and COVID-19 Impact Analysis, By Integration (Self-Contained Systems, Integrated Systems), By Installation (DIY Type, Professional Installed), By Sensor Type (Wireless Sensors, Wired Sensors), By Equipment Type (Video Surveillance, Intruder Alarms, Electronic Locks, Fire Sprinklers and Extinguishers, Others), By Country (United States, Canada, Mexico, Rest of North America), and North America Home Security Systems Market Insights Forecasts to 2032

Industry: Electronics, ICT & MediaNorth America Home Security Systems Market Insights Forecasts to 2032

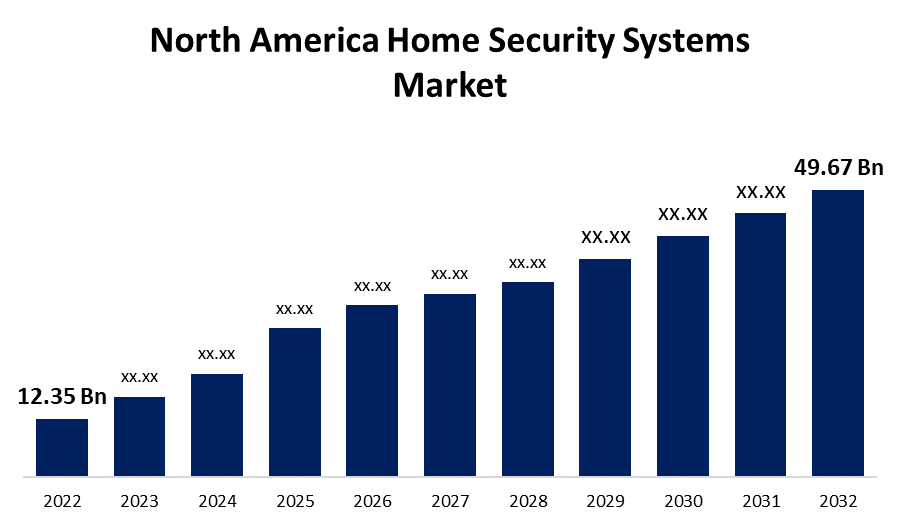

- The North America Home Security Systems Market Size was valued at USD 12.35 Billion in 2022.

- The Market is Growing at a CAGR of 14.93% from 2022 to 2032.

- The North America Home Security Systems Market Size is expected to reach USD 49.67 Billion by 2032.

Get more details on this report -

The North America Home Security Systems Market Size is expected to reach USD 49.67 Billion by 2032, at a CAGR of 14.93% during the forecast period 2022 to 2032.

Market Overview

A home security system is essentially made up of various sensors or cameras that connect together to a single control panel to protect the home. The devices used to control the whole house protection system, windows and door sensors, motion sensors, and security cameras are all part of the home security system. Yard indications, alarms, and window labels are also included. These integrated electronic devices are used to protect homes from invaders and burglars. The home security system industry in North America is the leading market for home security systems worldwide, owing to rising property-related crimes. The availability of advanced devices for the expansion of modern home security system applications is boosting industry growth. Wireless alerts, remote systems, motion or body temperature detectors, and adaptable and smart alarm systems are examples of home security systems. The Internet of Things (IoT) has had a significant impact on home security solutions in recent years. With the help of IoT integration in home security systems, several businesses are introducing systems with enhanced security features for monitoring. IoT integration makes the home safer, more interconnected, and controllable from a distance.

Report Coverage

This research report categorizes the North America Home Security Systems Market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Home Security Systems Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America home security systems market.

North America Home Security Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 12.35 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 14.93% |

| 2032 Value Projection: | USD 49.67 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Integration, By Installation, By Sensor Type, By equipment Type, By Country, and COVID-19 Impact Analysis |

| Companies covered:: | Protect America, Inc., Arlo Technologies, Inc., Vivinit Smart Home, Inc., SimpliSafe Inc., Bosch Security Systems, LLC, United Technologies, Resideo Technologies, Inc, ADT Inc., Johnson Controls International plc., and Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

IoT-based security systems improve user safety by sending immediate notifications. Smart sensing identifies and informs the user of changes in movement, temperature, and sound. With the availability of a vast number of high-quality data, IoT makes devices smarter. For example, the utilization of high-definition cameras, infrared vision, and night vision surveillance systems ensures that event details are available 24 hours a day, seven days a week. When there is actual movement, motion activation records and transmits the data. Digital video recording (DVR) devices assist in locating a clip of an event for a specific date and time within an entire recording. As a result, the advent of IoT devices and effective wireless communication is predicted to boost the adoption of multi-functional home security systems.

Restraining Factors

The cost of the hardware, software, and services necessary for security system implementation has a considerable impact on the adoption of home security systems. A professionally set-up system has a higher upfront installation cost due to costly components and consultation prices. The cost of ownership is also considerable because the system requires regular maintenance, membership fees, and replacement costs in the event of damage. Subscription costs charged by third-party monitoring players typically range between USD 150 and USD 1,500. Furthermore, software with extensive analytics features is expensive and contributes to the overall cost of the system.

Market Segment

- In 2022, the integrated systems segment accounted for the largest revenue share in the forecast period.

Based on the integration, the North America Home Security Systems Market is segmented into self-contained systems and integrated systems. Among these, the integrated systems segment has the largest revenue share over the forecast period. An integrated security system involves multiple security measures into one cohesive unit. The connection increases the effectiveness of your security building construction, simplifies system maintenance, and saves money in the long run. Integrated systems link CCTV cameras, alarm systems, access control systems, and other security solutions so that they can share data (for increased reliability and situational awareness) and individuals can manage and track their unified system from a single interface.

- In 2022, the professional installed segment accounted for the largest revenue share over the forecast period.

On the basis of installation, the North America home security systems market is segmented into DIY type and professional installed. Among these, the professional installed segment has the largest revenue share over the forecast period. A home security system will be correctly installed and functional when you require it the most when it is installed by a professional, delivering you security and assurance. In fact, electrical wiring, social networking, and connecting the system with the internet and other devices are all technical parts of home security system installation all this is professionally done by professional installed.

- In 2022, the wireless sensors segment is expected to hold the largest share of the North America home security systems market during the forecast period.

Based on the sensor type, the North America home security systems market is classified into wireless sensors and wired sensors. Among these, the wireless sensors segment is expected to hold the largest share of the North American home Security Systems Market during the forecast period. Remote solutions are available for wireless sensors. Wireless sensors benefit from the ability to communicate over cellular networks. Your wireless system, in essence, has its own mobile device for communicating with the monitoring center. You could, for example, track your system using a smartphone application.

- In 2022, the video surveillance segment accounted for the largest revenue share over the forecast period.

Based on the application, the North America home security systems market is classified into video surveillance, intruder alarms, electronic locks, fire sprinklers, and extinguishers. Among these, the video surveillance segment is expected to hold the largest share of the North American home Security Systems Market during the forecast period. The segment's expansion can be attributed to the increasing demand for video surveillance systems by residential, commercial, and industrial organizations due to their better efficiency and affordable cost of installation. The major benefit of video surveillance is that once the footage is recorded, anyone can able to access it from anywhere.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Home Security Systems Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Protect America, Inc.

- Arlo Technologies, Inc.

- Vivinit Smart Home, Inc.

- SimpliSafe Inc.

- Bosch Security Systems, LLC

- United Technologies

- Resideo Technologies, Inc

- ADT Inc.

- Johnson Controls International plc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On May 2022, Resideo Technologies purchased First Alert, Inc., a provider of home security solutions. Smoke alarms, carbon monoxide (CO) alarms, combination alarms, connected fire and CO devices, fire extinguishers, and other suppression options are all available from First Alert.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America home security systems market based on the below-mentioned segments:

North America Home Security Systems Market, By Integration

- Self-Contained Systems

- Integrated Systems

North America Home Security Systems Market, By Installation

- DIY Type

- Professional Installed

North America Home Security Systems Market, By Sensor Type

- Wireless Sensors

- Wired Sensors

North America Home Security Systems Market, By Equipment Type

- Video Surveillance

- Intruder Alarms

- Electronic Locks

- Fire Sprinklers &Extinguishers

- Others

North America Home Security Systems Market, By Country

- United States

- Canada

- Mexico

Need help to buy this report?