North America Fuel Cell Market Size, Share, and COVID-19 Impact Analysis, By Product (PEMFC, PAFC, and SOFC), By Application (Stationary, Transportation, and Portable), and North America Fuel Cell Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerNorth America Fuel Cell Market Insights Forecasts to 2035

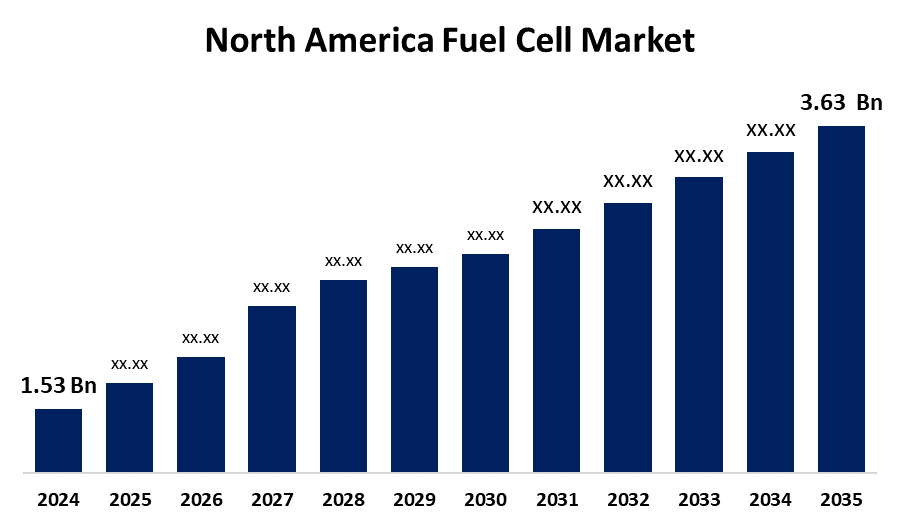

- The North America Fuel Cell Market Size Was Estimated at USD 1.53 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.17% from 2025 to 2035

- The North America Fuel Cell Market Size is Expected to Reach USD 3.63 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Fuel Cell Market Size is anticipated to reach USD 3.63 Billion by 2035, Growing at a CAGR of 8.17% from 2025 to 2035. Increasing application of fuel cell batteries for the electricity backup in various regions of North America, according to the U.S. Department of Energy, 40 states in America use fuel cells as backup for electricity, which shows the increasing adoption of fuel cells in North America

Market Overview

The electrochemical device that converts or transfers chemical energy into electric energy or heat is known as a fuel cell. In a fuel cell, the most commonly used chemical is hydrogen, and an oxidant (that is, oxygen from air) is converted into electricity and heat. Rather than using a mechanical generator to generate heat by burning the fuel, by avoiding combustion fuel cell interacts with the chemical and air electrochemically. Additionally, the fuel cell market in North America is driven by the increasing government involvement in controlling and reducing carbon emissions and pollution caused due to the automobile and various industries that use fuel for combustion and increase carbon emissions. Control measures for rising carbon emissions and pollution in North America are the rapid utilization of fuel cells in automobiles and various other industries. Furthermore, by 2050 for the United States the SDSN USA has revealed the United States Zero-Carbon Action Plan, a thorough set of regulations that outlines a calculated strategy to make the US economy carbon neutral. This rising government initiative for controlling carbon emissions in the United States further fuelled the fuel cell market growth and development.

Report Coverage

This research report categorizes the market for North America fuel cell market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America fuel cell market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the North America fuel cell market.

North America Fuel Cell Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.53 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.17% |

| 2035 Value Projection: | USD 3.63 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Plug Power Inc., Ballard Power Systems, FuelCell Energy Inc., Bloom Energy, Nuvera Fuel Cells LLC, Hydrogenics Corporation, Power to Hydrogen, Zero Emission Industries (ZEI), Horizon Fuel Cell Technologies, Bosch (North America), Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North America fuel cell market is expanding due to the growing demand for eco-friendly solutions for minimizing carbon emissions and pollution caused due to the combustion process of fuel. Additionally, around 210 fuel cell electric power generators were in operation at 151 facilities in the United States as of the end of March 2024, with a total nameplate electric generation capacity of approximately 384 megawatts (MW). This steady rise in facility and capacity for fuel cell electric power generators continues to fuel the growth and development of the North America fuel cell market. Furthermore, the US has 60 hydrogen fuel stations that are all present in California. This easy availability of fuel cell stations further increases the demand for fuel cell-operated automobiles, which directly propelled the growth of the North America fuel cell market.

Restraining Factors

There are some challenges in the fuel cell market in North America, such as high initial cost and a huge investment is required for initiating the manufacturing unit for fuel cells. Another factor is that the high price of fuel cells directly increases the price of automobiles that use fuel cells compared to a normal automobile. Limited availability of hydrogen to match the demand and a lack of infrastructure for the production of the required hydrogen.

Market Segmentation

The North America fuel cell market share is classified into product and application.

- The PEMFC segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America fuel cell market is segmented by product into PEMFC, PAFC, and SOFC. Among these, the PEMFC segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. The demand for proton exchange membrane fuel cells is increasing due to their ability to generate energy by providing more efficiency and less carbon emissions in comparison with other technologies. Additionally, this proton exchange membrane fuel cell technology is used in lots of different industries, such as the transportation industry, and also in portable gadgets and stationary electrical systems. Proton exchange membrane fuel cells (PEMFC) provide power efficiency up to 400kw that is more than compared to other technologies, and also PEMFC technology has a long operational lifetime among other technologies, which is around 60,000 hours.

- The stationary segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America fuel cell market is segmented by application into stationary, transportation, and portable. Among these, the stationary segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the ability of a stationary fuel cell to power various types of gadgets and instruments, from a PC to a home, and even larger than that, up to 200kw.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America fuel cell market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Plug Power Inc.

- Ballard Power Systems

- FuelCell Energy Inc.

- Bloom Energy

- Nuvera Fuel Cells LLC

- Hydrogenics Corporation

- Power to Hydrogen

- Zero Emission Industries (ZEI)

- Horizon Fuel Cell Technologies

- Bosch (North America)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Bloom and Oracle announced a significant agreement for the three-month deployment of Bloom's solid oxide fuel cell (SOFC) technology in specific data centers. Following partnerships with American Electric Power, Equinix, and CoreWeave, Bloom is now positioned as a major off-grid power provider for hyperscale and AI data center operators that are dealing with grid limitations.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America fuel cell market based on the below-mentioned segments:

North America Fuel Cell Market, By Product

- PEMFC

- PAFC

- SOFC

North America Fuel Cell Market, By Application

- Stationary

- Transportation

- Portable

Need help to buy this report?