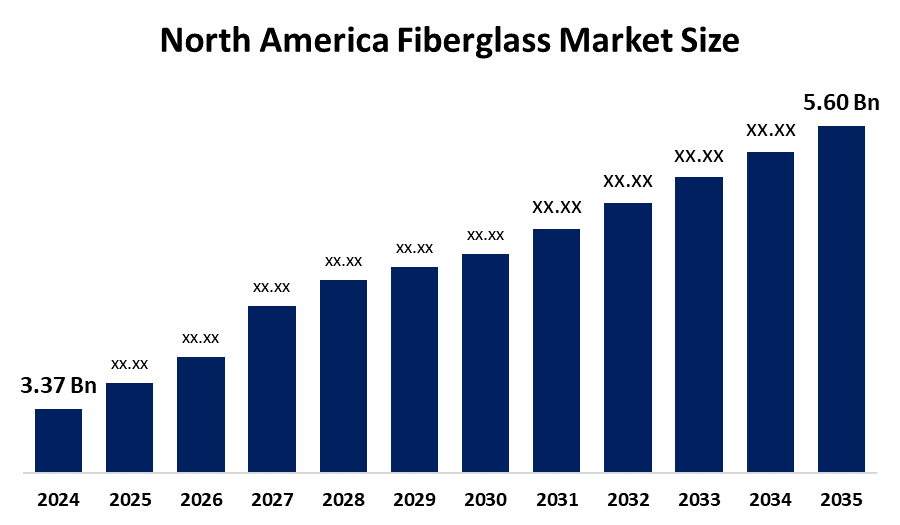

North America Fiberglass Market is Expected to Grow from USD 3.37 Billion in 2024 to USD 5.60 Billion by 2035, Growing at a CAGR of 4.73% during the Forecast Period 2025-2035.

Industry: Advanced MaterialsNorth America Fiberglass Market Insights Forecasts to 2035

- The North America Fiberglass Market Size Was Estimated at USD 3.37 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.73 % from 2025 to 2035

- The North America Fiberglass Market Size is Expected to Reach USD 5.60 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America fiberglass market is anticipated to reach USD 5.60 billion by 2035, growing at a CAGR of 4.73% from 2025 to 2035. The North America fiberglass market offers opportunities for growing infrastructure, renewable energy projects, lightweighting automobiles, and building applications. These chances are fueled by sustainability objectives, technical breakthroughs, and the growing need for long-lasting composite materials.

Market Overview

The industry that produces, distributes, markets, and sells carpets and rugs in the North American region, which is mainly made up of the United States, Canada, and Mexico, is known as the North America fiberglass market. The North America fiberglass market offers a wide variety of goods for both home and commercial use, including tufted, woven, needle-punched, and knotted carpets and rugs. These products are prized for their capacity to improve interior spaces, comfort, insulating qualities, and visual appeal. The demand for fiberglass has greatly increased due to the increased focus on lowering vehicle weight and improving fuel economy. Furthermore, it is anticipated that the growing need for composite materials and insulation in the automotive industry will further propel North America fiberglass market expansion. This expansion is ascribed to the growing need for strong and lightweight materials in the automotive and aerospace industries, which improve performance and fuel economy and drives the North America fiberglass market.

Report Coverage

This research report categorizes the market for North America fiberglass market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America fiberglass market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the North America fiberglass market.

North America Fiberglass Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.37 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.73% |

| 2035 Value Projection: | USD 5.60 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Jushi Owens Corning Taishan Fiberglass PPG Industries Inc Johns Manville Knauf Insulation Saint-Gobain Nippon Electric Glass Chongqing Polycomp International Corp. Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market expansion for fiberglass is fueled by its high resistance, durability, and other bled-of qualities, which are utilized in a variety of manufacturing industries. The fiberglass market is expanding due to the growing demand for lightweight and environmentally friendly materials from a variety of end-user sectors, including wind energy, wind energy, automotive, aerospace, and construction. Growth in the fiberglass market is accelerated by rising investments in the creation of fiberglass materials as well as research and development efforts aimed at expanding the use of fiberglass materials.

Restraining Factors

High production costs, environmental concerns, health risks during manufacturing, a lack of recycling options, and variable raw material prices that impact overall market growth are some of the factors restricting the growth of the North America fiberglass market.

Market Segmentation

The North America fiberglass market share is classified into product type and application.

- The glass wool segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America fiberglass market is segmented by product type into glass wool, yarn, roving, chopped strand, and others. Among these, the glass wool segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Glass wool is a popular option in the HVAC and construction sectors because of its superior thermal insulation qualities. Glass wool's appeal is further boosted by the movement toward sustainable construction methods due to its recyclable and supports environmentally acceptable building regulations.

- The composites segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America fiberglass market is segmented by application into insulation and composites. Among these, the composites segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Composite materials are a result of the growing need for high-performance, lightweight materials in a variety of industries, most notably the automotive and aerospace sectors. Composites provide a perfect answer because of their strength-to-weight ratio as manufacturers work to improve fuel efficiency and lower emissions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America fiberglass market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jushi

- Owens Corning

- Taishan Fiberglass

- PPG Industries Inc

- Johns Manville

- Knauf Insulation

- Saint-Gobain

- Nippon Electric Glass

- Chongqing Polycomp International Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, Saint-Gobain announced that it has acquired U.P. Twiga Fiberglass Ltd., a market leader in glass wool insulation in India. By addressing the growing need for acoustically pleasing and energy-efficient solutions, this calculated move seeks to strengthen Saint-Gobain's position in interior and façade solutions. U.P. Twiga has been using Saint-Gobain technology since 2005 and operates two manufacturing facilities close to Delhi and Mumbai.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America fiberglass market based on the below-mentioned segments:

North America Fiberglass Market, By Product Type

- Glass Wool

- Yarn

- Roving

- Chopped Strand

- Others

North America Fiberglass Market, By Application

- Insulation

- Composites

Need help to buy this report?