North America Feed Phytogenics Market Size, Share, and COVID-19 Impact Analysis, By Type (Herbs, Species, Essential Oils, Oleoresins, and Others), By Application (Ruminant, Poultry, Swine, Aquaculture, and Others), and North America Feed Phytogenics Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesNorth America Feed Phytogenics Market Insights Forecasts to 2035

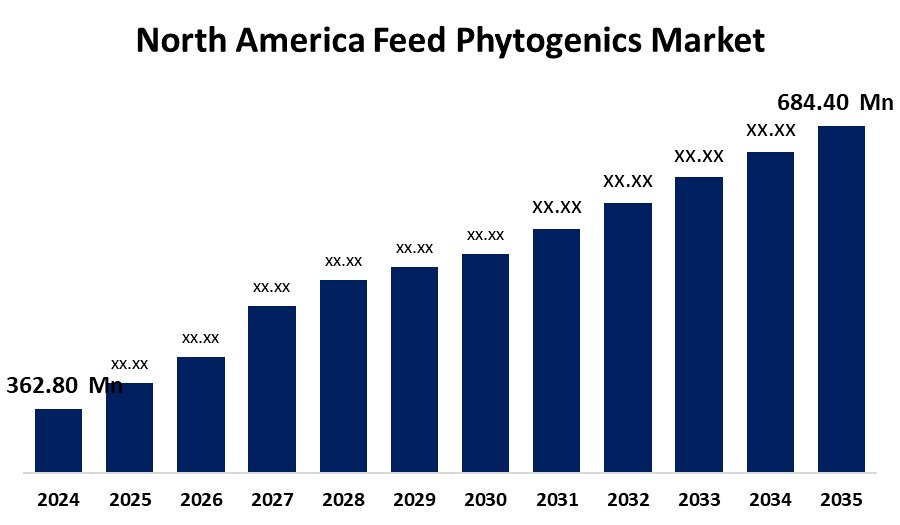

- The North America Feed Phytogenics Market Size Was Estimated at USD 362.80 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.94% from 2025 to 2035

- The North America Feed Phytogenics Market Size is Expected to Reach USD 684.40 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America feed phytogenics market is anticipated to reach USD 684.40 million by 2035, growing at a CAGR of 5.94% from 2025 to 2035. Growing focus on animal health and welfare, rising demand for natural growth promoters, rising meat consumption and quality standards, and technological advancements in extraction techniques are the main factors driving the North America feed phytogenics market.

Market Overview

Natural plant-based additives used in animal nutrition to improve growth, immunity, and digestion are the main focus of the North America feed phytogenics market. These additives, which support sustainable animal production, act as antibiotic substitutes and include flavonoids, essential oils, and saponins. Growing customer demand for meat free of antibiotics, legal limitations on artificial additives, and improvements in extraction techniques are driving the North America feed phytogenics market. Due to extensive industrial farming and strict food safety laws that encourage innovation and market growth. Increased demand for feed phytogenics, natural growth promoters generated from plants, has led to a rise in the market by improving the health and performance of cattle. Increased disposable income and population increase are driving the need for feed phytogenics in the North American market. North America feed phytogenics market expansion is expected to be driven by government investments in agriculture to meet the need for food.

Report Coverage

This research report categorizes the market for North America feed phytogenics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America feed phytogenics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America feed phytogenics market.

North America Feed Phytogenics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 362.80 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.94% |

| 2035 Value Projection: | USD 684.40 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type, By Application Share, and COVID-19 Impact Analysis |

| Companies covered:: | ADM, Cargill, Inc, Adisseo, DSM-Firmenich, Pancosma SA, Kemin Industries, Natural Remedies Pvt. Ltd., DuPont de Nemours, Inc., Delacon Biotechnik GmbH, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Growing consumer awareness of food safety and a growing desire for dairy and meat products that are produced naturally are driving the North America feed phytogenics industry. The growing demand for premium animal products is fueling the North America feed phytogenics market. The need for feed additives in the creation of compound feed is driven by the growing use of intensive farming techniques. The market for feed phytogenics in North America is expected to develop as a result of this trend. The need for healthier meat and dairy products from consumers has led livestock farmers to improve the quality of their feed. The demand for natural feed additives has increased in the North American region as a result of the move to organic and sustainable animal production practices as well as growing worries about antibiotic resistance.

Restraining Factors

High production costs, varying species efficacy, regulatory obstacles, low consumer knowledge, and competition from synthetic additives are the main factors restricting the North America feed phytogenics market.

Market Segmentation

The North America Feed Phytogenics market share is classified into type and application.

- The essential oils segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America feed phytogenics market is segmented by type into herbs, species, essential oils, oleoresins, and others. Among these, the essential oils segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The essential oils segment is characterized by its high concentration of bioactive components and demonstrated ability to improve animal health and feed conversion rates. These substances are essential oils for contemporary animal production due to their strong antibacterial and anti-inflammatory qualities.

- The poultry segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America feed phytogenics market is segmented by application into ruminant, poultry, swine, aquaculture, and others. Among these, the poultry segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The poultry segment, primarily affected by the industry's early adoption of natural feed additives to improve performance and meat quality, and the large-scale production of chicken products. In intensive poultry operations, these additives are essential for preserving intestinal health and improving feed efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America feed phytogenics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADM

- Cargill, Inc

- Adisseo

- DSM-Firmenich

- Pancosma SA

- Kemin Industries

- Natural Remedies Pvt. Ltd.

- DuPont de Nemours, Inc.

- Delacon Biotechnik GmbH

- Others

Recent Developments

- In July 2024, a new range of essential oil-based feed additives with improved stability and bioavailability was launched by Cargill, Inc. especially for the production of poultry.

- In October 2024, expanding its research facilities in the United States, BIOMIN Holding GmbH has decided to focus on creating next-generation phytogenic feed additives for sustainable animal production.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America feed phytogenics market based on the below-mentioned segments:

North America Feed Phytogenics Market, By Type

- Herbs

- Species

- Essential Oils

- Oleoresins

- Others

North America Feed Phytogenics Market, By Application

- Ruminant

- Poultry

- Swine

- Aquaculture

- Others

Need help to buy this report?