North America Fats & Oils Market Size, Share, and COVID-19 Impact Analysis, By Source (Animal Fat and Vegetable Oil), By Application (Food and Non-Food Use), and North America Fats & Oils Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesNorth America Fats & Oils Market Insights Forecasts to 2033

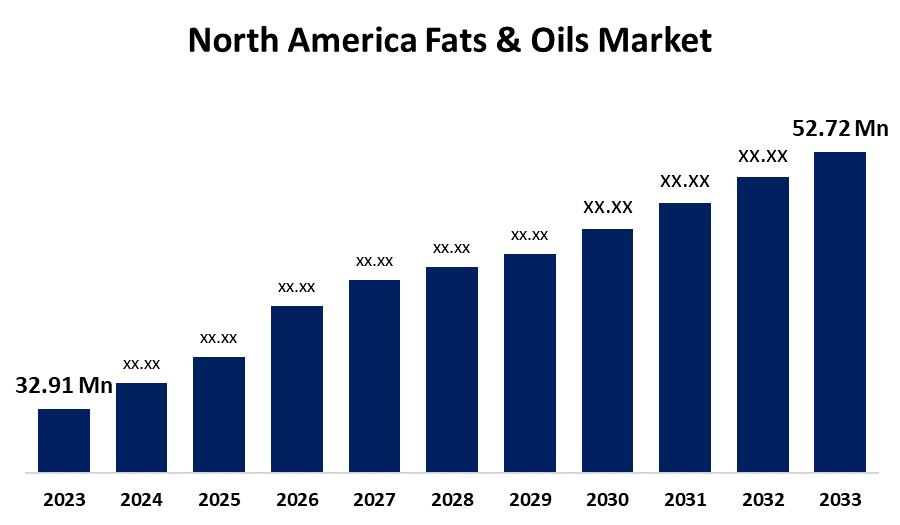

- The North America Fats & Oils Market Size was valued at USD 32.91 Million tonnes in 2023.

- The Market is Growing at a CAGR of 4.82% from 2023 to 2033

- The North America Fats & Oils Market Size is Expected to reach USD 52.72 Million tonnes by 2033

Get more details on this report -

The North America Fats & Oils Market is Anticipated to reach USD 52.72 Million tonnes by 2033, Growing at a CAGR of 4.82% from 2023 to 2033.

Market Overview

The North America fats and oils market involves the production, distribution, and consumption of plant and animal-derived fats and oils used in food preparation, industrial applications, and processed foods. Free fatty acids, phospholipids, glycolipids, sterols, triglycerides, mono and diglycerides, and other fat-soluble constituents are all complex combinations of lipids that make up fats and oils. They are extensively utilized in a variety of industries, including the food, cosmetic, and pharmaceutical sectors. The market for functional foods and nutraceuticals is focused on bioactive lipid components because of their potential health advantages. Two types of fats are solid at room temperature: trans fats and saturated fats. Fish and poultry include saturated fat, which raises cholesterol levels. Utilized in processed goods, cookies, and chips, trans fat is harder at room temperature. Fats and oils are liquids at normal temperature. Monounsaturated fats from avocados, almonds, and vegetable oils are examples of unsaturated fats that can lower cholesterol. Through the maintenance of high HDL cholesterol and the reduction of harmful LDL cholesterol, monounsaturated fats aid in cholesterol regulation. Omega-3 and Omega-6 polyunsaturated fats have the potential to reduce LDL heart disease. The market for fats and oils is expanding due to the expansion of the cosmetics and personal care sector. Since they have their emollient qualities, oils and fats are necessary components of cosmetic goods like cosmetics, skincare, and haircare. Shea butter, coconut oil, and argan oil are well-known for their moisturizing and nourishing properties. The market is also being positively impacted by the rising demand for convenience and processed goods. Ready-to-eat (RTE) and packaged items are becoming more popular as consumers look for quick meal choices. As they provide texture, flavor, and shelf stability, fats and oils are essential in product development. One of the main drivers of increasing demand is the growing disposable income of the middle class.

Report Coverage

This research report categorizes the North America fats & oils market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America fats & oils market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America fats & oils market.

North America Fats & Oils Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 32.91 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.82% |

| 2033 Value Projection: | USD 52.72 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Source, By Application, and COVID-19 Impact Analysis. |

| Companies covered:: | Riceland Foods, Perdue Agribusiness, Bunge Limited, Cargil, Incorporated, Viterra Inc., Canadian Oilseed Processors Ltd., Archer Daniels Midland Company, Associated British Foods Plc., Incobrasa Industries, Ag Processing, Inc., Louis Dreyfus Company, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for fats and oils is expected to benefit from shifting consumer dietary preferences, an increase in the consumption of processed foods, and a demand for premium edible oils. Due to heightened awareness of obesity and its connection to diabetes and heart disease, producers are focusing on creating healthier products, such as those with lower cholesterol and carbohydrate content. Suppliers of fats and oils have responded to this trend by updating their product portfolios to address the potential demand for new types and benefits. Consuming olive oil, a beneficial dietary fat that contains monounsaturated fatty acids, can also reduce the risk of heart disease, osteoporosis, blood pressure, diabetes, cholesterol, and improve brain function.

Restraining Factors

The North American fats and oils market faces several challenges, including health concerns, regulatory challenges, price volatility, environmental impact, and consumer preferences, strict regulations on labeling, production, and trans-fat content create compliance issues, which may impede the market growth.

Market Segmentation

The North America fats & oils market share is classified into source and application.

- The vegetable oil segment held the largest share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The North America fats & oils market is segmented by source into vegetable oil and animal fat. Among these, the vegetable oil segment held the largest share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The food industry makes extensive use of vegetable oils, such as olive, canola, and soybean oil, as they are healthier than animal fats. The market for fats and oils in North America is anticipated to expand more quickly owing to the rising adoption of vegetable oil by families for heart and digestive health. The market is additionally anticipated to be driven by consumer demand for organic and plant-based products.

- The food segment accounted for the largest share in 2023 and is predicted to grow at a significant CAGR during the forecast period.

The North America fats & oils market is segmented by application into food and non-food use. Among these, the food segment accounted for the largest share in 2023 and is predicted to grow at a significant CAGR during the forecast period. This is attributed to its widespread use in cooking, baking, frying, and processed foods. The rise in convenience and ready-to-eat meals has increased the use of fats and oils in food manufacturing. Oils like soybean, canola, and olive oil are widely used in snack, bakery, and frozen food production. Consumers are seeking omega-3 and omega-6 fatty acids for health benefits, which results in the growth of the segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America fats & oils market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Riceland Foods

- Perdue Agribusiness

- Bunge Limited

- Cargil, Incorporated

- Viterra Inc.

- Canadian Oilseed Processors Ltd.

- Archer Daniels Midland Company

- Associated British Foods Plc.

- Incobrasa Industries

- Ag Processing, Inc.

- Louis Dreyfus Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Cargill became the first global supplier to meet the WHO's best practice standard on iTFAs, limiting iTFA content to no more than two grams per 100 grams of fats/oils. This achievement, announced in December 2021, reflects decades of work, including early innovation, investments, and R&D hours. Cargill has helped over 400 customers create nutritious products, removing over 1.5 billion pounds of iTFA-containing products from the global food supply.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the North America fats & oils market based on the below-mentioned segments:

North America Fats & Oils Market, By Source

- Animal Fat

- Vegetable Oil

North America Fats & Oils Market, By Application

- Food

- Non-Food Use

Need help to buy this report?