North America Electrical Steel Market Size, Share, and COVID-19 Impact Analysis, By Product (Grain-Oriented Electrical Steel, Non-Grain-Oriented Electrical Steel), By Application (Transformers, Motors, Inductors, Others), By Country (U.S., Canada, Mexico) and North America Electrical Steel Market Insights Forecasts to 2032

Industry: Advanced MaterialsNorth America Electrical Steel Market Insights Forecasts to 2032

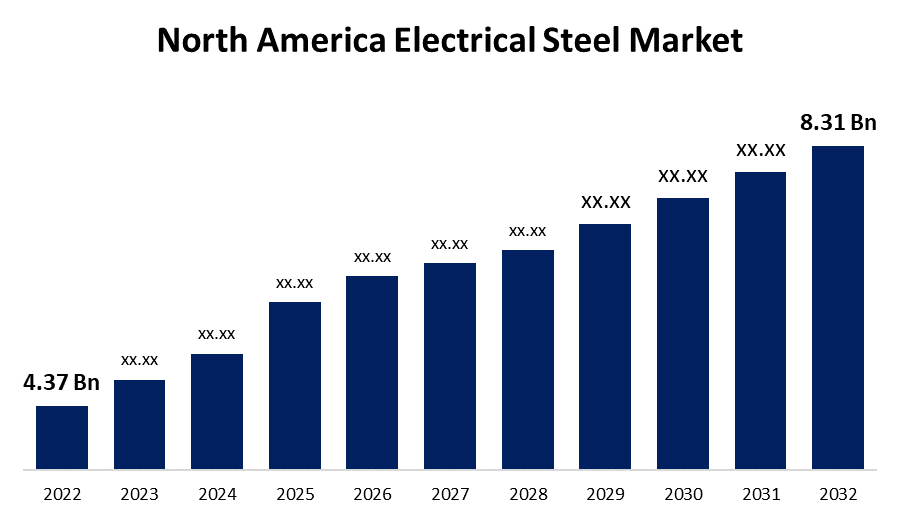

- The North America Electrical Steel Market Size was valued at USD 4.37 Billion in 2022.

- The Market is growing at a CAGR of 6.6% from 2022 to 2032.

- The North America Electrical Steel Market Size is expected to reach USD 8.31 Billion by 2032.

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The North America Electrical Steel Market Size is expected to reach USD 8.31 Billion by 2032, at a CAGR of 6.6% during the forecast period 2022 to 2032. The North American electrical steel market is currently being driven by growing consumer demand for cost-effective automobiles, notably electric and hybrid vehicles, as a result of the widespread application of electrical steel in the automotive sector. Furthermore, the industry benefits from the increased requirement for reducing energy consumption, which drives demand for transformers in the utility sector.

Market Overview

Electrical steel, also known as transformer steel, silicon electrical steel, and lamination steel, is an iron alloy. They have the properties of soft magnetic material with improved electrical characteristics. It is used in a variety of contexts including motors, generators, solenoids, relays, and electromagnetics. Rising power generation in the region, increased awareness of renewable energy sources, and increasing demand for electric vehicles are expected to drive market expansion throughout the forecast period. Electricity generation and distribution infrastructure development, in the region, are driving demand and hence boosting market expansion. Furthermore, motors are widely employed in EVs, and the changing trend toward electrically powered vehicles is increasing demand for motors and accelerating the usage of electrical steel.

Report Coverage

This research report categorizes the market for North America Electrical Steel Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Electrical Steel Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America Electrical Steel Market.

North America Electrical Steel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.37 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.6% |

| 2032 Value Projection: | USD 8.31 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, By Application, By Country, and COVID-19 Impact Analysis |

| Companies covered:: | ArcelorMittal, ATI, Cleveland-Cliffs Inc., LIBERTY Steel Group, Steel Dynamics, Arnold Magnetic Technologies, Continental Steel & Tube Co., Posco America, JFE Steel America, Inc., Klein Steel Service, Tata Steel Minerals Canada Ltd., Cleveland-Cliffs, Inc., Kobe Steel USA Inc., LSI Steel Lamination Specialties, Sumitomo Canada Limited, Union Electric Steel Corporation, and United States Steel Corporation |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

With regard to higher expenditures in energy companies and the EV sector, the United States controls the entire market in North America. The increasing demand for electricity necessitates significant investments in power generation and infrastructure. The most common equipment utilized in the sector is motors, generators, and transformers. As a result, a rise in power output increases the demand for electrical steel in the manufacture of generators and motors. Furthermore, a favorable regulatory policy toward EVs is expected to support market growth. For example, recent US government steps to assist the development and competitiveness of the American manufacturing industry include investments in the manufacturing of cleaner materials such as steel, aluminum, and concrete, which can be utilized to build green infrastructure. As a result of government backing and forthcoming legislation, the North America electrical steel market has a considerable opportunity to grow and extend its business activities.

Restraining Factors

However, raw material prices are highly volatile, having significant effects on electrical steel manufacturing and processing processes. Because the steel-making sector relies primarily on a consistent supply of raw materials for the production and refining of steel products, particularly electrical steel. Iron ore, coal, industrial gases, silicon, and ferroalloys are the key raw materials required for steel manufacture.

Market Segment

- In 2022, the non-grain-oriented electrical steel segment accounted for the largest revenue share of more than 75.3% over the forecast period.

On the basis of product, the North America Electrical Steel Market is segmented into grain-oriented electrical steel and non-grain-oriented electrical steel. Among these, the non-grain-oriented electrical steel segment has the largest revenue share of 75.3% over the forecast period. It is an iron-silicon alloy with magnetic characteristics that are almost identical in all directions. Depending on the core loss requirement, it has a modest to high alloy content. It's used to produce superior magnetic properties for applications including electric home appliances, workplace equipment, and stabilizers.

- In 2022, the transformers segment accounted for the largest revenue share of more than 46.2% over the forecast period.

On the basis of application, the North America Electrical Steel Market is segmented into transformers, motors, inductors, and others. Among these, the transformers segment has the largest revenue share of 46.2% over the forecast period. The primary reason for this is the increased demand for electrical steel in the power production, transmission, and distribution industries. Increased investment in grid expansion raises the rate of transformer deployment, which is expected to boost the market in the predicted timeline.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Electrical Steel Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ArcelorMittal

- ATI

- Cleveland-Cliffs Inc.

- LIBERTY Steel Group

- Steel Dynamics

- Arnold Magnetic Technologies

- Continental Steel & Tube Co.

- Posco America

- JFE Steel America, Inc.

- Klein Steel Service

- Tata Steel Minerals Canada Ltd.

- Cleveland-Cliffs, Inc.

- Kobe Steel USA Inc.

- LSI Steel Lamination Specialties

- Sumitomo Canada Limited

- Union Electric Steel Corporation

- United States Steel Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On January 2023, Cleveland-Cliffs is entering the North American market with the MOTOR-MAX product line of non-oriented electrical steels for high frequency motors and generators. MOTOR-MAX High Frequency Non-Oriented Electrical Steels (HF NOES) are intended for use in high-speed motors (with frequencies more than 60 Hz), electric vehicle (EV) traction motors, aircraft generators, and other rotating equipment. Cleveland-Cliffs, the only producer of automotive-quality electrical steels in North America, is at the forefront of this sector as demand for electrical steels for EV traction motors rises.

- On March 2023, United States Steel Corporation stated that manufacturing of its new electrical steel product, InduXTM, will commence in the summer of 2023 at its Big River Steel facility with the inauguration of its new non-grain oriented (NGO) electrical steel line. Big River Steel in Osceola, Arkansas, will manufacture InduXTM steel on its new NGO electrical steel line. The NGO line is presently under construction and, when completed, will produce up to 200,000 tons of InduXTM steel per year. The NGO line's total projected capital expenditures of about $450 million are supported by cash earned by Big River Steel. InduXTM electrical steel is a broad, ultra-thin, light-weight steel with all of the magnetic qualities required for electric vehicles (EV), generators, and transformers.

- On May 2023, JFE Holdings' Canadian division continues to lead the way in the constantly expanding demand for electrical steel materials and components required to develop our clean electrical energy future. JFE Shoji Power Canada, in collaboration with strategic partners, announces that are continuing to invest more in the machinery and people required to continue to expand our production of electrical steel components for power and distribution transformers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America Electrical Steel Market based on the below-mentioned segments:

North America Electrical Steel Market, By Product

- Grain-Oriented Electrical Steel

- Non-Grain-Oriented Electrical Steel

North America Electrical Steel Market, By Application

- Transformers

- Motors

- Inductors

- Others

North America Electrical Steel Market, By Country

- United States

- Canada

- Mexico

Need help to buy this report?