North America Digital Oilfield Market Size, Share, and COVID-19 Impact Analysis, By Process (Product Optimization, Drilling Optimization, Reservoir Optimization, Safety Management, and Asset Management), By Application (Onshore and Offshore), and North America, Digital Oilfield Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerNorth America Digital Oilfield Market Size Insights Forecasts to 2035

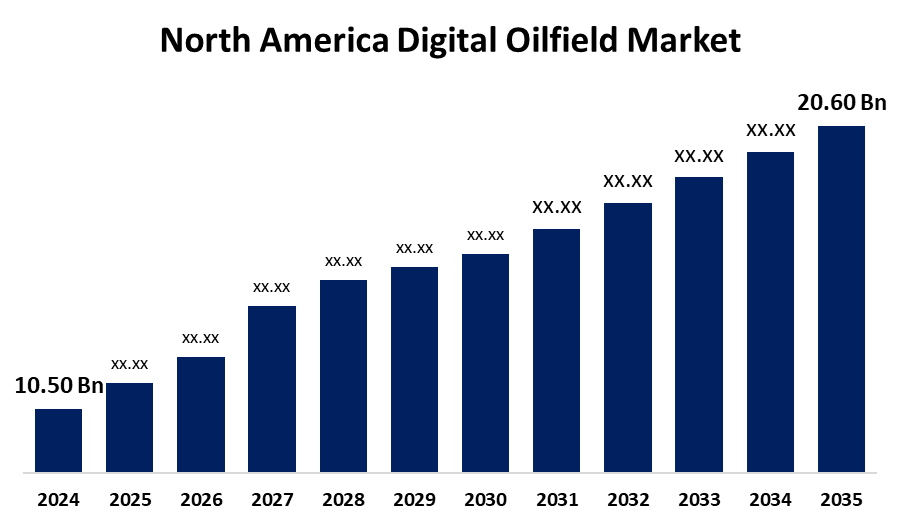

- The North America Digital Oilfield Market Size Was Estimated at USD 10.50 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.32% from 2025 to 2035

- The North America Digital Oilfield Market Size is Expected to Reach USD 20.60 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the North America Digital Oilfield Market Size is anticipated to reach USD 20.60 billion by 2035, growing at a CAGR of 6.32 % from 2025 to 2035. Increased use of automation, data analytics, and IoT technologies, which improve operational effectiveness, real-time decision-making, and reservoir management in upstream oil and gas operations, presents prospects for the North America digital oilfield market.

Market Overview

The regional industry devoted to incorporating cutting-edge digital technologies into oil and gas exploration, production, and field operations throughout the United States, Canada, and Mexico is known as the North America digital oilfield market. Automation, data analytics, cloud computing, the Internet of Things (IoT), artificial intelligence (AI), and real-time monitoring systems are all included in digital oilfield solutions, which maximize asset performance, save operating costs, and improve decision management. The goal of the North America digital oilfield market is to maximize oil and gas production while cutting expenses by improving operational efficiency, real-time data monitoring, statistical modeling, automation, and virtual field management.

The industry's increasing desire to maximize hydrocarbon recovery, lower costs, and improve operational efficiency through sophisticated data integration and automation is driving the North America digital oilfield market. Technological developments that improve efficiency, safety, and regulatory compliance are driving an increase in the demand for digital oilfield solutions. The North America digital oilfield market continues to expand due to the growing demand for sustainability, collaborations between tech and energy firms, and a rise in exploration and production operations.

Report Coverage

This research report categorizes the market for North America digital oilfield market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America digital oilfield market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America digital oilfield market.

North America Digital Oilfield Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.50 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.32% |

| 2035 Value Projection: | USD 20.60 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Process, By Application and COVID-19 Impact Analysis |

| Companies covered:: | ABB, Infosys, Intel, Wipro, Accenture, Siemens, Halliburton, Weatherford, Emerson Electric, General Electric, Schneider Electric, Rockwell Automation, National Oilwell Varco, Honeywell International, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sector is expected to be driven by growing efforts to incorporate efficient production techniques to increase output, as well as the presence of ancient and mature wells in various regions. The growing use of solar photovoltaics as a key power source is propelling the expansion of the North America digital oilfield market. In addition to ongoing efforts to reduce production costs, developing economies' rapidly expanding demand for oil, gas, and other petroleum products is driving the North America digital oilfield market. One of the main drivers of market expansion is the growing requirement to supplement production from older wells.

Restraining Factors

High upfront installation costs, cybersecurity threats, integration difficulties, data management issues, and reluctance to change inside conventional oil and gas operations are some of the factors restricting the growth of the North America digital oilfield market.

Market Segmentation

The North America digital oilfield market share is classified into process and application

- The product optimization segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America digital oilfield market is segmented by process into product optimization, drilling optimization, reservoir optimization, safety management, and asset management. Among these, the product optimization segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The implementation of product optimization, which uses contemporary technology and market trends to improve efficiency, lower costs, and boost production rates, is what propels the practice.

- The onshore segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America digital oilfield market is segmented by application into onshore and offshore. Among these, the onshore segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Compared to offshore drilling, onshore drilling operations usually require less upfront capital commitments. Furthermore, technological innovations like horizontal drilling and hydraulic fracturing are advantageous for onshore resources.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America digital oilfield market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB

- Infosys

- Intel

- Wipro

- Accenture

- Siemens

- Halliburton

- Weatherford

- Emerson Electric

- General Electric

- Schneider Electric

- Rockwell Automation

- National Oilwell Varco

- Honeywell International

- Others

Recent Developments

- In June 2023, Digital Prime is a cloud-based digital twin solution designed for the oil and gas sector and was launched by Honeywell. Businesses may monitor, oversee, and test process control modifications with this platform without interfering with production. It reduces rework while promoting increased quality control, effective change management, and cooperative testing. The platform offers real-time monitoring and testing capabilities, secure cloud access, and ongoing updates, which eventually save maintenance costs and boost operational effectiveness.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America digital oilfield market based on the below-mentioned segments:

North America Digital Oilfield Market, By Process

- Product Optimization

- Drilling Optimization

- Reservoir Optimization

- Safety Management

- Asset Management

North America Digital Oilfield Market, By Application

- Onshore

- Offshore

Need help to buy this report?