North America Dietary Supplements Market Size, Share, and COVID-19 Impact Analysis, By Ingredient (Vitamins, Botanicals, Minerals, Proteins & Amino Acids, Fibers & Specialty Carbohydrates, Omega Fatty Acids, Probiotics, Pre & Postbiotics, and Others), By Form (Tablets, Capsules, Soft gels, Powders, Gummies, Liquids, and Others), and North America, Dietary Supplements Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsNorth America Dietary Supplements Market Size Insights Forecasts To 2035

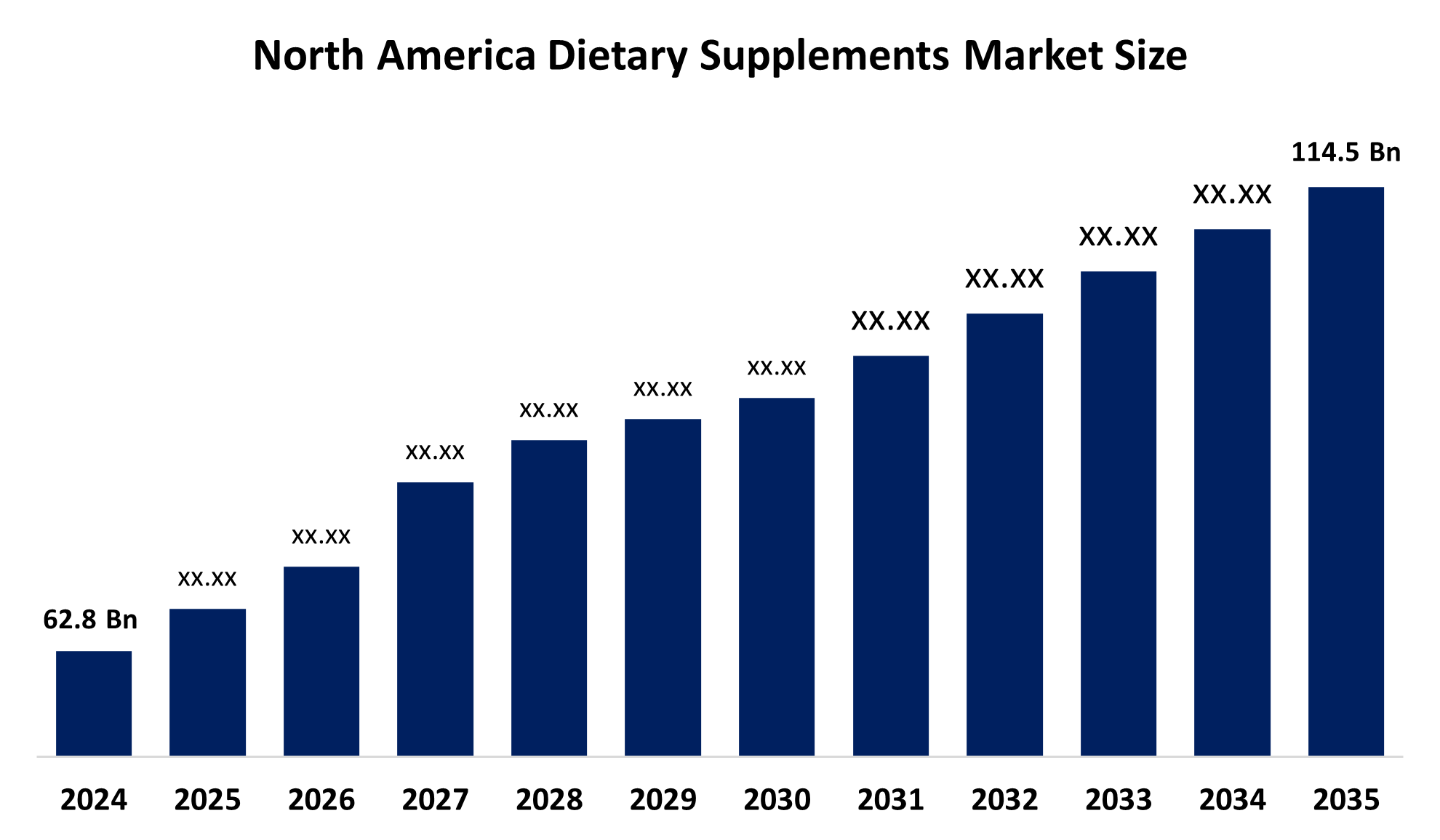

- The North America Dietary Supplements Market Size Was Estimated at USD 62.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.61% from 2025 to 2035

- The North America Dietary Supplements Market Size is Expected to Reach USD 114.5 Billion by 2035

Get more details on this report -

According To a Research Report Published by Spherical Insights & Consulting, North America Dietary Supplements Market Size is Anticipated To Reach USD 114.5 Billion by 2035, Growing at a CAGR of 5.61% from 2025 to 2035. The main factors propelling the industry are the growing consumer consciousness of personal health and well-being. Additionally, the market is anticipated to be driven throughout the forecast period by the rising demand for goods that support healthy dietary choices in order to lead disease-free lifestyles.

Market Overview

The North America dietary supplements industry includes dietary supplements production, distribution, and consumption. The market for dietary supplements is expanding significantly due to consumers' growing emphasis on eating well and leading healthy lives. Adoption rates are increased by growing knowledge of the advantages of supplements and the creation of application-specific products by major companies. Additional factors driving market expansion include new product innovation, advancements in supply chain management and marketing, and cutting-edge technologies. Product accessibility is improved by multi-channel distribution strategies, which include offline locations like pharmacies and hypermarkets as well as online platforms like Amazon. North America is crucial since many manufacturers there are adopting vertical integration and tailored solutions to satisfy changing customer needs. Companies are exploring innovative distribution practices, such as the biotech company Specnova announced NovaQSpheres, an innovative delivery system, in November 2024. The system allows the precise and controlled release of components over an 8 to 12-hour timeframe, thus enhancing efficacy in a number of different industries. The development of Beachbody's direct-to-consumer and Amazon sales channels are illustration of partnerships and alliances that ease entry into the marketplace. It is expected that the dietary supplements market will continue to grow, owing to factors such as increasing health consciousness, customizable product alternatives, and more efficient distribution networks.

Report Coverage

This research report categorizes the market for North America dietary supplements market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America dietary supplements market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America dietary supplements market.

North America Dietary Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 62.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.61% |

| 2035 Value Projection: | USD 114.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Ingredient, By Form |

| Companies covered:: | Amway Corp., Glanbia PLC, Abbott, Bionova, Arkopharma, Herbalife, Nature’s Sunshine Products, Inc., Bayer AG, Pfizer Inc., ADM, NU SKIN, GSK plc., Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

North America Dietary Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 62.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.61% |

| 2035 Value Projection: | USD 114.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Ingredient, By Form |

| Companies covered:: | Amway Corp., Glanbia PLC, Abbott, Bionova, Arkopharma, Herbalife, Nature’s Sunshine Products, Inc., Bayer AG, Pfizer Inc., ADM, NU SKIN, GSK plc., Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Growing consumer emphasis on leading healthy lives and the need for application-specific supplements are driving the dietary supplement industry. Accessibility and acceptance are increased when supplement advantages are better understood and distributed through a variety of channels. Growth is further fuelled by new technology in supply chain management and marketing, product innovation, and customised strategies. Sales are dominated by the retail industry, particularly supermarkets, although internet channels are growing quickly since they are convenient. The demand for supplements is also increased by an ageing population and a rising prevalence of chronic diseases. Innovations like microencapsulation and partnerships with internet merchants boost market expansion and competitiveness.

Restraining Factors

The high costs of product development and new technology, plus the regulatory environment with strict compliance requirements, are restrictive to market growth. Other restraints include concerns surrounding product safety, lack of consumer knowledge in some markets about food made from cell-cultured technology, and competing with food from natural sources and alternative therapies are all factors limiting the North American dietary supplements market.

Market Segmentation

The North America dietary supplements market share is classified into ingredient and form.

- The vitamins segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America dietary supplements market is segmented by ingredient into vitamins, botanicals, minerals, proteins & amino acids, fibers & speciality carbohydrates, omega fatty acids, probiotics, pre & postbiotics, and others. Among these, the vitamins segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Advances in science and technology, the ageing population, and growing interest in achieving wellness via diet are some of the factors driving this segment's rise. Numerous businesses in the nutrition and health sectors have launched new product lines in response to growing consumer demand based on age, application, and particular needs.

- The tablets segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America dietary supplements market is segmented by form into tablets, capsules, soft gels, powders, gummies, liquids, and others. Among these, the tablets segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Key characteristics of tablets, like their easy packing and ease of use, have increased demand. The growing adoption is partly a result of their strong absorption capacities. Furthermore, the expansion of this market segment has also been impacted by the increased market penetration of the e-commerce sector, which makes it easier to purchase dietary supplements online. Tablets are one of the forms that manufacturers choose since they offer better stability and shelf life than liquid or gummies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America dietary supplements market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amway Corp.

- Glanbia PLC

- Abbott

- Bionova

- Arkopharma

- Herbalife

- Nature's Sunshine Products, Inc.

- Bayer AG

- Pfizer Inc.

- ADM

- NU SKIN

- GSK plc.

- Others

Recent Developments

- In January 2025, Ancient Nutrition was purchased by Wellful, Inc., a global player in the health and nutrition sector. It is anticipated that this strategic move will bolster Wellful's position in the online market for products in the vitamin, mineral, and supplement (VMS) sector.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America dietary supplements market based on the below-mentioned segments:

North America Dietary Supplements Market, By Ingredient

- Vitamins

- Botanicals

- Minerals

- Proteins & Amino Acids

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Probiotics

- Pre & Postbiotics

- Others

North America Dietary Supplements Market, By Form

- Tablets

- Capsules

- Soft gels

- Powders

- Gummies

- Liquids

- Others

Need help to buy this report?